China’s Rise in Electric Vehicles

China’s Dominance in the Global Electric Vehicle Supply Chain

Highlights revealed in the article:

- China’s rapid ascent in the global electric vehicle (EV) industry.

- The impressive global expansion of Chinese EV brands.

- China’s evolving EV market penetration and its growth in various market segments.

- The competitive advantages that fuel Chinese manufacturers’ dominance in the EV sector.

- China’s strategic approach to expanding its EV brands globally and their competitiveness in international markets.

The Electric Vehicle market has been a key area of focus for many Chinese fund managers over recent years. It was only as recently as 2018 when they started talking about researching supply chains of electric batteries and within five years China’s dominance of this sector is visible on roads globally.

Earlier in the summer, a friend in the UK asked me why he shouldn’t buy an MG over a Telsa, which is significantly cheaper and reviews well. MG was bought out of bankruptcy by SAIC, a Chinese State-Owned Enterprise, in 2005. Coincidentally, around the same time, one of the largest car dealerships in a Middle Eastern country asked us to arrange a call with an industry expert to discuss Chinese EVs. It seemed like everyone wanted to know more about Chinese electric vehicles.

17 years after being bought out by SAIC, MG, once a proud British auto icon, is back in the UK with a flagship store in London in the heart of prestigious Mayfair. Over recent months I have seen MGs on the streets of London, Lahore, Dubai and Muscat.

”…but in a world where electric cars always feel like marginal value, the MG4 does not. It’s a wake-up call to mainstream manufacturers. And yes, as other cars come to market and improve, the MG4 will become a harder sell. But for the next 18 months, MG is going to shift as many of these things as it can physically get into the country. If competition improves the breed, you’re looking at the catalyst for better value EVs for all of us.” – Top Gear 2023

Therefore, it wasn’t surprising to us when China surpassed Japan this year to become the world’s largest auto exporter. This letter sets out China’s dominance of this market and its competitive edge.

Chinese manufacturers by size

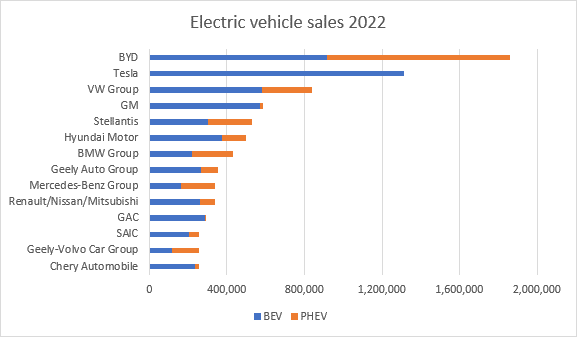

With a market capitalisation of over $800bn, Tesla is bigger by value than all of the legacy car makers combined. It also holds the world record for being the largest manufacturer of pure battery electric vehicles (BEVs). However, combining BEVs and hybrids (PHEVs), Chinese company BYD outsold Tesla by nearly 50% in 2022.

Source: EV-Volumes.

China has clearly led the roll-out of electric vehicles for many years as the chart below shows.

Source: CAAM, Cephei Capital.

Within two years, China’s EV penetration rate surged from under 10% to 35%. Initially, this growth was driven by the high-end segment, with luxury EVs gaining traction among affluent consumers.

Within two years, China’s EV penetration rate surged from under 10% to 35%. Initially, this growth was driven by the high-end segment, with luxury EVs gaining traction among affluent consumers. However, more recently, the low-end segment has also witnessed a surge in EV adoption. This expansion across market segments demonstrates the increasing acceptance and accessibility of EVs among a broader range of consumers in China.

The size of this lead has allowed the Chinese auto supply chain to expand into and dominate electric vehicles. Furthermore, Chinese manufacturers have also benefitted from the home advantage and developed products that resonate with the market. This has also coincided with the Chinese mastering other important aspects such as design, quality, and brand management.

This has led to Chinese companies establishing strong moats in the EV sector.

Moat 1 – Access to Resources

China’s dominance in the EV supply chain begins with a significant advantage: access to critical resources. The country holds a near-monopoly on several key materials used in battery production. For instance, China produces nearly 70 percent of the world’s graphite. The country also accounts for over two-thirds of the world’s rare earth supply and is even higher in terms of processing capacity. Furthermore, Chinese companies also have secured further supply of scarce minerals from Latin America and the African continent.

This resource control extends across the entire battery supply chain, allowing China to be self-sufficient from upstream lithium production to downstream battery assembly.

Moat 2 – Government Support and Policy Initiatives

The Chinese government’s strategic foresight and commitment to green technology have played a key role in shaping the country into a global EV powerhouse. Numerous policy initiatives were implemented to support the growth and development of the EV sector. These include both direct subsidies to automakers and tax exemptions for consumers. The EV subsidy scheme was initially introduced in 2009 and lasted for more than a decade; tax breaks to consumers were recently extended until 2027 with an estimated value of $72bn for the next 4 years.

