Updated IPEV guidelines

As part of the rhetoric to support Brexit, the “curvy banana and crooked cucumber rules” were highlighted as being the result of overeager Brussels bureaucrats trying to control the every move of the EU member states. Regardless of one’s opinion regarding Brexit, the financial world is becoming subject to ever-increasing regulation. The need for fair value reporting and the difficulties in estimating fair value highlighted by the Global Financial Crisis, guarantees that this trend will also continue in the valuation field.

This brings us to our small microcosm of regulation – the IPEV Guidelines. The IPEV Board issued updated guidelines in December 2015, expanding and detailing methodology for valuation as well as clarifying some ambiguous wording and concepts.

Use of the Discounted Cashflow (DCF) Technique

One of the most impactful changes is the softening of the wording in the standard regarding the use of DCF valuations. In the old standard, the guidance specifically stated the following “…utilising discounted cash flows and industry benchmarks in isolation, without using market-based measures would be considered rare and with caution only”.

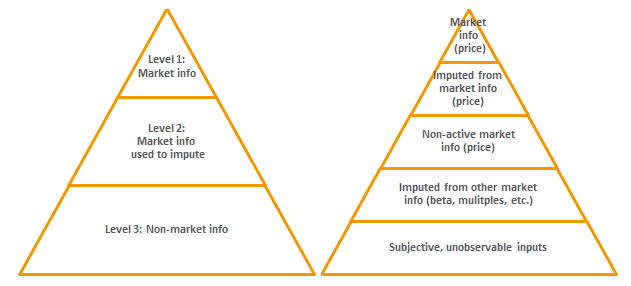

This makes sense in a highly developed market where good quality and highly comparable market information is available. However, in less developed markets this becomes problematic. As shown below, International Financial Reporting Standards (IFRS) believes market-imputed values have higher evidentiary value than subjective, non-market information. On the right-hand side is the Global Investment Performance Standards (GIPS) version of this hierarchy which is almost more informative.

Left: International Financial Reporting Standards (IFRS); Right: Global Investment Performance Standards (GIPS)

The distinction between values indirectly imputed from a market price, and values imputed from other market information such as betas or multiples makes the CFA institute version more informative. As every practitioner knows, the majority of imputed information used is of the latter variety. In other words, we use the multiples or betas of our comparator companies to value an entity. However, in the South African and African market, the reality is that the comparative companies are never going to be 100% comparative.

In fact, being able to find an entity that has the same business model in the same market is considered lucky. Practically then, it is unlikely that one will be able to match the size and growth prospects of the entities as well. The result is that whatever comparators are selected, they will be heavily adjusted before a value can be imputed. Considering the lack of consensus and academic proof for the size of these adjustments, the valuation becomes increasingly subjective. The question then is, “how much less subjective is the imputed multiples valuation, than the DCF valuation”?

The regulation has thus been altered to rather focus on the use of multiple valuation techniques, rather than explicitly stating that DCFs should be avoided as much as possible. However, the standard has retained the wording that indicates that DCFs should be used to corroborate values obtained using market techniques rather than as a primary technique for valuation.

So this leaves us with what many practitioners in the market have been doing all along, which is to do the imputed multiples valuation as a primary method of valuation, with the DCF as a valuation check. We advocate this method as long as reliable financial forecasts are available, which is a prerequisite the Standard sets for the use of the DCF technique.

Back-testing

The second relatively major change is in relation to the concept of back-testing. Back-testing is an extension of the concept of calibration. Calibration is performed when the investment is initially entered into, whereas back-testing is performed when a realisation event takes place. In both cases, the purpose is to try and understand what the inputs into the valuation should be for the valuation to match the achieved market price. In the case of calibration, the reason for doing this is to inform the valuation process going forward, while the reason for back-testing is to improve the valuer’s process and understanding. In other words, it creates the final step in any well-designed system, a feedback loop that allows for fine tuning.

