International Market Commentary: May 2016

- Equities rebound at month-end, as concerns about US growth ease and the Federal Reserve Bank sounds a hawkish tone G7. Ministers sound stern warning on beggar-thy-neighbour currency interventions, despite some dissenters. Uncertainty about Japanese stimuli measures but shares pare back year-to-date losses

- UK Brexit concerns resurface at month-end to send stocks, currency on roller-coaster ride ahead of June 23 EU-membership referendum

- Emerging markets lag, as industrial metals, key commodities soften and US dollar bounces back

- Supply constraints push oil above the USD 50 per barrel mark, but respite likely to be temporary ahead of June OPEC meeting

US Markets

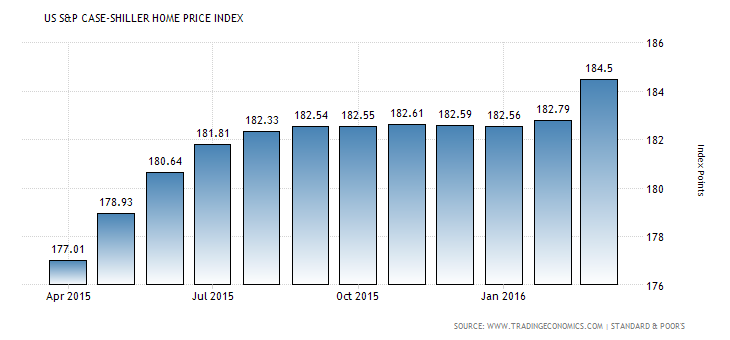

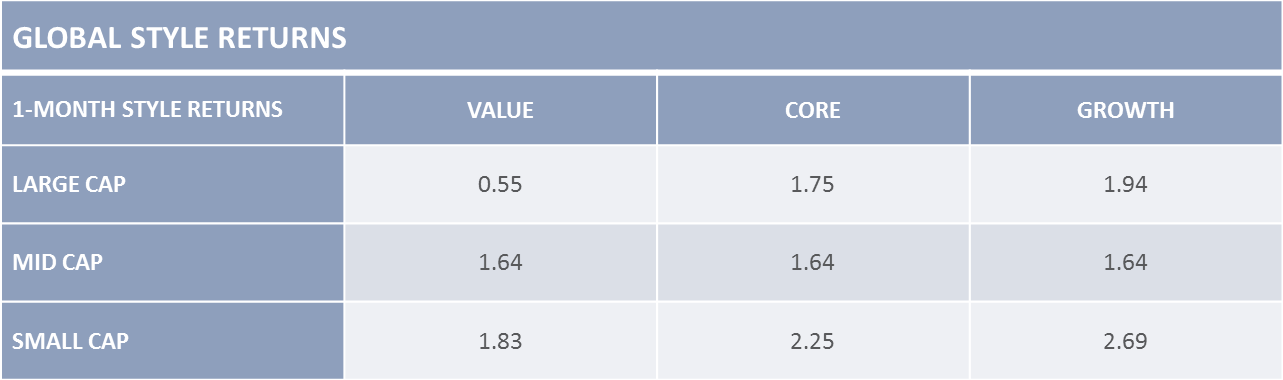

US stock markets rallied from mid-month doldrums, buoyed by a moderate and sustained improvement in economic data and upbeat investor sentiment. The S&P 500 bounced back to register +1.8% for the month and its first three-month winning streak since November 2015; and the Nasdaq recouped some of the prior month losses to close 3.36% higher. Formal and informal Federal Reserve guidance (in the form of the release of May’s Federal Open Monetary Committee Meeting minutes, press statements and comments from committee members) served to highlight an apparently steadily-ticking US growth engine. The tone underpinned market expectations that a rate-rise is imminent within the coming months, spurring a global rotation into Developed Market equities. Positive macroeconomic data included the Department of Commerce’s revision of first quarter GDP growth, from 0.5% to 0.8%, and upward revisions to second quarter growth forecasts (to 2.9% from 2.5%). US housing data was remarkably strong, providing the initial spark for the mid-month rally: new home sales spiked 16.6% in April, reaching an eight-year high; housing starts (which refers specifically to residential construction projects) rose 6.6% for April; the S&P Case-Shiller home price index and the median house price ticked up by 5.2% and 7.7% monthly respectively, with the latter at a record high. The increased propensity and ability to spend on fixed assets supports the picture painted of a US consumer in sound health (with a concomitant uptick in construction spending fuelling broader upward momentum). Consumer and spending data released during May underpins the view: US personal spending rose by 1% in April, the largest monthly jump in seven years; personal income increased by 0.4% for the second consecutive month; retail sales rose by 1.3% month-on-month; and the University of Michigan’s consumer sentiment index was nearly 6 points higher at 94.7 year high.

Business owners appeared to share consumers’ optimism: both the Institute for Supply Managements (ISM) Business confidence and National Federation of Independent Business (NFIB) Business Optimism Manufacturing measures were markedly higher in May. Against the largely positive macroeconomic backdrop, relatively weaker spots were therefore perhaps more notable: the Final Markit US Manufacturing Purchasing Managers Index (PMI) came in at 50.7, a trend echoed by preliminary numbers from the Dallas, New York, Richmond and Philadelphia Federal Surveys and the lowest figure since September 2009. Softer new order growth and efforts to deplete built-up inventories drove a decline in production. The Services and Non-Manufacturing PMI slowed by more than markets had anticipated, reaching a 15 month low. The sector saw little new business, a marked slow-down in activity and a drop in employment.

More disappointment was in store on the labour front: soft May jobs data (released shortly after month-end) is regarded to have scuppered the chances of a June rate hike. The tally of job gains was the lowest in more than 5 years, at a relatively meagre 38 000 non-farm payroll additions. The construction, manufacturing, mining and information sectors shed more than 65 000 jobs, with only healthcare employment providing a significant offsetting gain. The US Bureau for Labour Statistics indicated that productivity in the non-farm business sector had declined by -0.6% for the first quarter of 2016, and that wage growth remained sluggish during the first quarter, with the Employment Cost Index for the same period rising only modestly (0.6%) and average hourly wage-growth (month-on-month) slowing. The jobs report, perhaps most significantly in terms of shorter-run market impacts, undershot expectations (164 000 forecast for May, with March and April payroll numbers also revised lower). Investors, who had previously been quietly confident that the Federal Reserve would hike rates in June, quickly revised their positions. Unemployment, at 4.7% is well below the 5% Non-Accelerating Inflation Rate of Unemployment (NAIRU) the Federal Reserve is thought to target, but the Bank has adopted a wait-and-see attitude in light of the current soft patch.

