China Market Commentary: February 2021

Here are this month’s highlights: Chinese equities had a strong month again, with the MSCI China and MSCI China A Onshore rising by 7.4% and 3.7%, respectively. On the macro front, Chinese economic data such as PMI, retail sales and exports remained strong as the economy continued to recover. Institutional investors’ attention to the rapid growth of Asian stock markets was matched by rising concerns regarding ESG in the region, and especially in China.

China in January

In January, investment returns across developed markets were slightly negative, buffeted by the troublesome transition of the US presidency and mixed COVID-19 news. The vaccine rollout was offset by the spread of new variants, leading to extended or re-introduced lockdowns in many countries.

By contrast, emerging markets ploughed on, led by China. Chinese equities had a strong month again, with the MSCI China and MSCI China A Onshore rising by 7.4% and 3.7%, respectively. Offshore-listed Chinese equities noticeably outperformed their A-share counterparts on the back of strong “southbound flows” (investments from the mainland into Hong Kong), chiefly from mutual funds looking for more attractively valued stocks listed in the offshore markets.

Among individual sectors, chemical, banking and technology were the best performers, while non-bank financials and real estate lagged.

On the macro front, Chinese economic data such as PMI, retail sales and exports remained strong as the economy continued to recover. There was a brief spike in COVID-19 cases in China in early January, but the situation was quickly under control thanks to fast and strict prevention and control measures.

The “S” in ESG

Institutional investors’ attention to the rapid growth of Asian stock markets was matched by rising concerns regarding ESG in the region, and especially in China. Although China’s effort to tackle the environment such as carbon emissions is well recognised, concerns regarding human rights cast a shadow over the incredible growth opportunities.

“At RisCura we believe that ESG and financial performance are integrally linked and especially so in emerging markets. The higher overall risk of investing in these economies means that global investors apply far higher levels of ESG standards to emerging markets than anywhere else.”

One could argue, rightly so: several examples over the past few years have cost investors dearly — the Marikana massacre was the beginning of the end of mining conglomerate Lonmin; furniture retailer Steinhoff International saw an almost $10bn market cap fall within a day when fraudulent accounting was exposed; and Chinese coffee chain Luckin’ Coffee collapsed in 2020 when it emerged a quarter of its sales were faked, not long after listing on the NYSE.

Luckin Coffee scandal gave further impetus to the US administration’s demand for improved access to Chinese companies’ accounts or face delisting from US stock market.

What to look for in Social

There is a lot of written guidance on the subcategories of Environment and Governance within ESG. But what about Social? Most people have an intuitive understanding of what “Social” means in the context of ESG, but there is less guidance for investment professionals.

The emphasis also differs significantly by country, sector and is shaped by current affairs.

For example, gender and ethnic diversity are currently front of mind in developed markets thanks to movements like the Black Lives Matter campaign whereas human rights are the biggest concern in China. Another global theme is how internet companies use personal data