So let us look at a quick example:

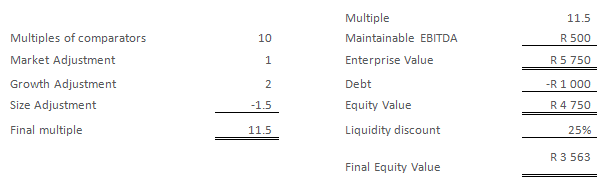

At the last valuation date prior to exit, the valuation of company X was performed as follows. Firstly, an imputed market EV/EBITDA multiple was calculated using whichever method the valuer uses to estimate these multiples. In this example the comparative multiple was adjusted for market, growth and size discrepancies. The imputed multiple was then used to calculate the enterprise value and after the waterfall has been implemented, a final equity value is calculated.

Then a realisation occurs and the realisation takes place at an equity value of R 4 650, not an uncommon occurrence. The standard breaks down the investigation of differences into three categories: 1. Find out what information was known or knowable at the last valuation date; 2. Assess how this information was used in calculating value at the last valuation date; and 3. Determine if the information was properly considered, given the final result.

Firstly information is gathered that was either known or knowable. In this example, let us confine that to information that influences the material judgemental inputs. This includes: the information considered for the calculation of the maintainable EBITDA, the information considered for the estimate of the liquidity discount and the information considered in estimating the quantum of the various multiple adjustments.

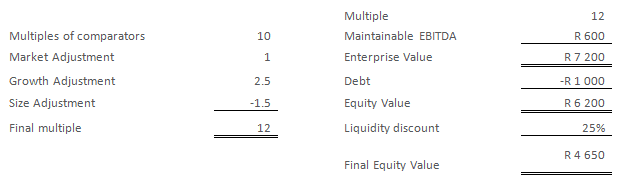

In the perfect world of examples, two errors become apparent in hindsight, the first being an overly conservative adjustment that was made to the maintainable earnings and similar conservative estimates of future growth prospects. After the correction of these estimation errors, the calculation would be as follows:

As always, the idea is simple in the world of examples, but a lot harder to execute in practice. A lot of research is being done on valuation as the subject attracts a lot of interest. Interesting to note when reading this research is that in general it is very hard to prove anything conclusively in the field. The reason for this is quite simple. The prices that assets obtain in the market are subject to the imperfection and the noise of the market. And, these factors are significant. On examining the research regarding the effectiveness and perfection of the market, it indicates that markets have weak to partially-effective characteristics. This indicates that this research is performed on listed markets, how much the more so for private markets where the market price is set by only two participants that will always bring different levels of skill, motivation to transact, synergies and awareness of market prices to the table.

When taking into account all the factors, the reality is that although both calibration and back-testing are extremely useful tools that allow practitioners that do a large number of valuations to refine their skills, it is definitely not the final solution to ensuring accurate valuations.

Value of debt in the waterfall

The final relatively meaty subject the changes addressed is the issue of whether the market value or the face value of debt should be deducted from the enterprise value in the waterfall of a valuation. Built into the definition of fair value is the assumption that the asset is sold. If following the theoretical argument, what if the debt is repayable on change of control?

The guidance says that if the debt is repayable on change of control, the debt will likely be held at the settlement amount, whatever that may be, incorporating such charges as prepayment penalties. If the debt is not necessarily repayable and have certain non-market related terms, the impact of these terms should be incorporated into the value, resulting in a value higher or lower than the face value. The guidance does also open the possibility of valuing the effects of the most probable actual settlement of debt in timing, which then in turn dictates the most probable outcome of pre-payment penalties. This on the face of it seems contradictory to the fair value assumption of realisation, but will most probably be seen by many asset owners as the most accurate method.

As the field of valuation develops, these standards will only become increasingly detailed and prescriptive. The ultimate goal is truly comparable valuations even when performed by different practitioners. Lofty goals for our small microcosm of regulation.

DOWNLOAD THE PDF

Media contacts

For media enquiries please contact Courtney Atkinson via email or on +27 (021) 673 6999.