International Market Commentary: June 2016

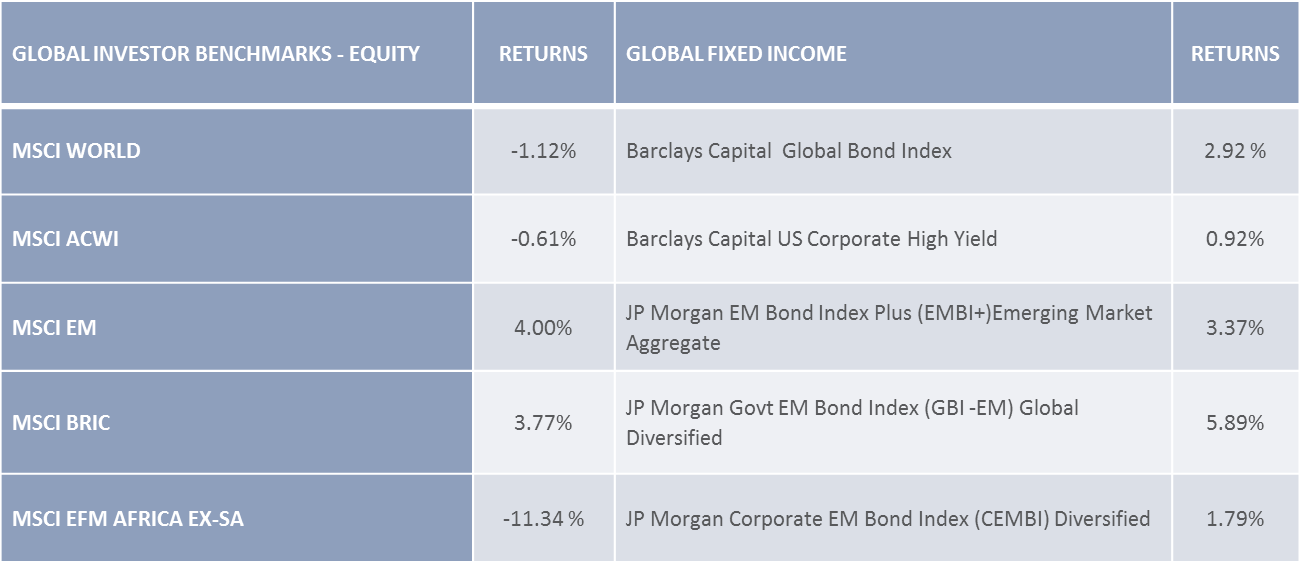

- Equity markets caught on the backfoot by Brexit – risk assets tumble before steadying at month end.

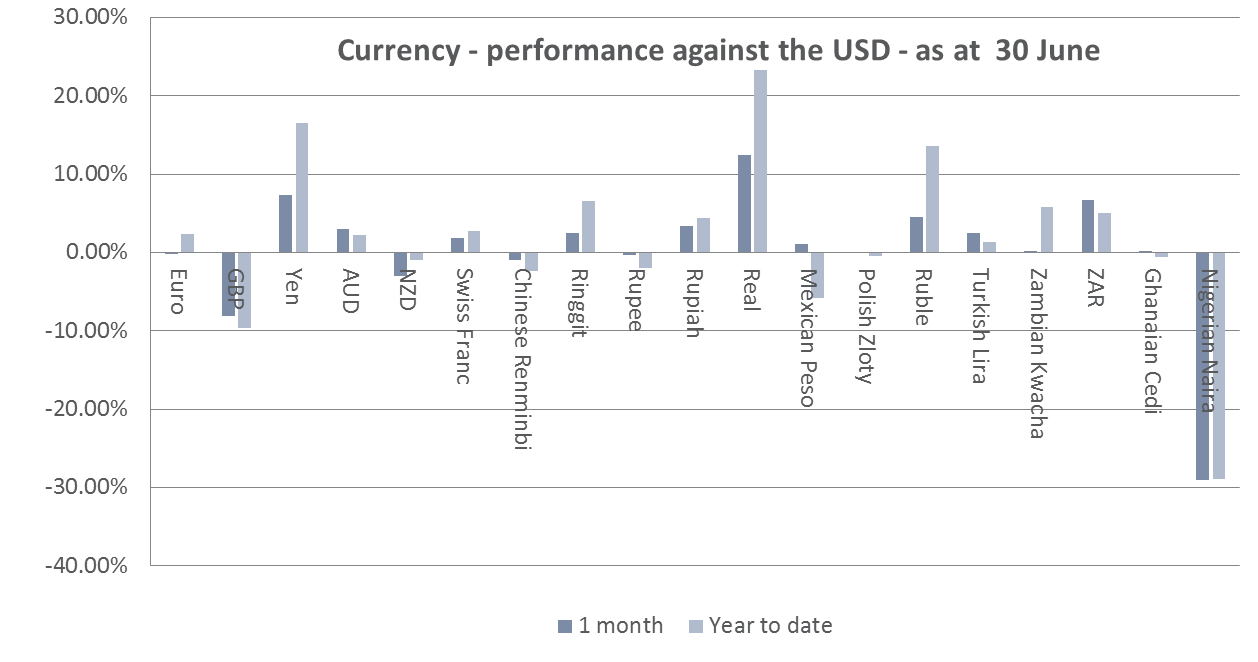

- Volatility remains elevated, amidst intra-EU bloc tensions and UK political uncertainty. Currency markets seen as bellweather, with Sterling and Euro swinging sharply.

- Investors rotate toward traditional safe havens, prompting further Yen appreciation and surge in gold

