Private equity multiples in Africa cost of equity

Risk versus reward is the key determinant of investment activity. Cost of equity is representative of the investor’s evaluation of the risk that the enterprise is exposed to. Elevated cost of equity and limited availability of capital created headwinds for many African countries during 2016. In the current year, this appears to be easing, with currency risk declining and equity risk premiums lowering on the back of more positive sentiment towards many markets.

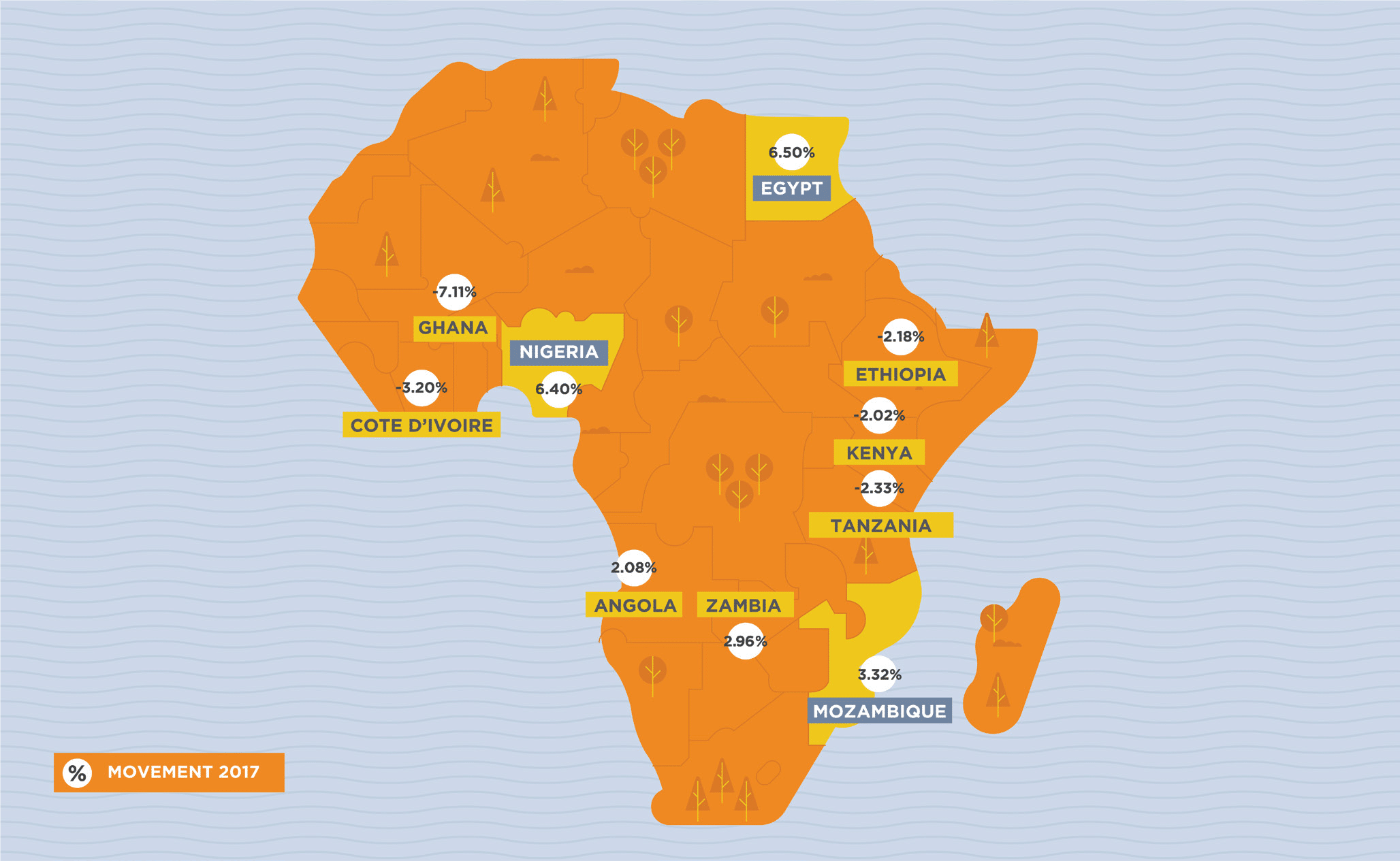

Since 2015, the three large increases in cost of equity were experienced in Egypt (6.5%), Mozambique (3.2%) and Nigeria (6.4%). As can be expected, these are on the back of significant currency depreciation. For Mozambique and Nigeria, this is due to the decrease in the export value of commodities. More recently, the high inflation caused by the depreciation of the currency is starting to taper off and the balance of payments is improving.

