Market Commentary: April 2017

Market View

Cash

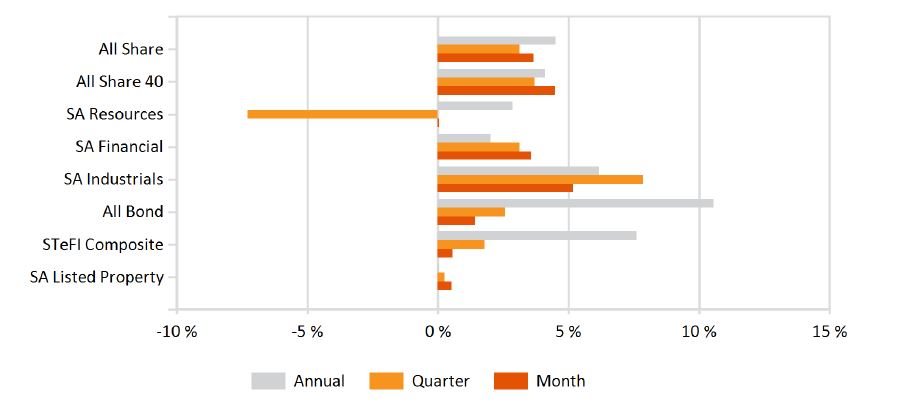

The latest inflation data indicates a continued downtrend in local price-increases as March CPI eased to a six-month low of 6.1%. The South African Reserve Bank anticipates that price growth will slow to 5.9% for 2017 and 5.5% in 2018, but remains cautious. Growth in the transport component still outstrips overall inflation (7.7% year-on-year) and motorists may expect more pain at the pumps in the wake of Rand-volatility. Analysts anticipate a 55c fuel-price hike in May. Shorter-term interest rate prospects reprieve were dealt an overall blow by the fall-out from ratings downgrades. An unpredictable currency-pass-through has also pushed risks to the upside. Cash (STeFI Returns) earned 0.57% in April.

Bonds

Despite slightly outperforming global peers, South African Fixed Income lagged local equities. The Barclays ILB index closed 1.15% higher, partly on moderating inflation expectations, while the ALBI gained 1.42%. After rating agencies Fitch and Standard & Poor’s downgraded South Africa to sub-investment grade (junk) status, the full impact will take time to filter through. However, ongoing rating agency concerns continue to weigh on longer run growth prospects. This was exacerbated by a still turbulent domestic political environment with the rifts in the Tripartite Alliance highlighted at month-end celebrations, as May Day rallies were cancelled. Nonetheless, the current account outlook has improved. The commodity-recovery has created a more favourable terms of trade and perceptions of external vulnerability have therefore eased. Relative Rand resilience – with movements nowhere near as pronounced as in previous political episodes – has also supported fixed income markets. Developed market bond yields have continued to taper off.

In the US some of the initial Trump-bump reversed on policy-disappointment. In the UK, the overt confidence of the Conservative Party eased Brexit-uncertainty. Elsewhere in the Eurozone, populist-politic-fears somewhat dissipated with the victory of a French centrist presidential candidate. US 10-year bonds closed 10 bps lower, at 2.29%, with 10-year German bonds little changed at 0.32%. Meanwhile, South African bonds continued to attract foreign flows, in line with its emerging peers, as global investors search for yield. The potential destabilising impact of a double-notch downgrade (Moody’s due to visit SA shortly) cannot therefore be underestimated. Investment grade and high-yield credit spreads widened in April and Emerging Market (EM) bonds continued to find favour.

Property

The challenging local economic, political and operating environment has continued to weigh on SA-listed property. The asset class returned only 0.51% for the month. The importance of asset selection was once again highlighted, with some listed counters managing a solid performance. Rebosis, after internalising its management team and refining its focus to retail malls, reported sound half-year results (year-ending Feb). This included a 74.6% jump in property income growth and a 7.07% dividend growth year-on-year. Regional disparities were evident in the recent FNB Major Metros House Price Index, while average house price growth (year-on-year for the 1st quarter) was well below inflation in most provinces (KZN at 1.1%, Gauteng at 0.7%, and the Eastern Cape at -1%). However, the Western Cape saw an increase of 6.2%. A number of companies such as Growthpoint and Redefine have increased their offshore footprint, but portfolio managers have perhaps found it more rewarding and clear-cut to include 100% offshore-focussed (MAS, Intu, Echo Polska, NEPI) listings. The strategy has paid off thus far, despite an uncertain currency environment. However, the need to better monitor and manage effective offshore exposure may mean that opportunities in the unlisted sector are an increasingly better fit for institutional investors.

Equity

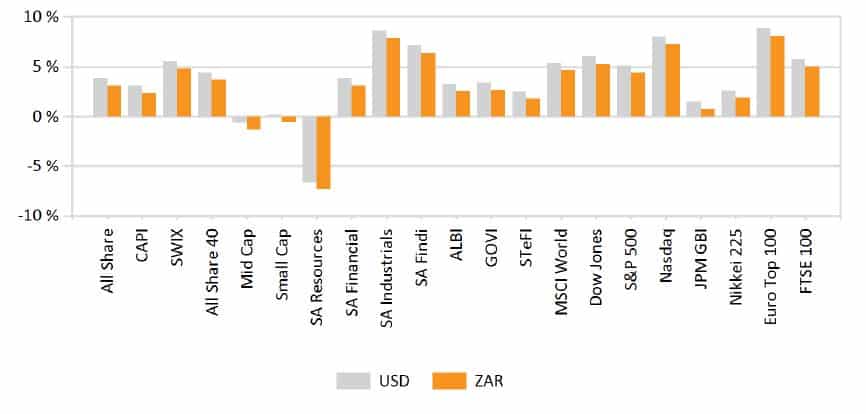

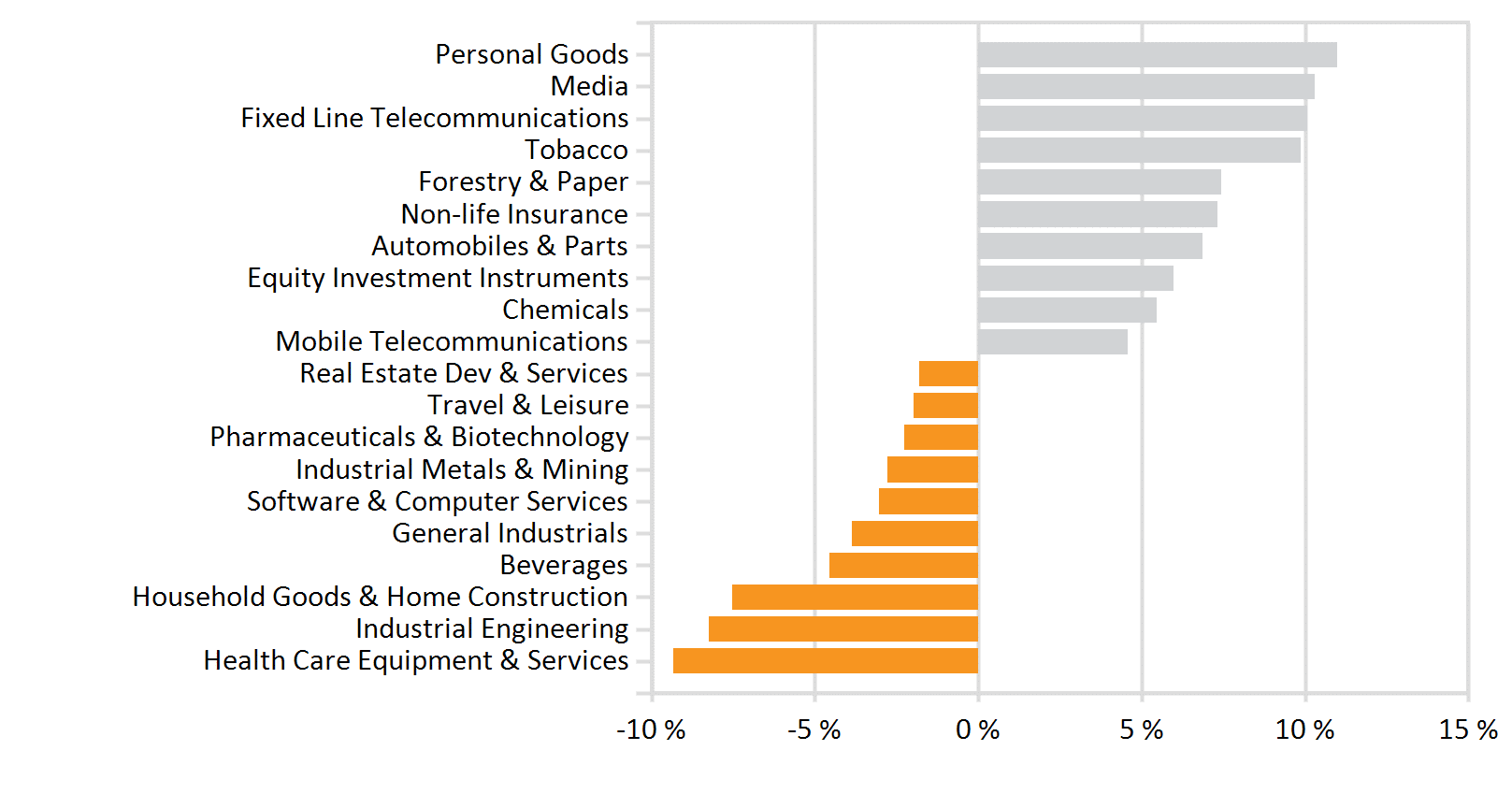

South African equities ticked up nicely over a holiday-shortened April, with the All Share posting a 3.64% gain and outstripping Emerging Market (EM) and developed peers (MSCI World +1.48%, MSCI EM +2.19%). With still-sound underlying fundamentals, SA Financials recovered some of their reshuffle-losses and closed 3.56% higher. After a particularly strong showing, resource counters closed near the flat line (0.01%) as commodity prices, currency movements and safe-haven trade battled for ascendancy. Gold prices rose in US dollar terms (1.43%), but Gold miners struggled to repeat the prior month’s stellar performance as safe-haven trade abated somewhat. The overall Bloomberg commodity index closed -1.51% lower, weighed down by significant weakness in Sub Industrial Metals (-3.4% overall) and Energies (-2.99%). Strong runs for industrial heavyweights Naspers, Richemont and Remgro saw the Industrial Index make a 5.17% leap for the month. Richemont and Naspers, both beneficiaries of rand-hedging trades and recovering global growth, hit new all-time highs in the last week of the month. Naspers gained 15.4% in the 30 days prior to month-end and Richemont gained 12.03%.

Sharp recoveries in MTN and Mediclinic also boosted the index. MTN has largely emerged from its Nigerian slump on the aims of its newly-appointed CEO and group President Rob Shuter to consolidate the recent gains in Iranian and Nigerian subsidiaries. The group posted total revenue-growth of 7.1% for Q1 2017, up 19.3% in total revenue from Irancell and 11.6% from MTN Nigeria. Under-pressure Mediclinic gained more than 13% on the last trading day of the month. The group announced that authorities in Abu Dhabi, where performance was particularly disappointing, had made concessions which could significantly boost its operating profits. Research supports the observation that companies with a high degree of foreign exposure continue to dominate the JSE indices. This proved true for 2016 as British American Tobacco was the largest JSE-listed company (by market capitalisation) at R1.5 trillion, followed by Naspers at R900 million. Other notables in the top 10 included Glencore, BHP Billiton and Anglo American. It is crucial that investors are aware of spill-overs from offshore sentiment and market movements. The volatile domestic and global political and trading environment make a diversified equity exposure, with room for timeous and appropriate changes, a critical factor in achieving sustainable and suitable returns.

