The Russian Invasion of Ukraine

A complex geopolitical situation is unfolding in the form of the invasion of Ukraine by Russia. We describe this in some detail below. The situation has already, of course, had implications for markets, a brief summary of which we cover in the following paragraph followed by our advice for how to navigate the coming times.

A summary of the market reactions thus far

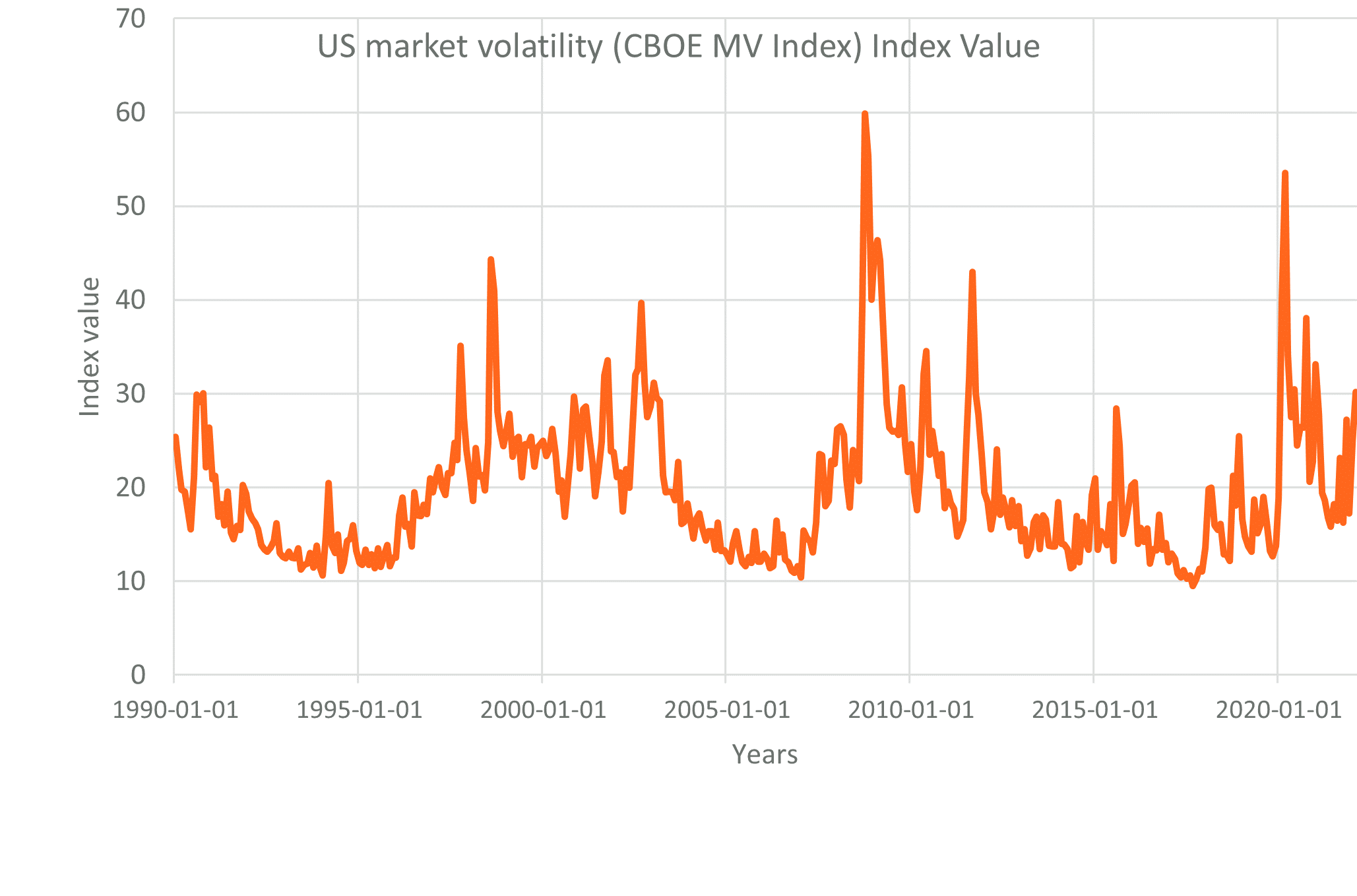

The events of the past week have already demonstrated that the market reactions can be extreme. It would thus not surprise us if volatility remained elevated.

