Market Commentary: June 2023

Global market themes

The US economy has shown resilience after the current interest rate hike cycle. US first-quarter GDP prints came in at 2% versus the expected 1.4%, and household spending rose by 4.2%, the strongest rise in nearly two years. Combined with this data and the lowest level of unemployment, it is not surprising that the Fed is considering more rate hikes, possibly as soon as July. The S&P 500 rose 6.5% for the month, staging an improbable 16% gain for the year in dollar terms. Recession forecasters have missed out on some significant movements in the US as the AI rally continues to push the market up.

Equity analysts are divided in their predictions as they are forced to make sense of conflicting data and irrational market participants. In the post-pandemic world, where the economic and market cycle defies conventional theory, earnings will need to provide more evidence for the future path of the stock market. Traders are increasingly wary of potential headwinds, as seen in the spike in VIX option purchases. The last time there was this much activity in the options market was during the COVID-19 pandemic.

The US economy has shown resilience with strong GDP growth and household spending, leading to discussions of potential interest rate hikes, while inflation has decreased, and supply chain bottlenecks have improved.

Inflation in the US continued its downward trend, currently sitting at 4% year on year. US manufacturing PMI, as an indicator of the general state of the underlying economy, shows that the US has been in a contractionary state throughout 2023. June PMI numbers printed 46, pulling back even further from May’s 46.9. In contrast, data from the Global Supply Chain Pressure Index (GSCPI) indicates that the supply chain bottlenecks experienced during the pandemic have been ironed out. A breakdown of the data shows that more than 50% of the cause was from stockpiling due to supply or price concerns.

The eurozone appears to be in a deflationary trend. However, CPI prints stubbornly remain high at 6.1%. More interest rate hikes are expected from the European Central Bank (ECB) as they maintain a highly data-dependent outlook and intend to “do too much rather than too little”. The region still has a way to go before inflation returns to the ECB’s two-percent target. The ECB has raised rates at the fastest pace ever over the past year following Russia’s war in Ukraine, which caused energy and food prices to surge. While energy prices have since subsided, the food component continues to put strain on consumers’ disposable income.

China’s economic recovery has been underwhelming, and both exports and imports are contracting. Although consumer spending rebounded following the removal of the zero COVID policy, the results were far below expectations. China has the world’s highest household savings rate, currently at 35%, which has greatly muted internal consumption and is in stark contrast to the US, which has been on a spending frenzy since 2021. S&P Global cut China’s GDP forecast to 5.2% in 2023, down from an earlier estimate of 5.5%. Other rating agencies have since followed suit, with the likes of Goldman Sachs also lowering their forecasts.

China’s economic recovery remains lacklustre, marked by declining exports, weak consumer spending, and high household savings. Despite some improvements in specific indicators, downgraded GDP forecasts, slumps in property investment and retail sales, and rising youth unemployment reflect ongoing challenges in the Chinese economy.

In May, property investment slumped further, industrial output and retail sales growth missed forecasts, and youth unemployment hit a record 20.8%. Towards the end of June, China cut its key lending benchmarks, the first such reduction in 10 months. A week earlier, the People’s Bank of China (PBOC) lowered short- and medium-term policy rates. It is anticipated that more stimulus will roll out later this year. MSCI China rose by 3.3% in June, along with a slight uptick in manufacturing PMI, currently sitting at 49.

China has started to make moves to compete with the US in the AI tech space. Until now, investment in the US far outpaced that of China in the AI sector, but that gap has started to narrow. China will likely go head-to-head against the top American tech companies to take pole position in the rapid race for AI development. American policymakers have tabled a ban on AI chip sales to China to curb their opposition’s progress. Analysts and executives believe AI will shape the technology leaders of the future, much like the internet and smartphone created a group of multinational titans.

UBS is preparing to cut over half of the Credit Suisse workforce only two months after the government-brokered rescue. Three rounds of job cuts are expected to take place between July and October. UBS announced that it is aiming to save some $6 billion in staff costs in the coming years. Currently, UBS has a total headcount of 120,000 staff and will look to cut around 30,000 to reach, in this case, target. UBS is not the only bank that has focused on cost-cutting. Goldman Sachs is planning their next round of job cuts in September. While the number of job losses in this case is a lot more modest, it is clear the banks are focused on maintaining profit margins even in the short term.

Russian President Vladimir Putin faced a challenge to his regime led by Wagner Group leader Yevgeny Prigozhin. Although the attempt to overthrow the president did not work, it revealed weaknesses in the military ranks. Putin has survived this coup, but without the Wagner troops on Putin’s side, Russia may have lost a substantial portion of the firepower for the war in Ukraine. This event has taken war negotiations with Russia off the table in the short term until tensions subside within the Kremlin.

Sentiment in the cryptocurrency market rose this month as Blackrock announced its SEC application for a Bitcoin ETF on 15th June. This application marks the 28th filing for such approval to date, with none being approved. Blackrock has had 575 filings approved by the SEC, and only one rejected. While there is no certainty about the outcome, Bitcoin advocates remain hopeful that the institutional heavyweight will be able to get the application over the line. Historically, ETFs have brought significant inflows into the underlying assets and provide benefits to investors, such as lower spreads and increased regulation.

