China Market Commentary: August 2022

Here are this month’s highlights: The MSCI China and MSCI China A Onshore indices were down 9.4% and 6.0% respectively for the month. Value-style managers are starting to show improved results. More than two-thirds of the bottom quartile managers have outperformed the median since January 2021. Operational setup can be as important as investment acumen when evaluating a manager.

China in September

Chinese equities pulled back in July after a two-month rally, giving back their outperformance over the developed markets from June. Concerns around slowing economic recovery and mortgage payment defaults weighed on market sentiment. The Politburo meeting in late July reiterated China’s commitment to a zero-COVID-19 policy and fell short of announcing additional stimulus measures which disappointed the markets. The MSCI China and MSCI China A Onshore indices were down 9.4% and 6.0% respectively for the month.

China’s second-quarter GDP growth of 0.4% year-on-year was below market expectations. A slowdown in the property sector and lacklustre consumption data dragged on economic recovery. Although these headwinds may linger for a while, we think the probability of any systemic risk is low, as explained in our last letter. The Chinese government has recently stepped up efforts to ease property developers’ liquidity stress and ensure that incomplete properties are delivered. Notwithstanding that the property market has cooled down a lot since late 2021, house prices have remained stable. This suggests that the country was not in a housing bubble and household balance sheets are still strong. The housing wealth effect (where homeowners experience positive wealth creation from property investment) is important to consumer confidence, which is needed for the Chinese economy to return to its potential growth rate.

Winners today may be losers tomorrow

In the investment world, “past performance is not indicative of future results” is commonly cited but an underappreciated risk warning. Empirical studies suggest that recent winners tend to underperform in the subsequent period. There are many reasons, including luck (or randomness), market style change, style drift due to AUM growth, complacency and so on.

That statement is particularly true for the Chinese markets, given the rapid market change and macro environment. But yet, we saw many investors, including sophisticated asset owners, chase performance during the bull phase of consumer and internet companies over the last decade. Even some mediocre fund managers delivered outstanding performance over this period. It was tough to beat any portfolio that held Tencent, Alibaba, Moutai and several other outstanding large consumer companies since 2015.

However, everything shifted last year as the market environment changed through a combination of regulation and a slowing economy. Very few of the winning managers of the previous five years were nimble enough to alter their positioning. Unfortunately, those hoping for a turnaround this year have continued to underperform. We are now reaching a stage where even the survival of some fund managers is in doubt with significant drawdowns, loss of business and staff exodus.

Times like this are an important reminder of fundamental manager selection principles such as emphasising manager skill, diversification and risk management. We have always noted that manager selection in China is a specialised skill.

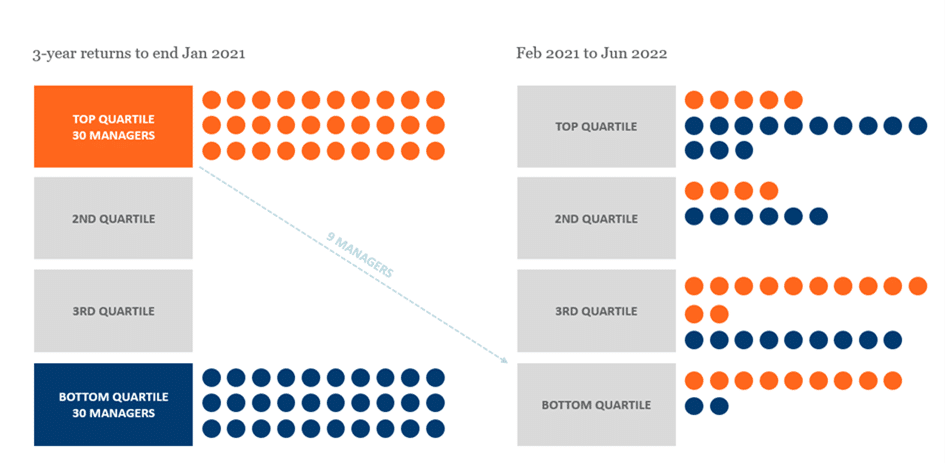

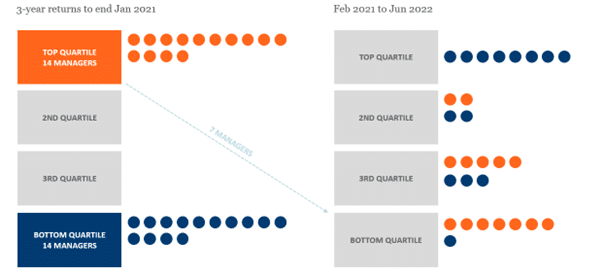

The orange and blue circles in the charts below represent top and bottom quartile managers for the three years up to January 2021 when the share prices of Chinese technology companies reached their peak. We then tracked the performance of those same managers over the subsequent months to June 2022 and plotted their results relative to the wider peer group. We did this separately for the All China and China A share universes of fund managers.