It is important to remember that the current conflict is taking place in what is already a rather challenging global environment, with capital markets having been under some pressure since the end of 2021 driven by: concerns around inflation and the looming reality of rising interest rates; uneasiness about the sustainability of current economic and fiscal policies; along with some signs of a deterioration (slowdown) in the global economic outlook.

For now, it would appear that markets have chosen the following responses:

- Heightened volatility;

- A sell-off in the Russian assets (currency, bond and equities), although the exposure in EM equity funds is fairly low at around 2-3%, some managers have fairly large positions, especially where they are value style biased;

- Rising commodity prices, especially oil, with precious metals being particularly volatile i.e., both up and down aggressively, on an almost daily basis, creating a counterbalance to asset falls in more direct Russian exposure;

- A moderate sell-off in global markets – especially as the market senses that the Fed will now need to be less aggressive in hiking rates as it might have otherwise intended to be (pre the conflict).

- Global supply chains are likely to be negatively impacted, with some further inflationary implications.

- Russia’s exclusion too, from certain global indices e.g. emerging debt or equity, will add a further level of complexity, and increase the risk of errors in the index construction and tracking thereof.

- South African markets:

- Equity markets have already seen some of the impact filter through. Resource companies, and oil-giant Sasol, made substantial gains during the latter part of February. The Resi gained more than 16% over the course of the month. South African Industrials, on the other hand, felt the impact via the knock-on effects on sector heavyweights Naspers and Prosus. The subindex lost more than 7% for the month.

- The impact on South African bond markets is more difficult to gauge. On the one hand, an aversion to Russian debt can have an impact on Emerging Market sentiment, leading to a broader sell-off. On the other hand, higher prices for Developed Market debt (and therefore lower yields) can have a positive spill-over impact on the debt of Emerging Markets, such as South Africa, whose sovereign ratings have remained unaffected, and which are largely insulated. As Developed Market debt becomes more expensive, reasonably priced (solidly rated) Emerging Market debt, becomes relatively more attractive.

- It is likely that traditional inflation hedging mechanisms (including Inflation Linked Bonds) will tick up, in line with the uptick in global inflation and as inflationary fears become more prevalent (locally and elsewhere).

Advice for the reader strapped for time

With Russia’s invasion of Ukraine, uncertainty is raised and market volatility increases. When markets are this volatile, RisCura advice to clients is to observe closely, and to prepare to react if and when pricing becomes favorable. Though this may mean sitting tight as things unfold, it also means preparing to pounce if and when material mispricing occurs. This approach has paid off in the past. Thus far, the volatility observed to date, has not been meaningful enough to call for significant changes. Having said that, we remain vigilant and have geared up to recommend any shorter-term tactical asset allocation (TAA) calls, to enable clients to take advantage of market dislocations and mispricing where mandates allow. Where clients are invested in multi-asset (e.g. balanced) portfolios, it is the job of the appointed asset managers to respond appropriately. In such cases RisCura has in turn asked those managers to provide input as to their strategic approach to the unfolding situation.

The backdrop

Tensions between Russia and Ukraine have been rising ever since the so-called “Orange Revolution” in 2004. Recently, however they have taken a dramatic turn for the worse. Whilst the risk of military hostilities had undoubtedly been looming, especially as 2022 kicked off, most market and political analysts regarded it as an unlikely outcome. Risks of major military conflict seldom manifest and are more often than not resolved by international diplomacy. But not in this case: Russia started massing troops along the border to Ukraine, even as they reassured the international community that this was not the prelude to a military offensive. On the 24th of February 2022 however, the truth was finally exposed: Russia launched a ‘special military operation’ (invasion) of Ukraine.

President Putin is regarded as an arch-strategist, and a master of manipulation and propaganda. He is therefore notoriously hard to read. Either way, he is certainly not a leader to be trifled with. He means business and is quite prepared to use the Russian military to achieve his goals. This has been amply demonstrated over the past few decades, whether in Chechnya, Georgia, Syria, the Crimea, and elsewhere, even in Africa. On the continent, Russia has been getting even more involved – from Libya to Mali, Sudan to Mozambique, Russian troops have been on the ground.

