Market Commentary: May 2023

Global market themes

The US debt ceiling claimed global headlines in May as the biggest economy in the world came perilously close to potentially defaulting on the nation’s debt. President Joe Biden and Republican House Speaker Kevin McCarthy reached an agreement to suspend the nation’s $31.4 trillion debt limit until January 1, 2025. While this agreement still needs to be approved in Congress, the threat of a catastrophic default is unlikely. The agreement essentially holds spending flat for 2024 and caps increases to 1% for 2025. The Republicans have advocated for reduced spending going forward and have highlighted the dangers of the nation’s ballooning debt, while Biden has ensured that a historic default does not occur during his term in office. This politically-fuelled topic sets the scene for America’s policy discourse and budget agendas going forward.

The S&P 500, bolstered by the tech sector, closed the month up 0.4%. In comparison, the NASDAQ Composite Index rose 2.4%. This latest growth surge has been driven by investors swarming into Artificial Intelligence (AI) companies to partake in its likely disruptive effects on the economy. Nvidia, one of America’s leading graphic card and API companies, climbed back towards a $1 trillion dollar market capitalization. From a humble beginning in developing graphics cards for early video games, Nvidia has made major leaps in computing capabilities which are used in CGI for movies, sophisticated medical procedures, and now AI. Peer tech companies, like Microsoft, Meta, and AMD have all been beneficiaries of this latest trend, with AMD gaining 57% year to date and Microsoft growing 37% over the same period. While these capital gains are enjoyed by early investors, the dangers of an economic recession pose major risks for these companies who will need to sustain substantial earnings to justify their current valuations.

As economic indicators like the Leading Economic Indicator (LEI) and Purchasing Managers Index (PMI) all point to an underlying economy that is slowing down, it is increasingly difficult to ignore the risks of a recession.

The US Federal Reserve Fed will remain the harbinger of investor sentiment through monetary policy. As inflation numbers soften, the policy debates will shift from an inflation-fighting goal to a recession-fighting agenda.

Currently, the futures market has priced in a 75% likelihood of an interest rate hike in June, marking a significant rise compared with a mere 23% a month earlier. The lagging effect of the interest rate transmissions are visible in the US economy with the job market remaining tight at an unemployment rate at 3.7%.

The European Central Bank delivered an expected 25 basis point hike, raising the deposit rate to 3.25%. The eurozone’s headline inflation rate fell to 6.1%, from 7% in April. While still well above the 2% target, the recent inflation print came in below expectations. ECB President, Christine Lagarde, reiterated in a speech that “inflation was still too high and there is still ground to cover to bring interest rates to sufficiently restrictive levels.” The market remains hawkish and has priced in two further interest rate hikes in its upcoming meetings, to reach a terminal deposit rate of 3.75%. Off the back of April’s weak economic data presenting a sluggish outlook for the rest of 2023, STOXX All Europe fell 2.2% in May. The UK also had a dip in investor confidence this month, with the FTSE 100 down 5%. Inflation has remained high and continues to put significant pressure on the cost of living in the UK. Additionally, housing prices have started to pull back as the market stagnates in a high interest rate environment. It is expected that the Bank of England will set a terminal rate of 5.5% for the United Kingdom.

MSCI China was down 8.4% for the month as their economic rebound fails to meet expectations. Recent Manufacturing PMI prints coming in at 48.8, the lowest reading since December 2022. China being the world’s largest exporter and global demand being surpassed, it comes as no surprise that their economy remains sluggish. The Chinese internal growth narrative was centred around pent up domestic demand, which has also proven to be lacklustre. The Chinese government still has capacity for intervention in the form of monetary stimulus.

China has managed to sustain low levels of inflation (hovering around 0%) while the rest of the world deals with drastic monetary policy shifts to combat inflation.

It is worth noting that the United States sent the CIA director, Bill Burns, to China on a clandestine visit to nurture the diplomatic relationship between the two countries. The Whitehouse is yet to make a statement about the outcome of the trip, but if this relationship improves, it will likely be positive for Chinese companies doing business with the Western world.

