Making Sense of Derivatives in Your Investment Strategy

Derivatives are often perceived to be complicated financial contracts left only to the experienced or risk savvy investor. Derivatives are contracts, linked to various securities from which they derive their value. This being said, the actual derivative has no intrinsic value, receiving its value from its underlying investment. The vast world of the derivative markets centres around three main financial strategies, being Options, Forwards/Futures, and swaps.

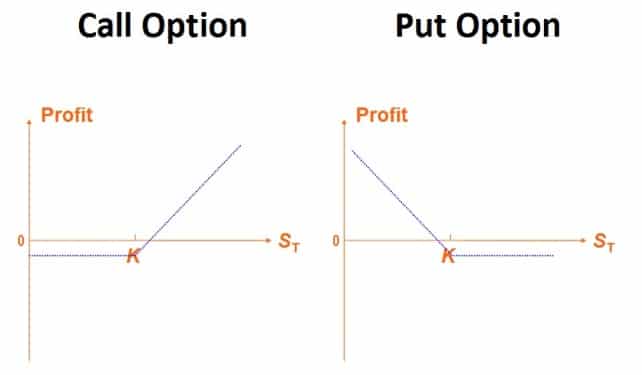

Options are contracts entered into by two parties to buy or sell specific financial products highlighted through the use of a “Call” or “Put” option. These are options that give the holder the right (but not the obligation) to buy or sell the underlying asset at its predetermined price (referred to as a strike price) on or before expiration of the contract. The timing of execution is determined by a strategy on the option, “American” or “European”. An American option allows the holder to execute before and up to expiration, while European options limit the holder to execution on expiration date only. Greater understanding of options are gained through the popular graphical representation of “hockey stick” diagrams, seen below. They aid the user in a visual representation of whether the contract should be executed or allowed to expire worthless. Derivative contracts do have cost implications, the premium paid is at a cost below the x-axis, and your strike price illustrated as (K). In order for the derivative to profit, the price would need to outweigh the Strike + premium, on the upside for a call, and the downside for a put.

Forwards and futures are both obligated contracts entered into by two parties for an asset to be delivered or settled in cash on a future date at a predetermined price. The fundamental difference being that futures are exchange traded standardised contracts while forwards are traded over-the-counter in a customised nature.

Swaps are the exchange of one financial security for another by the parties agreeing terms, taking place at a predetermined time. Swaps are traded over-the-counter with dealings typically taken care of by banks. Currency and interest rates swaps are the two leading contributors to the swap market.

Through their complex nature and lack of understanding by investors many myths have arisen. Many people believe that the use and implementation of derivatives is a new concept. This myth is debunked by the use of derivative options in Aristotle’s writing almost 2500 years ago. Derivatives are “purely speculative highly levered instruments and are a form of gambling in one’s portfolio”. This is the second common myth associated with derivatives and is in itself debunked by the rise in popularity of derivative usage by portfolio managers during the 1970’s. This was used as a risk management tool to curtail a highly volatile period, which brought about the demise of the Bretton Wood exchange regime and OPEC oil crisis. Finally, it is believed that only large corporations and banks have a purpose for using derivatives when in fact companies of all sizes use derivatives to meet their specific risk-management objectives. Through astute implementation businesses can protect themselves on the downside as a form of insurance.

Derivatives have many uses in financial markets; through hedging out risk and managing exposures, they are frequently implemented in portfolios to bring about efficiency. An illustration of this concept can be seen through an equity-only fund manager. They are required to have a cash buffer to meet potential cash outflows on a daily basis. If it is assumed that the manager needs a 3% cash buffer, he is limited to a maximum equity exposure of 97%. To mitigate this loss in exposure, as cash will have a drag on upside performance, the manager can increase his equity exposure to 100% by entering into an index future with equal exposure to the cash buffer.

In the case of a cash transition between two equity-only portfolios, the time taken to transition will force the new manager to hold an increased cash position for an extended period of time, limiting any upside gains. Traditionally portfolio managers would start to buy stock and gradually increase the new fund’s equity exposure over time. Preferably the manager would like to increase their equity exposure to 100% immediately so that they can participate in any upside gains during the transition period. The use of derivatives through an index futures vehicle can ensure 100% equity exposure through the transition. The manager will then progressively reduce the future’s exposure as shares are acquired over time.

The use and implementation of financial derivatives should be one of integration within a well-managed portfolio rather than a strategy that is feared for its complex nature. The idea of derivatives as a risk management tool to limit losses coupled with its ability to perform on the upside should find managers aligning the use of these financial strategies to their portfolios in the future. Through proper use and simple techniques the derivative market will open up many doors for risk management rather than speculative trading.

Media contacts

For media enquiries, please contact Courtney Atkinson via email or on +27 (0)21 673 6999.