The S&P/Case-Shiller 20-City Composite Home Price Index measures changes in residential house prices in 20 metropolitan regions in the United States: Atlanta, Boston, Charlotte, Chicago, Cleveland, Dallas, Denver, Detroit, Las Vegas, Los Angeles, Miami, Minneapolis, New York, Phoenix, Portland, San Diego, San Francisco, Seattle, Tampa and Washington D.C. It serves as a complementary leading gauge of consumers’ propensity to invest, employment and income trends , and business prospects per metropole.

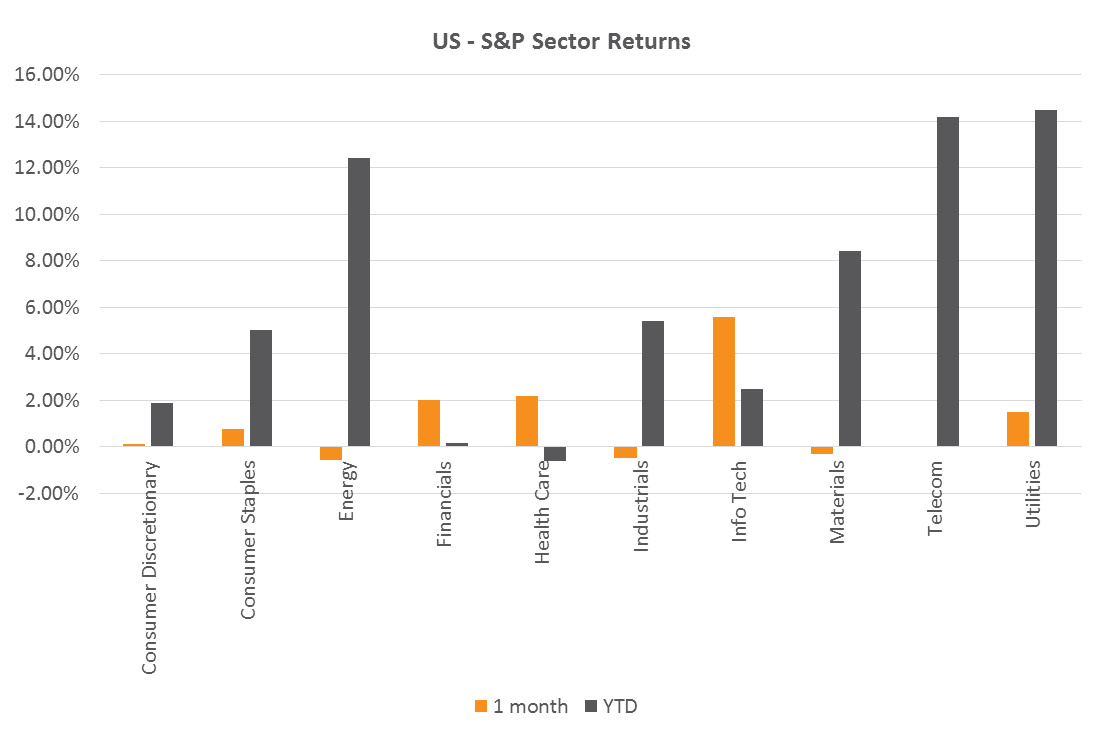

This is likely to add to volatility in the near-term. Sector gains were patchy: information technology, a traditionally cyclical stock, was a sectoral leader at 5.6%; financial stocks outperformed in May, based on improved profit-prospects in a higher interest rate environment, though June may be a bumpy ride if the Fed delays; whereas defensive utilities put in a solid performance, telecoms (usually of the same ilk) were poor. Notable Merger and Acquisition activity in the Pharmaceutical sector (Anacor and Jazz Pharmaceuticals made respective acquisitions for a combined USD 6.7 billion; and German-based Bayer AG proposed a USD 62 billion bid for Monsanto) boosted gains in healthcare. Despite the uptick in oil prices, energy stocks gave up prior month gains.

The Eurozone

European stocks advanced ahead of US peers, boosted in nearly equal measure by an easing of US growth concerns, and Zone-centred developments (political progress, a weaker Euro and sound Eurozone macroeconomic data). The Stoxx All Europe closed 2.45% higher, and the German DAX and French CAC ticked up nicely, while the UK’s FTSE notably lagged (+0.31%). In the policy-related/political sphere, the last week of May saw a significant breakthrough in negotiations between Greece and it main creditors. Talks between Eurozone finance ministers and the IMF resulted in a loosely-defined deal to restructure the country’s debt when the €86 billion bailout ends in 2018. The outline-deal will (crucially) see official creditors afford Athens debt relief for the first time since November 2012. The first injection of bailout funds will kick off with a €7.5 billion cash release in June, aimed at keeping the country afloat for the summer months. Ongoing stimuli by the European Central Bank has left investors less jittery about both Eurozone growth and inflation prospects, as well as the region’s ability to weather any US policy-induced shocks. The Bank will begin purchasing corporate bonds during June, and offering cheaper long-term loans to banks to spur credit extension, boosting overall appetite for European assets. In the midst of still-furious campaigning,

Brexit remains a source of market-volatility, but the threat seemed to wane toward month-end, as polling results were increasingly weighed toward a vote to remain. The Organisation for Economic Cooperation and Development has added its voice to those warning of the knock-on impacts of an exit on the zone’s economic growth, including some effects extending to the micro-economic/household level. At any event, macroeconomic data has been largely upbeat, despite lingering niggles (Brexit, Greece and the migrant crisis). The latest release of first quarter GDP growth was revised upward to 0.6% for the zone, with the annual rate unchanged at 1.7%. As is to be expected, the average masks some country-level divergence: Germany is powering along; France (the second largest economy) is finally showing sustained upward momentum; Greece remains slumped in recessionary territory, posting a 1.4% annual decline in GDP; Italy has been a regional laggard, with 1.0% GDP growth for the year.

