Market Commentary: March 2017

Market View

Cash

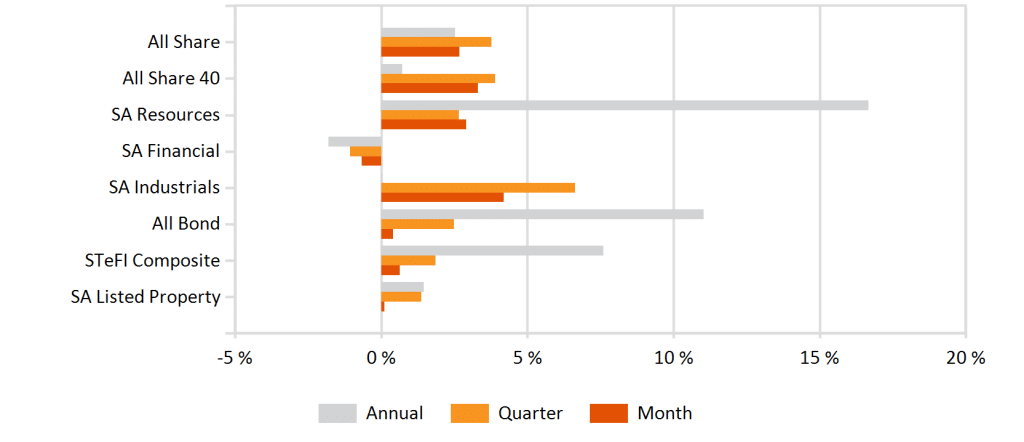

Domestic inflationary pressure continued to ease during February. Producer Price Index (PPI) inflation — a leading indicator with a greater weighting to food prices — eased at a faster rate than Consumer Price Index (CPI) inflation, stripping out food price inflation. This saw the Producer rate decline to 4.2%. Analysts speculated that the South African Reserve Bank’s (SARB) interest rate cycle had peaked as a result of a global shift in monetary policy, coupled with the easing drought, a stable rand and prospects for a 50 cent fuel price cut in April. Consumers may have been hoping for a respite, but proved to be disappointed. The SARB, at its meeting on 30 March, kept the benchmark repo rate unchanged at 7%. The decision, while anticipated, was not unanimous: One of the six Monetary Policy Committee (MPC) members advocated a 25 bps rate cut which would be the first in five years. The lingering political uncertainty, and concerns about a ratings downgrade from international agencies likely stayed the Bank’s hand. The fallout from the Cabinet reshuffle, particularly from a volatile and weaker currency, is likely to keep inflation uncomfortably near the upper range and has pushed the Bank into more hawkish territory. Cash (STeFI Returns) earned 0.63% in January, outstripping fixed asset peers.

Bonds

South African Fixed Income assets slumped noticeably at month-end, as domestic political uncertainty caused a sharp reversal in previous largely positive investor sentiment. Overall, inflows into Emerging Market (EM) Bonds surged during March, as the US Federal Reserve reassured investors as to the path of US rate increases. Somewhat perversely, investors initially continued to pile into the liquid domestic market even after the removal of Finance Minister Pravin Gordhan — the week ending 31 March saw foreigners buying a net R11.2 billion in South African bonds (mainly in the R186), and bond yields climbed to 8.9% late in the month (prices and yields move inversely). Prior to the reshuffle, SA 10-year government bonds had rallied about 47 bps. The ALBI narrowly managed to hold on to gains, closing the month at 0.4% despite dropping 2% on the last day of trading. The Barclays ILB index closed 2% lower. Evidence of modest growth and progress toward inflation targets continued to build in major developed markets and policymakers responded accordingly.

Early in the month, the European Central Bank indicated that additional stimuli were unlikely, and kept its bond-buying programme unchanged. The Federal Reserve, in turn raised short-term rates as expected and indicated that two more hikes were on the cards. The US Treasury yield curve saw a back-up of rates at the short-end and flattened during March. Largely unchanged from February, 10-year Treasuries closed the month at 2.39%. European government bonds rallied during the last week of March, with the yield on 10-year German Bunds dipping to around 0.33% and the French equivalent declining to 0.94%. UK government bonds rallied at month-end, after Prime Minister Theresa May delivered on her promise to invoke the Article 50 clause on 29 March. The yield on 10-year gilts decreased to 1.12%, a one-month low. Investment grade and high yield credit spreads widened in March, with high yield activity ticking up after a sluggish start. EM Bond indices outstripped developed and South African counterparts, providing returns of nearly 2% for the month.