The largest decreases in cost of equity have been in Ghana (-7.11%), Ivory Coast (-3.2%) and Tanzania (-2.33%). These countries are expected to see improved economic growth because of lower energy prices, improving trade, falling inflation and decreased political risk.

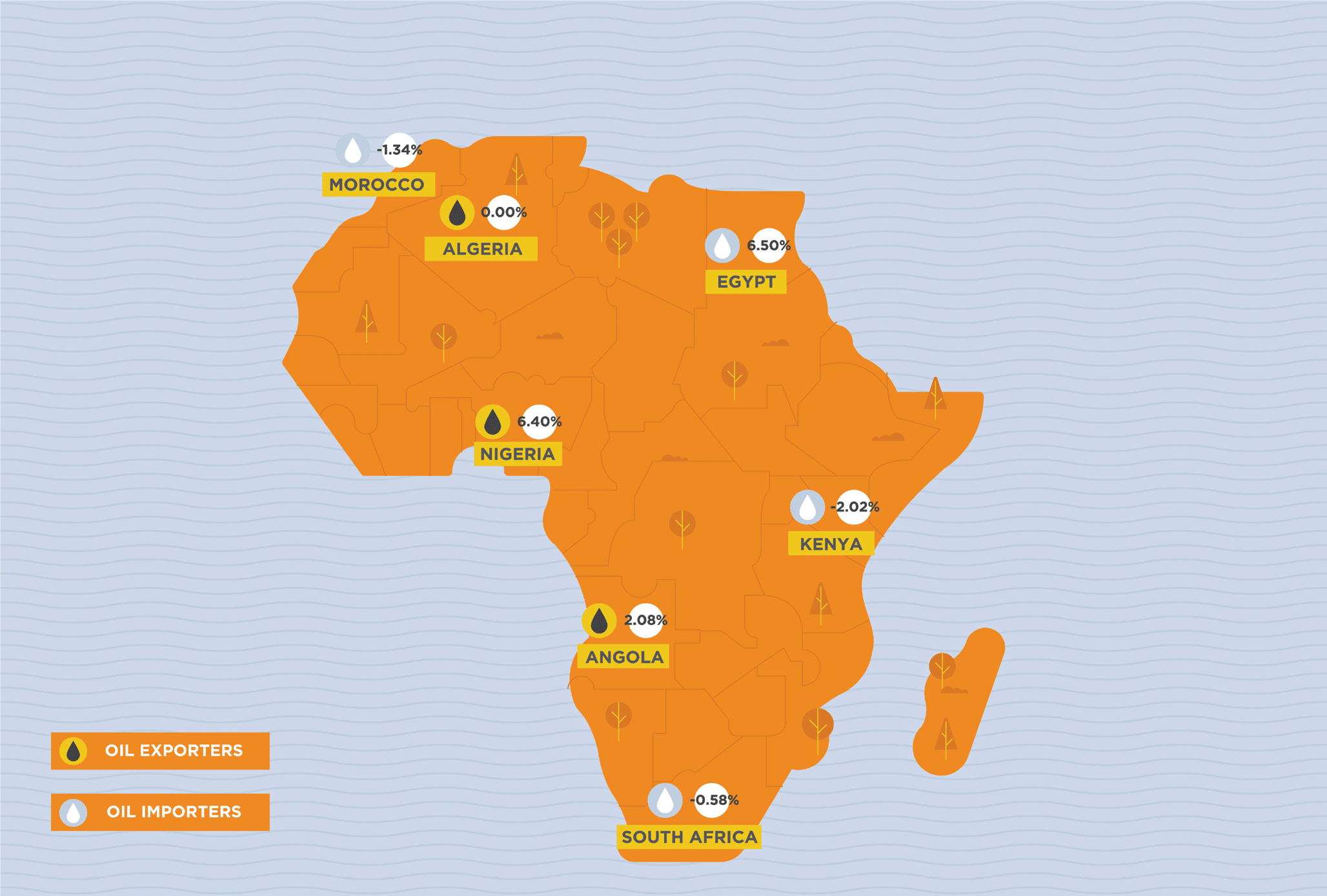

Opposing effects of the fall in global oil prices are on oil exporting countries such as Angola (2.08%) and Nigeria (6.4%) and oil importing countries such as Kenya (-2.02%), Morocco (-1.34%) and South Africa (-0.58%).

MAJOR CHANGES IN COST OF EQUITY

June 2015 – March 2017

Source: RisCura, Moody’s, BMI Research

MAJOR CHANGES IN COST OF EQUITY

June 2015 – March 2017

Source: RisCura, Moody’s, BMI Research