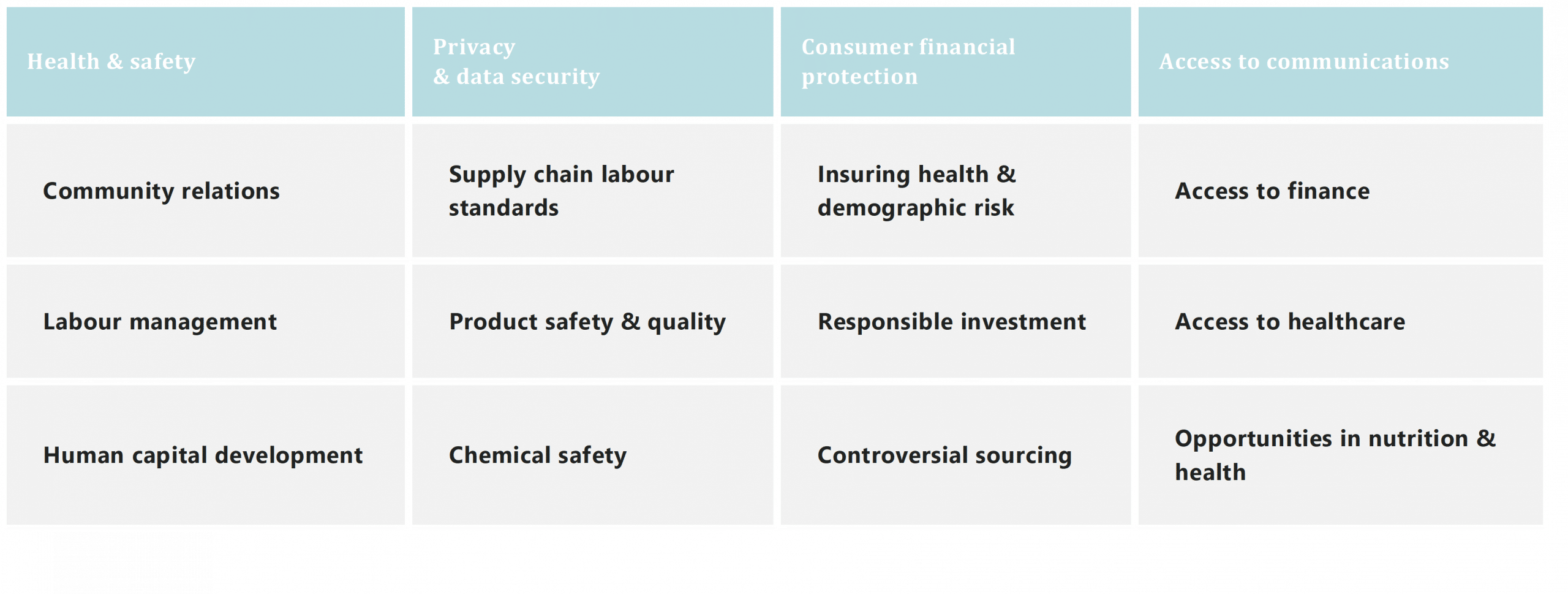

MSCI has developed a set of categories that make up the Social in ESG:

“There is no clear global standard for many of the issues here. Attitudes to data privacy in Germany are very different from those in China, which is different again to the US.”

Some countries believe universal healthcare models are essential, others find the whole idea alien. Laws in one country mandate child car seats, in others there is no requirement. Product safety standards are not harmonised.

The list goes on. The standards applied to each of these issues may therefore need to be adapted to the country and sector. In contrast, environmental factors can be applied fairly consistently across the world.

Separate social record of countries’ from ‘investing in companies

Whenever we discuss investing in China with investors, the question of human rights often tops the list, and perhaps rightly so. Here is what we think.

Firstly, we make a distinction between the country and investing in companies. Investors may not necessarily be able to effect change at country level, but they may do so at company level. It is easy to find controversial behaviour at the country level in many emerging markets and China is no different.

“We believe our clients have a duty to their beneficiaries and ignoring the world’s fastest-growing economies because of controversies at country level, may come at a very high investment opportunity cost to those beneficiaries. “

On the other hand, it can be argued that many of the rapidly growing companies in these regions create jobs and products that help the largest population of the world improve its living standards. This allows the local population to enjoy the basic goods and services that we take for granted and offer investors an opportunity to make positive social changes.

However, a company participating in or helping to facilitate human rights abuse of any kind anywhere in the world is wholly unacceptable and all fund managers must pay attention to this. Most often this relates to labour conditions in the supply chain. Do we really know who made the t-shirts we are wearing? Or where the coffee came from? From 2017 to 2019, the Australian Institute of Strategic Policies investigated and exposed the forced transfer of over 80 000 Uighurs to 27 manufacturing facilities that supply 83 global brands, including Adidas, Apple, Amazon, Gap, H&M, Microsoft, Nike, Sony, Victoria’s Secret and Zara.

Poor transparency in the clothing supply chain has been a concern ever since the Bangladesh factory collapse in 2013 where it transpired that clothing was being stitched under wholly unacceptable standards for many mainstream UK retailers.

What is disappointing is that now, seven years later, we are often just as unaware of where the products are coming from and how they are being made. Investigative journalists continue to uncover forced and/or child labour in apparel manufacturing across the globe from Syrian refugees in Turkey to Bangladesh and China.

But positive results can be achieved with engagement and co-ordination.

“The Fairtrade Coffee and Cocoa campaigns show that we can achieve meaningful change through coordinated global efforts, particularly through consumer attitudes that consider other dimensions beyond the price of the item.”

RisCura’s role as an allocator is to direct our fund managers to engage with companies and be part of this global effort. When it comes to investing in China, we believe that missing the opportunity to invest in 4 000 companies serving the largest population in the world is not an option; instead, we must – through our fund managers – engage and make a difference.

Adapting the ‘S’ to China

Investors should recognize that China is still an emerging economy and the average level of corporate governance in emerging economies, as with China, is poor. However, an active investor can select higher quality companies where ESG attitudes provide a competitive edge over those who are willing to take unsustainable shortcuts. Let’s take a look at how the “S” can be adapted to China.

Malpractice can have severe consequences in China

China is a communist country that is run very differently from western democracies. The state has a significant influence on society and the economy, and it is able to clamp down quickly and substantially on perceived malpractice, especially if the company is seen to be running “at the expense of society”. A clampdown could immediately overturn a company’s fortunes, including the possibility of complete shutdown.