Property

SA listed property was lacklustre during March, as the interest rate sensitive sector was hit hard by political uncertainty. The index eked out an 11 bps return for the month, at least some improvement on the prior month. The weak domestic economy has continued to put pressure on local businesses, with knock-on effects for their property decisions including the renegotiation of leases, expansions and acquisitions. While leasing escalations still typically outstrip inflation at between seven and 10%, listed companies report that renegotiations are increasingly sticky. The demand for CBD office space, particularly in Gauteng, continues to soften. Further downgrades remain on the cards and an interest rate reprieve is increasingly unlikely, retailers are under pressure as indebted consumers battle. A number of listed companies are turning to offshore diversification: In 2008, 5% of SA listed property companies’ earnings were derived from offshore, today it is at 40%. This introduces a new range of risks, and sources of volatility, making a prudent and measured approach essential. In the short-term, some listed counters have been rewarded for their offshore (ad)ventures, but sustainable and predictable income growth is an essential part of what has traditionally been attractive to pension fund investors in listed property. The need to derive a suitable stable return from property might be better matched by opportunities in the unlisted sector.

Equity

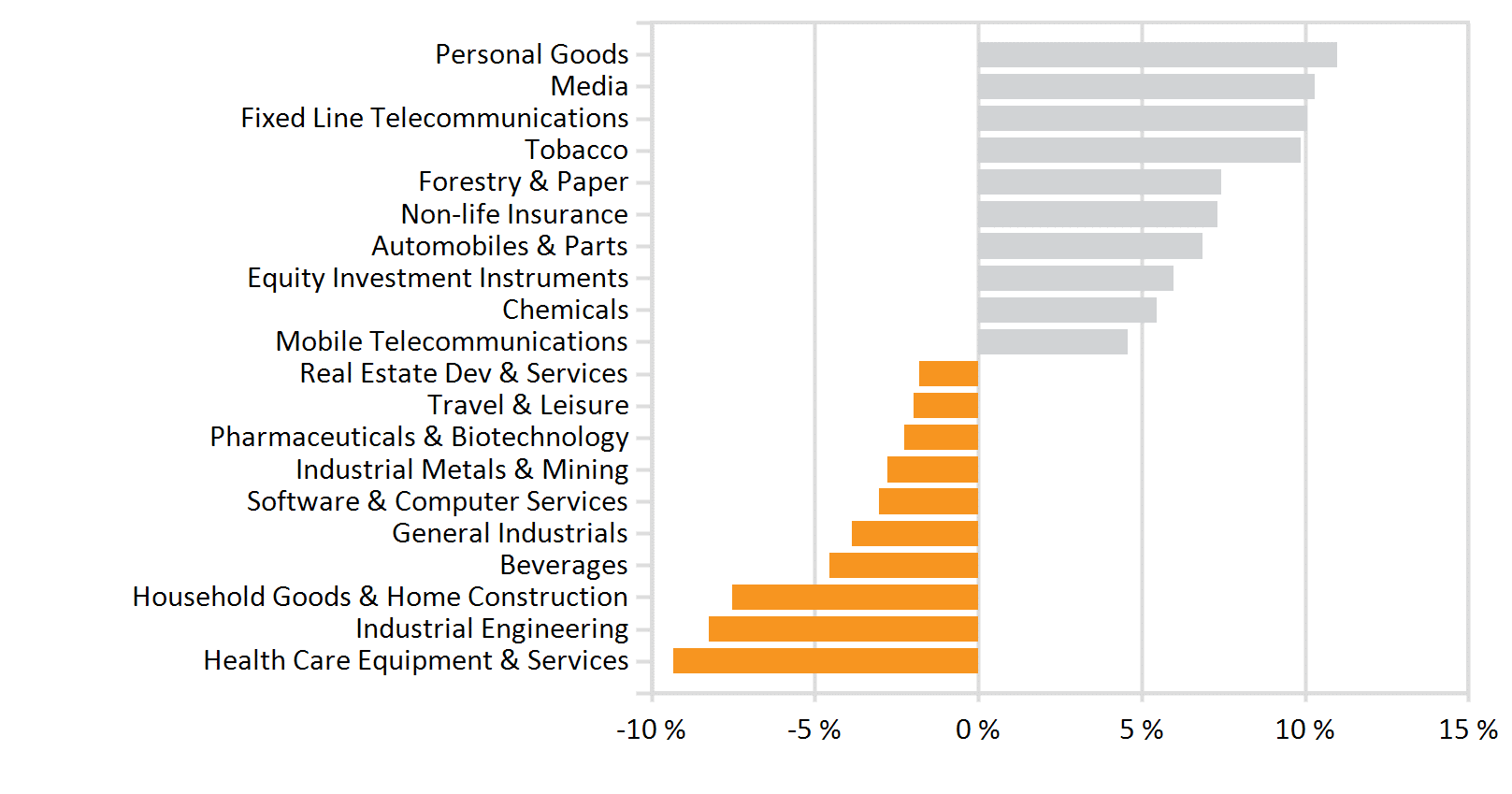

Despite month-end political upheaval, South African equities closed the month in the green. The All Share gained 2.68%, slightly edging out EM peers (The MSCI EM gained 2.5%) and easily outstripping the MSCI World (+1.22%). South African financials were amongst the worst performing sector: The Monetary Policy Committee’s (MPC) anticipated rates decision (unchanged) initially steadied expectations about future profit margins, but the shake-up at the Finance Ministry quickly dampened investor sentiment. The last day of trading saw the Big Four’s shares plummet by more than 5%, and the Banking Index closed the month 3.25% lower. Even in the week preceding the announcement, heightened political risk and ratings-downgrade fears saw investors shy away from interest-rate and Rand-sensitive stocks, and act to limit their exposure to SA Inc. FirstRand was one of the biggest losers, down by more than 7%, over the course of the week. In line with developments elsewhere, as a stalemate on the US Healthcare Bill spilled over sectors and borders, healthcare stocks were jittery (the index lost 6.19%).

General retailers remain encumbered by a weak domestic consumer, with limited prospect for debt-relief as the MPC kept rates unchanged. Resources, where companies’ margins are often linked directly to Rand-rebased commodity prices, managed a nearly 3% gain. Selected gold miners proved to be a magnet for risk-averse investors, even as gold prices weakened — the share prices of Gold Fields and Sibanye gained 16% and 9% respectively, pulling the Gold Index 4.93% higher. Platinum and Copper Prices remained weak, translating into a poor performance from diversified miners, BHP Billiton and a dismal -23% for Lonmin, for the month. Simultaneously, the lack of confidence saw investors pile into Rand hedges, boosting the Industrial sector and the overall bourse. The top three stocks on the JSE (BAT, Naspers and Richemont make-up more than 40% of the index’s market cap) were much sought-after for their defensive properties (Rand-hedging and dividend paying). Gains of 7.32%, 10.36% and 10.98% respectively, cushioned a potential equity route. These uncertain times require a diversified equity exposure, with due awareness of concentration risk and offshore exposure and the agility to adjust timeously and appropriately.

International Markets

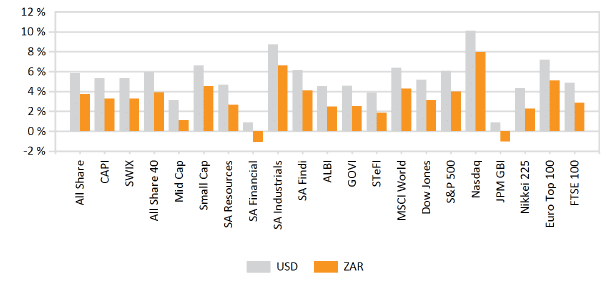

Developed markets were not spared a volatile end to the first quarter, but closed mainly higher: The MSCI World gained 1.07% and Emerging Markets (EM) outstripped Developed counterparts (MSCI EM +2.52%). African markets were laggard, ending nearly flat (MSCI EFM Africa ex SA -0.09%). In the US, the stalemate on the healthcare policy cast doubt on newly-elected President Donald Trump’s ability to deliver on policy reforms, particularly regarding taxes. Simultaneously, the Trump administration has continued to take aim at developing powerhouses Russia and China. Diplomatic ties have deteriorated amidst allegations of election-meddling against the former. Trump’s administration has also made clear its intent to rebalance the scales in favour of the US in trade relations, and Chinese companies have been the target of decidedly non-veiled threats. The timing (March month-end) of the recent proposals to amend US trade acts is perhaps particularly bizarre, with presidents Trump and Xi Jinping set to meet for the first time early in April. Thus far, Chinese authorities have largely shrugged off aggressive manoeuvers, but the US may need to tread carefully around the sleeping dragon.

A January 2017 study by Oxford Economics estimated that US exports of goods and services to China, plus bilateral FDI flows, supported 2.6 billion US jobs (directly and indirectly) and contributed 216 billion to US GDP. A significant deterioration in diplomatic and trade relations, may have a more substantial impact than many average Americans envisage. On the monetary policy front, the US Federal Reserve raised interest rates as expected, but hinted at three further interest rate hikes (rather than two) on improved growth data. Recent reports suggest an upward revision to 2016Q4 growth rates, unemployment continued to tick lower (4.7%) and February saw the addition of a better-than-expected 235 000 non-farming jobs. The S&P 500 managed a modest 0.12% gain, the tech-heavy Nasdaq recouped most of its losses and energy stocks were boosted by an oil price recovery.

