International Market Commentary: April 2015

Introduction

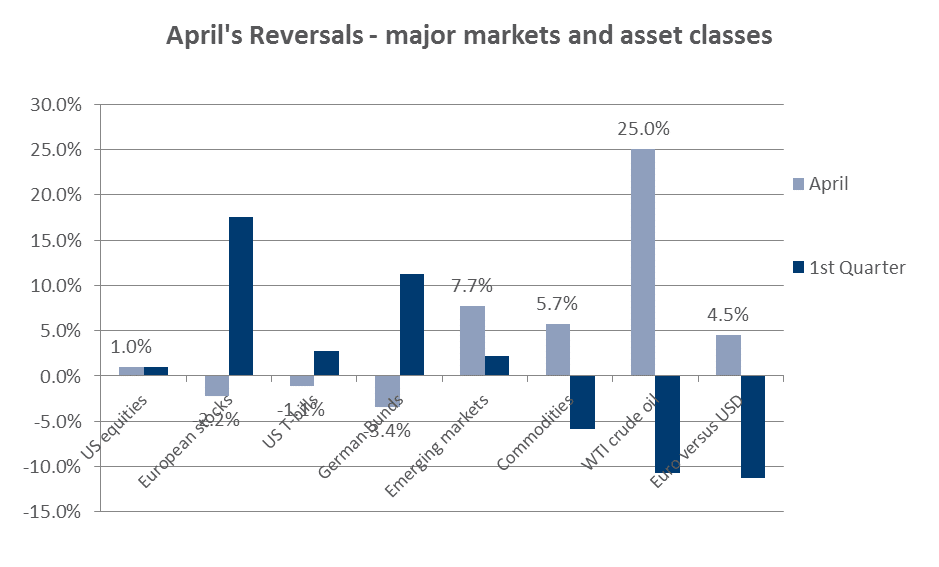

Global equities were somewhat mixed during April. Weaker economic data from the US, Germany, and China encouraged investors to lock in profits toward month-end and trimmed gains in US and European markets. Simultaneously, expectations of a Federal Reserve Bank rate hike were pushed out to September, fostering a risk-on attitude. Bolstered by a steady stream of liquidity from Chinese and European Central Banks, emerging market equities broadly outperformed their developed counterparts. April also saw the pronounced reversal of the trends seen in 2015 thus far: The dollar halted its winning streak; developed sovereign yields rose from their historic lows; and commodities bounced back.

Regions and Sectors

US equity indices reached record highs during April – the Nasdaq attaining its highest level since the dot.com-bubble of 2000. Softer economic data releases, however, raised concerns about the pace of the US recovery, and stocks markets pulled back sharply toward month-end. Equity indices ended only modestly up: the S&P500 and Nasdaq gained 1%, the DJIA 0.4%.

First quarter GDP growth came in at a lacklustre 0.2%. This undershot expectations, which had already been revised downward in response to the anticipated (mainly transitory) impact of adverse weather conditions, labour unrest, the slump in the energy sector and the extended dollar-rally. The IMF has revised its growth forecast for the US downward to 3.1% for 2015. The Institute for Supply Managers and Department of Commerce data underscored a slowdown in manufacturing activity, core non-durable goods orders and fixed investment spending. Retail sales data and consumer spending disappointed. Data was mixed on the employment front: the addition of only 126 000 during March was lower than anticipated, although partly explained by the hiring-freeze in energy-related and weather-dependent industries (such as construction). Weekly jobless claims during April fell to a 15-year low (at 266 000); and real wage growth remained stable. The seasonal ‘correction’ in hiring, and the increase in disposable income is predicted to feed through to increased consumer spending. Consumer sentiment (as measures by the University of Michigan’s consumer sentiment survey) turned positive during April. Preliminary housing data supports an optimistic medium-run outlook, as existing home-sales jumped by 6.1% to an 18 month high. US quarterly corporate earnings delivered an upside surprize, as 69% of firms reported earnings above the mean estimate. (Noted, however, that the mean estimate had been revised sharply downward toward the end of March (to -4.97%) so the estimate-beating decline of -0.4% is somewhat bittersweet).

The Energy, Materials, Information Technology (IT) and Telecommunications sectors lead the DJIA up during April. Boosted by the sharp bounce, and apparent bottoming-out, of the oil price, energy stocks rose by 7% and energy futures gained 25%. IT was up by 2%, as Apple reported strong first quarter results, and Microsoft climbed nearly 20% on cloud-related-software income. The excellent Q1 revenues reported by Goldman Sachs boosted Financial stocks, while significant Merger and Acquisition (M&A) activity played out within the Pharmaceutical Sector. In a reversal of March sector-fortunes, healthcare and utilities lagged. Healthcare declined by 1.5%, after being the S&P’s strongest performer in the first quarter (+7.1%). Large cap stocks outperformed mid-and small caps, and value stocks were favoured by investors across capitalization sizes.

Global investors continue to scrutinise the Federated Reserve Bank’s meeting notes for guidance as to the timing of rate hikes. Headline inflation was flat during March, following a second consecutive month of declines, but the Fed is paying closer attention to economic fundamentals (housing and employment data). At present, the Bank is giving little clear direction, somewhat blunting the efficacy of forward-looking expectations as a monetary policy tool, and injecting some volatility in global financial markets. In light of the most recent lacklustre economic data, however, analysts have pushed out expectations for a rate hike to September. The anticipation of ‘lower interest rates for longer’ have supported global risk appetite, with equity markets elsewhere mainly posting solid gains.

The United Kingdom’s stock market was one of the star performers in developed markets. Despite some electoral investor jitters, the FTSE100 gained 3% for the month. UK macroeconomic data was positive overall. Unemployment was lower, at 5.6% and real wages grew at 1.8%. The Bank of England has kept rates on hold for the present and with easier credit conditions, consumer confidence is on the rise, paving the way for a consumer-led domestic recovery.

Heavyweights in the Energy and Mining sectors accounted for a large portion of the FTSE’s April gains. Significant M&A activity in the oil-and-gas sector amplified gains from the recovery in oil prices. Royal Dutch Shell made a bid for BG Group, sending stock prices soaring. The potential for more such moves in the sector, as companies try to consolidate their share in a tightening buyers’ market, boosted the prices of other energy companies, notably Total and BP. Diversified miners (Rio Tinto, BHP Billiton and Glencore) were strong gainers, as demand from China appeared to be ticking up, and iron ore prices stabilised. Telecommunications and UK financials performed well. Whilst domestic-consumer-focused goods fared well, food retailers dragged on the Consumer Services sector, with Tesco’s reported its biggest-ever full year loss of GBP 6.4 billion. As in the US, healthcare and utilities lagged after outperforming in the previous month.

The Conservative election victory means that the referendum on Britain’s membership of the European Union is firmly back on the agenda. Political and economic ramifications are unlikely to be immediately apparent in equity markets, but the uncertainty around membership and potential implications for the trade balance could well inject volatility in financial markets. Sterling moves, in particular, will be closely watched by traders in the currency space.

Within the Eurozone, equity markets were mixed, and the final days of April saw selling pressures similar to those across the Atlantic. Germany posted a loss of 4.4%, making it the laggard amongst its developed peers. German and French Purchasing Managers Indices retreated, leading the Eurozone Markit Flash PMI down by 0.5 to 53.5 for April. The zone therefore remains in expansion territory, though the strength in manufacturing is unevenly spread (France and Greece are still contracting, with Spain and Germany, despite slipping, firmly in recovery). In a reversal of the prior month, German automakers (BMW) in particular struggled, amidst concerns on slowing global growth and cooling demand in the face of a stronger Euro. Eurozone Financials, in contrast to US and UK counterparts, had a somewhat dismal month. The lacklustre performance was driven by the 50% profit decline reported by Deutsche Bank, after being hit by large fines for LIBOR manipulation. Energy, Telecommunications and (in contrast to elsewhere) Utilities gained, while Healthcare lagged.

Overall, however, the outlook for the Eurozone is positive. The IMF revised its growth forecast upward to 1.5%, and the Union is experiencing its strongest expansion since 2007. Eurozone unemployment remained stable at 11.3 % month-on-month, and inflation ticked up to 0.0% (from -0.1% in March), easing deflationary fears. The recent European Central Bank Lending Survey reports that loans to the private sector turned positive for the first time in three years, registering a 0.1% year-on-year increase in the first quarter. (Year-on-year) during the first quarter of 2015 Eurozone equities are up nearly 17% for the year-to-date, The recent European Central Bank Lending Survey reports a rise in the net demand for loans to enterprises, and a 0.1% increase in loans to the private sector. A 6% rise in the net demand for loans to enterprises was largely driven by financing needs for inventories and working capital. European businesses are booming (or at least in an up-cycle, and Eurozone equities are up nearly 17% for the year to date. Much of the turnaround is being attributed to the European Central Bank’s stimulus measures, which are set to inject significant liquidity until 2016. The apparent efficacy of the package had even led pundits to question President Draghi at a recent press conference as to whether it might be wrapped up earlier than anticipated. This is an unlikely scenario, as pockets of significant weakness remain in the region. Much has been said of the likelihood of a Greek exit. Suffice it to say that, at present, negotiations remain somewhat acrimonious. Whilst contagion to peripheral markets thus far is limited, the uncertainty continues to inject volatility in financial markets.

Japanese equities delivered amongst the strongest developed market performances, with the TOPIX gaining 3.2%. Economic data was mixed: Industrial production ticked up and exports increased in both Yen and volume terms. Wage inflation is up, and unions are set to push for even higher increases this year. With the consumption tax-effect set to ‘drop out’ during April 2015, confidence indices reached their highest levels since November 2013. Consumer spending and retail sales data, however, were lower, while the overall inflation rate undershot expectations. Nonetheless, the Bank of Japan kept rates on hold at the April meeting, but capitulated by revising its inflation forecast lower. Investors, crestfallen at the lack of further stimuli, locked in profit toward month-end, considerably trimming the overall monthly gain (the market was down by 2.1% on the day of the announcement). Prior-month sector trends saw some reversals similar to those elsewhere, with Healthcare and Consumer Staples (food retailers in particular) lagging. Financials remained attractively valued, and gained 8% for the month, and Telecommunications performed well. Exporting giants Sony and Panasonic posted strong operating profits, sending share prices higher. The Yen strengthened against the dollar, in line with global peers. Although Fitch downgraded the country’s credit rating by one notch, the IMF revised its estimates for growth upward to 1%, and the outlook remains benign.

Emerging markets outperformed their developed peers, boosted by Central Bank liquidity (European and Chinese) and the rally in commodity prices. The MSCI Emerging Markets, at 7.7%, outperformed the MSCI All World by more than 5%. The extent of this outperformance is largely attributable to double-digit gains amongst the BRICs (note ex SA). India lagged, but the bloc collectively returned 12% for the month, with Brazilian, Russian and Chinese equities recording up to 17% gains.

Within Asia, the Chinese stock market easily outperformed its peers. Regulatory amendments, allowing mainland mutual funds to invest in Hong Kong stocks, boosted both the Hang Seng and the Shenzen indices. The People’s Bank of China announced a further (100bps) reduction in the required reserve ratio, the heftiest monthly cut since 2008. The PoBC is poised in a somewhat precarious position: It needs to balance the need to cool domestic credit demand, but simultaneously maintain a politically expedient growth rate. Moreover, the Bank has stated aspirations for the Renminbi to gain reserve currency status alongside the USD. Competitive devaluation is therefore not a viable policy measure, despite the potential ‘quick growth wins’ from currency brinkmanship. Chinese liquidity spilled over to other emerging Asian markets, and the Taiwanese stock exchange hit a 15-year high. The Indonesian market was the regional loser, as the index lost 10.6% on growth concerns and poor corporate earnings. India was a regional laggard, and certainly the BRICs step-sibling. The country lost ground (-5.1%) as investor sentiment turned negative, resulting in profit-taking toward month-end. The Indian Central Bank refrained from further easing, citing the impact of adverse weather conditions on food-prices as an upside risk to inflation. Analysts also weighed mainly disappointing corporate earnings results, and the potential implications of changes in fiscal policy (notably a tax on foreign investors). India is still on track to set the global pace in terms of growth: the IMF predicts that India will clock 7.5% GDP growth in 2015 and 2016, surpassing China for the first time since 1999. Latin American countries ended in the black, with Brazil the biggest gainer. The rally in commodities, in conjunction with the appreciation of the Real against the USD, boosted domestic equities. The scandal-rocked state-owned utility Petrobras announced the write-down of $17billion in debt, and the company’s share price jumped by a whopping 59%. This measure allayed concerns about debt-default which had been weighing on Brazilian equity and credit markets. Mexico, though edging slightly higher, underperformed its regional peers. In Emerging Europe Russian stocks saw an advance of similar magnitude and direction. The easing of political tension, the resurgent oil price and a 13% appreciation in the Rouble lifted some of the gloom surrounding the country. The outlook, however, remains fairly bleak, with inflation at 17% and the IMF predicting that the economy will shrink during 2015. A number of other peripheral markets in Emerging Europe performed well, with Hungary the star performer (nearly 20%). Turkey saw a more modest rise (1.9%), as electoral uncertainty weighed on Turkish investor sentiment. African markets were mixed, but positive overall. The Egyptian market, however, declined by 5.06 % during April. This is partly due to global perceptions around the country’s participation in military action in Yemen. Largely on the strength of the commodity bounce, Nigeria was the regional leader, ending the month 9.31% higher. Financials (Zenith Bank, Unity Bank) posted solid gains, boosting the exchange further. Indeed, African Financials generally saw an upswing during April, having also underpinned the performance of the region’s year-to-date star performer. Namibia has outstripped its neighbours, with year to date gains of 9.86% (besting South Africa by 48bps). FNB Namibia and Bank Windhoek were notable contributors (gaining 21.4 and 15.2% respectively for the year-to-date).

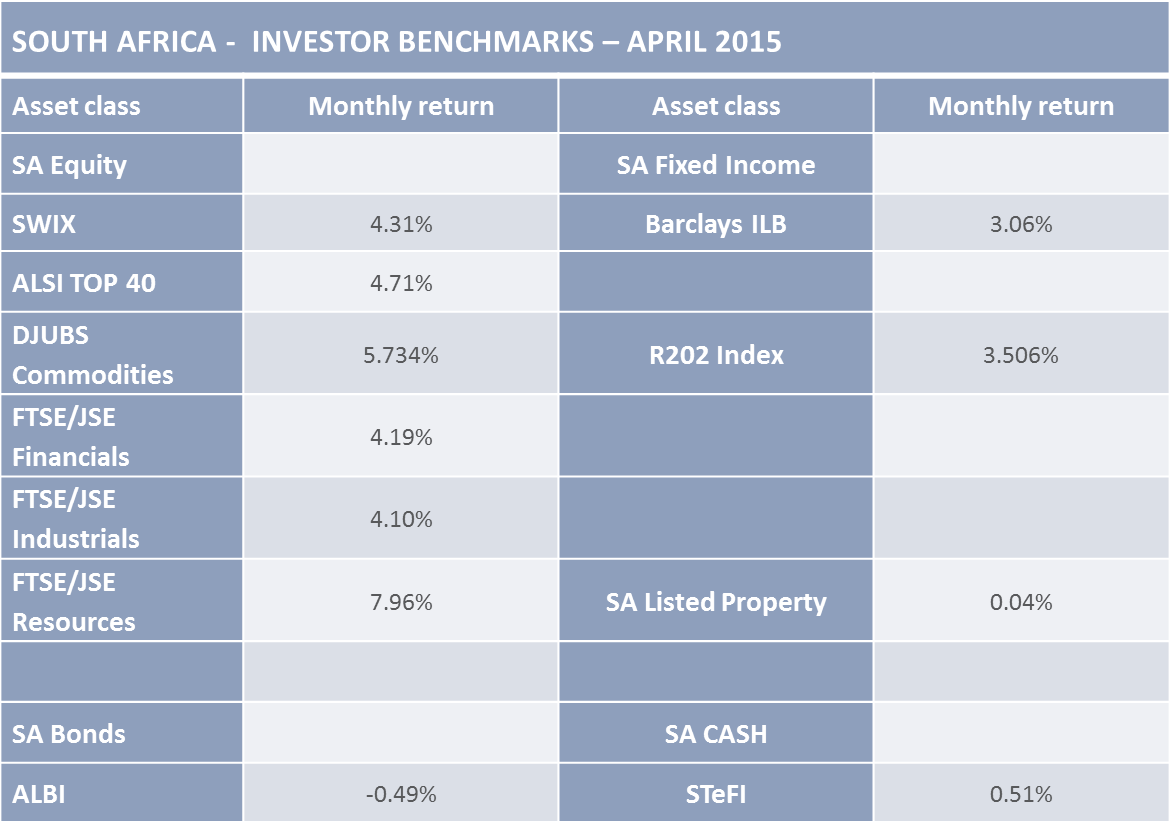

South African equity indices hit record highs during April, though potential gains were pared by poor investor perceptions and economic data. The ALSI was up by 4.7% for the month (12% for the year). As elsewhere, Diversified Miners and Energy (Anglo, Billiton and Sasol) rallied, and the FTSE/RESI surged by 7.9%. SA consumer confidence took a knock, with survey respondents feeling less positive about the country’s growth prospects. Social unrest, ZAR-weakness and expectations of higher basic rates and tariffs (debt-servicing, electricity, water and property), weighed on consumers’ minds and pockets. The Kagiso/BER Purchasing Managers’ Index declined by 2.5 to 45.4. The drop was partly expected, with April having considerably fewer working days. However, the slump exceeded (pessimistic) expectations, as the impact of elevated labour market activism and energy constraints continue to filter through to the manufacturing sector. As inventories build up in the absence of new sales, the Kagiso leading indicator also fell markedly (to its lowest level since 2014). Further contraction is on the cards. South African CPI data showed that inflation ticked up to 4.5% in April (from 4% in March). Electricity inflation alone increased by 7% year-on-year. Should the 25% tariff hike materialise (and with the CPI basket containing a 4.18% electricity component), there’s a substantial upside risk to inflation for the second half of the year. A hawkish South African Reserve Bank has signalled quite clearly that there is ‘less scope for pause’ on a rate-hike. Analysts predict that the repo-rate be adjusted at the next Monetary Policy Committee meeting. The SARB’s policy continues to diverge from many of its Central Bank counterparts, 20 of which have implemented easing measures thus far this year.

SA remained a net recipient of foreign funds, with strong flows toward the end of March and during April. The year-to-date foreign purchases of SA equities total R16 billion, exceeding the combined amount for the previous four years. Currency confidence, measured by the USD/ZAR bid-ask spread, remained low. As elsewhere, volatility introduces uncertainty in domestic equities’ run – importers and interest-sensitive sectors are wary of a lower Rand, while mining and industrial Rand-hedging stocks benefit from it.

Fixed Income, Currencies and Commodities

A number of reversals of year-to-date trends were notable in the fixed-income, commodity and currency universe.

Sovereign yields lifted off from record lows. During the last days of April trading (as the expectations for a Fed rate-hike were pushed out) major sovereigns saw significant selling pressure, particularly at the longer end of the yield-curve. US 10-year Treasury yields increased by 11bps to 2.03, UK 10-year Gilts to 1.83 and the German Bund yield jumped by 19bps to 0.37%. Peripheral European bond yields also rose (Italy and Spain up by 26bps, to 1.5 and 1.47% respectively). Investment-grade corporates recorded losses, as new issuances (partly in aid of M&A funding) outstripped demand. High-yield riskier corporates outperformed both sovereigns and investment-grade corporate bonds. Some volatility is likely to remain in the bond market: the Fed is yet to commit to timing and magnitude of rate hikes, and the Central Banks of Japan and the Europe still have considerable capacity for further easing.

Currency appreciation, stabilising commodity prices and a global risk-on attitude supported strong gains in emerging market bonds. Emerging market bonds outstripped sovereigns and investable emerging market corporates outperformed developed counterparts. Within the emerging market bond space, South African corporate bonds are regarded as attractive to the ‘conservatively risky’ investor. SA corporates tend to have relatively low exposure to foreign-denominated debt, or considerable backing from the state (Eskom), and are therefore somewhat more insulated against currency- and interest-rate shocks to debt-servicing costs. During April, South African government bond yields ticked up slightly on weaker domestic data. Inflation-linked longer maturities benefited from rising inflation expectations, posting a 3.1% return for the month. Brazilian, Russian and Venezuelan debt rebounded. Corporate issuance in the oil-and-gas sector was active, as companies attempt to offset the impact of lower oil prices. China Petrochemical recorded a $6.4 billion bond sale, the third largest in Asian history.

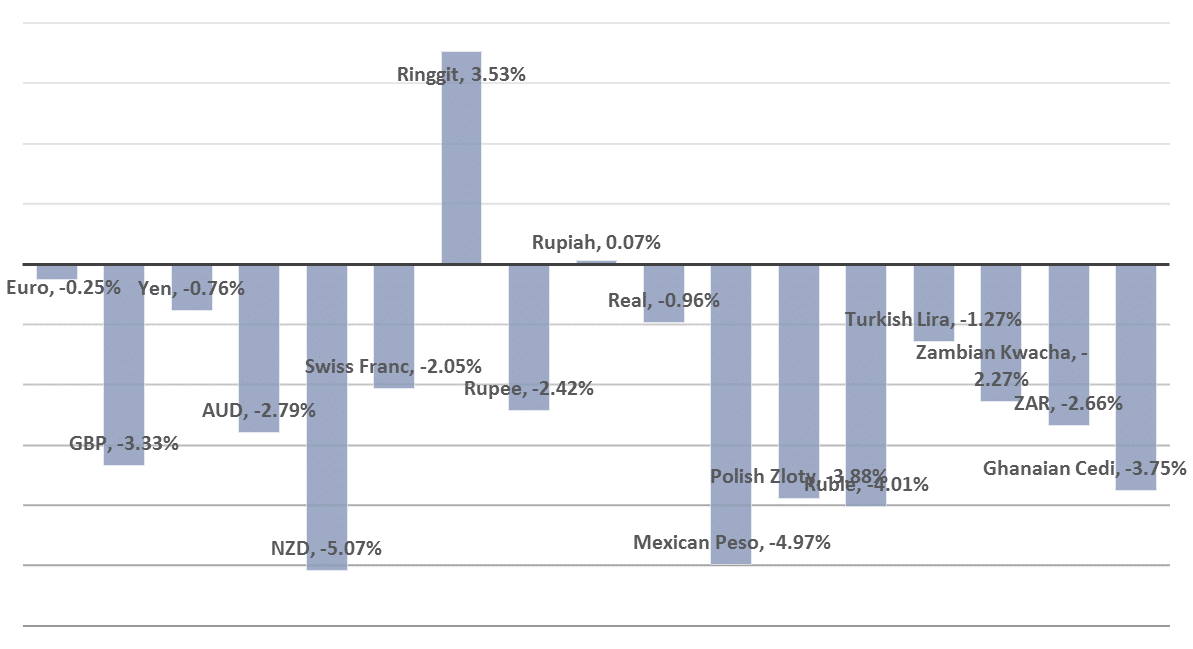

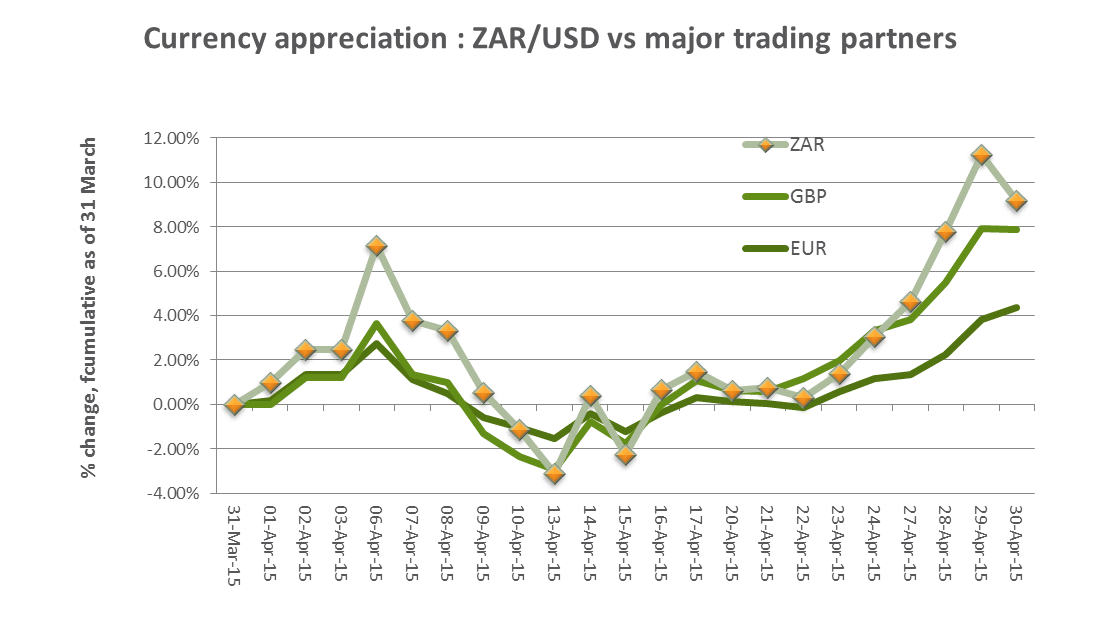

Although the consensus view for much of the year had been that the dollar would continue onward and upward, April witnessed an end to the Greenback’s 9-month winning streak. It depreciated against a basket of global currencies, including a number of emerging markets’. The Russian Rouble and Brazilian Real were the biggest climbers (12.7 and 6.6% respectively). The ZAR saw a modest 1.3% appreciation against the dollar over the month, with major trading partners seeing more pronounced gains (the Euro ending the month 4.33% higher). The Turkish Lira and Indian Rupee were weaker.

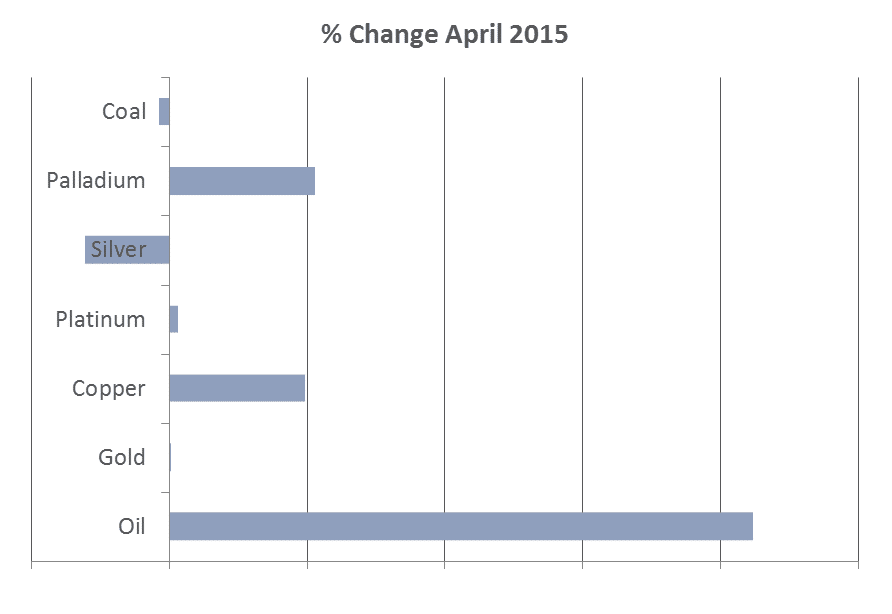

Commodities had a good month. Indeed, the most prominent reversal during April was witnessed in oil markets – bouncing by 21%. Traders jumped on signs of curtailed supply, as US inventory build-up reportedly slowed and the rig count declined (new projects were shelved and existing operations made dormant). Brent crude surged, reaching $66 per barrel, from its January low of $45. The global commodity index was up by 11.1% overall, led by energy and industrial metals. Agricultural commodities (-1.6%) and precious metals declined, with Gold 0.1% lower.

Closing comment

April saw a number of marked swings, particularly in fixed income, commodity and currency markets. Reversals of similar magnitude are unlikely in the medium term, but the potential remains for traditionally more stable credit markets to experience the same type of ‘stampede’ effects that jolt equity markets. Particularly currency markets are likely remain volatile, as the referendum on EU membership is back on the British agenda, and with a potential Greek exit still looming. Forward guidance from Central Banks will remain key in managing financial market reactions, and shaping investor’s expectations.