China Market Commentary: August 2021

Here are this month’s highlights: Regulatory activity led to a broad sell-off across Chinese markets amid concerns on China’s policy direction. Following recent market dislocation, RisCura is in the process of rebalancing client portfolios and topping up some recent underperformers. We look at the concept of ‘Common Prosperity’ which has received renewed attention from the Chinese Communist Party.

China in July

Chinese regulatory events dominated July market news. (as discussed in detail in our last letter and our related white paper – do let us know if you would like to receive a copy). This regulatory activity led to a broad sell-off across the Chinese markets as investors became concerned about China’s policy direction with some even questioning the government’s commitment to a market economy.

The offshore market index fell more than the domestic onshore market due to a bigger exposure to affected technology sectors and a larger foreign investor base that took fright more easily in this situation. For July, the MSCI China and MSCI China A Onshore indices were down 13.8% and 5.1%, respectively.

“Although RisCura agrees with those commentators who argue that some of the policies are too draconian, we still believe that the underlying growth trend has not shifted. We remain constructive on China’s long-term economic and capital market development.”

July was a story of contrasting sectoral fortunes. Consumer Services lagged considerably during the month whereas the Semiconductor, Electrical Vehicles and Renewable Energy sectors saw further inflows. Materials and Utilities also performed well while Banks, Information Technology, Healthcare and Property also lagged. At the macro level, the latest data suggests the economy is holding up well, although recent flooding in Central China and localised COVID-19 outbreaks will be a drag on growth during the second quarter. At the time of writing this commentary, the COVID-19 situation had subsided as China reported zero local cases for the first time in weeks.

Following the recent market dislocation, and the resulting wider dispersion of individual manager returns, RisCura is in the process of rebalancing client portfolios and topping up some recent underperformers.

Our aim is always to maintain a balanced portfolio while recognising that some of the companies held by the underperformers may now represent attractive valuations. As a long-term investor, we do not mind being contrarian at times to take advantage of market volatility.

Some of our managers are reporting attractive valuations in high-quality companies whose fundamentals remain unaffected and perhaps regulatory fears are exaggerated, or whose prices were depressed due to indiscriminate selling by investors. Examples include some high-quality banks that happen to be large constituents of the MSCI China index.

While regulatory news took centre stage in the capital markets, investors may have also noticed that the Chinese government’s references to “common prosperity” has surged in recent weeks. This subject is topical for many in China, including RisCura’s senior analyst Robin You, whose views we share below.

Economic reform and inequality

China’s economic reforms have brought tremendous capital growth and lifted the entire population out of extreme poverty but have also deepened income inequality between the rich and poor and made social mobility more difficult.

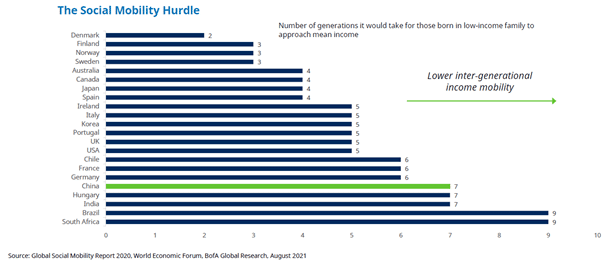

“Today, there are about 700 billionaires in China, a close second to the US, while its GDP per capita (PPP adjusted) is only a quarter of that in the US. According to the Global Social Mobility Report 2020 by the World Economic Forum, it would take another seven generations for the bottom 10% income families to reach median income in China.”

This compares unfavourably to many of the capitalist countries such as Japan (four generations) and the US (five generations). It is quite an irony for a socialist regime.

Former Chinese leader Deng Xiaoping famously said that to develop a socialist market economy, China would have to “let some people get rich first”, as he argued that “common prosperity” does not equal “synchronised prosperity”. Forty years have passed, and this approach has so far been correct. But we need to remember that common wealth is still the greatest goal of socialism. Now it is once again at the top of the Communist Party’s agenda – and may remain so for the coming decades.

“Some top party officials have explained that it is less about an even distribution of wealth, but rather about finding a balance between efficiency and fairness.”

Acceleration of tax reforms and promotion of charitable contributions are among the things to expect. Although more details remain to be seen, the transition process will likely be gradual. Some large corporates are already making responses.

Tencent, for example, has announced a 50 billion Renminbi fund to support a range of initiatives for low-income groups. Alibaba and JD.com also reaffirmed their commitment to creating value for society.

Any structural change will bring both risks and opportunities, and we will discuss these in detail in the next edition, using a case study of South Africa (1994 to 2010).