Blackrock’s Bitcoin ETF application brings hope to the cryptocurrency market, potentially enabling easier investment and integration for financial advisors overseeing trillions of dollars in assets.

At the time of writing, the price of Bitcoin (BTC) is at $30,000, and the overall cryptocurrency market capitalisation sits at roughly $1.2 trillion. With the approval of a BTC ETF, financial advisors who oversee $23 trillion in assets will now have the avenue for investment and can consider offering exposure to the asset class for their clients. The approval of a BTC ETF is likely to remove prohibitive barriers from the asset class, such as dealing with cryptocurrency exchanges and creating a vehicle for exposure that will fit into existing management software and record-keeping systems.

It was expected that further volatility in Russia would have an impact on the oil price; however, the price has remained suppressed for most of 2023. Oil closed the month at $75, while this is a slight gain for the month, the commodity is down 33% from $122 only a year ago. OPEC has forecasted that global oil demand will rise by 7.8% to 110 million barrels per day by the year 2045. Current demand is around 102 million barrels. Precious metals all pulled back in June, with Palladium sustaining the biggest loss of 10%.

South African market themes

The South African Reserve Bank is likely to keep interest rates high for the time being as persistent inflation remains a concern. The central bank’s monetary policy committee has raised the benchmark rate by 475 basis points over the last 10 meetings with the aim of anchoring inflation back within its target range. May’s annual consumer price inflation slowed to 6.3% from 6.8% in April. This disinflationary trend will reassure the Reserve Bank’s monetary policy committee that the economy is indeed cooling down. The next MPC meeting is scheduled to take place on 20 July, and market participants are divided as to what the outcome will be. Traders are pricing a 63% chance of a 25-basis point hike, while Bloomberg surveys returned a similar probability for a pause on rate hikes. In an interview with Bloomberg, the Reserve Bank governor, Lesetja Kganyago says he expects inflation to be back in the target range by the next quarter.

The South African Reserve Bank is expected to keep interest rates high to tackle persistent inflation, with the next meeting’s outcome being uncertain but the aim to bring inflation back within the target range.

The Rand remained volatile in June as both internal and external factors continued to affect the currency. The USDZAR started the month around its all-time high of 19.72 and for the first two weeks of the month managed to pull back 7.8% to 18.18. This rebound was short-lived after the US Federal Reserve indicated it expects more hikes this year. The Rand subsequently lost 3.7% against the dollar to close the month at 18.85. The interest rate differential plays a significant role in the value of the rand. This means that South Africa offers much higher interest rates than developed markets like the US, making South Africa an attractive investment opportunity in the fixed income space. But following aggressive US rate hikes, that differential has now shrunk. The US has hiked by 500 basis points to date in its current cycle, while South Africa has increased by 475 basis points. If the Fed hikes again, the Rand will appear even less attractive.

