South Africa’s 3% inflation target: A new investment equation

Rethinking South Africa’s inflation anchor

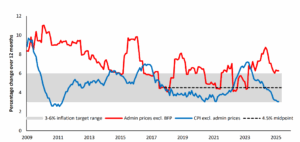

South Africa’s inflation-targeting framework has guided policy for 25 years, keeping inflation within a 3–6% band, informally anchored around 4.5%.

This has provided stability compared to the volatility of past decades. Yet today, the framework looks increasingly outdated.

Other emerging markets such as Brazil, Chile, Mexico, and Israel now target 3% directly, and evidence shows that narrower targets improve monetary credibility and lower borrowing costs.

South Africa’s broad band, by contrast, has allowed inflation expectations to cluster near the top of the range, raising the cost of capital and weakening credibility. For investors, this is more than a policy shift – it’s a potential structural reset of how assets are priced and portfolios are constructed.

Why a 3% target matters

Catching up with peers

Most advanced and emerging economies operate with tighter inflation anchors. South Africa’s 3–6% range is now an outlier.

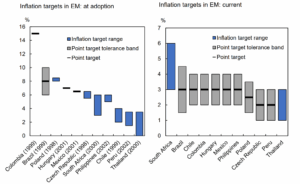

Figure 1: Peer comparison of inflation targets

Shows how South Africa’s range compares with peer emerging markets, many of which now anchor around 3%.

*Source: SARB (2025c)*

This divergence limits South Africa’s competitiveness, as higher inflation makes exports costlier and keeps borrowing costs structurally elevated.

Managing inflation differentials

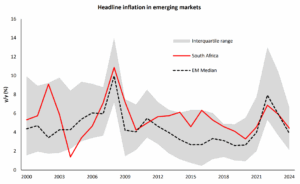

While trading partners such as Germany, the US, and China have averaged inflation around 2–3%, South Africa has averaged closer to 5–6% over the past two decades.

Figure 2: South Africa’s inflation performance relative to peers and trading partners

Compares South Africa’s inflation path to major emerging and developed economies.

*Source: SARB (2025c); Bricco, Mansilla & Wingender (2025)*

Reinforcing credibility

Wide inflation bands undermine confidence. A narrower 3% target would align South Africa with global best practice,anchoring expectations more effectively and supporting lower long-term borrowing costs over time.

From target to transmission: How a 3% world looks

Lowering the inflation target resets the pricing of capital throughout the economy.

Monetary effects

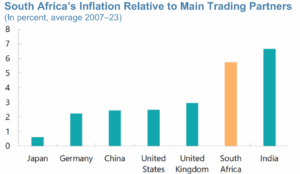

SARB modelling shows that with a credible 3% anchor over time, inflation expectations fall, the repo rate declines by over 100 basis points, and GDP stabilises after adjustment. Wages also moderate, reinforcing credibility.

Figure 3: QPM macro responses under a 3% target

Illustrates SARB’s modelled responses for repo rate, CPI, GDP, and wages under a 3% inflation target scenario. *Source: SARB (2025c)*

Fiscal implications

Lower inflation expectations reduce sovereign borrowing costs and ease the debt-service burden. SARB estimates that a credible 3% target could save around R870 billion in interest payments over a decade and improve the primary balance.

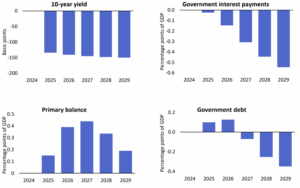

Figure 4: QPM fiscal responses – 10-year yield, interest payments, primary balance, and debt

Shows how reduced inflation expectations may translate into lower yields, smaller interest bills, and fiscal savings. *Source: SARB (2025c)*

Over time, this compounds. Debt-service costs decline, and the debt-to-GDP ratio improves as credibility strengthens.

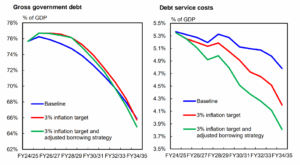

Figure 5: Debt and debt-service costs – Baseline vs 3%

Compares debt and interest cost trajectories under the current regime versus a 3% inflation anchor. *Source: SARB (2025c)*

Portfolio implications by asset class

Fixed income

A credible 3% target initially benefits bondholders. Lower yields and flatter curves deliver capital gains and reduce volatility. However, long-term returns become thinner as income streams reset lower.

Short-term gain, long-term moderation: bonds remain stabilisers, not return engines.

(Sources: IMF, 2021; Wright, 2008; Blake, Rule & Rummel, 2015)

Equities

Lower discount rates may lift valuations, particularly in rate-sensitive “SA Inc.” sectors like banks and retailers. But slower nominal GDP growth caps future earnings, meaning forward returns compress.

Valuations up, growth down: performance becomes more dependent on stock selection and capital discipline.

(Sources: Bekaert & Engstrom, 2010; BIS, 2019)

Balanced portfolios

Balanced strategies benefit from an initial “double lift” – bond rallies and equity re-ratings. Yet over time, returns converge lower as all components face thinner margins.

Diversification, offshore exposure, and liability alignment become essential in sustaining real returns.

(Sources: IMF, 2017; IMF, 2020)

Private markets

Cheaper capital can inflate entry multiples, boosting valuations in the short term. But with slower nominal growth, long-run IRRs compress. Sustainable performance will depend on operational value creation, not leverage.

Key risks to watch

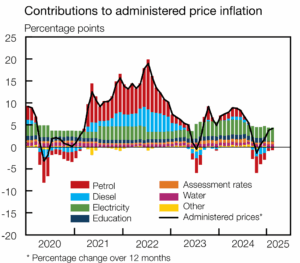

Administered prices

Electricity tariffs, fuel levies, and municipal charges – which make up nearly one-third of the CPI basket – still run well above headline inflation.

Figure 6: Administered prices and their contribution to headline CPI

Highlights the gap between headline CPI and administered price categories such as electricity, fuel, and water. *Source: SARB (2025b, 2025c)*

Fiscal discipline

Without credible fiscal consolidation, cheaper capital could be offset by renewed risk premia.

Anchoring expectations

Wage settlements and rand volatility must align with the new target for its benefits to hold.

The bigger picture

A 3% inflation target would not simply fine-tune policy – it would redefine South Africa’s investment landscape. Lower inflation and interest rates could strengthen fiscal sustainability and stabilise long-term growth, but investors must adapt to a new equilibrium of thinner nominal returns.

Stability replaces excess. The winners will be those who adjust first.

Our view

At RisCura, we help institutional investors build resilient, diversified portfolios that adapt to structural shifts like this one. Our teams combine deep research, robust asset-liability modelling, and dynamic portfolio management to align investment strategies with long-term objectives.

Book a meeting with a RisCura expert to discuss what a 3% inflation target could mean for your portfolio.

For the latest South African market updates, subscribe to our newsletter: www.riscura.com/subscribe