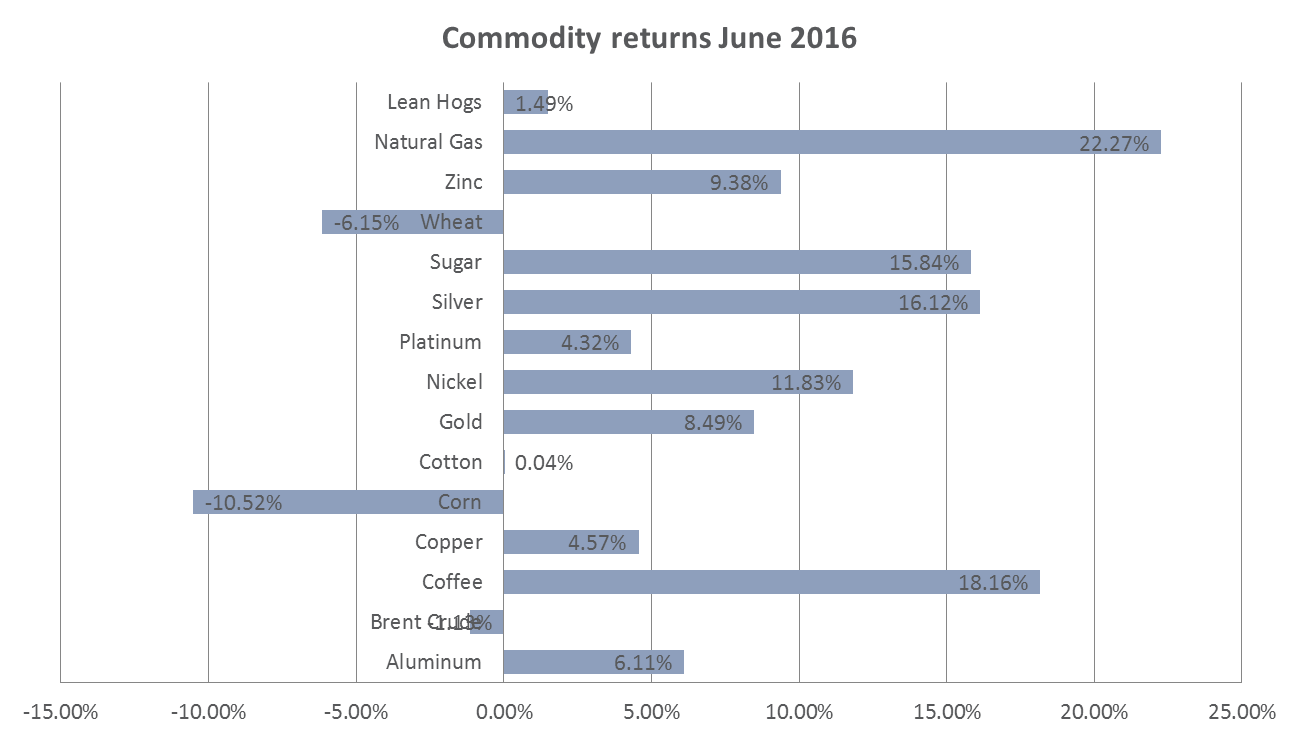

- Emerging markets surprisingly steady – expectations of further monetary easing and delay in Fed hikes outweigh Brexit fall-out. Commodities tick up, led by Precious and Industrial Metals (Silver at 16.1% amongst the biggest gainers)

US Markets

US equities initially tumbled after markets were wrong-footed by the UK’s rejection of the status quo. As elsewhere, however, the majority of losses were relatively quickly reversed, and the S&P ended a modest 0.26% higher for the month, after registering a -5.3% slide in the immediate aftermath. The Dow gained 0.95%, while the Nasdaq lagged, losing 2.06% for the month. The broad-based reversal was partly prompted by anticipation of renewed Central Bank accommodation in a bid to steady the ship (specifically in the UK, and Eurozone, but also elsewhere in Japan) in the wake of Brexit. Excessive market volatility saw expectations of a Federal Reserve Bank hike pushed out further, with the odds favouring a December rate hike at the earliest. The tone of recent statements has certainly been more cautious, despite some improvement in domestic economic data.

Perhaps most notably, the latest jobs data saw many investors heave a sigh of relief. May’s particularly poor data (showing that only 38 000 jobs were created) appears to have been a blip: The Labour Department reported that 287 00 jobs were added during June, the highest total in 8 months and well in excess of consensus forecasts (for 175 000). The transitory impact of the Verizon strike in the information services sector certainly told in the data, but it is heartening that the only sector to show a contraction was mining. Overall unemployment remains low, and the labour force participation rate and average hourly earnings edged up modestly. Investor sentiment was boosted by the month-end release of better-than-anticipated Institute for Supply Management data, with the Manufacturing Purchasing Manager’s Index, at 53.2, delivering its highest reading in 3 months. New orders recovered from disappointing May numbers, as did the Markit US Services PMI (trumping expectations). The indicators for employment growth expanded for the first time since November 2015, supporting the latest Labour Department releases. The Chicago PMI and NFIB (National Federation of Independent Business) Business Optimism Indices were similarly upbeat.

Measures of consumer sentiment, however, reflect a generally more subdued outlook: uncertainty about the knock-on impact of developments in Europe, rising domestic terror concerns and the tense run-up to the US elections weighed on consumer sentiment. The Michigan Index dipped to 93.5 for June, from a steady 94.7 in May. Spending on big-ticket items was reluctant, reflected in auto sales, durable goods and construction. Research firms (S&P Global, LMC) have revised annual vehicles sales forecasts lower (to an average 17.5 million, from an average 17.8 million units), making it likely that 2016 will be the first annual drop since 2009. Automakers note that the decline comes off a high base, but it does nonetheless affirm the overall medium-term expectation of somewhat pedestrian economic growth. New orders for US manufactured durable goods shrank by 2.2% in May from April 2016, and housing starts (referring specifically to residential construction projects) slowed. Other housing data was mixed after the previous month’s buoyancy: While the S&P Case-Shiller home price index maintained its upward trajectory (prices rising by 5.4% year-on-year for April); new homes sales and pending home sales slipped by 6% and 0.2% respectively during May 2016. Retail sales rose only modestly, and at a markedly slower pace than during the previous month (0.5% versus 1.3%).

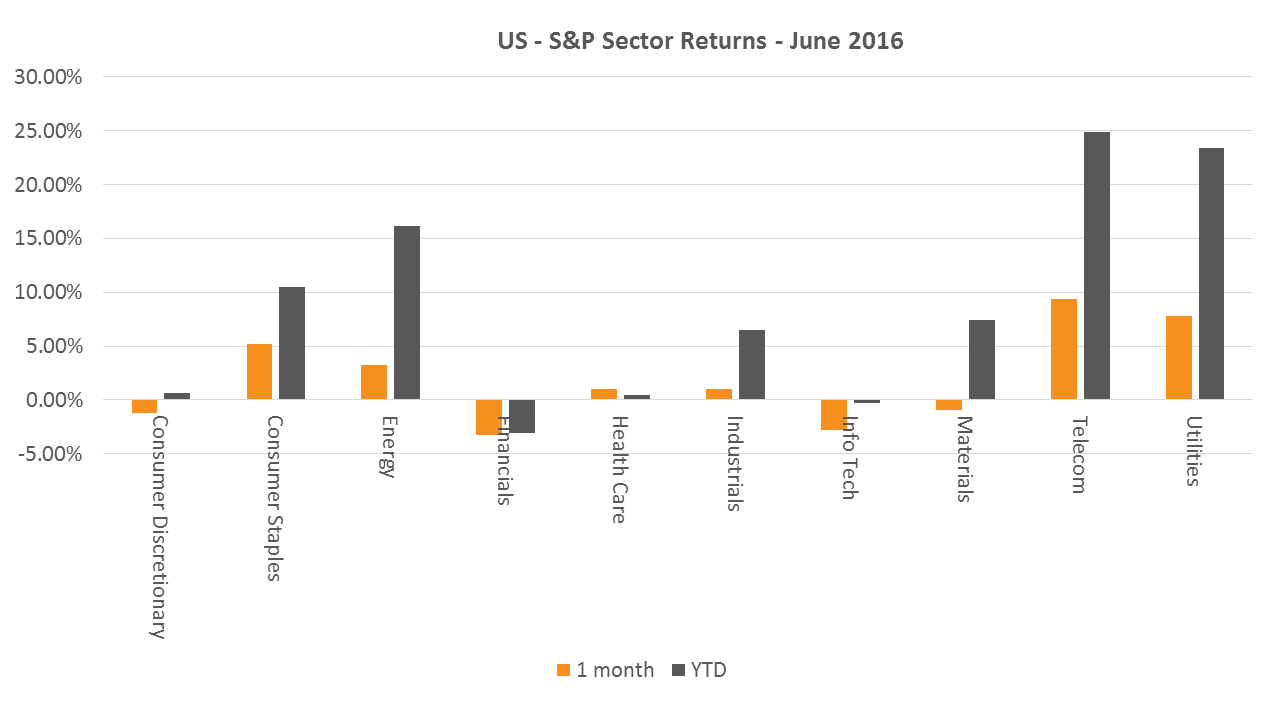

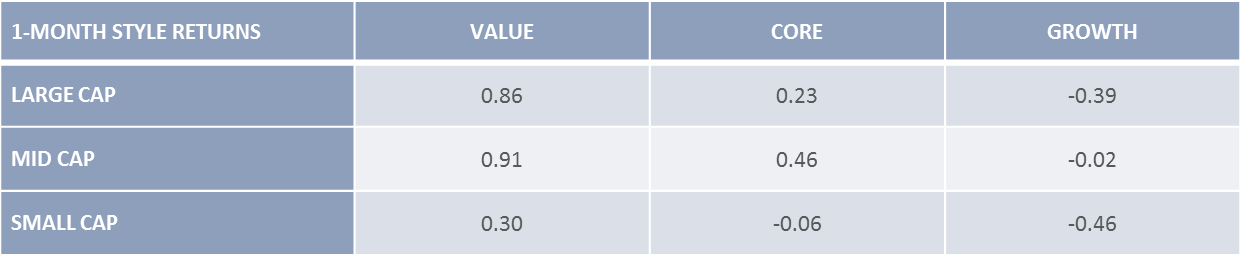

Post-Brexit investor caution and subdued consumer sentiment – likely to be exacerbated by electoral tension, renewed domestic terror threats and a resurgence in populist activism – saw a marked divergence in sector returns. Traditionally defensive stocks (Utilities, Telecommunications and Consumer Staples) benefited from the risk-off sentiment. Cyclical Financials bore the brunt of the sell-off, as investors slashed positions built on expectations of higher margins (which were based on imminent interest rate hikes). Energy stocks bucked the overall downward trend in cyclical stocks, as higher commodity prices supported oil-and-gas related companies. Information Technology disappointed, despite notable Merger and Acquisition activity – Microsoft announced an all-cash deal to acquire the professional networking platform LinkedIn for USD 26 billion. The chemicals and pharmaceutical sectors saw further competitive consolidation from the big players: German BASF SE, the largest chemical producer worldwide, is set to purchase a division of speciality US chemicals firm Albemarle (This follows a move on Monsanto by compatriot Bayer AG during May). Activity continued in the consumer staples sphere: the AB InBev-SABMiller deal this month managed to clear most of the regulatory hurdles, receiving the nod (albeit conditional) from SA, EU and US regulators; and Mondelez International made a bid to gobble up iconic confectioner and rival Hershey for USD 23 billion.

US Sector Returns

Global Style returns

The Eurozone

European equities were sent on a rollercoaster by the UK’s decision to leave the Union. Stocks plummeted immediately after the outcome was announced. Despite rallying alongside US and UK peers, Eurozone markets, were unable to recover losses as effectively. The Stoxx All Europe subsequently closed -4.53% lower, in sharp contrast to the 4.72 % gain booked by the UK’s FTSE 100. The exact path of the intended orderly exit, including the timeframe (estimated to be at least two years) and the policy implications for the UK and the Zone remain unclear. The longer-run impact on Eurozone trade and growth will be highly path-dependent, but in the short run, elevated uncertainty is spooking investors. The political spill-over has certainly already made itself felt, with political concerns outweighing economic fundamentals in a number of peripheral markets’ performance: Italy and Spain were regional laggards, with drops of nearly 10% for the month partly reflecting heightened policy uncertainty. Tepid global growth, anxiety over immigration and the uneven distribution of Eurozone and global growth has seen anti-establishment sentiment take hold in a number of Western countries: The Trump campaign in the US has been capitalising on voter unease and fatigue with the status quo; The Anti-Austerity Syriza party remains in the ascendance in Greece; The Lega Nord and Podemos parties are prominent contenders in Italy and Spain; and France’s right-wing National Front and Germany’s AfD (Alternative for Germany) are gaining ground. Upcoming referenda on constitutional reform in Italy, and elections in the Netherlands, France and Germany have exacerbated political sensitivity and fears that other countries will follow Britain to the EU-exit. It is perhaps therefore unsurprising that EU ministers have taken an apparently hard line in statements and discussions around the process: Ranging from European Commission President Jean Claude Juncker clearly stating that the severance was “ not and amicable divorce”; various ministers agitating for the immediate negotiation of exit terms, despite something of a leadership vacuum at present in the UK; and an unreceptive response to Scotland’s overtures to negotiate remaining in the EU. The stance is intended both to forestall a rush to the exit, and to clearly signal the still-solid negotiating power of and commitment to the Bloc.

On the macroeconomic front, though the Zone is likely to suffer a short-to-medium-term setback, the growth story (slow and steady recovery) remains largely unchanged. Unemployment is at all-time lows, at 10.1% in May. Inflation data has improved: Early in June, the European Central Bank kicked off its purchases of investment grade corporate notes, an extension of the stimuli measures aimed at bolstering growth and spurring inflation in the region. The preliminary reading of Eurozone inflation showed an improvement during June, from -0.1% to 0.1%. Despite the referendum and its outcome, sentiment indicators were stable or positive for much of the region: Euro-area consumer confidence remained fairly stable; The German Business Confidence Index improved to an 8-month high (the measure reflecting that more executives in the manufacturing, construction, wholesale and retail industries are optimistic than pessimistic about economic prospects). Eurozone retail sales grew by 0.4% May, with the latest data reflecting the highest month-on-month jump for the year. European new car sales bounced back sharply in June, bolstered by strong sales growth in Germany, France, Italy and Spain and bringing the year to date growth to 8.2%. The propensity to spend on such big-ticket items reflects the general robustness of the European consumer. Incentives such as Spain’s cash-for-clunkers initiative have also boosted the pace of sales, as has fierce competition amongst dealers. Eurozone unemployment has remained at all-time lows, and PMI data points to an economy still in expansionary territory: the final Market Eurozone manufacturing PMI can in at 52.8 in June 2016, the highest reading this year. The services sub-index saw a mild slowdown, but remained in positive territory. The latest trade data, released mid-June, indicated that the Eurozone surplus grew to 31.5% year-on-year in April, driven by a larger drop in imports than exports. Intra-EU trade grew by 2% for the year, and represented Euro 260 billion at the time. This measure will be increasingly scrutinised as trading patterns, policies and relationships change whilst the UK exits the Union. The latest industrial data, however, shows that Eurozone output contracted by -1.2% in May, disappointing expectations and giving back some of the gains from the previous month. This likely reflects an uncertainty-penalty passed through in the run up to the referendum, with many firms deferring investment and spending decisions (including holding back on new hires and capital outlays, and preferring to draw-down existing inventories) and a number of sectors buffeted by currency volatility. Estimates indicate that the Eurozone economy slowed during the three-months to June, growing by only 0.4%, and slowing from 0.6% in the first quarter. The potential for further economic pain as the terms and mechanics of the exit are negotiation are negotiated, has seen both the European Central Bank and the Bank of England indicate their readiness to use the weapons in their policy arsenal to ease the transition and support growth. Reassured investors saw some return of their risk-appetite.

On a sector basis, traditionally more defensive stocks and safe haven assets nonetheless held investors’ attention: Utilities were the best performing sector, with a German utility company (RWE) proving to be the best performer in the FTSE World Europe ex-UK index. Oil-and-Gas also proved resilient, as the global nature and exposure of the many companies make them relatively immune against any Brexit-fallout. Industrials were laggardly, but Financials bore the brunt of June’s jitters. Those lenders which are viewed as peripheral or at-risk (in terms of exposure to non-performing loans) were particularly vulnerable. Banco Commercial Portugues and Greece’s Eurobank Ergasias were notable laggards.

UK markets

UK investors were seemingly as surprised as their global counterparts by the results of the referendum, despite preliminary polls indicating that “leave” was a distinct possibility. The shock initially triggered a sharp sterling depreciation, wild sector rotations and steep drops in share prices. The FTSE 100, however, weathered the fall-out far more gracefully than did developed peers, with the bourse rising by 4.53% for the month. The somewhat counterintuitive result is due to the fact that the index is made up largely of large-cap multinationals, with some dominance from oil-and-gas and goldmining companies. The bulk of earnings are therefore derived from overseas markets and are poised to benefit from sterling weakness. The index additionally benefited from the relative insulation of the Oil-and-Gas Sector, as well as the surge in safe-haven gold.

The political arena, however, has seen a far less graceful response: Prime Minister Cameron resigned immediately after the referendum leaving the leadership of the Conservative Party to be contested. Labour’s Jeremy Corbyn has clung on to his position, but the tally of Shadow Ministers and Party stalwarts who resigned or were fired made the vote of no-confidence and subsequent leadership contest a non-sequitur. Emotions are running high and the apparent leadership vacuum has failed to inspire confidence – the milder summaries from political analysts of the situation describe it as an “utter mess”. Irrespective of the political vacuum, any transition period is likely to be messy, costly and lengthy. This essential recognition has seen the Governor of the Reserve Bank, Mark Carney, take the lead in allaying domestic and international investors’ concerns. The Bank has signalled that it stands ready to implement easing measures as early as this summer to manage the “economic post traumatic stress disorder”. The first meeting, on the 14th of July, however, saw the Bank hold rates steady, citing a lack of evidence that the impact of the referendum merits a rate cut yet. Committee members have indicated that the size and nature of any measures will be determined during the August forecast, with most indicating that some easing is likely.

Welcome reassurances aside, it was not sufficient to stabilise the wild swings in the currency: sterling fell to a 31 year low against the dollar immediately following the vote, and has continued to bear the brunt of adjustments. Data from the Office of National Statistics show that the UK’s current account deficit is still at a record high of 6.9% of GDP, meaning that the currency will remain vulnerable. The perception that the run-up and immediate aftermath have been poorly managed politically and on the economic front (though actual impacts may be muted and transitory) saw Standard & Poor’s strip Britain of its triple AAA sovereign rating. Consumer confidence declined during June, and filtered through to domestic spending patterns: Retail information company Springboard reported that footfall (number of visitors to High Street stores) was significantly lower during the month, and month-on-month retail sales growth slowed during May. GfK compiled a consumer confidence in the run-up and immediate aftermath of the Referendum: immediately after the decision, the index dropped by the most in 21 years. Underlying macroeconomic data, despite some political posturing and highly charged emotions, has remained stable. Unemployment remained at a low of 5% for the third consecutive month (an 11-year low), and average weekly wage growth continued to tick up (rising 2% year-on-year by the latest data). The manufacturing Purchasing Managers Index showed an improvement during June, with both output growth and new orders accelerating. Despite a deterioration in the Confederation of British Industry’s Quarterly Business Optimism Index, looking through the data indicates that UK manufacturing firms are positive on prospects of higher output volumes and new orders in the coming quarter. The UK

On a sectoral basis, domestically focused stocks were the biggest losers, with financials and housebuilders experiencing the largest declines. The Markit/CIPS UK Construction PMI came in at 46 during June, signalling the first contraction since 2013, with Brexit uncertainty the biggest challenge in securing new work. Airlines and tourism-related companies also came under pressure: While EasyJet and International Consolidated Group will endeavour to secure access to the single aviation market, both companies nonetheless issued profit warnings. The telecommunications sector, despite traditionally defensive stocks being favoured elsewhere, were hurt by the warning from Vodafone that it may relocate its headquarters. The quarter was dominated by the month-end rally in the major overseas earners including healthcare and consumer goods, on prospective pound-depreciation driven earnings. The Oil-and-Gas sector reaped the additional benefit of stabilising energy prices and ongoing supply disruptions in the Niger Delta oil-producing region. Resurgent gold prices added to support for diversified miners Rio Tinto, Anglo America and BHP Billiton.

The UK saw a modest though healthy annual growth rate of 2% year-on-year for Q1 2016, driven by a higher than anticipated rise in household spending and exports. Business investment, however, was sharply lower than expected, as investment was generally deferred in the run-up to the referendum. It is acknowledged that short-run effects are likely to be painful, particularly in the environment of elevated uncertainty. It must also, however, be clear that knee-jerk negative reactions tend to overlook the potential upside: In the medium term, some businesses may elect to relocate, but such decisions are not made lightly. It is equally possible that there will be a resurgence in business’ essential fixed investment as whether they are in agreement with the decision or not, business owners prefer any outcome to none at all. Similarly, trading patterns and partners are likely to change, but negotiations will be plodding and existing relationships/agreements will remain in place for the foreseeable future. A number of export-oriented firms therefore stand to benefit from short-run currency weakness. Nor is it clear that renegotiations will eventually leave the UK in a worse position relative to main trading partners. The economy is likely to remain on a slow-and-steady growth path, despite the presently bumpy road.

Japan and China

In line with global peers, Japanese stocks reversed some knee-jerk losses at month end. The months’ earlier risk-on sentiment (following the announcement of the delay in the implementation of the consumption tax hike was short-lived) as global growth concerns were exacerbated by Brexit-induced volatility. Troubled sentiment was soothed by reassurances from Central Bankers that further easing was likely in the wake of the Brexit vote. The bourse nonetheless ended the month sharply lower in local currency terms, declining by nearly 10%, and it remains one of the poorest performing year to date amongst developed peers. Amidst a general air of risk aversion, the key sources of concern for Japanese market participants (investors, consumers and business leaders) remain: the efficacy (or lack thereof) of a host of stimuli measures implemented by the Abe administration and the ongoing strength of the local currency. Minister Shinzo Abe continues to do his best to appease markets, but the reality is that unorthodox stimuli have not yet yielded the necessary results. Japanese annual inflation remains in negative territory: Consumer prices dropped for the third straight month, declining by 0.4% year-on-year during May 2016. Monthly data was similarly tepid, with a slowing month-on-month uptick of 0.1%. June month-end saw the release of the Bank of Japan April policy meeting minutes, in which the Bank was already notably pessimistic about inflation levels and the risks to the Japanese economy. Similar concerns were likely the driving force behind the decision to hold off on further easing in June, somewhat flying in the face of market expectations. Sustained Yen-buoyancy is therefore on the cards, dragging on exports and anchoring inflation expectations (particularly on fuel and the import-component) lower for longer. The impact on exports is partly reflected in the latest trade data: The country reported a 40.72 billion Yen deficit in May 2016, missing market expectations for a surplus. The 11.3% decline in year-on-year sales is the fastest drop since January, reflecting falling numbers to all major export partners. The -14.9% drop in exports to China, the -10.7% to the US and -34.3% to South Africa, partly reflects relative strength in specific currency-pairs. Though Finance Minister Taro Aso has reiterated the stance against ‘abrupt’ or ’disorderly’ currency movements, June month-end saw a special meeting held by policymakers, with some hoping that the bank would step in and sell Yen in order to weaken the currency. The rhetoric on currency interventions will only heat up further, as investors rotate away from the Euro and Sterling.

Domestic economic data, any event, remained mixed: The latest data shows that industrial production declined by more than expected during May (2.3% month-on-month). Unemployment was steady at 3.2% for the third consecutive month, but wage growth was muted, with companies negotiating smaller wage hikes in the shunto spring-labour management season. Consumer spending nonetheless ticked up modestly and month-on-month retail spending showed some improvement (though still sluggish). Consumer confidence has also remained upbeat (climbing by an index point). The latest Tankan Quarterly Poll, shows that overall Business confidence is largely unchanged. It does, however, illustrate a marked divergence in sector-sentiment: While sentiment amongst manufacturers remained fairly solid, banking business leaders’ confidence hit their lowest in 3.5 years. Banking stocks were amongst the worst performing on a sector basis for the first half of 2016, with investors wary of the impact of monetary policy measures (both by the BoJ and the Fed) on earnings prospects and profit margins. Perhaps somewhat contrary to expectations, the ongoing strength of the yen has not depressed already-lower local manufacturing sentiment further. This is reflects the relative robust domestic consumer appetite – sectors such as health care and retailers continued to attract buyers. As elsewhere, defensive food, land-transportation and pharmaceuticals were resilient. The months’ earlier risk-on sentiment (following the announcement of the delay in the implementation of the consumption tax hike was short-lived) as global growth concerns were exacerbated by Brexit-induced volatility. Troubled sentiment was soothed by reassurances from Central Bankers that further easing was likely in the wake of the Brexit vote, prompting speculation on further BoJ easing, but the Bank’s track record of communicating and translating its intentions to the market has left room for investors to doubt the direction of future policy. The odds, however, are in favour of an official downward revision to inflation forecasts – to 0% for the 2016 fiscal year – at the July meeting.

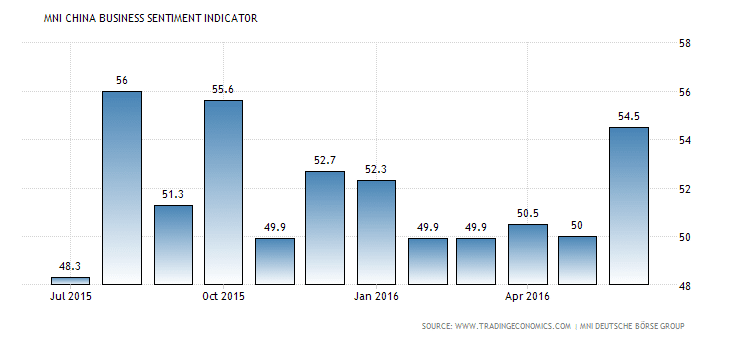

Chinese equities rose sharply in the last week of June as investors piled back into shares hard-hit by the Brexit-turmoil. The Shanghai composite managed to eke out a slight gain of 0.15% in local currency terms. The resurgence was partly fuelled by the expectation that Beijing would add to stimuli, potentially implementing additional measures aimed at stabilising European demand for Chinese exports, and cementing trade relations with both the UK and Eurozone. The latest G20 Summit, hosted by China, already sees Commerce Minister Gao Hucheng pushing for further reductions in trade costs, greater policy coordination and progress on a trade growth plan. On the economic front, the outlook remains largely unchanged for the world’s largest economy: Chinese Growth will be decidedly more pedestrian in the adjustment to the new normal, but will still outstrip developed market and the majority of emerging peers (it is estimated that GDP growth will moderate to 6.7% in Q2, from 6.8% in Q1). Economic releases for the month were mixed. PMI data signalled a continuance of the year-to-date trend, with both the official and private Manufacturing PMI data contracting during June, but the Service Sector PMI ticking up nicely to 53.7 from 53.1. Employment, inflation and industrial production numbers were largely stable between April and (the latest release) May. After a disappointing April release, trade data improved, driven by an upside surprise in import growth. Consumer confidence showed signs of ebbing further, the index moderating from 101 to 99.8, and the trend is reflected in the still-muted retail sales data (a drop of 0.1% in the year-on-year growth rate to 10% for May), and lower propensity to spend on big-ticket items such as new vehicles. Business confidence measures reflect the extent of uncertainty around the fall-out from the Brexit vote, and the impact of additional easing on future growth prospects. The MNI index is a poll of executives at a mix of listed manufacturing and service sector companies, conducted ahead of official data releases, aimed at present a snapshot of economic and business conditions (also covering perceptions and expectations). The marked uptick – to a 6-month high – may reflect that expansive policies are feeding through more prominently. Business’ capital outlay and fixed investment growth, however, remained sluggish.

Equity investors, already unsteadied by Brexit nerves, were further disappointed by the decision of leading index provider MSCI to omit local currency shares from its emerging market index. Market participants had widely anticipated that the inclusion of A shares would attract more foreign capital, particularly given the fact that the MSCI EM Index is widely tracked by money managers deploying more than USD 1.5 trillion. The index provider cited institutional investors’ lingering concern about the openness and transparency of Chinese markets. One of the concerns remains access to invested funds: There is still a 20% monthly repatriation limit, changes to the Qualified Foreign Institutional Investor program have not yet been implemented and new rules on the trading suspension mechanisms still require fine-tuning. The delay in inclusion has been perceived by some as something of a slight to Chinese authorities’ reform efforts, but is perhaps better viewed as a call for the Bank to step up its efforts. While the People’s Bank of China has been somewhat more transparent in its communications of late, investors are nonetheless wary. One particular area of concern remains the Bank’s exchange rate policy: The Yuan has been allowed to depreciate by over -2.9% over the quarter, with the bulk of losses coming in May and June. The Bank has reiterated that is does not want to see the offshore Yuan depreciating too quickly, and the country still has ample reserves to manage any devaluation. In the currently volatile market however, analysts are revising their projections for the Yuan for the year – estimates see a 5 to 7% drop against the USD for the year as the country seeks greater export competitiveness. Investors therefore remain wary of Yuan denominated assets, as previous devaluations (particularly where communication has been lacking) prompted large capital outflows. On a sector basis, financial stocks came under renewed pressure as elsewhere, while the somewhat weaker US dollar boosted Resources and Materials

Emerging Markets

Emerging markets were mainly higher during June, an outcome perhaps somewhat counterintuitive in a risk-off environment. Though developments in the UK and Eurozone initially saw investors shy away from risk, emerging markets proved to benefit from sector and asset class rotations. Given increased uncertainty in developed markets, investors’ behavioural bias leads them to bet on the higher yields (with no downside trade-off, as the magnitude of uncertainty is the same) available in selected emerging markets. Signals of further easing from the BoE and ECB, and the fading prospects of an imminent Fed hike alleviated some of the pressure from current accounts, further boosting risk appetite. The MSCI EM closed 4% higher, significantly outperforming the MSCI World (at -1.12%). Latin American markets marched upward, led by gains in Brazil (6.30%), while emerging Europe and African markets lagged peers. The Brazilian market has seen a strong turnaround since President Rousseff left office, driven largely by external developments (stronger commodities and favourable sentiment). Slightly more upbeat domestic economic data has also been evident: Though unemployment remains high (11.2%), it has apparently stabilised below market expectations; Persistently high inflation has moderated somewhat (registering 7.7% in June, versus 8.23% in May); Pressure on the current account has eased, with a stronger Real facilitating a second monthly surplus; Indicators for business confidence improved, and the Markit Manufacturing PMI ticked up to 43.2. Despite the headwinds from populist activism, scepticism as to the country’s readiness, and infrastructure bottlenecks (including in terms of essential support services, such as laboratory testing facilities), the Rio Olympics does hold positive prospects for domestic businesses. The hosting of the 2014 Football World Cup netted the country more than half a million new arrivals (the full year saw 10.6% more arrivals). A similar boost is expected from the Summer Olympics, and Tourism spending has already increased significantly in the first five months of the year (up by 10.24% year-on-year during May 2016). Peruvian and Colombian markets did well, while Mexico lagged. Mexican economic data was mixed: Consumer confidence ticked up, but manufacturing slowed (the PMI decreasing from 53.6 to 51.1, but still in expansionary territory). Inflation moderated somewhat, and the Central Bank implemented a 50bps interest rate hike, allowing for some alleviation of the pressure on the local currency.

Emerging Asia saw pockets of strength: The Philippines and Indonesia were notable outperformers (at 5.3% and 5.9%), and Indian equities managed to build on prior month gains. Political goodwill and progress toward reform played a notable role in these rallies: The newly inaugurated Duterte administration in the Philippines is seen as pro-market, while Indonesia’s passing of an amnesty law targeting undisclosed income is likely to broaden government’s tax-blanket and tighten the budget deficit. Korea and Taiwan followed the Indonesian Central Bank in cutting interest rates, and closed modestly higher. On the political front, India’s Cabinet also appears to be moving toward swifter decision-making (with reform-fatigue a source of concern for international investors and domestic business interests). After the approval of the Bankruptcy bill in May, June also saw recommendations for increases in government wages relatively quickly approved. The Reserve Bank of India left interest rates unchanged, though inflationary pressure has eased with the onset of the monsoon. Taiwanese equities were under pressure from weakness in technology stocks. Performance in emerging Europe was uneven, driven to some extent by relative exposures to the UK as a trading partner. Greece proved to be the regional laggard, with the spotlight firmly back on the challenges facing Greek lenders as international creditors call for better handling of bad loans. Turkey and Russia have significantly less exposure to EU trade, though it is to be noted that this is more an outcome of political processes than country preferences, and were therefore relatively insulated against the fall-out. Russian equities were boosted by a recovery in the rouble against the USD, and the stabilisation in oil prices, while domestic economic data also showed some improvement. Unemployment edged down to 5.6%, industrial production rose by 0.7% year-on-year, and Manufacturing and Services Purchasing Managers’ Indices rose, with both ending in expansionary territory. The Central bank made us of the opportunity to cut interest rates by 50bps, somewhat boosting consumer confidence. The Russian economy is largely insulated against the direct fall-out of any EU-exits – due to sanctions, trade-related impacts are extremely limited. The UK’s exit, however, does present an interesting political opportunity in terms of a Russia’s ability to reposition itself. The exit may weaken the cohesion of the bloc’s leaders, and provide an opening for renegotiation. It may also, however, present the EU with a tool – the promise of re-entry – to induce ‘better behaviour’. Renewed aggression in the Ukraine, and ongoing Middle-Eastern tension, saw long-running bank sanctions against Moscow and retaliatory Russian sanctions extended for a further year, potentially costing billions in lost revenue. The frosty relationship, moreover, has led to net foreign investment flows between Russia and Europe reaching a two-decade low – net flows went from about USD 80 billion in 2013 to almost nil in 2015. Any measures aimed at thawing relationships is likely to have positive spill-overs, which will extend to immediate neighbours and other Baltic states such as Poland.

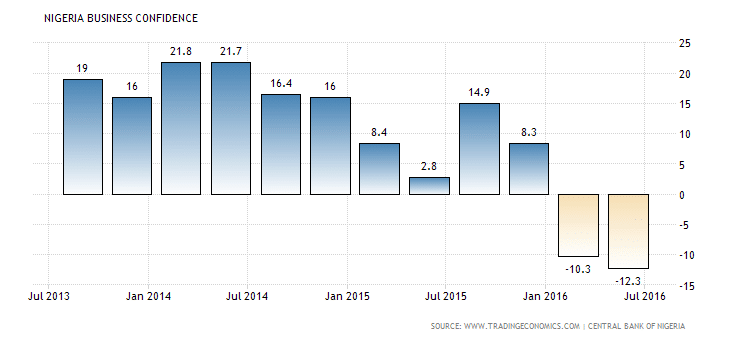

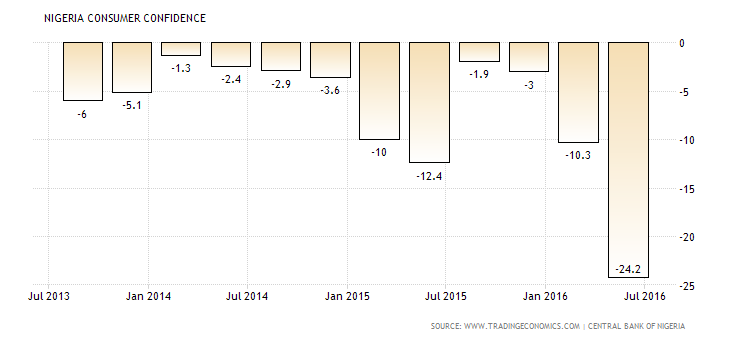

African markets closed lower, and lagged emerging peers. Patchy returns were exacerbated by local currency weakness – the Nigerian market was the clear laggard in USD terms, as the Naira devaluation saw the bourse close 24.6% lower in USD terms. This is in line with market expectations, given that analysts had been expecting a 30% step-impact as the currency was allowed to adjust. The abandoning of the peg, a departure from President Buhari’s dogmatic defence of the local unit, has been greeted as a positive development by international investors and local business people. Short-run volatility, combined with Brexit jitters, saw limited initial gains. Macro economic data was mixed, with domestic inflation hitting its highest levels in 10 years during May 2016 and surging by 15.6% year-on-year. This partly reflects the pass-through from a 67% spike in gas prices, following the attacks on Chevron oil in the Niger Delta and consequent supply disruptions. Financials and insurance were notable underperformers, before renewed interest sparked a modest month-end recovery in the banking sector. Guarantee Bank and Zenith Bank, regarded by many market watchers as bellwether stocks (alongside the Dangote Group), closed notably higher (4.2% and 2.2% respectively). Though the latter signals positive investor sentiment, ratings agencies and local businesses are still cautious on growth prospects. Consumer confidence and spending remains similarly. The Business Expectations and Consumer Expectations Surveys, both reported by the Nigerian Central Bank, declined to 3-year lows during the second quarter. Fitch has downgraded the country’s sovereign credit rating by one notch (to B+ with a stable outlook), and predicts that GDP growth will decline by 1.5% over the course of 2016, in a continuation of first quarter weakness.

East African markets were mixed, with the Kenyan bourse lagging, despite some positive news on the inflation front: The National Bureau of Statistics in Kenya (following May’s surprise rate cut by the Central Bank) released consumer price figures which mark the first upward move in 2016, following months of disinflation. The Egyptian bourse closed lower, with declines exacerbated by local currency weakness, and poor growth prospects. African markets were relatively insulated, but Brexit negotiations in will be watched closely for spill-overs into key markets (notably commodities). Simultaneously, policymakers will be keeping a keen eye on trade-related developments due to the UK’s exit. Easing current account pressures (with the Fed unlikely to implement rate hikes in the near-term), may spur more active pursuit of opportunities in this space.

South Africa

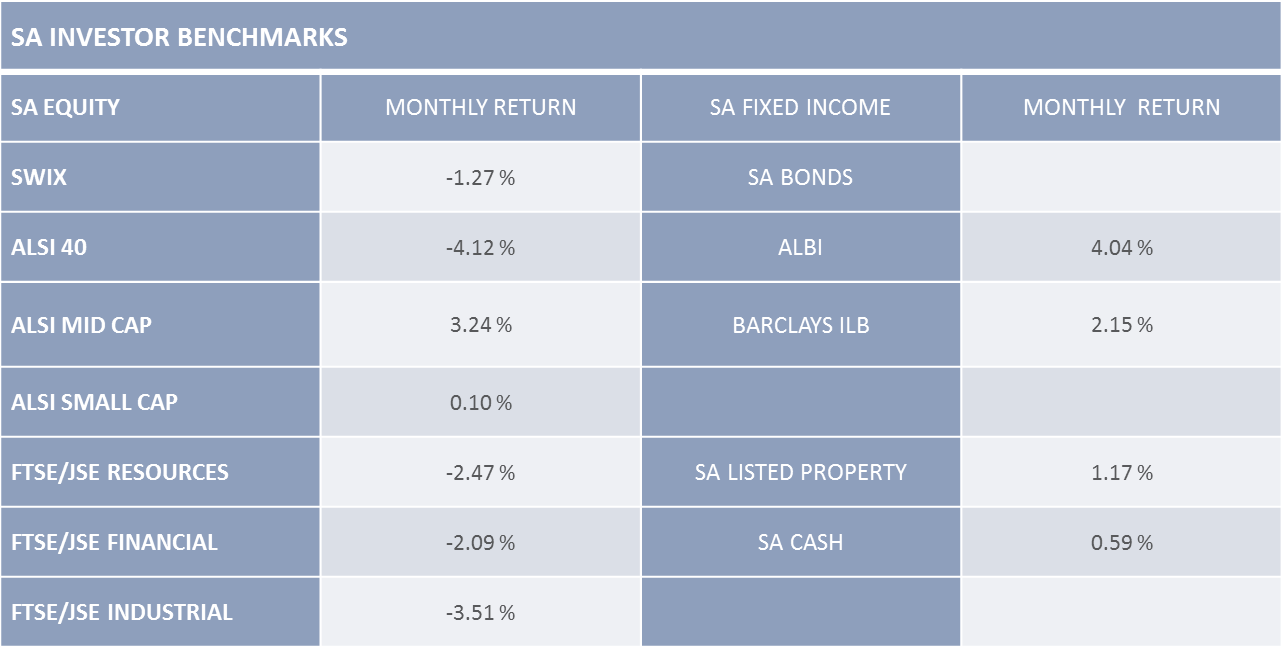

South African markets were mixed during June: referendum-related risk-off sentiment saw investors rotate toward fixed income assets for much of the month. Equities ended the month lower, with the Top 40, comprised of a number of companies with significant exposure to British and European markets eg SABMiller, Mondi, Investec), registering a 4% decline. South African bonds, in direct contrast, attracted keen interest from local and global investors and the ALBI ended 4% higher. Bond markets received inflows for the month of about R16.4 billion, bringing the year to date figure to R40.5 billion. Equity markets, in contrast, had seen a year-to-date inflow of R19.8 billion. On a sectoral basis, SA Financials were particularly hard-hit, as elsewhere, by the decision. The significant UK-exposure of Old Mutual and Investec were notable detractors, with Investec declining -17%. Gold and platinum shares were supported by the surge in safe-haven buying, with the JSE Gold and Platinum Sectors gaining 19.05% and 2.06% respectively for the month. A number of mining companies have had a stellar year: Harmony Gold is up by 236.35% for the year to date, Assore by 189.87%, Kumba Iron Ore by 169.42%, and Sibanye by 119.34%, to name a few.

A recent report from Moody’s suggests that South Africa remains one of the more vulnerable amongst emerging peers to the knock-on effects from UK-EU wrangles. The local market is significantly more integrated with global markets, particularly in comparison to other Sub-Saharan African countries. The problematic current account deficit, and the extent of foreign ownership of domestic shares, leave it more vulnerable to short-term capital outflows. Traditionally close ties mean that dampened UK-growth prospects would have a negative impact on SA’s trade and growth outlook. The impact, however, is likely to be muted: Despite being the largest recipient of British Foreign Direct Investment in Africa, flows had already eased significantly by 2015 (reaching 10-year lows); And while both the EU and the UK remain important trading partners, shares of exports have been declining steadily since 2013.

Market jitters aside, macroeconomic data was more upbeat during June. Inflation eased somewhat, reaching 6.1% and below market expectations. June saw a surprising improvement in manufacturing activity, with the Barclays PMI coming in at 53.7, for a fourth consecutive month of expansion. The South African Chamber of Commerce and Industry reported that business confidence rose to 95.1 (from 91.8 in May), based on improved trends in inflation, a more favourable exchange rate and higher export volumes. The Trade account registered a surplus of R18.7 billion in May 2016, underpinned by export growth of 10.2% year-on-year. Commodity export revenues surged, as improved commodity prices combined with significant jumps in the numbers for exports of commodity-based products: Precious metals rose by 49% month-on-month, while mineral product and base metals rose more modestly (10% and 6% month-on-month respectively). Gold with its status as safe haven asset, moreover, is unlikely to see its lustre wane amidst still-elevated levels of uncertainty. Despite a still-subdued consumer outlook, retail sales improved by 3.4% on a month-on-month basis during May. Vehicle sales, however, having slowed by 10.3% year-on-year during May, continued to trend weaker (10.6% lower compared to June 2015). NAAMSA (National Association of Automobile Manufacturers of South Africa) expects that the underlying trend in new car sales, and commercial vehicles will remain subdued, partly reflecting above-inflation new car price increases and lower levels of finance approvals. Fewer approvals are in line with the underlying trend in credit extension: household credit growth was subdued, at 2.4% year on year for May, and corporate sector credit extension slowed to 10.6% year-on-year from 11.6% in April. Strained domestic economic conditions and depressed business sentiment have weighed on corporate fixed asset investment. In addition, UK corporate parents, are unlikely to provide any near-term boosts. On the political front, in-fighting appears to have taken a backseat as campaigning for the municipal elections heat up. Finance Minister Gordhan has therefore been better able to focus on reassuring and attracting international investors. The Minister’s recent visit to the UK capital made it fairly clear that the policy emphasis will be on positioning the country as a “good place to be in” and a post-Brexit winner.

Commodities, Fixed Income and Currencies

Safe haven assets were a clear winner in a risk-off global environment. On the commodity front, precious metals lead the pack. Silver rose by 17.1% for the month, and gold, platinum and copper all benefited from safe haven buying. Anecdotally: Google reported a 500% spike in the number of internet searches using the phrase “buy gold” when the results started to trickle in from around 5 am. With Chinese data showing modest improvements, industrial metals gained 5.7%. Somewhat bucking the recent trend, the energy sector was less volatile during June: Brent Crude oil prices ended -1.13% lower, reflecting perhaps that markets were adjusting to supply disruptions (ongoing in the Niger Delta) in a more measured manner.

The fixed income space was dominated by the UK referendum: Core Government bonds and high quality corporates saw strong returns throughout the course of the month. As investors piled into safe havens, yields declined (bond prices and yields move in opposing directions): UK Gilts yields ended at 0.87%, seeing the most pronounced drop; US T-bills were less volatile, ending at 1.47%; The 10-year German Bund yield strayed into negative territory, at -0.13%. Peripheral European sovereigns continued to benefit from the ECB’s accommodative stance, while European investment grade corporates were boosted by the expansion of the programme. The first week of the programme saw Euro 1.9 billion worth of corporate bonds purchased, exceeding market expectations. Riskier high yield bonds were more muted, though some return of risk appetite saw a month-end rally. Emerging market bonds, given the potential for higher yields, were regarded as relatively attractive against a backdrop of developed market uncertainty. Stronger commodity prices, stabilising domestic currencies and diminishing prospects of Federal Reserve hikes has seen current account positions: the JPMorgan Emerging Market Bond Index for Government bonds registered a total return of 5.89% for the month. In comparison, the Bank of America Merrill Lynch European Union Government Bond Index posted only 1.03%.

The US Dollar Index (representing the trade-weighted aggregate for a basket of currencies) gained 0.3% in June. Sterling saw the wildest swings during the month: The currency dropped to a 31-year low after the decision. The collapse is the biggest one-day plunge amongst the world four major currencies since the demise of Bretton Woods’ Gold Standard. While the Bank of England promptly stepped in to reassure investors, and the currency pared losses toward month-end, sterling remains on the backfoot. Emerging currencies were stronger against the dollar, with the biggest gains in the Real, the Rand and the Rouble, mainly on stabilising commodities. Japanese policymakers had enjoyed brief breathing space during May (as the Yen depreciated), but the Yen rallied aggressively on renewed appetite for relatively insulated currencies. With a nearly 17% year to date appreciation, the currency-intervention debate is back on the table, and competitive devaluations are likely to remain a source of tension between international monetary authorities in the coming months.

Conclusion

June indeed proved to be a rollercoaster ride for international investors, as markets struggled to adjust to the shock of the UK’s decision to leave the European Union. July is likely to be somewhat less volatile, as initial knee-jerk reactions make way for more measured policy responses, and as investors take on board the protracted nature of negotiations. Political in-fighting and a lack of cohesive leadership may hamstring the UK’s response. Elevated uncertainty make tighter monetary policy an unlikely near-term prospect. Rapidly changing investor sentiment, and potential rebalancing of negotiating power, expose both vulnerabilities and opportunities, particularly in emerging markets and selected asset classes.