The socio-economic and political spill-overs from an ongoing flood of migrants have weighed heavily on both the Mediterranean nations, with little signs of the crisis subsiding. Tension is exacerbated by already-high unemployment rates (11.7% for Italy), particularly amongst the youth, (the rate is about 37% amongst this population group). Economic sentiment surveys in the country showed sharp declines in confidence during May. On the other hand, the German IFO business climate survey beat expectations. German industrial orders (for March) rose by 1.9% month-on-month and preliminary PMI data ticked up for the month of May. Trade data was positive, with the surplus maintained at near-record highs, and supported by a weaker Euro. Initial readings on French Composite PMI data were upbeat, with the service subsector offsetting continued contract in manufacturing. French unemployment has remained stable, albeit at a stubbornly high 10.2%. Labour unrest, however, sparked by proposed labour market reforms (inter alia aimed at streamlining hiring-and-firing) is likely to add to short-term churn. Recent protests have also highlighted the at-best tenuous hopes that incumbent President Francois Holland would have of holding onto office after 2017.

Europe’s corporate earnings season closed with a (perversely welcome) whimper as opposed to a bang: results were weak, but the overall view is that they were not as bad as had been feared. On a sector basis, as elsewhere, information technology stocks clawed back prior month losses, a still-steady European consumer underpinned an uptick in consumer staples and energy stocks were unable to take advantage of the oil-price recovery. The Healthcare sector saw a particularly active month: the USD 62 bn bid by Bayer for Monsanto dominated news, but smaller acquisitions, positive drug-testing trials (Astrazeneca) and an easing of the pointed rhetoric featured in the US presidential run-up also served to boost Healthcare stocks. In contrast to US peers, European financials lagged, mainly due to ongoing concerns about the health of the banking sector in peripherals, as did defensive utilities. UK assets lagged the broader Eurozone, as investors and markets struggled to contend with the uncertainty still surrounding the June 23 referendum. With polling and survey results during May suggesting that that a vote to remain will win out (65% probability) investors nerves abated over the course of the month. The UK currency and risk appetite recovered accordingly. The last trading day, however saw the FTSE endure a rollercoaster day, as an ICM UK telephone poll gave markets a shake-up. The poll showed that 45% of respondents favoured an exit, and only 42% wished to remain in the EU, sparking a late-afternoon sell off in equities and the currency.

Polls tend to be noisy indicators, but a few things are worth noting: a leave-result is not off the table, and the likely knock-on impacts are difficult to quantify. While it is true that campaigners may exaggerate the direct impact on the UK economy, it remains equally true that any transition period is likely to be messy and costly, both for the UK and its main trading partners (especially for the smaller peripherals such as the Netherlands, Ireland and Belgium, where exports to the UK account for more than 5% of GDP). It is also likely to be a protracted process of renegotiating terms: for Greenland, the only other territory to have left thus far, negotiations took 3 years. The short-run impacts of the referendum, whatever the outcome, are already playing out, as highlighted by comments from the governor of the Bank of England (Mark Carney) that the vote proves the “biggest domestic risk” to the short-and-medium term economic outlook. Sterling has absorbed the brunt of the nervous fallout, with the pound 5.6% lower on a trade-weighted basis than at the start of 2016. Another key consequence is that inwardly-focused UK firms, offshore prospects and individual investors have likely deferred projects, capital expenditure and investment decisions until after the outcome has been decided. UK investment declined by -2.1% in the last quarter of 2015, after a nine-month sustained rise of 1.4%. Economic growth for the first quarter of 2016 was revised lower to 2%, the weakest rate in 3 years. It is not clear, with vociferous claims being made by both camps to what extent this is a reflection of UK-centred uncertainty, as opposed to sluggish global conditions.

UK macroeconomic data maintains a modestly positive trend and tone: UK unemployment has stayed at a 10-year low (5.1%) for the 5th consecutive month and average weekly earnings rose modestly. Tension in the labour market has slightly abated, with ongoing negotiations between Tata Steel, potential bidders and the UK government resulting in a deal which will see the company’s UK business remain operational. This is likely to preserve at least 11 000 jobs in the in the traditionally politically-and-economically sensitive steel industry, though details are still being finalised. The Markit/CIPS Purchasing Manager Indices rose for May, with both services and manufacturing ending above the key 50 mark in expansionary territory. Industrial production jumped by 2% month-on-month in April, driven by a 2.3% increase in manufacturing. The Confederation of British Industry’s Industrial Trends Survey, published on a quarterly basis, indicated that business confidence is still shaky, but that manufacturers (at the March survey date) expected improvements in volumes, employment and new orders during the second quarter. A separate indicator of small business sentiment underpins the upbeat view. Consumer confidence (measured by the GfK index) rose for the month, but remains in depressed territory. An encouraging development, particularly for domestically focused companies and struggling retailers, is that respondents indicated a greater propensity to spend on both discretionary and big-ticket items. After a dismal couple of months, notable for the particularly gloomy updates and outlooks from leading retailers, retail sales finally picked up during May, registering a 1.4% year-on-year improvement.

Companies such as Next and Marks & Spencer, however, remain cautious as to whether this is a sustainable upturn in consumer spending, or merely a seasonal blip. UK-centric companies, at any event, rallied from the previous month’s lows.

Financials, housebuilders and retailers all managed to recoup some of their year-to-date losses, led by mid-cap domestically-focused companies. The mining sector performed poorly, as industrial metal prices buckled (copper in particular) against the backdrop of a stronger USD and disappointing Chinese macroeconomic data. Bourse-heavyweights Glencore, Rio Tinto and BHP Billiton tumbled at month-end, largely offsetting gains elsewhere. The oil price continued to recover throughout the month, with supply disruptions spurring the price per barrel to above the key USD50 mark. Energy stocks in the US and Europe were largely unable to capitalise and lock-in gains for May, but UK counterparts Royal Dutch Shell and BP ended the month in positive territory. Despite persistent concerns about the sustainability of the recovery, some global companies are targeting new exploration: shares of Statoil and Centrica were given a fillip as they were amongst the first companies to secure rights to oil-and-gas fields in the Barents Sea in more than two decades. UK healthcare and pharmaceuticals gained on strong M&A activity, upbeat earnings updates and positive outcomes of clinical trials. Developments in the British referendum and in global oil markets (as an equity market barometer) will be closely watched, but June is likely to be a bumpy ride.

Japan and China

Japanese stock saw some respite in May, after being the worst performer amongst developed peers for the year to date. The bourse closed 2.9% higher for the month. Minister Shinzo Abe is doing his utmost best to reassure international investors and appease domestic concerns about the much-questioned Negative Interest Rate Policy, and the consistency of Bank rhetoric. The Yen, which has caused dissent between Japan and its G7 peers (in terms of whether the Bank should be allowed to intervene in staging a depreciation), showed signs of softening during May. The depreciation against a basket of peers is likely to boost prospects for exporters, and temporarily stave of additional criticism/conflict. At month-end, domestic investors welcomed the news that the implementation of the consumption tax hike would be delayed. The relief is partly based on the fact that the previous VAT-increase (in April 2014) was followed by three consecutive quarters of recession, a potential consequence the economy can ill afford in the current stuttering growth environment.

Domestic macroeconomic data was mixed: headline GDP growth for Q1 2016, and industrial production and housing starts for the month trumped market expectations. The labour market shows further signs of tightening, with a rise in the number of people employed, and the pace of hiring (signalled by the ratio of job-offers-to-applicants). Domestic consumer confidence, however, remained depressed, with retail sales showing a zero percentage month-on-month increase and continuing its negative year-on-year trend. The Bank, moreover, is not seeing much movement toward its inflation target – data for April shows a further -0.3 % drop, as the prices of major components (food, transport and housing) all eased. Pressure on the Bank to implement (and market expectations for) further easing is therefore mounting, with many expecting some form of fiscal stimulus package to be announced during June. On the corporate front, earnings season concluded on a somewhat sour note, dominated by negative surprises particularly in the financial, commodity-related and outwardly focused cyclical sectors. Despite recently depressed domestic sentiment, and increasing scepticism as to the efficacy of stimulatory policies, domestically focused companies reported robust earnings for the fiscal year ending March 2016. Sector-wise, financial stocks were initially further dragged down by the previous month’s surprising decision to maintain policy unchanged, but pared back losses. Food stocks were amongst the outperformers, export-related shares benefited somewhat from the depreciation in the Yen, and IT outperformed as elsewhere

Chinese equities ended the month lower, with economic indicators for April doing little to reassure investors as to a steadier path of economic growth. Disappointing trade data weighed on sentiment, with exports and imports both falling during April. Industrial production data came in below expectations, registering only a 6.0% uptick (after a 6.8% rise in March), and Purchasing Managers’ Indices showed signs of softening in all three categories (Services, Non-Manufacturing and Manufacturing, with the latter remaining in contractionary territory). Retail sales registered a similarly declining and disappointing rate of growth for April (10.1% year-on-year versus 10.8% for the previous month), though consumer confidence ticked up modestly. Overall business confidence remained unchanged, signalling a less-than-sanguine outlook.

The People’s Bank of China reiterated its stance that markets should expect an ‘L-shaped’ path for economic growth, an indication that large stimuli measures would not be used to kick-start a sharp recovery. Whether domestic pressures and a tough economic environment changes the picture, given the Bank’s somewhat unpredictable history of communicating and implementing policy, is yet to be seen. Chinese authorities reported that the Bank had over the course of May injected significant liquidity via targeted measures, and has already pumped roughly 110 billion into the market in June (including 70 billion in seven-day reverse repos into the banking system) to ease liquidity. At any event, despite previous indications that staged management of the currency would be limited in future, the Bank intervened during the course of the month. The Bank implemented a daily currency-fix at a 5-year low, resulting in a -1.6% Renminbi depreciation renewed fears over capital outflows. Markets were boosted somewhat at month-end by increased odds that Chinese A-shares would be eligible for inclusion in the major MSCI indices (signalling some renewed confidence that bubbles/excessive volatility were less likely in future, and opening an avenue for demand from offshore and passive vehicles) On a sector basis, Technology stocks outperformed as elsewhere, and blue-chip financials benefited strongly from prospects of MSCI-inclusion.

Emerging Markets

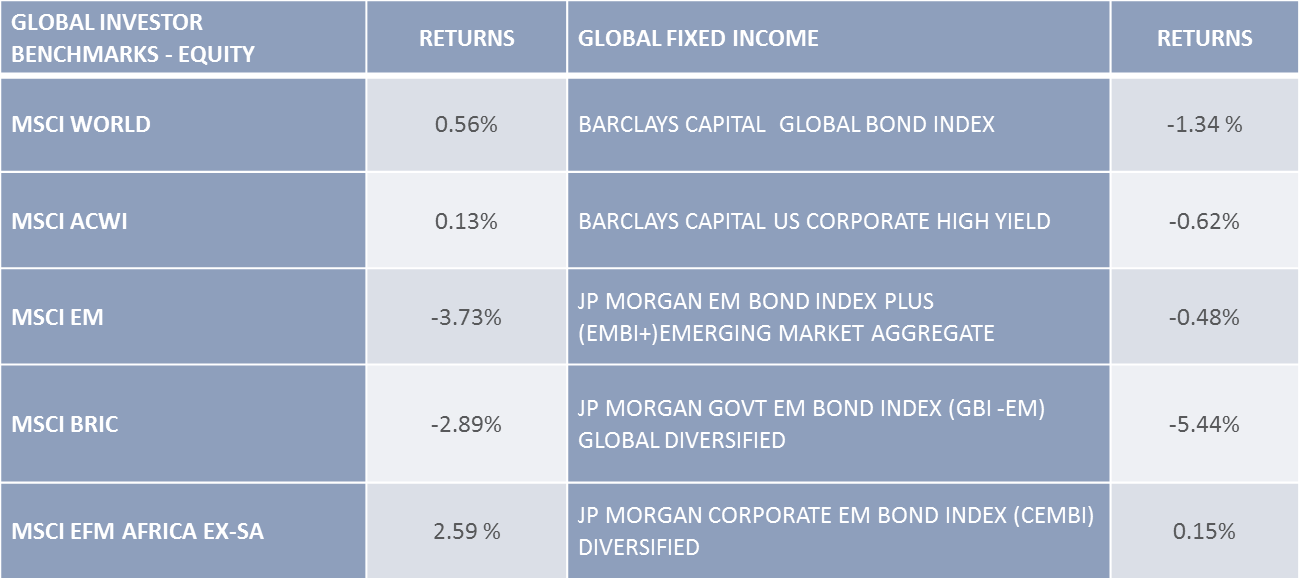

Renewed dollar strength halted the recent rally in Emerging Markets (EM), and the MSCI EM closed -3.73% lower (significantly underperforming the MSCI World at 0.56%). Emerging African markets outshone their peers, with the MSCI EFM ex SA posting a 2.59% gain, boosted by developments in oil and currency markets. Emerging Asian markets were mixed, though dominating Latin American markets. Phillipine and Indian markets were boosted by local political results, with the election of the pro-market Rodigo Duterte in the former, and a strong performance from the ruling BJP party in the latter’s local government elections. The Indian government’s progress on significant reform has been regarded as patchy, hence the move by Parliament to approve a national bankruptcy law (which could see progress to cleaning up the troubled financial sector), was greeted with cautious optimism. The country’s GDP growth for the first quarter trumped expectations and it is likely to maintain its ‘star performer status’ in this regard (outstripping China). The knock-on impact of the delayed monsoon (due to the El Nino weather phenomenon) on food prices and a recovery in oil has left the Central Bank hesitant to implement further rate cuts, and the June 7th meeting, as expected, saw no change. As with India, Thai equities are regarded as more insulated against Federal Reserve interest-rate decisions, and therefore saw limited fall-out from the Fed’s rhetoric, somewhat outperforming peers. Taiwanese equities outperformed, largely on expectations that sales of new Apple products would boost the (heavily-technology dominated) bourse, while Malaysian and Korean equities suffered particularly on currency weakness.

Latin American markets saw widespread losses, breaking a four-month winning streak. While the run-up to the impeachment of President Rousseff was cheered by markets, stocks gave up gains shortly after the event. Vice-President Temer has been sworn in as a replacement, and succeeded in relatively quickly forming a cabinet which is perceived as market friendly, and passing a revised budget for the remainder of 2016. The moves are seen as a positive, both as material policies and as measures of his ability and willingness to implement reforms. Delivery, however, is yet to be tested, and investors remain cautious on still-depressed macro-economic data and socio-economic concerns. Inflation remains rampant, the economic recession has not yet played out and social unrest remains elevated (notably so ahead of the Rio Olympics). Economic data in Mexico was mixed: whilst labour market conditions were tighter and the inflation outlook improved, industrial production was disappointing. Across the Latin American region, energy, material and financial stocks underperformed, with controversial Petrobras, material giants Cemex and iron ore miner Vale leading losses. Following the catastrophic collapse of a dam last November, formal investigations into the latter’s Brazilian operations, have resulted in charges of deliberate misconduct against Samarco (the joint venture between BHP and Vale). The latest criminal charges against top executives come on top of the USD 6.2 billion deal agreed with the Brazilian government, and a USD 44 billion pending civil lawsuit. Despite upticks (albeit volatile in nature) the Brazilian mining sector is not well-positioned to benefit much from the resurgence in commodity prices.

Most of Emerging European markets underperformed peers, with the exception of Greece. The agreement outlined regarding an extension of the bailout, and further relief measures, prompted a rally in Greek equities. Much maligned financials were the sectoral leader, as in Hungary. Sentiment toward the latter was boosted by the news that rating agency Fitch had restored the country’s investment-grade status (raising its long term rating from BBB- to BB+). Despite the uptick in oil prices, Russian energy companies proved unable (as did peers in many developed counterparts) to translate the benefits into month-end gains. Equity markets slid lower, although economic news showed signs of slight improvement: while still in recession, a -1.2% 2016 Q1 contraction in GDP trumped expectations (for -2%); the jobless rate declined to 5.9% and inflation remained stable at 7.3% in May. This fuelled expectations that the Central Bank would have some wiggle-room in lowering rates at the 10th of June meeting (a 50bps cut was subsequently implemented). In an additional positive signal as to the return of investor confidence, the country’s first issuance of Eurobonds since Western sanctions were imposed saw a resounding uptake. Consumer confidence and retail sales, however, remained depressed. Political matters weighed on Turkish sentiment, as the ongoing tension between President and Prime Minister Davutoglu resulted in the PM vacating his post. His successor, Mr Yildirim, is a key AKP ally to President Erdogan and likely to push for constitutional reforms which will extend the Presidency’s power. Yildirim is known for his support of infrastructure projects, likely to further boost the party’s popularity and stimulate the economy. The leadership change, however, comes at a time when Turkey is already at odds with the EU regarding its stance on terrorism, the Syrian conflict and the migrant crisis. Its future EU-membership is still uncertain. The lira, at any event, bore the brunt of the political fall-out (declining more than 13% against the USD over the course of the month).

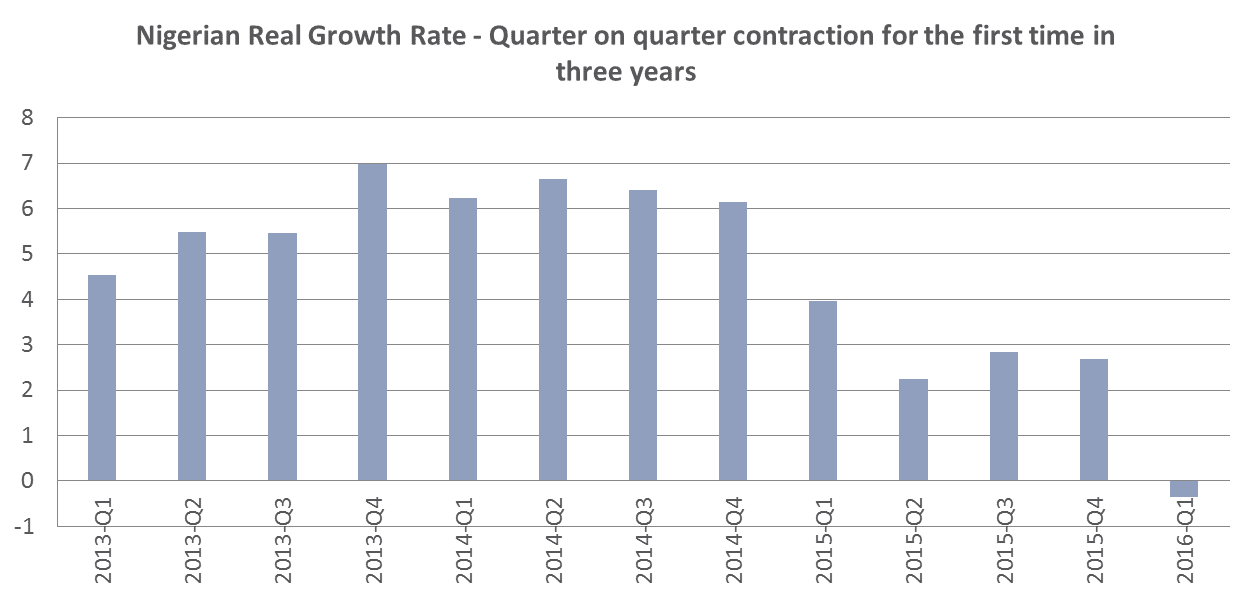

African markets were mainly lower, with Nigeria the notable outperformer. The NSE ALSI closed 10.41% higher. Nigerian equities were stronger, on the back of an oil-price recovery and talk of currency devaluation, despite mixed macroeconomic news. The economy posted its first quarterly contraction in five years (since GDP was rebased in 2010), as output slowed to -0.36% for Q1 2016.

The decline was led by the Finance and Insurance, and the Manufacturing sectors, surprising to the negative with -11.28% and -8.39% contractions respectively. The rebound in oil prices saw a marked improvement in related sectors (-1.89% versus -8.28% in Q4 2015). Whilst domestic conditions (notably infrastructure bottlenecks) will continue to weigh on short-to-medium term economic prospects, President Buhari has taken steps to reassure investors as to the country’s future path. The most concrete measure in instilling business confidence (still to be realised and much-welcomed by domestic and international market participants) includes a stated commitment to move away from the tight dollar peg, and allow the currency to devalue (to at least the 290 naira-to-the-dollar rate suggested by the IMF). Nigeria’s beleaguered financials (Unity Bank, Diamond Bank) posted large gains.

The Kenyan Central Bank somewhat surprised investors, by implementing a 100bps reduction in the benchmark interest rate. Though the signal is positive (widely regarded as a confirmation of improving economic prospects, easing domestic credit conditions and a healthier banking sector), investors were unsettled by surprise moves, particularly at month-end, and equities closed lower. Ghanaian and Zambian markets declined, on softer copper and commodities, while the Egyptian bourse closed lower on a subdued economic outlook. Tourism, which constitutes roughly 12% of GDP, has not yet recovered from the October 2015 terror attacks, and Egypt Air’s recent woes are likely to frighten off more foreign arrivals. Alongside emerging peers (and global investors), African markets continue to watch the Federal Reserve closely, as changes in stance have fairly immediate pass-through, particularly in the currency space.

