China Market Commentary: March 2023

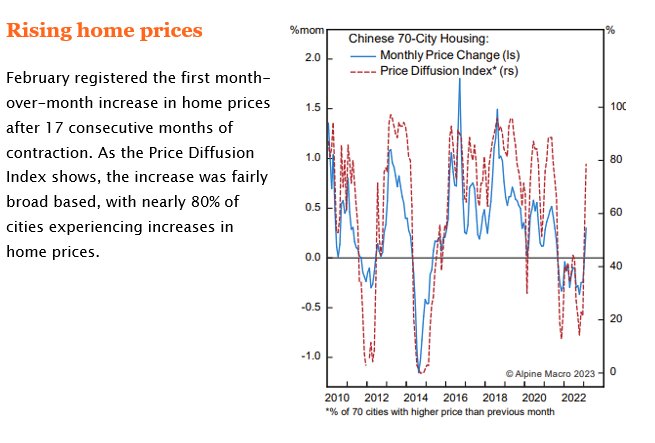

Here are this month’s highlights: February registered the first month-over-month increase in home prices after 17 consecutive months of contraction. While the recovery so far has been driven by pent-up demand from people who couldn’t spend during Covid lockdowns, it is too early to observe more sustained growth momentum.

China coming back to life

In February, Chinese equities gave up most of their gains from the previous month amid investor concern over a slower economic recovery. The re-emergence of geopolitical friction between the US and China further dented market sentiment. This included the suspected spy balloon incident and talks around the Netherlands and Japan joining the US in restricting chip exports to China. Globally, rate hike expectations led to a strong US dollar and weak equity performance across all markets. For the month, the MSCI China and MSCI China A Onshore indices were down 10.4% and 4.0%, respectively. Onshore equities once again showed greater resilience against external factors.

On the macro side, while we will seek more clarity on the trajectory of China’s recovery in the coming months, recent data is encouraging, as one of our managers commented:

“Travel picked up in China over the past months, as indicated by greater traffic congestion in major cities, higher ticket prices and higher hotel occupancy rates. Data from major recruitment apps showed a sharp rise in new job openings in February (well above the average for 2019 – 2022), which should lead to improved income expectations. Real estate finally saw signs of life, with a pickup in sales of new and second-hand homes in January and February, ending 13 months of negative growth, according to the Ministry of Housing and Urban-Rural Development.”

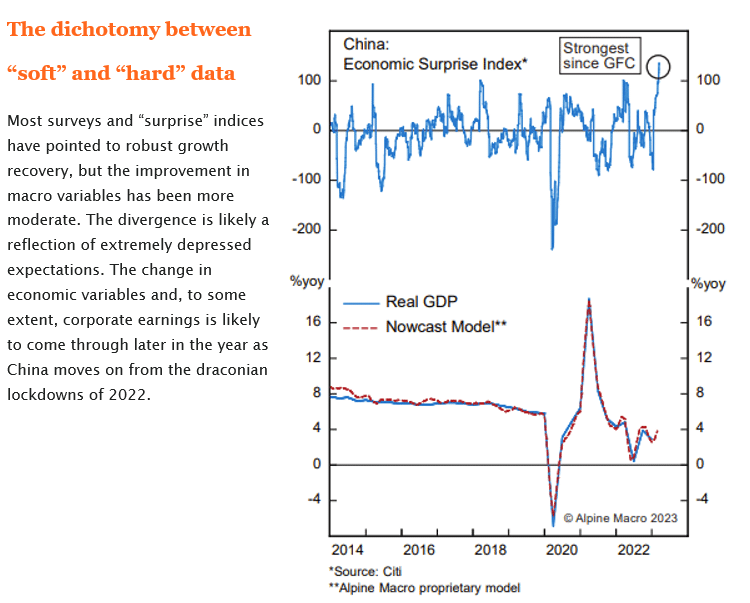

“These sector-level indicators mirrored stronger manufacturing PMI in February, which rose to 52.6, the second consecutive month above the neutral level of 50. Both production and demand subindices saw significant improvement. While the recovery so far has been driven by pent-up demand from people who couldn’t spend during Covid lockdowns, it is too early to observe more sustained growth momentum. In his Government Work Report to the National People’s Congress on 5 March, Premier Li Keqiang guided China’s GDP growth target for 2023 to ‘around 5%’, which is at the lower end of market consensus. With an incoming new administration, lower guidance sets the stage for stronger delivery later in the year. The appointment of new leaders at key government institutions, government institutional reform, and implementation of the pro-growth policies should drive growth momentum in the economy.”

In summary, there is a steady incremental improvement across the board; however, it is still too early for this to filter into the earnings of most companies or macro variables.