South African private equity returns highlight the value of the asset class in building resilient portfolios

The latest performance record of South African private equity, as reflected in the RisCura-SAVCA South African Private Equity Performance Report for the second quarter of 2016, confirms the capacity of this asset class to deliver steady returns in a setting of moderate to slow local and international economic growth.

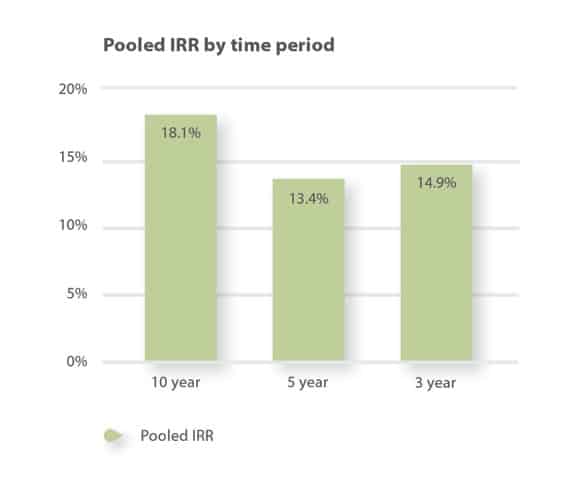

The report, which tracks a representative basket of private equity funds in South Africa, shows that the South African private equity industry delivered a ten-year internal rate of return (IRR*) of 18.1% at the end of June 2016, down from 19% reported in the previous quarter (ending 31 March 2016). This compares with the ten-year IRR of 21.7% measured at 30 June last year.

Graph 1: Private equity returns over different time periods (as at 30 June 2016)

As has been the case for several quarters, private equity performance relative to the listed equity market remains favourable: The 18.1% ten-year return from private equity is an outperformance relative to the 12.6% delivered by the FTSE/JSE All Share Total Return Index (ALSI TRI) over the same period. Private equity also outperformed the FTSE/JSE Shareholder Weighted Total Return Index (SWIX TRI), which yielded 14.0% over the equivalent period, and was in line with the 18.0% return from the FTSE/JSE Financials (FINDI TRI).

Over a five-year period, private equity provided a 13.4% return, slightly below the 13.8% ALSI five-year showing; over three years private equity yielded 14.9%, while the ALSI recorded a 13.0% return.

Erika van der Merwe, CEO of the Southern African Venture Capital and Private Equity Association (SAVCA), says that the private equity investment philosophy of active stewardship underpins the performance of the industry.

Van der Merwe adds that this outperformance makes a compelling case for private equity to be included in a diversified, institutional portfolio. “The returns-boosting nature of private equity, evident from this data series, represents a strong case for the inclusion of the asset class into long-term institutional portfolios such as pension and provident funds, endowments, other long-term savings vehicles and sovereign wealth funds. Moreover, the diversification characteristics of private equity – the fact that it is not strongly correlated with other asset classes – means its incorporation into a diversified portfolio contributes to the lowering of overall portfolio risk.”

Another factor in the appeal of private equity to institutional investors is its positive impact characteristics, says Van der Merwe. “Impact investing, with a range of targeted and measured variables, is often a mandated requirement by institutional investors. Private equity is ideally suited to meeting these mandate requirements, given its demonstrable track record of furthering environmental, social and governance (ESG) initiatives that drive sustainable development and growth.”

Deborah O’Hanlon, senior analyst at RisCura, adds that the latest performance report shows that US dollar returns of local private equity funds improved over the three-year and ten-year periods, as a result of the strengthening of the rand relative to the dollar. “The three-year returns improved from negative territory (-1.5%) over the last quarter, to 1.5% this quarter, while ten-year returns improved marginally, from 13.5% to 13.8% this quarter, despite the decline in local currency IRR.”

“As South African private equity continues to demonstrate its resilience and to deliver double-digit returns for investors, the asset class remains an attractive option for investors in the current low-returns environment,” Van der Merwe concludes.

Media contacts

For media enquiries, please contact Courtney Atkinson via email or on +27 (021) 673 6999.