China’s advancements in hard technology

Chinese equities extended their rally in August, with gains largely concentrated in the AI compute chain. While consumer and healthcare sectors took a pause, the strength of the market was underpinned by visible progress and substantial market opportunities across the computing power ecosystem. This reflects both the technological drive and the unique structure and ecosystem of China’s equity market. On the macro front, inflation remains muted, but activity data signalled resilience. The MSCI China Index gained 4.9% and the MSCI China A Onshore Index advanced by 12.8%. Domestic tourism registered a 21% year-over-year increase in the first half of 2025, while county-level regions are emerging as new growth drivers. Household deposits fell by 0.7% in July, representing a withdrawal of over RMB 1 trillion.

Key insights from the report include:

- The rising risk appetite among retail investors.

- The five key factors powering China’s hard tech ascendancy.

- How China is creating compelling investment opportunities across multiple high-growth sectors.

According to Alibaba’s Taobao, non-food orders doubled in 834 counties in July, with similar momentum projected for August. Meanwhile, policymakers are taking steps to address the cycle of price wars, or “involution,” by curbing aggressive sales practices that have weighed on corporate profitability.

A notable shift is also taking place in household investment behaviour. Household deposits fell by 0.7% in July, representing a withdrawal of over RMB 1 trillion. Deposit growth continued to slow in August, suggesting that households are reallocating capital toward investments. This is reflected by a surge in brokerage activity: year-to-date through August, new brokerage account openings averaged more than 2 million per month, up 48% compared to the same period last year.

In August alone, account openings jumped by 165% year-over-year, underscoring the rising risk appetite among retail investors.

Amid this market enthusiasm, the Chinese government has indicated plans to curb excessive stock speculation to promote more sustainable market growth. Potential measures include easing certain short-selling restrictions, which could help deflate overvalued stocks, and deploying additional tools to rein in speculative activity with the aim of protecting retail investors from significant losses later on.

Key drivers of China innovation

Over the past two decades, China has demonstrated an extraordinary ability to leapfrog in technology adoption and innovation. During the internet era, China leveraged its world-class telecommunication infrastructure and a large, tech-savvy population to nurture some of the world’s biggest digital platforms and ecosystems. Today, a similar transformation is unfolding in hard technology, with even greater potential global implications.

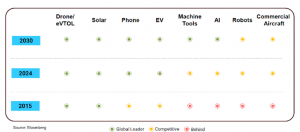

In just 10-15 years, China has moved up the global value chain in multiple “hard tech” sectors.

The country is recognised as a global leader, or a highly competitive player, in high-speed rail, shipbuilding, industrial automation, solar energy, batteries, electric vehicles (EVs) and machine tools.

For instance, China accounts for over 85% of the world’s solar panel manufacturing and operates the world’s largest high-speed rail network by a significant margin. Its EV sector, led by companies like BYD (a car manufacturer) and CATL (a battery supplier), is rapidly gaining market share both domestically and abroad.

This remarkable progress is no accident. Five key factors power China’s hard tech ascendancy:

-

Comprehensive industrial chain:

China has built the most complete industrial base and sophisticated supply chains in the world. In most categories, the country can independently manage the entire process: from raw materials and design to production and assembly. This vertical integration enables scale, cost efficiency and rapid iteration.

-

Largest customer base and onshoring:

China has for many years been the “factory of the world”, manufacturing toys, electronics, cars, robots, and everything in between. As a result, it is also the largest customer of hard technology, whether it’s semiconductors needed in car production or industrial robots for factory automation.

In a world increasingly impacted by geopolitics, Chinese companies can’t afford for their supply chains to be disrupted by sanctions, tariffs or other trade restrictions. Therefore, in today’s world they are prepared to procure their hard technology locally, even if those domestic products are currently inferior. This allows local hard technology suppliers to generate sales and reinvest into research and development (R&D) to catch up with international competitors. Increased competence in semiconductors is a notable example of this trend.

-

Large talent pool:

China churns out about 3 million science, technology, engineering, and mathematics (STEM) graduates every year. There are about twice as many software coders in China compared to the US, typically working for around half the salary of their American peers. This makes high quality R&D far cheaper and faster than any other country in the world.

-

Rising R&D investment and government support:

Chinese corporates have steadily increased R&D spending. In 2024, China’s expenditure reached a record high, second to the US globally. It is not uncommon to have companies spend as much as 20% of revenue on R&D. This amounts to an aggregate of approximately US$400bn per annum, a threefold increase since 2012. Local governments, alongside the central government, have also played a key role by offering funding and incentives to attract start-ups to their regions. These policies have significantly accelerated technological progress at a far faster pace than in the West.

-

Hard tech start-up boom:

Fuelled by entrepreneurship and venture capital funding, a new generation of hard tech start-ups are emerging across artificial intelligence (AI), semiconductors, robotics, new energy, and advanced manufacturing equipment. These companies are driving domestic innovation and import substitutions, reducing reliance on foreign technology.