Putin runs Russia as an autocracy, with himself as the (effective) Czar, and few have dared to challenge his power, either within Russia or indeed in the West. It seems fairly clear that President Putin expected a speedy victory. The general feeling is that he intended to capture the Ukrainian capital of Kiev with a quick, clinical attack. Having done so, he would likely have removed the current President, Volodymyr Zelensky, and installed a puppet regime – one far more amenable to Putin’s demands. Thus far (though it is early days and things could change rapidly), he has failed in his objectives, with reports of substantial resistance, of Russian lives lost, and of military equipment destroyed. The Ukrainians have put up a far better fight than most, Putin included, had expected. The Ukrainian leader, President Zelensky is currently being hailed globally as a great leader and a hero to his people, but it is early days yet.

There are other elements which should not be overlooked. The most critical is the increasingly close relationship between Russia and China. These two aspirant global super-powers are both determined to challenge, and change, the current status quo, in which the West (notably the United States of America and the European Union) dominate inter alia, global discourse and thought leadership. This fight is not a new one and is being fought on many levels. Some commentators argue that the Cold War is back, though others contend that it is rather a ‘Grey War’ that has been underway for some time i.e., one which includes cyber-wars, trade-wars, social-media wars, psychological warfare, and the like. These battles have not, until now, involved soldiers, tanks, and planes, but are nevertheless a (new) form of warfare.

With Russia both able to utilize nuclear powers, and reportedly having acquired weapons that even the West may not (currently) possess, the stakes are high. Up for grabs is significant power and influence globally. The Russian incursion into Ukraine should be understood within that context.

Some key questions

There are so many, important questions that arise, including:

- Does Russia succeed in conquering Ukraine (if that is even the true intention)? And if so, how long does that take? And with how much collateral damage to both countries?

- How does the international community react? The West, China, African countries, South Africa? In particular, China’s view is not well understood, with them seemingly understanding Russia’s position, yet not actually supporting the invasion into another’s territory.

- Is Putin’s threat of nuclear war a real possibility?

- Just how secure would Putin be in the case of defeat in Ukraine, a public uprising, a determined Western response?

- What are the implications for global geo-politics? Economies? Markets?

- What is the risk to energy supply in Europe, oil prices and downstream inflation?

- What are the implications for South Africa and its markets?

- And many more…

With so many unknowns, speculation is rife, but answers are few and far between. The outcomes could be poles apart.

An example: Just how do markets price in the risk of a nuclear war in Europe (albeit hopefully a very remote one), and the potential consequences thereof? The outcome would be totally catastrophic. On the other hand, there is also a probability that Putin has erred (badly), with the possibility of him being removed from power (albeit remote too). This outcome would, undoubtedly, be very positively viewed by markets i.e. two very different outcomes.

Implications for Russia, Ukraine, NATO

The recent conflict has come as a rude shock. Most believed that the big battles between the super-powers died a well-deserved death after the end of the Cold War; that traditional warfare was reducing in frequency; and that Russia had unequivocally joined the ranks of the ‘well-behaved’ nations. This has, most sadly, not proven to be the case.

What of the outlook?

- Russia may succeed in winning the battle (subjugating Ukraine), yet end up losing the (longer term) war.

- Its unprovoked attack has had far-reaching responses, notably in Europe. There have been massive public demonstrations against Russia’s actions, even from within its own borders (an extremely brave act). Many governments across the globe have publicly condemned the attack, and pledged support to the Ukrainian effort.

- Increasingly aggressive sanctions against Russia. Sanctions include:

- Targeting the political elite: Putin’s foreign-held assets in the EU, US and United Kingdom (UK) have been frozen; Russian ministers (351 members of the Russian Duma) have been put on travel bans and had their assets frozen; Russia’s richest men have had assets frozen and have been banned from traveling.

- Targeting banks and financial services: The US has cut off Russia’s biggest bank and its 25 subsidiaries (Sberbank) from the US financial system; Russian Central Bank assets (which are originated after April 2022) may not be directly or indirectly traded; A number of Russian banks have been excluded from the SWIFT international payments system.

- Targeting specific companies: The world’s largest natural gas company, Gazprom, Russia’s largest oil refiner Gazprom Neft, and Russia’s largest power company, RusHydro face severe restrictions in the USA, as does the world’s largest diamond mining company Alrosa; Russian airlines, including Aeroflot, have been banned from UK, EU, US airspace; Trading has been suspended for shares in Rostec, Russia’s largest defence company; EU-based companies are banned from exporting technologies to strategic Russian companies such as shipyards, pharmaceutical companies.