All China universe

China A universe

Source: RisCura, eVestment; 121 funds in All China universe, 57 funds in China A universe; 1 dot represents 2 funds

Most top quartile managers not only failed to stay at the top but actually moved to the bottom quartile. The reverse is also true, with only a trickle of the bottom quartile performers remaining in the same place since January 2021. This phenomenon is consistent for both the A-share and Greater China managers. More than two-thirds of the bottom quartile managers have outperformed the median since January 2021. Some of these managers had delivered poor returns for a long time – many of them are value-biased managers. It shows how difficult it was to retain value managers in China in the past, but also their importance in a multi-manager structure.

We now discuss a few case studies where managers have experienced a substantial change in fortunes. This is a follow-up to a similar note we wrote in our December 2021 letter.

Managers impacted by the change of market environment

One manager, a large global brand, was a popular choice for global institutions implementing their China allocation. Their buy-and-hold strategy of large blue-chip stocks in the Consumer and TMT sectors delivered outstanding returns for a prolonged period. Other managers struggled to match their returns and we spent many meetings trying to build confidence in their investment team. They had benefited from the rapid growth and rerating of large consumer brands such as Tencent, TAL, Haidilao and Moutai, but it all changed for them in 2021 as these sectors went out of favour.

Whilst we missed that manager, we do have a small allocation to another manager who follows a similar approach. Significant biases in style, sector or geography resulted from a concentrated portfolio approach. The manager’s strategy worked very well in 2019 and 2020, but since early 2021, regulation, COVID-19 lockdowns, geopolitics and market style have all weighed heavily against their portfolio companies’ fundamentals and valuations. From peak to trough, the manager experienced a drawdown of over 65%, falling from the top decile of returns to the bottom decile in the last five years. Thankfully, our allocation to the fund manager has always been less than 3%. Our small weighting to this manager was heavily influenced by its portfolio concentration.

Bad operating decisions kill a business

This manager(to whom we have no exposure), was once a high-profile boutique with strong investment performance and rapid asset growth. Within just six months, their AUM fell by 80%: half due to poor performance and the other half due to redemptions. There were bad trades, but performance alone is insufficient to explain such a sudden downfall.

They also made poor operating decisions, such as not having a side-pocket for illiquid positions and allowing in-kind redemptions, which led to an exit stampede by investors. This reminds us that the operational setup can be as important as investment acumen when evaluating a manager. A poorly structured fund matters especially during challenging times. At RisCura we pay a great deal of attention to operational due diligence which is conducted by a separate team who can veto any investment decision.

The recovery of value style

One of our value managers has deep expertise in traditional sectors such as financials and mining. We selected them at the height of the growth market, expecting that they who would “tread water” whilst their style remained out of favour. That is exactly what they did until the market turned last year and rich valuations started to tumble. They have been one of our top performers since the market turned last year.

Finding the right value manager to invest in a growth market was a hard task but we felt it was important to maintain a balanced portfolio across styles. We steadily increased our allocation to this manager since 2020 as we saw the early signs of a style rotation towards value.

Other managers, who are more sensitive to valuation, also outperformed in the last 18 months as they had been underweight to the expensive areas. Most of these were the bottom quartile managers in the charts above that are now delivering top quartile returns.

Top and bottom quartile managers that remain there…

Inevitably there will be cases of exceptionally good (and in some instances bad) managers that have continued to deliver as they had done in the past.

One of our largest fund manager relationships is with a platform that hosts high-calibre managers. Their multi-PM product exposes us to three exceptional investors with different investment strategies. At a combined level, they have continued to deliver strong performance.

On the flipside, we have researched several fund managers who used style as an excuse for lacklustre performance and who continue to deliver mediocre returns even though the market environment has completely changed. We continue to follow many managers even if we dismiss them during our research process. We are always prepared to be proven wrong in our assessment!

Underwriting fund managers is a challenging task, especially in a country like China. It requires local expertise, patient research that sometimes can take years and close monitoring, ideally in person (pandemic or not).