Japan has experienced renewed investor interest over the course of the year. After remaining dormant for almost three decades, the Japanese economy has soared back to levels last seen in the 1990s. Last month’s tourist statistics are at pre-Covid levels and should provide the country with a substantial foreign capital inflow as they head into cherry blossom season. Warren Buffet’s Berkshire Hathaway has over $15 billion invested in the Japanese market and has been growing their position for more than two years. Although Berkshire Hathaway typically invests in US stocks, their position on Japan was said to be a “no brainer”. Using typical Buffet investing paradigms, the firm identified companies with strong fundamentals, operating in familiar markets, and that had consistent dividend policies. The Nikkei 225 is up 7% for the month and up almost 20% for the year.

Commodity markets also experienced some weakness this month with all resource’s segments losing ground. The Oil price is about 37% lower compared to this time last year, closing the month at $72.6/barrel. The June OPEC+ meeting may result in further production cuts from the cartel. As it now stands, the oil price has been on a downward trend for almost a year and sits just above $70 a barrel. Saudi Arabia and its fellow OPEC countries require a higher oil price to achieve economic prosperity. Theoretically, Saudi Arabia has a fiscal breakeven oil price of $78 a barrel for 2023. There are however strong geopolitical agendas at play in the oil market, with the Russian war in Ukraine. As Russia benefits from a higher oil price, the US and fellow NATO members have recently relied on oil reserves to meet demand and managed to nullify recent actions for price support from OPEC+. Production materials like copper and coal have been negatively affected by the lacklustre rebound of China, down 6% and 23% respectively.

While these price movements have not been beneficial for resource stocks, their downward pressure on inflation will be welcomed by the markets.

South African market themes

The South African Reserve Bank surprised the market this month by raising interest rates by 50bps, taking the repurchase rate to 8.25% and the prime lending rate to 11.75%, effective as of 26 May. It is expected that the current interest rate environment will likely dampen inflation in the coming months, back to the 3-6% target range. Currency weakness was a major driver in the policy decision; the Rand depreciated almost 10% since the last MPC meeting. A rise in interest rates is expected to strengthen the currency. However, the knee-jerk response in the market was counterintuitive, depreciating a further 3% on the day.

South Africa has seen significant capital outflows over the course of the year as tightening global financial conditions have led the market to react to the country’s deteriorating risk profile.

The composition of holders of South African Government Bonds (SAGB) has changed substantially over the last 5 years. In 2018, 42% of the total government bonds in issue were owned by foreigners. This number has decreased down to 25% in 2023. South African credit default swaps (CDS) spreads, which measures cost of insuring against sovereign default risk, remain at elevated levels.

Domestic inflation has been driven primarily by fuel, electricity, and food price inflation. With a weaker Rand, South Africa will import more inflation, especially on fuel. Along with fighting inflation, the SARB’s primary mandate is to protect the value of the currency in the interests of long-term economic growth. The Option market appears to be pricing in a likely 20 USDZAR within the next couple of months. By accessing the rate hike within an emerging market context, the recent hike helps keep South Africa’s rates in line with other emerging economies. Brazil, for example, currently has an overnight rate of 13.75%. According the MSCI Emerging Market Currency Index, of which South African accounts for 6.6% of the total index, the Rand has underperformed relative to its EM peers. In addition to idiosyncratic political and structural issues, the interest rate differential between EM counterparts has been a driving factor. For example, the Mexican Peso has gained substantial ground against the Rand since the start of the interest rate hikes in 2021. Mexico has increased their interest rate by 7.25%, while South Africa has hiked rates by 4.75% over the same period.

Eskom remains the Achilles heel of the economy, keeping operating costs high along with production constraints. The South African PMI, Absa Purchasing Managers Index as a measure of economic activity, remains in a contractionary state of 49.2. Businesses and households scramble to implement backup solutions to the power outages on an ad hoc basis with generators and solar power. With the weakening Rand, the input costs of running the generators will significantly affect business profits and raise the costs of imported solar supplies. On a positive note, the price of fuel came down at the beginning of June, which will support the fight against inflation, with petrol down 71 cents/L and diesel down 84 cents/L. The Monetary policy committee (MPC) forecasts 280 days of loadshedding in 2023. GDP forecasts have been revised slightly higher to 0.3% from 0.2%, the 10-bps revision will not be enough to elevate the country from its low growth path for the foreseeable future.