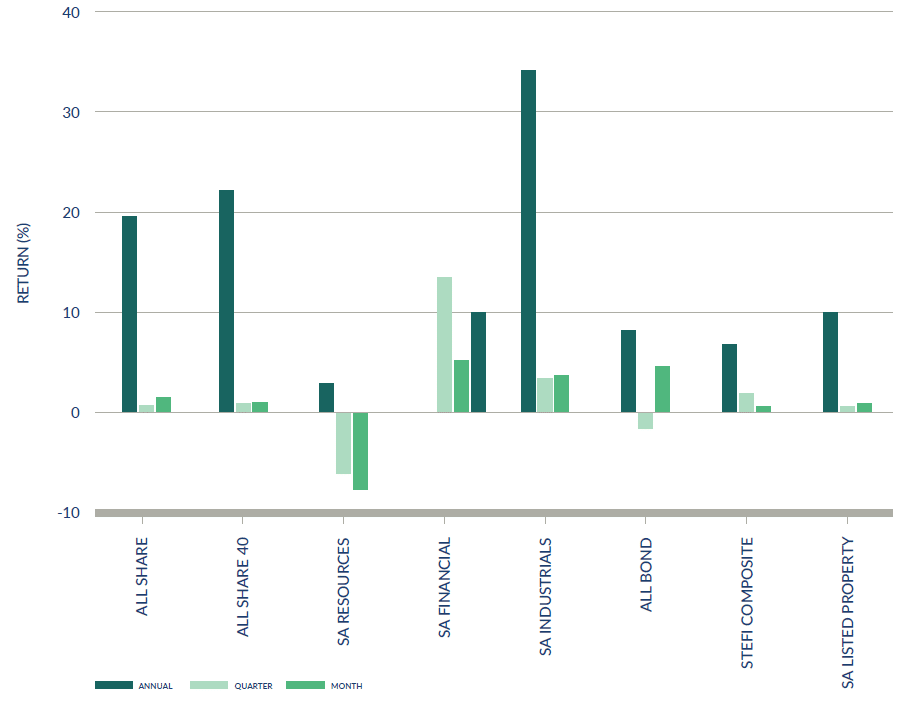

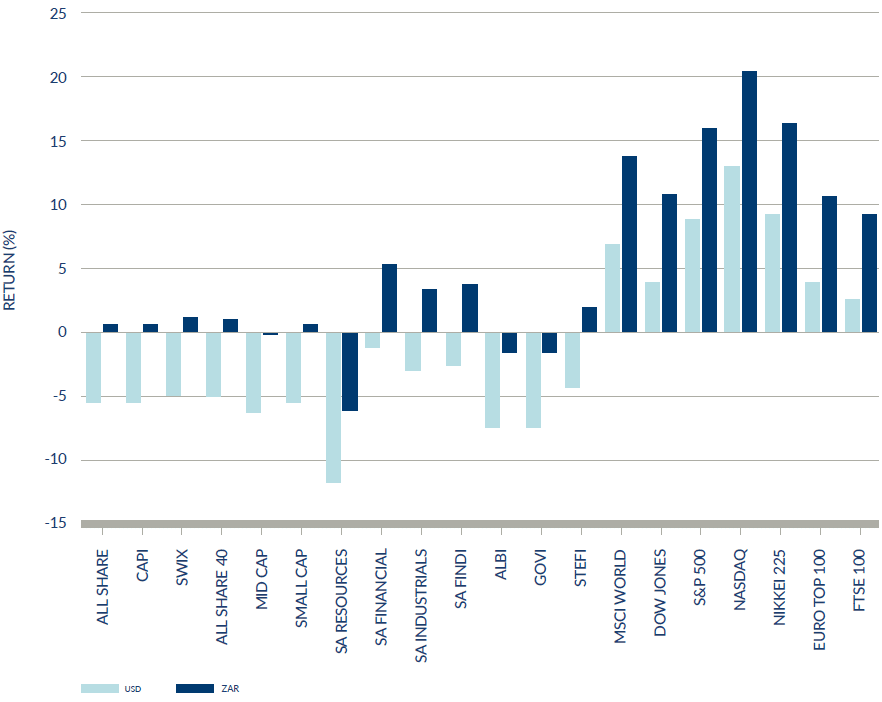

Bonds outperformed all other asset classes in June with the All Bond index posting a rand total return gain of 4.6%, its best monthly performance since May 2020. The FTSE JSE All Share index returned +1.4% over the month, with Mid Caps returning +4.2% and Small Caps returning +3.8%. Financials were the best-performing sector, up 11.6%, which was in stark contrast to Resources, down 7.63%. The year-to-date numbers on the JSE have underperformed compared to the rest of the global economy. The FTSE JSE SWIX has returned 4% for the year in rand terms, while MSCI World has returned a strong 27.8% over the same period. Industrials have been the best-performing sector of the year, up 17.5%. Richemont has been the driving force behind JSE growth with a performance of 43.6% year-to-date.

The severity of load shedding ebbs and flows with the production capacity of the various power stations in the country. Recently, fewer power station breakdowns, less required maintenance down periods and subdued demand have been among the reasons for improved load shedding schedules this past month. The Eskom board has set an Energy Availability Factor (EAF) target of 70% by the end of March 2024 and they are closer than expected to reach that target. Electricity Minister, Ramokgopa said that a study underway by German consultancy VGBE, which was analysing the technical problems at coal power stations, would make its report final at the end of July. This report will guide the timetable for the delayed decommissioning of coal power stations and indicate whether any were suitable for private-sector partnerships. An estimated 3.2% of GDP will be lost due to load shedding this year.

It is worth noting that electricity has been a significant driver of headline inflation in South Africa. The electricity price forecast for 2023 is 12.9%, projected to increase to 15.5% in 2024 and then decrease to 10.9% in 2025. South African inflation recorded 6.3% year on year at the end of May, which aligns with the South African Reserve Bank’s (SARB) forecasted annual inflation rate for 2023. It is expected that inflation will decrease to 5.8% in 2024. The SARB has also projected a GDP growth rate of 0.2%, slightly lower than the previous prediction of 0.3% made in January. Additionally, the country’s current account is expected to deteriorate, reaching a deficit of 2.7% of GDP over the next three years. Consequently, external financing will be a crucial source of capital for the country’s future.

South Africa has formed partnerships with Germany and the Netherlands to promote the development of green hydrogen projects, positioning the country to contribute to the global demand for eco-friendly fuel and boost the African economy.

South Africa has made significant strides in fostering international relationships to enhance domestic production capacity. Last month, South Africa and Germany signed an agreement to establish a task force that will facilitate the creation of projects to meet global demand for green hydrogen and simultaneously bolster the African economy. Moreover, state-backed firms from the Netherlands have agreed to support the establishment of a $1 billion (R18.6 billion) green hydrogen fund, specifically dedicated to investing in South African projects. This collaboration positions the country to play a role in the development of an industry expected to supply Europe with this eco-friendly fuel. BMW South Africa has also committed to the transition to electric vehicles, investing R4.2 billion over five years to prepare its manufacturing plant in Rosslyn, Pretoria for the era of electromobility. A BMW spokesperson has reassured that this transformation will not impact employment levels in the region.

World Market Indices Performance

Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices