International Market Commentary: February 2015

Introduction

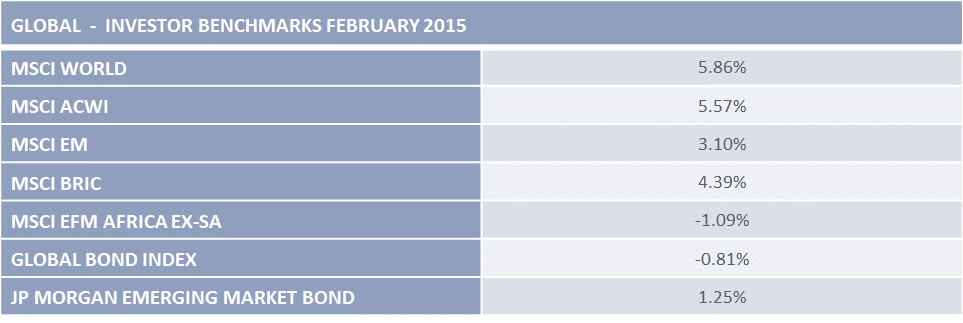

Global equity markets remained buoyant in February, ending near cyclical-highs. An eager anticipation of the European Central Bank’s economic booster-shot, and a recovery in oil prices, has carried market sentiment. The more disappointing economic data releases (notably from China, from the United States and in South Africa), had little apparent impact on the upward momentum.

Regional

The mood in the USA was upbeat during February, despite the conclusion of a lacklustre earnings season and predominantly disappointing economic data. The S&P500; Dow Jones Industrial Average and NASDAQ notched up 5.7%; 5.6 % and 4.8 % respectively. Energy stocks clawed back some of the previous period’s losses, but US exporters continue to face headwinds from the strong dollar. Consumer discretionaries performed well, as consumers saw an increase in their disposable income.

On the economic front largely, it was a month of mainly-missed expectations: 4th Quarter GDP growth was revised downward by 0.4% to 2.2%; The Department of Commerce reported a drop in new-home sales; and retail sales declined for the second consecutive month (by 0.8% for January). US investors, however, shrugged off these negatives, with two main themes underlying the overall positive sentiment: The prospects for employment, and the outlook for inflation and interest rates.

The US economy appears to be on an upward curve: In contrast to the disappointing data on new-home sales, and indicative of the renewed buying power of US consumers, the American Realtors’ Association reported an increase of 1.7% in pending home sales. Non-farm payrolls data continues to point to increased labour market absorption in the world’s largest economy – January’s release saw 257 000 new jobs added, with an uptick (to 295 000) in the latest data for February. Inflation remains at low levels, CPI falling by 0.1% over January, and 0.2% year-on-year, partly due to the pass-through from lower oil prices and the stronger Greenback. The result is an increase in real wages – average Americans are feeling the change in their pockets, which supports a consumer-led recovery. Business confidence recovered, albeit modestly, as gauged by the increase in durable goods orders (0.3% for January).

As economic prospects improve, investors continue to scrutinize the Federal Reserve Bank’s communication for guidance as to the likely timing of an inevitable interest-rate hike. The language of the Fed, as always, remains non-committal. Chairman Yellen’s testimony to the US Congress in mid-February, however, included some attempt to clarify the Bank’s ‘patient’ stance… Though no action is imminent, analysts are pricing in the announcement of a rate-hike at the September meeting.

The outlook for US markets and the country’s growth remains sanguine. The ‘Misery Index’ is perhaps the simplest indicator for the current consensus view: [Misery Index = Unemployment Rate + Inflation Rate]. The US Misery Index for February 2015 is at a 56-year low.

Economic prospects in the Eurozone too appear to have improved in February. European equity markets ended February on a remarkable high note, supported by a steady stream of improved economic data, the pending kick-off of the European Central Bank’s stimulus programme and the successful aversion of crises in Greece and Russia. The DAX increased by 6.6%, the CAC by 7.5% and the UK FTSE by 2.9%.