In contrast, there are companies in Europe and the US that have gotten away with poor environment and social practices for many years, sometimes despite media and regulatory attention, and frauds occur in developed markets as well. The recent Wire card scandal in Germany being a good example, where regulators sided with the company for a considerable time until evidence of the fraud became overwhelming.

“There are multiple examples where the Chinese state has shutdown malpractices. Polluting steel mills, overcharging for generic drugs and aggressive personal lending companies like P2P platforms have all been targeted.”

These changes came into effect with short notice and many companies with unsustainable practices simply closed. In contrast, good operators in those sectors benefitted significantly from the resulting reduced competition.

The risk of a total loss is why Chinese investment managers already pay significant attention to unsustainable practices when researching companies including environment and social. Missing something could have a direct impact on the financial return of their investments.

Better companies pay attention to their workers and society

In emerging economies, skilled labour is a scarce resource. Almost all fundamental investors are focused on identifying companies that are leaders in manufacturing both in China and globally. As companies go up the value chain, attracting and retaining scarce talent is critical whether that be for engineers in Nio (an electric carmaker), or programmers in an internet company. Therefore, good treatment of employees is essential to a company’s financial success.

Avoiding the scrutiny of the global customer and shareholder

As stakeholders demand greater focus on ESG, global companies are paying far more attention to their supply chains. Apple, Nike and similar big companies can’t afford to use suppliers with poor ESG practices because when this is exposed, customers will go elsewhere. A good investor always assesses the risk of a company losing its customers. Therefore, an understanding of the company’s social record is required to assess its quality.

The same principles apply to Chinese companies looking for a global shareholder base.

“Recent clampdowns on communications equipment supplier Huawei and the surveillance camera maker Hikvision regarding their use of personal data or their links to the Xinjiang region are good examples.”

A good fund manager will seek detailed information from the company on the nature of its business dealings with government entities.

Understanding that ‘S’ needs to incorporate local culture and values

Finally, as outlined earlier the standards of ‘S’ really do differ by the society under consideration.

“We have found gender diversity in senior positions to be far greater in some emerging markets than, for example, in the UK.”

Most of our managers in China have women in senior positions whether they are portfolio managers, COOs or heads of research.

But we must also respect that China is different and their way of life is different from ours. For example, as in many other Asian countries, the Chinese, have a much more relaxed attitude to data privacy. We see many examples of how data can be misused, but in China it also has many benefits. China’s ability to deal with COVID-19 was in large part due to the information the authorities have about the whereabouts and status of citizens. The abundant data means China is ahead in artificial intelligence. For example, facial recognition technology is applied to curb jaywalking in major cities by publicly shaming the jaywalkers and sending them a warning message.

“It may come as a surprise to learn that China does have stringent data rules and regulations in place, but they have a focus on national security and recognise the benefits of economic growth from artificial intelligence and e-commerce.”

More recently, the Chinese government has stepped up scrutiny on internet companies over how the use of data and algorithms might facilitate monopolistic behaviour.

Engagement rather than exclusion

In RisCura’s view, “engagement is much better than exclusion”. Fund managers who actively engage with their investee companies to improve ESG make a bigger difference to the world than those who exclude “poor ESG” companies from their universe. If the company is involved in a problematic industry or service (for example, creating facial recognition software to identify ethnic minorities) then exclusion may be the only option.

“For most other companies a better result can be achieved by engaging with management and advocating for better working conditions or safer products – eventually leading to better corporate performance as less ethical competitors are shunned by consumers.”

The same principle can be applied to selecting the fund manager: a big impact could be made by hiring (and encouraging) a manager who is incorporating ESG into their process for the first time and helping them on that road.

The role of an active fund manager

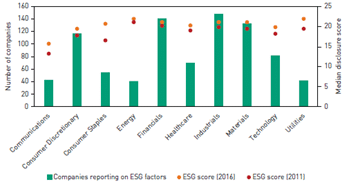

All this means that the active fund manager plays a critical role. They need to engage with companies on this difficult subject and educate companies to provide more ESG disclosure. China is still lagging behind developed markets, but it is improving. The chart below, taken from a CFA paper, shows the improvement of the median ESG disclosure score in China per sector from 2011 to 2016. It has continued to improve since then.

Conclusion

For RisCura, the answer is clear: ESG and financial performance are integrally linked and especially so in emerging markets. Fund managers who fail to consider the ‘S’ in ESG run the risk of material adverse outcomes from the companies they invest in. The standards of ‘S’ will differ across the world, but through engagement and education, global allocators are in a strong position to have a positive impact. For us, being a responsible investor that invests with care is at the forefront of everything we do.