China Market Commentary: July 2022

Here are this month’s highlights: Chinese equities are behaving very differently to developed markets. Mortgage defaults have become the latest focus for investors in China.

China in June

Global risk assets and commodities took a beating in June due to rising recessionary concerns; Chinese equities were the exception. In June, the MSCI China and MSCI China A Onshore indices were up 6.6% and 10.1% respectively compared to an MSCI World return of -8.7%. Several positive news headlines in China during the month helped shore up investor sentiment, including easing COVID-19-related measures, better than expected credit growth and acceleration of infrastructure project financing. While still weak on a year-on-year basis, China’s economy continued its recovery path with both manufacturing and service PMI returning to expansion.

The month of June demonstrated the low correlation between Chinese equities and the rest of the world.

“China is on a different trajectory. It does not have the same concerns over stagflation nor the challenge of unwinding significant fiscal and monetary stimulus provided over a prolonged period.”

The stock market has also derated when compared to US equities. China is recovering from a depressed economy resulting from the burdensome regulatory regime and tight monetary conditions over previous years. Lockdowns to control the spread of COVID-19 also slowed economic growth. As such, Chinese equities are behaving very differently to developed markets, having outperformed in 2020 but lagged in 2021 when the rest of the world enjoyed a bull market. Whilst many expect Chinese equities to recover, they have lagged again in July and this volatility is expected to continue for the remainder of the year.

Mortgage defaults of unfinished properties

Mortgage defaults have become the latest focus for investors in China. Buyers of hundreds of unfinished homes across the country are ceasing to pay mortgages in response to prolonged delays in delivery, raising fears that housing woes will spill over to the broader economy. This is not about the inability to pay but rather buyers of off-plan properties running out of patience and refusing to continue with their mortgage payments. Delay to delivery of homes is normal but the slowdown of the property sector has created a significant backlog as construction of properties has slowed or even stopped as developers faced liquidity issues.

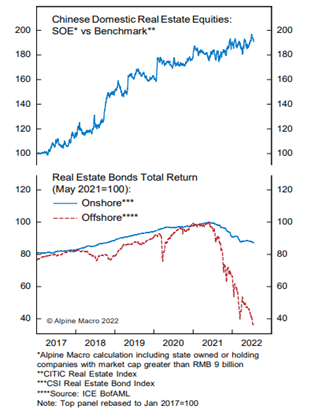

This is an unintended consequence of the policy-led liquidity crisis in the property sector that started in the second half of 2021. Many private developers are over-leveraged, cash-strapped and their US dollar-denominated bonds are trading at distressed levels. Meanwhile, developers’ Renminbi-denominated onshore bonds have been much more stable (see below chart), indicating the liquidity stress is not universal. For example, the state-owned developers with strong balance sheets continue to grow and gain market share, as reflected in their equity performances versus the sector index.

Source: Alpine Macro

Undoubtedly, this latest development will hinder the recovery in the housing market, but its impact on the financial sector seems manageable. So far, 26 commercial banks reported their current exposure to mortgage defaults, impacting only 0.01% of their total mortgage lending. We see estimates on the potential size of exposure largely fall in the range of 200 to 1,000 billion yuan, roughly 0.1% to 0.5% of banks’ total outstanding loan books.

The Chinese government is already acting together with local governments, banks and developers to resolve the issue.

“There is an expectation that banks will receive some form of liquidity to specifically address the shortfall of capital required to complete the construction.”

We have seen the government’s capacity in successfully managing previous financial crises and the bankruptcies of Baoshang Bank, China Huarong and HNA Group. It is also important to note that, unlike other markets, Chinese homebuyers usually put down a deposit of 40-60% of the property price, making a “walkaway” very costly.

Our portfolio has remained significantly underweight to Chinese banks and property developers. Still a prolonged slowdown in the housing market may impact our exposure to related industries, such as home appliances, construction materials and property management, despite their relatively strong fundamentals and attractive valuations. Therefore, we will stay vigilant and watch the situation closely. On the other hand, we are well positioned for a consumption recovery theme and structural growth opportunities in advanced manufacturing and green technology.

For most active fund managers, the key driver of returns over the next year or so is the reopening of the economy after recent lockdowns that brought the economy to a standstill.