Opportunities in China hard tech

China continues to present compelling investment opportunities in hard technology. Investors can find value in both established industry leaders and a new generation of innovative start-ups. This includes companies that are integral to Nvidia’s supply chain, as well as those developing domestic alternatives.

Global semiconductor supply chain

Chinese manufacturers supply several key components used in Nvidia’s servers, such as optical transceivers, network processors and printed circuit boards.

For instance, Zhongji Innolight, a leading producer of high-end optical communication transceiver modules, has more than doubled its sales and profits each year in recent years. Its market capitalisation has increased 15-fold since 2022, reaching US$50 billion today. With global demand for AI and cloud computing rising rapidly, Chinese suppliers are well positioned for significant growth.

As technology hardware becomes more complex and energy-intensive, it creates new challenges that need solving – for example cooling systems or products that improve energy efficiency are two areas where Chinese companies are also innovating.

Domestic substitution of semiconductors

At the same time, China’s ongoing drive for technological self-sufficiency is creating long-term opportunities for local companies in multiple areas.

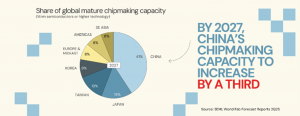

China has become the world’s largest producer of mature node chips – those with transistor technology of 14 nanometres (nm) or larger – thanks to efficient, cost-effective manufacturing. According to SEMI, a global industry association, China accounted for 30% of global mature node chip production in 2023, a share expected to increase to 41% by 2027.

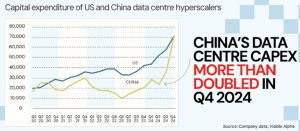

As China’s capital expenditure of domestic data centre hyperscalers catches up with the USA, these data centres are becoming major customers for global semiconductor companies, including Nvidia. Supply of advanced semiconductors is at the heart of Sino-US geopolitics. Although US President Trump has agreed to lift the export ban to China of Nvidia H20 chips, there is considerable pressure by the Chinese government to buy domestic substitutes.

Whether fears of trackers or kill switches in Nvidia products are true or not, it creates demands for local providers such as Huawei and Cambricon Technologies. This would not have happened in the absence of present-day geopolitics. Cambricon Technologies, founded less than ten years ago, increased its revenue 44-fold in the first half of this year and swung into profit. Growth of this magnitude in turn allows these companies to deploy significant resources into R&D to catch up with US chip technology.

And there is progress. The Huawei CloudMatrix 384, its most advanced artificial intelligence chip cluster, boasts of similar performance to Nvidia’s NVL72, which is a popular cluster used by US tech giants. It does use more chips, is more energy intensive and requires a much larger human resource of engineers to maintain – but China has an abundance of low-cost energy and engineers.

Robotics

Robotics is another highly promising field. Recent events such as the World Robotics Conference and the inaugural World Robotic Games, both held in Beijing, have highlighted China’s rapid progress in this area. China is already the world’s largest industrial robot market, accounting for over 50% of global installations.

Today, factories across the country use robots to automate repetitive tasks like lifting and cutting, as well as more complex operations such as welding.

For example, Xiaomi’s well-known “dark factory” is fully automated and operates without human intervention, producing one mobile phone per second without the need for lights. Engineers monitor the facility using live 3D virtual images of the machinery, allowing them to quickly identify and address any issues. This level of automation is becoming increasingly common nationwide.

Humanoid robots are emerging as the next trillion-dollar industry, and China is well positioned to lead alongside the US. The country has strengths across the entire value chain ─ from the “brain” (semiconductors and software) to the “body” (sensors, motors, and electric joints), to system integrators. As with EVs, the most critical aspect of developing humanoid robots lies in possessing robust hardware and software capabilities, as well as successfully integrating the two.

China has developed substantial expertise in these areas, drawing on its experience with other advanced technologies.

Artificial intelligence

While the US still leads in advanced chips and computing power, China has notable strengths in data, talent development and energy infrastructure. In addition, they also have greater access to rare minerals required to make semiconductors, and significantly lower labour costs. As discussed, companies are already actively innovating to overcome hardware limitations.

Earlier this year, DeepSeek disrupted the industry by releasing low-cost, open-source AI models prioritising algorithmic innovation and computational efficiency. This demonstrates how China’s AI ecosystem can address advanced chip shortages by making breakthroughs in software and system optimisation, buying time for domestic companies to catch up in semiconductor fabrication technology.

A low-cost solution also brings faster adoption of AI across industries in China.

For instance, Tencent integrated DeepSeek’s R1 model into its chatbot, YuanBao, while BYD launched new AI-powered autonomous driving features for all its cars without increasing prices.

From an investor perspective, AI solutions do not need to match ChatGPT or other American competitors to achieve success. Being the leading player within China alone can be enough to build a multi-billion-dollar company.

Subscribe to our Monthly China insights report, providing a detailed and insightful analysis of the state of the Chinese equity m