China has also made substantial investments in building a robust public charging network. With nearly 1.8 million EV charging stations installed, China leads globally in charging infrastructure. In comparison, South Korea ranks second with circa 200,000 charging stations. Public transport is also electrifying with Shenzhen becoming the first city to fully convert their bus fleet in 2018

Moat 3 – Industrial System and Cost Advantage

China has developed extensive and efficient industrial supply chains in the auto industry, resulting in significant network effects and cost advantages. The proximity of major clients and suppliers enables streamlined communication, faster response times, and cost-effective adaptation to changes. This competitive edge makes it unlikely for any country including India to replace China as the world’s manufacturing hub within the next 10 or 20 years.

Additionally, China has become a global leader in mass engineering as a result of the abundance of a specialised workforce, and experienced management that can coordinate production and government assistance where required.

Tesla’s Gigafactory in Shanghai rolled out its first car just 10 months after it was awarded the license to build a factory. The Gigafactory is the size of 100 football fields with around 20,000 workers. Not only can the plant make a brand-new car every 40 seconds, it is also highly profitable with a gross margin of over 30%.

Moat 4 – EV Batteries

A prime example of Chinese companies leveraging their manufacturing expertise and economies of scale is the production of EV batteries, which represent the most expensive and complex component of an electric car. China’s ability to achieve mass production of batteries at a lower cost grant it a significant competitive edge over other countries.

Two primary battery technologies are prevalent: NMC, which uses varying quantities of lithium, nickel, manganese, and cobalt, and LFP, composed of lithium, iron, and phosphate. LFP batteries have advantages such as higher safety levels and lower production costs.

While China already accounts for 75% of the global EV battery output, it has an absolute monopoly over LFP technology, commanding a 99% market share worldwide. Even in the realm of solid-state batteries, which is considered the next generation technology, Chinese companies lead the research and development efforts.

Replicating China’s manufacturing capabilities and scale would require extensive investments of time, resources, and tens of billions of dollars, spanning years if not decades.

The world’s largest producer of EV batteries is Contemporary Amperex Technology Co. Limited (CATL). In 2022 alone, they allocated $2 billion to research and development. As part of their ongoing ventures, CATL is collaborating with Ford Motor to build a $3.5 billion battery plant in Michigan, USA, highlighting their commitment to expanding their manufacturing capabilities and global presence.

Key Players in the Domestic Market

In the Chinese domestic market, pure-play EV companies are rapidly gaining market share from legacy manufacturers, particularly foreign brands like Volkswagen and Toyota. With over 20 players in the EV market, notable contenders have started to emerge, all of which are local OEMs except for Tesla.

According to the chart below, BYD stands out as the clear leader with about one-third of the Chinese EV market. Tesla, Aion (GAC Group), SAIC (MG), and Li Auto closely follow. While BYD offers a comprehensive product suite catering to various market segments, many other players focus solely on specific markets. For example, Li Auto has always positioned its models for family users. Thanks to their attractive product design, their electric SUVs were among the best-selling cars in the premium segment in 2022. There are also more niche premium brands such as Xpeng and Nio.

Source: Cephei Capital.

Growing Global Presence of Chinese EV Brands

Chinese electric vehicle (EV) brands are not only achieving substantial success in the domestic market but are also making significant strides in global markets. This expansion is driven by their competitiveness and increasing brand recognition. Companies like Dongfeng and BYD stand out as some of the most successful exporters in this domain.

Chinese EVs are distinguished by their emphasis on smart applications and entertainment features, presenting a different selling proposition compared to their foreign counterparts. Additionally, Chinese EVs frequently offer superior value for money, making them particularly attractive in markets where cost is a pivotal factor.

Despite the noteworthy accomplishments thus far, substantial potential for further growth and expansion remains untapped. Several prominent Chinese brands, particularly those in the premium segment such as Li Auto and NIO, have yet to penetrate foreign markets.

It is worth highlighting that some recognized foreign brands are under the ownership of Chinese companies. Apart from the previously mentioned MG, Polestar, the Swedish electric car company, is integrated into the Volvo Group, ultimately owned by China’s Geely.

In conclusion, China’s dominance in the global EV supply chain stems from a synergy of strategic resources, robust governmental support, a comprehensive industrial framework, robust manufacturing capabilities, and a substantial domestic market. As China’s influence grows in international realms, its position as a global EV powerhouse is poised to fortify even further.

Click here to subscribe to our Monthly China commentary, providing a detailed and insightful analysis of the state of the Chinese equity market.