Growth momentum for the 19-nation bloc has swung into positive territory, with 0.3% GDP growth reported for the 4th Quarter of 2014, and the ECB revising its forecast for 2015 upward to 1.3%. The Markit Purchasing Managers’ index for February increased to a seven-month high of 53.5, confirming industrial expansion. The unemployment rate dipped by 0.1% across the region; new loan applications increased and overall business confidence is on the up. Political tension within the Bloc eased during February, supporting positive business sentiment. The tenuous cease-fire between Russia and the Ukraine has thus far halted the introduction of further economic sanctions. An eleventh-hour deal was struck between Greece and its creditors, extending the bailout terms and keeping the EMU intact for the present. The reaction of broader European markets to the Greek deal was muted. As noted in the previous commentary, the threat of contagion has been limited. With the firewalls put in place subsequent to the previous crisis, foreign banks’ current exposure to Greek assets is roughly 20% of the pre-2010 levels.

Successful crisis-management, however, has engendered renewed confidence in the integrity of the European Monetary Union and its banking system. Financial stocks responded particularly well, registering as the region’s strongest performing sector. Across the Eurozone, exporters have benefited from the weaker Euro, with German automakers a big winner. As in the US, defensive stocks (consumer staples, telecommunications and utilities) underperformed.

UK equities registered a record-breaking month – the FTSE ending on a 15-year high. The performance was largely led by mining houses, and the resurgence in the oil-and-gas sector. Rio Tinto, BHP Billiton and Glencore announced better-than-anticipated earnings results, and notable dividend increases. Setting aside the bounce-back of the Athens Stock Exchange and Russian markets, peripheral Eurozone markets outperformed their peers, with Italy’s MIB registering the largest gain (4.3%).

Asian markets extended gains during February. The Japanese Nikkei was up 6.42% and the Shanghai composite by 4.03%. Data from China was limited, with the trading month shortened by the Chinese Lunar New Year (heralding the Year of the Goat). Preliminary indications, however, are that the pace of economic growth has moderated further. The HSBC Purchasing Managers’ Index (at 49.8 for January) signalled contraction in the manufacturing sector; and Chinese imports declined by 19.9%. The latter decline is partly a response to lower demand for raw materials, with consequent knock-on effect on commodity exporters and on regional trading partners. The People’s Bank of China has intervened in an attempt to ease liquidity and boost flagging growth: During February, three key rates (the reserve ratio, the deposit rate and the lending rate) were cut by 25bps. Additional stimuli, and a potential move to devalue the Renminbi, are on the cards and continue to provide support for Chinese equities. A statistic to be taken with a pinch of salt (somewhat more than the normal healthy dose) is that the historical average returns to Chinese equity for the Year of the Goat have been 18%.

The Japanese economy remains on a solid growth-footing, and Japanese equities rose sharply in February. The TOPIX gained 7.7% to reach a 15-year high. Japanese inflation slowed to 0.2%, largely due to the pass-through from lower oil prices. The Bank of Japan, though not yet intervening, has reaffirmed its commitment to reaching its 2% target as soon as is feasible. A rate cut is likely if the spectre of deflation continues to loom. Yen-weakness against the renminbi and the dollar (after a further 2% decline during February) remained a boon to export-oriented sectors. Automotive and Technology stocks registered solid earnings results (Toyota, Sony) and, as elsewhere, stocks in consumer staples underperformed their (consumer) discretionary counterparts. The Financial and Real Estate sectors, prior-month laggards, were the better performing sectors. Japanese stock markets are likely to continue to rise, as Japan’s Global Pension Investment Fund (GPIF), the largest public pension fund in the world, has increased its target allocation to Japanese equities.

After outperforming in January, Indian stocks put in a more modest performance for February. The economy continues to chug along nicely – growth is estimated to be 7.4% for the 2014/2015. Investors were encouraged by the ongoing commitments to reform delivered in Governor Modi’s maiden Budget. Indonesia was the regional star performer for February, after a surprise rate cut by the Central Bank.

The MSCI Emerging Markets was up by 3.3% for February. Emerging stock markets gained ground, though underperforming their developed peers. The recovery in commodity prices has allowed oil-dependent countries some breathing room, most notably affecting (the respective regional heavy-weights) Russia, Brazil and Nigeria.

