Impact on the production of key agricultural commodities

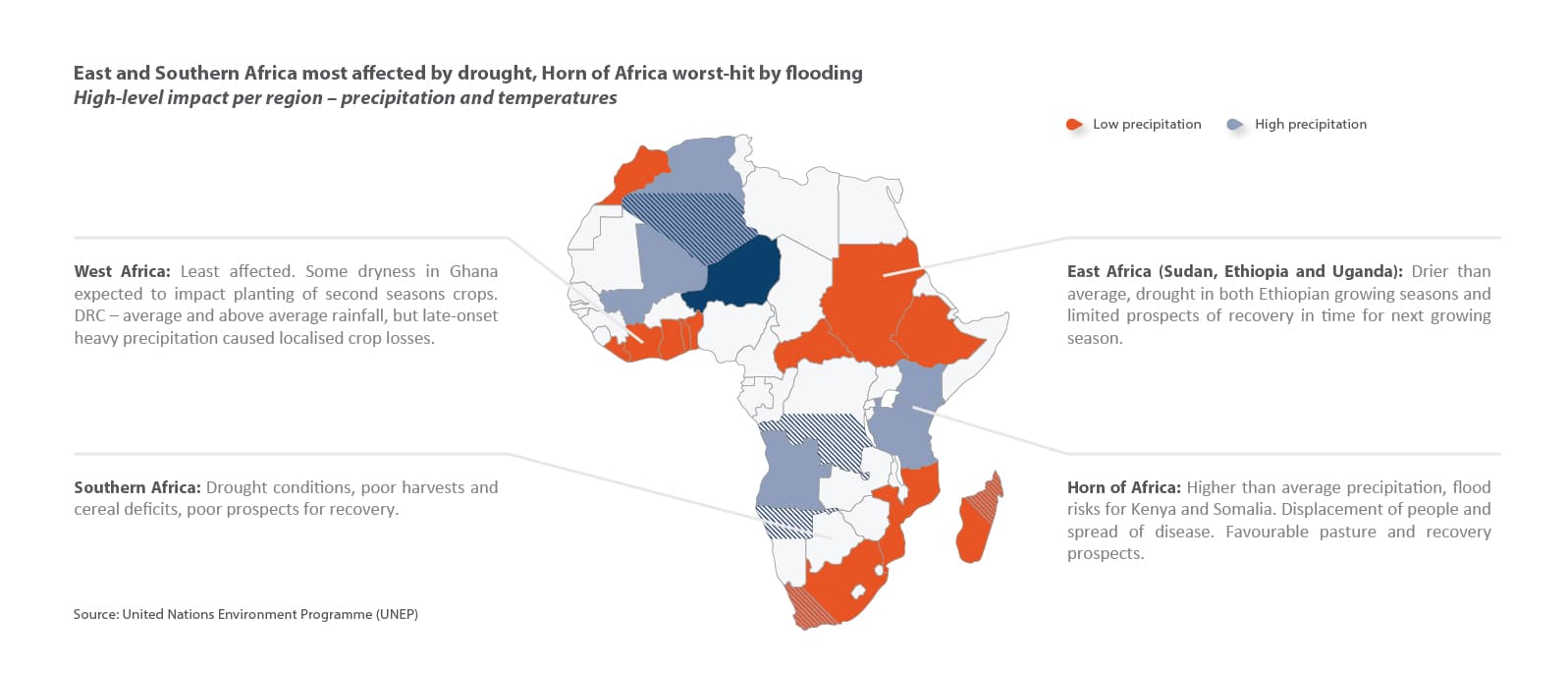

The map below illustrates some of the anticipated impacts in Africa at a country level. While drought conditions have affected Southern and Eastern Africa, a number of areas have experienced above-average rainfall. High rainfall may favour the production of certain crops, but an erratic pattern complicates planting and harvesting seasons, and flooding introduces a different set of humanitarian challenges.

East and Southern Africa most affected by drought, Horn of Africa worst-hit by flooding High-level impact per region – precipitation and temperatures

Maize

Despite country-level variations in the production of maize (with Namibia and Angola experiencing above-average production levels), the deficits in the main African exporting countries (South Africa and Zambia) have resulted in a substantial shortfall.

Source: BMI research

Year-on-year South African maize production fell by 28%, while Zambia and Zimbabwe fell by 23% and 45% respectively. South Africa and Zambia are normally major exporters of maize in Africa, but this year both countries will need to import it. Already prone to food insecurity, El Niño has left Zimbabwe needing USD 1.5 billion in food aid. Nigeria, Tanzania and Kenya have also shown declines in maize production.