Geopolitical risks have reared their head, as the South African government granted Russian president Vladimir Putin diplomatic immunity for the upcoming BRICS summit scheduled in August. This political stance brought another blow to the weak currency as the Rand hit an all-time low of 19.78 to the dollar. This news came shortly after claims that South Africa provided arms to Russia. While the claims have yet to be verified, investor sentiment towards the political ties with Russia resulted in further capital outflows. The SARB issued a statement citing that the risks of indirect sanctions imposed on South Africa have been included in their Risks and Vulnerabilities matrix (RVM).

Should this risk materialise, the South African Financial system will not be able to function optimally if it is not able to make international payments in USD, which could lead to a sudden halt in capital inflows and increased outflows.

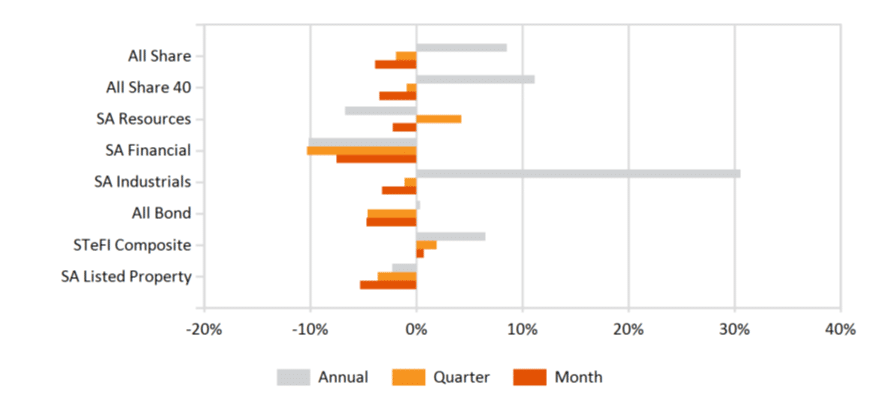

The South African financial markets fell across the board owing to recent, less optimistic news. The equity market, broadly captured by the Shareholder Weighted (SWIX) Index, was down 5.8% for the month. The property market also pulled back a lofty 5.4%. The financial sector was the biggest loser of the month, down 8%. Resources was the most resilient sector on the market; with the currency weakening it provides short-term benefit to the exporting resource companies. Despite this, resources still fell 2.2% for the month. The All-Bond Index (ALBI) fell 4.73%; as interest rates continue to rise, it places downward pressure on the price of the existing bonds.

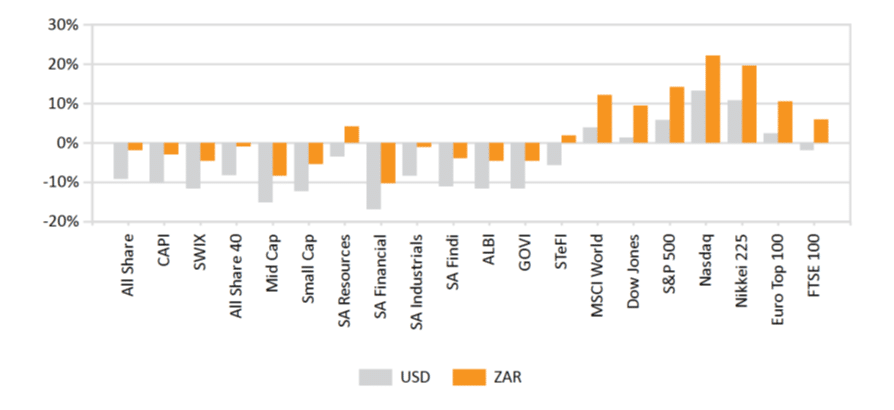

World Market Indices Performance

Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices