An African solution to a South African problem

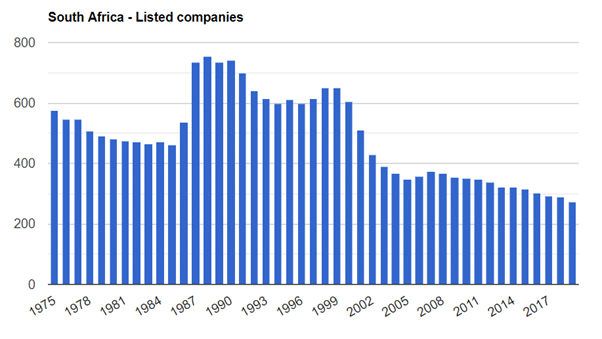

Over the last two decades, many companies have delisted from the JSE. In its 1988 peak, it had 754 companies listed, which was down to 274 at the end of 2020 with no slowdown in sight.

Although the reasons for delisting differ, major contributors include the popularity of private equity investment vehicles and the high regulatory burden placed on listed companies. This has been further exacerbated by low market values generally trending sideways and the COVID-19 pandemic.

For South African asset managers running Regulation 28 compliant funds for the retirement industry, this has caused a peculiar problem as their South African equity component, over time, has become less diversified, which is posing an increased concentration risk.

Current South African retirement fund regulation allows funds to invest 30% offshore, and, over the years, asset managers have maximised on this allocation, bringing a market advantage to their investors. This has allowed retirement fund members to gain access to tech-heavy developed markets and fast-growing emerging markets while also benefiting from a weakening South African Rand.

But an often underutilised and misunderstood offshore allowance is the additional 10% offshore African allocation, allowing a Regulation 28 compliant fund to invest a maximum of 40% offshore.

This can ease the concentration risk posed by the contracting South African equity universe, while at the same time, allowing fund managers to not decrease their current developed market and emerging market offshore allocations.

It’s important not to disregard Africa over negative headlines, even if some countries seem to be poorly run and saddled with corruption. Negative headlines does not warrant the dismissal of the entire continent as an investment destination. As an example, recent South African newspaper headlines don’t paint SA a positive light necessarily, but living here, we know that life goes on and there are many attractive investment opportunities.

Dig a little deeper and you will find about 180 well-run listed companies across Africa outside of SA, with sufficient liquidity, operating in fast-growing economies, at incredibly attractive multiples to invest in. Re-allocating South African equity exposure to African equity is a good option to boost investment diversification.

Africa as an asset class has historically been quite volatile but importantly, weakly correlated to other asset classes. By adding 5% African equity exposure, the entire portfolio volatility decreases, while also increasing the rand hedge component of the portfolio.

The best way to gain access to Africa is through a specialised, active African equity manager. Investing in Africa has certain nuances and requires many onsite visits that are performed best when you are 100% focused on the single asset class. It helps to have this focused specialist. The underdeveloped nature of African financial markets enables a talented manager to add sufficient alpha.

Additionally, passive managers seldom consider Africa as an asset class. And with index investing in its infancy in Africa, passive strategies ultimately prevent access to this asset class and is capturing additional capital in South Africa.

Within the current regulatory constraints, pension fund trustees should encourage their Regulation 28 compliant fund managers to resolve a uniquely South African problem by investing in Africa.

– Nikolaas Delport

Business Development, RisCura