Asian stock markets were mixed at month-end. In China, the CSI 300 closed only 0.12% higher, after the Shanghai index posted its biggest weekly loss since mid-December. Concerns over tighter liquidity and measures to curb perceived asset class bubbles, rather than US policy relations, took centre stage: The Chinese Central Bank withheld cash injections, skipping open market operations for six consecutive sessions; and more than a dozen cities have implemented a variety of measures to deter property investors, and dampen the property boom. Over the strait, Hong Kong’s bourse declined at month-end, weighed down by heavyweight Tencent and a lack of Chinese flows (due to a holiday). Despite some scepticism as to official sources, Chinese data nonetheless appears to be supportive of a stable-though-not-stellar growth trajectory: Manufacturing sector activity expanded for the first time in five years, new orders improved and the official Purchasing Managers’ Index (PMI) rose to 51.8 in March.

The Japanese Nikkei closed 0.8% lower, weighed down by disappointing economic data. February retail sales figures were lacklustre, as consumers held back on spending on durable goods (sales declined by 2.2% year-on-year). Spring wage increases, traditionally a boost to retailers, have come in at a four-year low so prospects are muted. The Yen’s recent strength (rising 1.2% against the dollar for March) has added to exporters woes and business confidence is decidedly downbeat.

The UK bourse ended the month on an upbeat note, with the FTSE posting a 1.12% gain. Oil-and-gas heavyweights boosted the index: Shares benefited from a month-end jump in oil prices, as Kuwait supported further OPEC production cuts and US crude reserves came in lower-than-expected. While the capital was shaken by a terror attack, the clearly communicated triggering of Article 50 caused relatively muted tremors in the financial hub. UK growth has been lacklustre. Firms have had their confidence dented of late, while inflation has picked up sharply and the pound has taken a beating, putting consumers and real wages under pressure. Negotiations are not likely to be smooth, but the European Union’s tone has become more conciliatory. However, hashing out the details of the exit niggling public dissatisfaction with Scotland calling for a second referendum on independence, may initially hamper policymakers. Hashing out the details of the exit process can only reduce uncertainty, and potentially reenergise capex.

European markets were mainly higher, on improved growth prospects and resurgent business confidence. As in the UK, higher metal and energy prices boosted European resource counters. The STOXX All Europe closed a solid 3.26% higher. Gains were most pronounced in Spain, Italy and France (10.4%, 8.6% and 5.6%, respectively). Concerns around the destabilising impact of populist politics have ebbed somewhat, as recent outcomes have mainly rejected the populist candidates (Dutch and Austrian elections). Odds are stacked against a surprise win for Marine Le Pen in France, though investors remained slightly wary.

The broader universe of Emerging Markets outperformed their developed peers, with some notable exceptions. The MSCI BRIC returned 1.69% for the month, lagging the MSCI EM (2.52%). Heavyweight Brazil dragged on the bloc’s performance, closing 2.5% lower on a disappointing macroeconomic outlook, as its government cut its expected growth by half (to 0.5%). The beleaguered Mexican market took top spot amongst emerging peers, regaining ground as a number of President Trump’s policies (including a cross-border tax) met stiff opposition. Turkish markets stabilised, despite ongoing Middle-Eastern tension — Egyptian markets were the EMEA regional laggards — and diplomatic tension with the Netherlands. Russian prospects have improved noticeably, as the economy returned to growth in Q42016, and the Rouble hit a 20-month high against the USD in March. Geopolitical tension, however, remains elevated. A diversified mix of developed and emerging market exposure will show due cognisance of hidden country-risks and unintended global spill-overs.

Currency

The US Dollar Index pulled back during March, losing 0.8% against a basket of currencies. The Yen strengthened by 1.2% over the course of the month. It has, however, remained a laggard for the year, depreciating roughly 5.3% in a boon to export firms. Sterling saw some recovery, gaining 1.4% against the USD, with market participants perhaps welcoming the formal triggering of the Brexit process at month-end. EM currencies were mostly firmer during March: As President Donald Trump shifted his attention east, the Mexican Peso gained substantial ground (+7.4%). The Rouble held onto 3.8% gains, supported by improving economic prospects and energy prices, despite a fraught geopolitical environment. The Brazilian Real and Chinese Yuan saw modest pressure, losing 0.3%. African currencies were mixed: The Naira has seen six weeks of active intervention (forex being made available for retail transactions from 20 February). The so-called parallel market premium is therefore narrowing (parallel rate at NGN/USD 380 at month-end) and market-watchers see this as a precursor to a devaluation. The South African Rand was volatile, echoing the country’s political unease. After a welcome period of stabilisation and appreciation, the currency ended the month more than 2.5% lower against the USD. Cabinet reshuffle blues saw the unit tumble by more than 7% during the last week of the month. Market reactions were, in fact, more restrained than had been expected, but the April ratings downgrade has done little to steady investor nerves.