South Africa

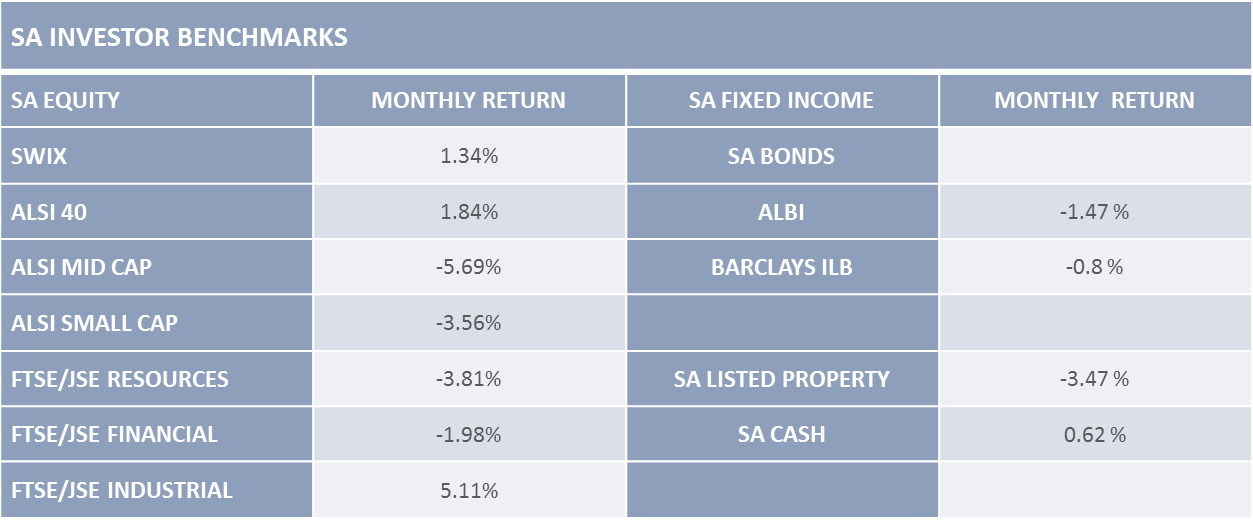

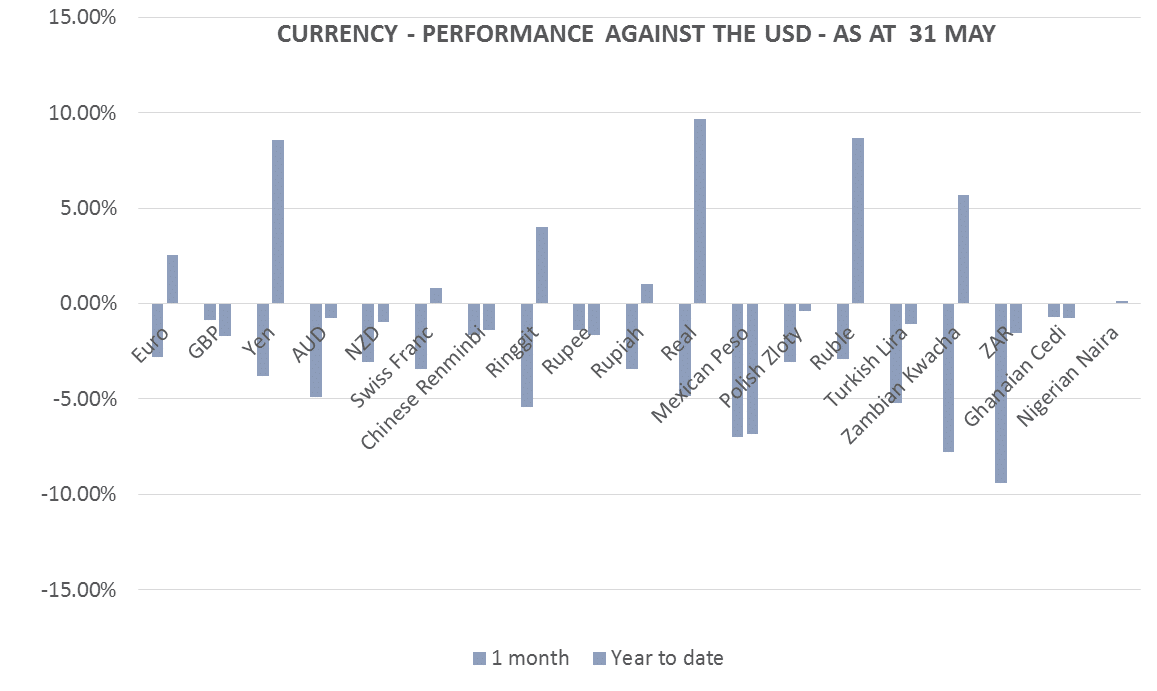

South African markets were mixed during May. The South African Rand again fell victim to a combination of US-dollar strength (on Federal Reserve rhetoric), soft domestic economic data and local political fall-out. The currency depreciated by more than 9% against the Greenback over the course of the month. Ebbing appetite for emerging markets saw estimated net foreign sales of R13.7 billion in SA bonds, a reversal of the previous two months’ trend, with the pending credit rating update from S&P added to investor jitters at month-end. The update was due on June the 3rd. The agency left the rating unchanged, albeit with a negative outlook, and bond investors were granted some breathing room. Foreign sales of SA equities came to approximately R14.9 billion for the month, reflecting the at-best-cautious stance of global investors toward the country’s economic prospects. The SWIX was modestly higher, at 1.34%, with gains solely attributable to the uptick in Industrials (5.11%), as Financials (-1.98%) and Resources (-3.81%) slumped. On a sector basis Rand Hedges within Industrials (such as BAT, Naspers and SAB) were stalwarts. Naspers saw its market cap hit R1 trillion, as share prices hit record highs, supported by Chinese parent Tencent. The Gold Index slid 10.72% for the month, as the metal lost its lustre on a decline in safe-haven demand. Generally, softer commodities and global demand for Materials further weighed on Resources (The platinum JSE sub-index alone lost 15.96% for the month). Ratings uncertainty contributed to a near 4% slip in the banking sector.

Macroeconomic data was mixed: GDP contracted by 1.2% (q-o-q) for the first quarter of 2016, undershooting already-subdued market expectations. The leading detractor, as a sluggish global growth-environment and continued commodity weakness would suggest, proved to be the mining and quarrying sector (declining 18% on an annualized basis). The Barclays PMI declined, signalling tougher conditions in the manufacturing sector, but it is encouraging that it remains in expansionary territory at 51.90 (previously 54.9). The drop, however, does emphasize the extent to which global volatility and currency considerations impact on local businesses, with local demand relatively stable. Total Vehicle Sales, for instance, improved during the course of the month, with a higher propensity to spend on big-ticket items. This was largely driven by inventory drawdowns and the second-hand market, as NAAMSA reported (National Association of Automobile Manufacturers of South Africa) reported that new vehicle sales remained subdued and had continued to decline on a year-on-year basis (10.3% lower than for the year ending May 2015). New vehicles for export, however, were resilient, and the Association anticipates further growth over the course of the year.

Retail sales data too was more upbeat, though the pace of growth slowed to 2.8% year-on-year for March. This is despite a slow-down in the household credit category of private sector credit extension. Changes in the underlying data, owing to the inclusion of the newly operational African Bank as of April, have somewhat muddied comparability. The overall trend, however, is subdued, slowing from 4.6% to 2.3% year-on-year. Somewhat perversely, the latest measures of consumer confidence have ticked up. Corporate credit extension moderated, but remained positive. Positive news emerged on the trading front: the surplus in April (0.43 billion) for the month was partly driven by a sizeable decline in food imports, including a 34% fall in vegetable imports as the domestic drought finally eases. It serves to further narrow the deficit for the year, alleviating some current account pressure, potentially ameliorating some fiscal pressure. This, however, has not yet boosted business confidence, with the latest confidence index ebbing further. The likely prospect that food inflation may ease, however, did allow the South African Reserve Bank to stay its hand at the May Monetary Policy Committee Meeting. CPI inflation pulled back to 6.2% during April, from 6.3 % in the previous year. The Bank reiterated its view that continued currency weakness, pending wage renegotiations, rising oil prices and the residual pass-through from food inflation are anchoring expectations to the upside. Inflation is predicted to breach the targeted band, and the reprieve is likely to be temporary, particularly if the Federal Reserve moves in the next two months.

Commodities, Fixed Income and Currencies

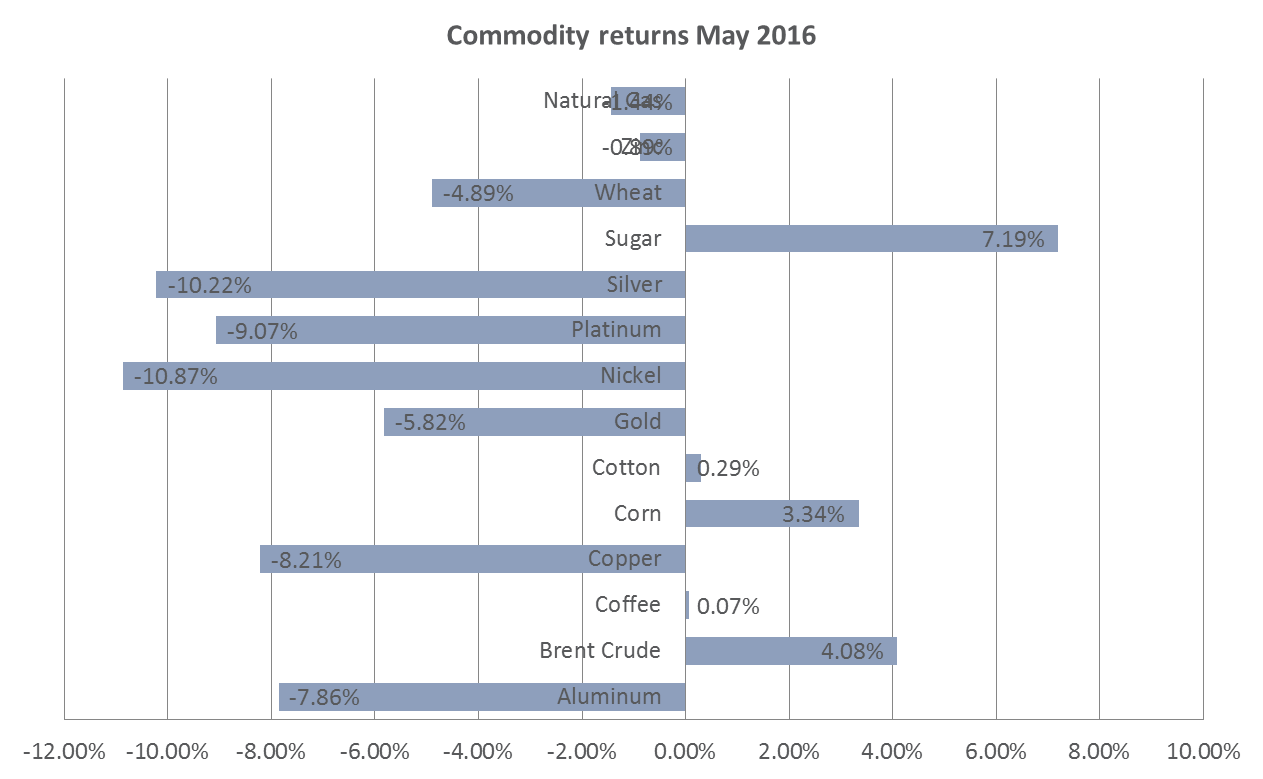

A hawkish tone from the Federal Reserve sounded a call for the dollar to rally, and resources gave up most of April’s gains. On sluggish Chinese data, the steepest losses were in industrial metals and iron ore prices (as flagged in previous commentary) reversed sharply, plunging by 28%. Federal Reserve comments also saw some easing in the demand for gold as a safe-haven asset, with the commodity paring back year to date gains (although still nearly 15% higher). Selected agricultural commodities and oil proved the exception, both sectors responding to supply side pressure. Adverse El-Nino-related conditions (resulting in still-poor harvests in Latin America and Africa) drove corn and sugar prices higher as demand outstripped supply. The oil price glut abated somewhat: the combination of devastating Canadian wildfires and militant attacks on Nigerian oil installations served to temporarily lower production to 2.5 million barrels a day. Simultaneously global demand was reported as rising by 1.4 million barrels on a year-on-year basis. Prices spiked to above USD50, although pessimistic expectations from the OPEC-members’ meeting early in June were capping gains.

Fixed income saw a mixed month, amidst the rapidly changing expectations of US interest rates, and on uncertainty about the EU-referendum. As the remain-camp remained in the ascendant for much of the month, UK Gilts returned 1.8% for the month, outperforming peers. Sterling corporate bonds were higher, partly due to subdued issuance ahead of the referendum. US 10-year T-bills returned 0.0%, and German bunds returns 1.0% (local currency returns). The High Yield space, which is dominated by energy-related firms and which is less sensitive to interest rate speculation, outperformed their investment grade corporate counterparts. The global high yield index returned 0.6%, but European high-yields returned 0.2%, underperforming US counterparts. With corporate issuance still fairly strong, especially in US markets, high-yields easily outstripped corporates. The JM Morgan Emerging Market Bond Index declined by 0.1% in USD terms (and -5.4% in local currency), as increased uncertainty arrested the strong upward trajectory for the year to date.

Emerging currencies slumped against the US dollar, with the Turkish Lira and South African Rand amongst the poorest performers. The Yen slipped by 4% against the Greenback, a development much-welcomed by Japanese exporters and the Bank of Japan. Fundamental differences and underlying tension on exchange rate management resurfaced at the G7 meeting hosted by Japanese Prime Minister Abe, with Japan advocating its right to intervene. For the time being, however, Finance Ministers emphasized the need to avoid beggar-thy-neighbour measures and fears of competitive devaluations have ebbed for the time being. Volatility in fixed income and currency markets, however, is likely to resurface after the UK referendum: if Brexit does occur, or if the leave-camp garners significant support, it is likely to elevate within-EU tension (already prevalent in a number of peripheral members’ political domains).

Conclusion

June may be a rollercoaster ride for international investors: whatever the outcome of the EU Referendum, there will be spillovers into the currency and fixed income markets; the Federal Reserve Bank, though putting a June-hike on the table, has been left unsettled by the most recent US jobs data; Oil prices remain extremely volatile and apparently (perhaps somewhat unjustifiably) closely linked to world equity markets. Emerging markets, in particular, will remain vulnerable, but are potentially also in a position for significant near-term gains as sentiment and the policy environment change.