Within the broad classification, European emerging markets took centre-stage. Russia saw its exchange strengthen by 6.75%, as the oil-price recovered, and a (tenuous) cease-fire was reached with the Ukraine. The rouble, having lost half its value against the USD since June, recovered by 12.5%. This should help ease Russia’s inflation woes – at 15%, CPI is the highest since 2008. Turkey was the European regional laggard, amidst concerns about political interference in monetary policy. Despite inflation remaining above target, the Central Bank bowed to pressure from Prime Minister Erdogan, introducing a 25 bps rate cut in February, causing the lira to tumble. The Brazilian BOVESPA pared prior-month losses, posting 9.97%. The recovery was tempered, however, by Real-weakness and continued setbacks at Petrobras (Moody’s having cut its rating to junk). The country’s inflation rate is at a 3-year high (7.1%) and policymakers appear to have little room to manoeuvre. Within Latin America, solid earnings results from internationally-affiliated companies (such as Walmart de Mexico) and stable economic growth, made Mexico the region’s star performer, with Colombia the regional laggard. The modest recovery in commodity prices proved a blessing to African equities, with few exceptions. The Kenyan and Ugandan stock exchanges ended 4.8 and 4.85% up respectively, after the remarkable 17% profit announcement by the Ugandan subsidiary of KCB (Kenya’s biggest lender). The Nigerian exchange added 1.64%, despite ongoing Boko-Haram-led violence (and the addition of IS to the already-volatile mix). After a loss of 14.7% in January, this reversal of fortunes is perhaps one of the starker illustrations of the impact of oil-prices on commodity-dependent economies. The Nigerian oil-and-gas sector makes up 35% of GDP, and accounts for 90% of export revenue. The outlier in the generally upbeat African market was Egypt, the exchange declining by 5.95%. Disappointing earnings and unemployment data exacerbated the impact of political tension with Libya and IS.

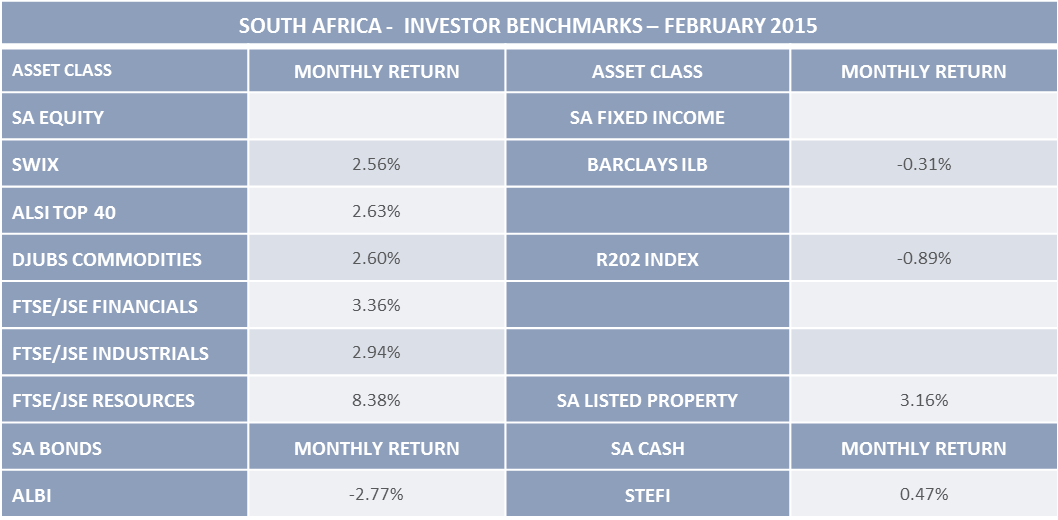

AnchorSouth African equity markets remained resilient, despite a rather gloomy economic picture. Investors were faced with some tough economic realities during February. Treasury released an annual figure of 1.5% for GDP growth during 2014. At the lowest level in 5 years, it tells of the cost of protracted strikes and infrastructure bottle-necks. The Kagiso/BER Purchasing Managers’ Index declined by 6.6 points to below the critical 50 mark. The contraction in industrial production was an expected response to electricity-supply constraints, but proved larger than forecast. Manufacturers continue to signal weak employment conditions, and labour-market absorption is unlikely to increase in the near-term. The country remains on the back-foot against its major trading partners. The terms-of-trade data confirmed that the country had swung back into a large deficit, and sent the Rand lower against major trading partners. The Rand, however, continued to be volatile, and weakened further against dollar, as did a basket of emerging currencies.