The aggregate data potentially hides a more nuanced picture: The production of white maize has declined more sharply than yellow maize. In a number of countries, such as South Africa, cultural preferences and norms dictate that white maize is seen as food for human consumption, while yellow maize is suitable for livestock. Shortages in white maize are therefore more acutely felt. Moreover, supplemental sources of white maize are limited.

The new surplus producers in Africa (Uganda, Tanzania) are likely to export their surplus to other countries in the East African Community, still leaving Southern Africa significantly short of Maize. Central America, usually an alternative producer of suitable stocks, has been hit by successive droughts, both in the current El Niño episode and in the run-up to it. Prices for both white and yellow maize are already elevated, and supply is tight. Any available dollar-denominated imports are likely to come with a hefty price tag, with currency weakness and volatility an added consideration.

Wheat

Wheat is the second most important food crop in Southern Africa after maize, which is the main staple for the majority of households. Kenya, the largest and only significant producer of wheat in East Africa, suffered a 15% fall in production in 2015.

Source: BMI research

Rice

Rice is another staple, albeit mainly in West African countries. Local production is supplemented with imports from Southern Africa and Asia. However, the effects of El Niño have hampered planting operations in a number of Southern African countries. El Niño also delays the onset of monsoons in East Asia, thereby reducing yields in India and Indonesia. Favourable conditions elsewhere, however, mean that shortages are still more easily supplemented with imports (albeit with the notable caveat of adding to the import-bill and potentially fuelling inflation).

Beef and veal

With feed and grazing for livestock severely reduced in drought-stricken countries, the impact of El Niño on the production of beef and veal has had a more surprising dynamic, with larger declines expected after the initial peak of the drought conditions. Many farmers in Southern Africa were forced to reduce herd sizes, at times before animals would normally be considered ready-for-market. An initial uptick in availability of meat belies the fact that current herd sizes are well below average. Cash-strapped farmers are unlikely to be able to purchase new livestock in the medium term, and production is likely to remain depressed.

Cocoa

Global cocoa production is concentrated in West Africa, which accounts for in excess of 70% of global output with Cote d’Ivoire and Ghana being the largest producers; Cote d’Ivoire accounts for 41% of global production. The dry weather as a result of El Niño, coupled with the severe Harmattan wind, has negatively affected the 2015/2016 harvests, resulting in a weaker harvest outlook for all of West Africa. Prices dropped significantly at the beginning of 2016, from the multi-year highs achieved in 2015, but are rebounding on the estimated production shortfalls due to the weather. The short-term after-effects of El Niño could result in growers struggling to establish new crops of high-yielding, disease resistant trees in depleted ground.

Although the tail-end of the harvest season in West Africa for the smaller, mid-year crop, has been impacted by the after-effects of El Niño, rains have started hitting the area, giving hope that the drought conditions will not impact the main crop, which will be harvested in the fall. If the yields are good, it could help compensate for shortfalls from the past crop.

Coffee

African coffee producers (Ethiopia, Ivory Coast, Uganda, Kenya, Rwanda and Tanzania) account for only 12% of global production, yet African beans are highly sought after, and the crop provides an essential revenue-diversification mechanism for these countries. The ongoing drought in the world’s main producers in South America has seen a decline in production and in the quality of beans from that region.

Over the short-to-medium term, depressed supply and ever-increasing global demand are likely to fuel price increases. East African producers, however, are unlikely to benefit, as crops are still recovering from El Niño-related disruptions such as heavy rains in Kenya and Uganda that damaged 2015’s crops, with localised flooding heightening the incidence of fungal diseases such as Coffee Berry Disease.

The graph below presents an overview of the change in production numbers (year-on-year) for selected commodities, including coffee, rice and sugar. It’s notable that Ghanaian coffee production benefited from the somewhat wetter 2015 season. Countries such as Cote D’Ivoire in West Africa benefited from seeing the only limited fall-out from El Niño. As noted, livestock production in South Africa ticked up on the slaughter of animals.

Source: BMI research

La Niña and its potential influence on commodity production

The advent of the La Niña, while it will have limited direct impact on African agricultural production, potentially adds to price distortions in some commodities. The hovering presence of a La Niña over Central America (including Brazil and Argentina), Australasia(including Australia, Indonesia and Malaysia) and some US states (including the

Midwest) means that supplies of corn, soybeans, sugar, oil-seeds, cotton and coffee are likely to tighten.

On a regional and sector basis, production of oil-seeds in the US Midwest and India; palm-oil in Indonesia and Malaysia; and sugar, soybeans and coffee in Central America (Brazil and Argentina) will be depressed. The resultant price adjustments feed into the ripple effects experienced by the broader market, including in food prices and food

insecurity. Simultaneously, it presents opportunities for African producers to position themselves to grow their future market share and take advantage of higher current prices (for instance in coffee, sugar, oilseeds).