- NATO, long been seen as enfeebled and lacking in commitment and purpose, has instead had its raison d’etre emphatically re-affirmed. We are likely to see an even stronger commitment by the Europeans to both the likes of NATO, and their own internal defense spending programs. Germany is a clear case in point, with its recent decision to increase its military spending to 2% (up from 1.5%) of GDP.

Putin, with his express intention to slow the advance of NATO, may just prove to have been the very catalyst for its revival and continuation.

Implications for South Africa

There is little that one can say with certainty. Local asset classes have recovered well from the COVID-19 sell-off in March 2020 (see graphic below). Most asset managers and market commentators still regard SA assets as relatively cheap in comparison to developed and Emerging Markets (EM).

Commodities:

South Africa has been a notable beneficiary of a strong commodity cycle. Listed commodity companies have delivered stellar performances on the local bourse. The country’s finances have vastly improved, with the fiscal deficit being revised lower to 5.7% for the 2021/22 fiscal year, largely due to higher mining receipts. The February 2022 Budget Speech highlighted that tax revenue collected (mainly from commodity companies) had reduced the budget deficit by almost R 200 billion. The deficit is projected to narrow further in the coming year. This is regarded as extremely positive for the government’s coffers (given the high cost of debt servicing) and may have a knock-on impact on social spending.

The prices of some key commodities have risen sharply. On the one hand and as a positive spill-over, South Africa is the second largest producer of palladium (with Russia the largest). With the majority of countries cutting trading ties with Russia, South African exports of palladium and a number of Platinum Group Metals (PGMs) are likely to continue trending higher. Gold, the stalwart store of value in volatile times, has also traded higher. On the other hand, South Africa imports oil, some of it from Russia. Beleaguered South African consumers are facing a whopping R1.46 per liter increase in the price of petrol as of the 1st of March.

Inflation:

A deterioration in the global growth outlook, or an escalation in global inflation, will be detrimental to the South African Reserve Bank’s aim of normalizing policy rates. The EU is likely to see higher gas-prices, due to the cancellation of Nord Stream 2. Nord Stream is a 1 200 km pipeline under the Baltic Sea, which carries gas from the Russian coast to Germany. The dearth of natural gas, and subsequently higher input prices, will weight on EU economic growth with a knock-on impact on the region’s major trading partners, including South Africa.

Higher input prices will likely drive South African Consumer Price Indices higher. There are also nuances to increasing prices: food price inflation is also likely to trend higher. In the run-up to the invasion, there was a spike in the prices of agricultural commodities, including maize (21% higher), wheat (35%) and sunflower oil (11%). African countries are largely dependent on grain imports, and inflation will consequently be driven higher by the increase in staple food prices.

Trade:

South Africa’s direct exposure to Russia and Ukraine is limited, in terms of the balance of trade. Select industries, however, will be impacted. In 2020, for instance, Russia accounted for 7% of South Africa’s citrus exports.

Listed companies impacted:

By Russia’s figures, South African companies have about R77 billion tied up in that country. Russia is a key market for Stellenbosch-based Zest Fruit. AB InBev has a 50% joint venture in Russia, valued at R17 billion. Naspers is a major shareholder (27%) in Mail.ru, a key internet player in Russia. Barloworld, the heavy equipment company, has attributed roughly 75% of its operating profit in Eurasia to its Russian operations.

The Currency

Commodity strength is usually supportive of a stronger Rand. However, if sentiment toward Emerging Markets or risky assets turns sour, it could result in currency depreciation. Thus far, there has been little evidence that the Rand is reacting much to the turmoil.

Conclusion

The political landscape is fluid and volatile at the best of times. The current conflict, which looks set to be the largest since the Second World War, has both exacerbated pre-existing tensions and fanned the flames of new tensions. South Africa has been careful in its response to the Russian invasion of Ukraine, with its political stance couched in diplomatic language, especially considering its membership of the BRICS.

In the coming weeks, the United Nations General Assembly, of which South Africa is a member, is set to act on a resolution condemning Russia’s war on Ukraine. South Africa, with its ties to both China and Russia via the BRICS agreement, will need to walk a political tightrope.

South Africa, to all intents and purposes, is physically removed from the conflict, and to some extent economically insulated. Investors in South African assets are therefore fairly protected. It is important, however, to remain cognizant of the risks and the opportunities, but to not overreact.