Despite CPI coming in at its’ lowest level in four years (at 4.4%), the SARB (as previously noted) left its rate unchanged at the January Monetary Policy Committee meeting. It indicated that there would need to be evidence of a clear and sustained pass-through from lower oil prices, before a rate-cut was considered. The Bank has proven its foresight: For a number of reasons, unlike their American and European fellows, South African consumers are unlikely to reap the benefits of lower oil prices. Though the country is a net oil-importer, the positive spill-over has thus far largely been diluted by electricity-supply constraints. The 2015 Budget allows for substantial commitments to alleviating infrastructure bottlenecks, including shoring up the struggling state power utility Eskom. Measures aimed at generating the revenue to do so include a hefty fuel levy. The Bank’s inflation outlook is likely to err on the pessimistic side, as the tax filters through to transport and food costs, and the oil price recovers. Consumers should not anticipate a rate-cut in the near-term. Treasury has predicted modest GDP growth of 2.5% for 2015, subject to downward revision.

Resources were the best performing sector, supported by the recovery in raw-materials, and improved growth prospects abroad. Bonds slipped, after a bumper January, with SA debt lagging the benchmarks (and less attractive than Asian emerging peers). The Rand continued to be volatile, and weakened further against dollar, as did a basket of emerging currencies.

Sectors

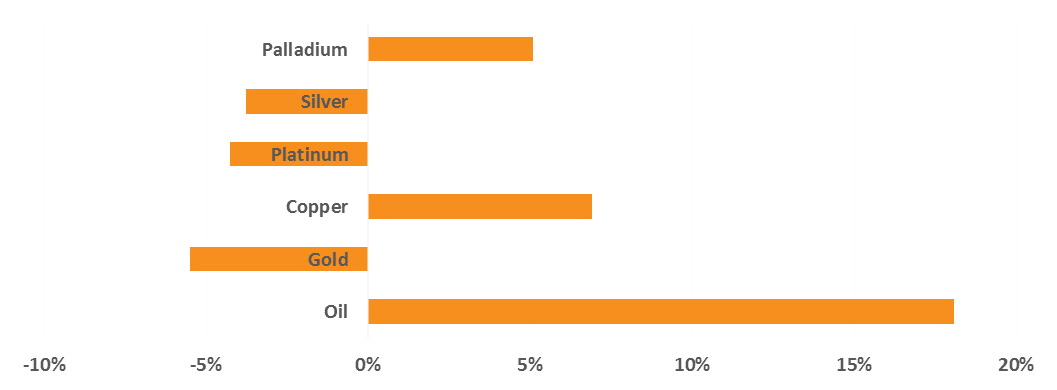

The commodity slump appeared to reach its nadir, with prices mainly strengthening during February. Gains were somewhat uneven, however: The oil price ticked steadily upward, increasing by 3.9% in the last week of February. This signalled the largest monthly gain in 6 years, albeit off a very low base. Gold, the traditional safe-haven asset, lost ground as investors risk-appetites returned.

On the currency-front, policymakers and traders alike are mulling the implications of the continued dollar-rally. The Dollar-Index, a measure of the USD against a basket of major currencies, has increased by 11% for the year to date. While this is a headwind to export-oriented US companies it has thus far been outweighed by positive consumption spill-overs in the world’s largest economy. Eurozone exporters, in turn, are benefiting from the weakening of the common currency (partly a pass-through effect of the ECB’s stimuli). Having started the year at 1.20, at 1.07 (as at the end of February) it is nearing purchasing parity. The effect on peripheral players is a cause for greater concern. Emerging market currencies, from the Rand to the Rupiah to Rouble, are losing value fast.

