China Market Commentary: May 2023

In April, Chinese equities posted negative returns and underperformed major global indices. Investors were concerned about a slowing and uneven recovery in the economy, as well as rising geopolitical uncertainty, following the US’s reported move to restrict tech investment in China. For the month, the MSCI China A Onshore and MSCI China indices were down 2.1% and 5.2% respectively.

Investors in the A-share market continued to show strong interest in State-Owned Enterprises (SOE) and Artificial Intelligence (AI) stocks, driving thematic trading activity in these sectors and dominating the market.

Significant revaluation of State-Owned Enterprises

SOEs have delivered gains of around 30% year-to-date over a period where other companies have lagged. Whilst some of this share price rally is justified, given further reform of the public sector, this is merely a continuation of a longer-term trend of reforms that has been ongoing for many years. What is different this time is that there seems to be a concerted effort by the authorities to instigate a share price recovery of these companies from long-term depressed valuations.

However, most fund managers argue that share prices will ultimately reflect long-term fundamentals, and they expect that this rerating will inevitably lose momentum. Whilst there are some well-managed, high-quality companies that happen to be SOEs (our portfolio has exposure to some of these), the vast majority are poor-quality businesses that are often not run in the interests of minority shareholders. Furthermore, following the recent outperformance, low Price-to-Book stocks, including most SOEs, have become less attractive in terms of their longer-term risk vs reward trade-off. After all, their historically low prices were typically due to a lack of earnings growth and fundamental support.

The rise and hype of Artificial Intelligence and ChatGPT

The Chinese stock market has not been immune to the global craze for anything related to AI or ChatGPT. These range from larger companies like Baidu – which released the Chinese equivalent of ChatGPT – to smaller companies. Until recently, share prices of pure-play AI companies were plagued by challenges resulting from the ban of advanced chips to China, and the threat of being directly sanctioned by the USA. However, their share prices have climbed materially since the AI/ChatGPT frenzy.

While Artificial Intelligence undoubtedly will revolutionize the world and present tremendous investment opportunities, it is too early to determine the eventual winners, particularly among Chinese players. This theme has garnered excessive attention and trading activity, leading to many overvalued stocks, even among companies that have a tenuous link to AI.

A number of managers feel that Chinese investors desperately seeking short-term returns have focused their attention on thematic investing, such as AI or the SOE rerating, in the absence of a strong economic rebound.

Slower economic recovery

In terms of a broader view, recent economic data largely fell below expectations, including social financing, industrial output, fixed asset investment, and consumption. The deceleration of industrial momentum was particularly notable, as the Manufacturing PMI dropped from 51.9 in March to 49.5 in April (readings below 50 indicate a contraction), following two months of strong readings. A major reason for this is reduced exports due to a slowdown of western economies. Recovery in the property sector also slowed down, with sales of the top 100 developers declining by 14.4% from the previous month (but still up 31.6% on a year-on-year basis). The property sector needs to address its debt burden before it can resume meaningful volumes of new developments.

Regarding consumption, China is attempting to revive demand more organically, unlike western countries that provided cash handouts to households, which lead to an immediate boom in consumer demand. They are doing this by boosting corporate confidence that should lead to more capital expenditure and employment opportunities. This approach is less likely to create inflationary pressure, and could be more sustainable, although it may be slower and more uneven in the earlier stages.

Nevertheless, we believe that China’s economy remains on a path to recovery. During the Labour Day holiday in May, domestic travel surged with 274 million trips, a 71% year-on-year increase and a 19% increase compared to 2019 levels. It was also a significant acceleration compared to the Lunar New Year holiday in January. This suggests that the Chinese economy is gradually returning to pre-pandemic levels. It is possible that the Chinese government may step in with more policy stimulus if indicators fall short of expectations in future. The government has sufficient tools to support the economy if necessary.

Company visits over the month

Robin You, our colleague based in Hong Kong, accompanied one of our managers on a site visit to several companies located in the Guangdong-Hong Kong region (the Greater Bay Area of China). He was impressed by the resilience of the businesses and the quality of their managements. Despite a challenging macro environment, most of the companies have managed to increase their market share, enhance operational efficiency, and fortify their competitive advantages in the past years.

We also spent considerable time with Chris Chen, CEO of Wuxi Biologics. This is a global Contract Research, Development and Manufacturing Organisation (CRDMO) service company with one of the world’s largest biological teams. Under Chris’s leadership the company has grown ten times over the last five years to become one of the largest companies in the sector by taking market share from the likes of Lonza, the global leader in this sector. Chris argues that the speed at which they can service their clients has helped them acquire 470 global partners, including the top 20 global pharmaceutical companies.

There was also a meeting with the Hong Kong Stock Exchange during the month, where investors were reminded of the ongoing opening up of China’s capital markets. Recent initiatives include the broadening of the asset classes available in the settlement agreements between the Hong Kong and mainland exchanges, as well as the expansion of eligible stocks under the existing Stock Connect program. Overseas investors buying on the mainland (“Northbound transactions”) can now trade 2500 stocks – up from the previous count of 1500 – while Southbound trading stocks have expanded from 400 to 560. Additionally, international companies that are primary-listed in Hong Kong are now included in the program.

China continues to reform and open its doors to international investors while at the same time providing greater opportunities for its citizens to invest internationally.

A year where most managers are underperforming

Many active managers underperformed in April. The main reason for this underperformance was our underweight position in AI stocks and shares of SOEs in the Financials, Energy, and Telecom sectors – both groups performed well due to favourable sentiment. Our managers remain structurally underweight to SOEs due to ESG and sanctions compliance considerations.

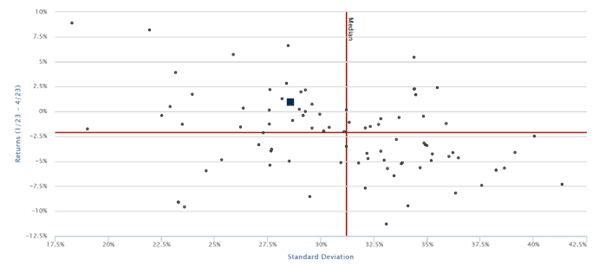

A peer group analysis revealed that Chinese active managers have underperformed across the board – as shown in the chart below. A peer group of 85 Greater China and All China products delivered a median return of -2.2% versus the MSCI China All Shares index return of 0.9%, and less than 20% have outperformed.

Source: eVestment, RisCura. Blue square is the MSCI China All Shares index.

In conclusion, markets have been following hype, rewarding poorly-governed SOEs and AI meme stocks. This has resulted in underperformance of managers across the board who have chosen not to participate in highly sentiment-driven movements. Most of our managers are positioned in high quality businesses, trading at attractive valuations, that continue to deliver earnings growth and can benefit from structural growth themes in the domestic economy.

Finally, we are pleased to announce the completion of our Indian stewardship study where we surveyed 35 Indian asset managers and have compiled our insights on the state of stewardship and current ESG practices in India. You are invited to choose your time zone and join the webinar for the launch of this valuable report.

Register to secure your place in the link below.

EMEIA

Thursday, 22 June 2023

- 09:00 – 10:00 BST

- 10:00 – 11:00 SAST

- 13:30 – 14:30 IST

- 16:00 – 17:00 CST

Americas

Thursday, 22 June 2023

- 10:00 – 11:00 EST

- 15:00 – 16:00 BST

- 16:00 – 17:00 SAST

- 19:30 – 20:30 IST