It has been previously noted that currency-brinkmanship (potentially short-sighted Central Bank intervention in currency markets, with the aim of gaining a competitive edge) could play out in the monetary policy arena. A consequent broader concern, however, is the effect on emerging market balance-sheets. In 2014, the Bank for International Settlements warned that a dollar-rally would expose the financial market fragility of emerging markets, leaving them once again vulnerable to large and volatile foreign capital flows. During the US QE era, many African and Latin American countries took advantage of low borrowing costs, incurring sizeable dollar-denominated debt. Asian countries have remained more insulated against the double-debt whammy implied by the strong dollar, weaker domestic currencies and imminent US interest-rate rise. Nonetheless, offshore punters (though more discerning than during the ‘taper tantrum’), are pulling back from emerging markets as a whole – the release of the latest US jobs report triggered a widespread sell-off. For many investors, potential volatility, despite the continued search for yield, has tarnished the attractiveness of emerging markets.

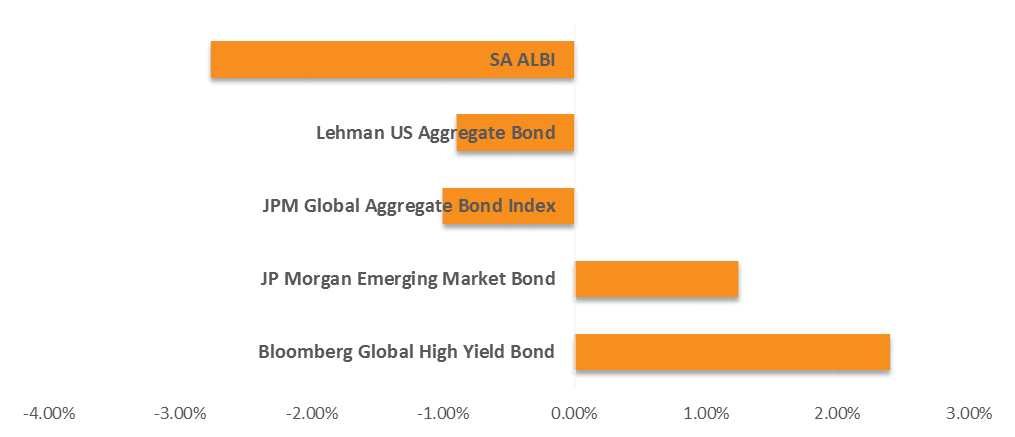

The divergence in monetary policy between the US and UK on the one hand, and the Eurozone and Japan (inter alia) was fairly apparent in the global bond market during February. Sovereign bond yields increased in the US and UK, where QE has largely tapered out. 10-year T-bill yields rose from 1.64 to 1.99%; UK Gilts increased by 50bps to 1.8%. Japanese and Eurozone yields remained low, with the Bund nearly flat. Italian and Spanish 10-year sovereign yields fell by 26 and 24 bps respectively.

As the ECB’s bond-purchases are set to kick off during March, sovereign debt, in particular, is likely to become a seller’s market. European countries are not running large deficits, and analysts predict that sovereign debt issuance will decline during 2015. The universe of sellers is to some extent limited, at any event, by the regulatory and capital adequacy requirements imposed on institutional investors and banks. Deutsche Bank estimates that the planned 1.1 trillion capital injection will represent roughly 189% of net sovereign debt issuance over the period. For the present, investors are hoarding their Eurozone government bonds, waiting to see to what extent short supply will drive prices and spreads along the yield-curve. This in turn has left ample room for investment-grade corporate bonds: US companies are already taking advantage of low borrowing costs and tapping into the euro-denominated market. Coca-Cola (in its centennial year) issued $9.5 billion in Euro-denominated debt during February, and high-yield investment grade corporate bonds far outperformed sovereigns for the month.

Conclusion

March should prove to be an interesting month, as the ECB’ stimulus kicks off in earnest, and international investors continue to seek guidance from Central Bank policymakers. The Federal Reserve’s mid-month statement could be a tipping point of sorts. Continued patience should see markets remain bullish, but ambiguity will spark investor jitters. Any return of risk-off sentiment will be particularly apparent in emerging markets, still in many cases smarting from commodity- and currency-lows.

More information?

To have the monthly International Commentary delivered to your inbox, please subscribe here.

Media contacts

For media enquiries in South Africa, please contact Courtney Atkinson via email or on +27 (0)21 673 6999.

In the UK, contact Andrew Slater via email.