International Markets

Developed markets closed mainly higher. Despite ongoing and escalating geopolitical tension, investor sentiment was somewhat soothed by centrist victories in Europe, a relatively orderly market response to the triggering of Article 50 and the potentially more gradual path of Federal Reserve adjustment. The MSCI World gained 1.48%, with Emerging and African Markets outstripping developed peers – the MSCI EM was up by 2.19% and a welcomed African recovery saw the MSCI EFM Africa ex SA index tick 2.06% higher. Eurozone equities outstripped developed peers, with the STOXX All Europe closing 2.17% higher, and European equity funds seeing a record USD 2.4 billion of inflows towards end April. The ECB confirmed its view that the region will continue to benefit from a slow and steady improvement in growth and inflationary prospects, electing to keep stimulus unchanged at its month-end meeting. French markets led regional gains, the CAC adding 3.5% on ebbing election fears. Sentiment was also boosted by surprisingly upbeat earnings results – midway through earnings season, investors saw an average positive 9.5% earnings surprise and 2% sales surprise.

Eurozone consumer confidence appears to support the recovery, despite the unease around populist politics and terror-incidents and PMIs have been ticking steadily higher. US equity gains were tempered by dimming hopes of any radical imminent Trump-tax reforms, a renewed push by the GOP to amend the healthcare bill, and barely-contained geopolitical flare-ups (North Korea-China and Syria-Russia). Economic data was sluggish: Although unemployment is at a record low of 4.5%, March data showed a disappointing 98 000 additional non-farming jobs. April was more positive, but concerns linger. The latest manufacturing data has undershot expectations, with a notable slowdown in new orders.

US consumers, it seems, are less upbeat than the initial Trump-bump may have led one to believe – personal consumption growth slowed to its weakest quarterly pace since 2009, retail sales growth lagged and auto sales fell month-on-month. US growth data came in at 0.7% for Q1, the slowest rate in three years. This, perhaps giving the Federal Reserve pause for thought in its anticipated hike-cycle. Earnings reports were mixed – some bellwether stocks delivered nice surprises, including the likes of Amazon and base metals manufacturer Alcoa, often regarded as proxies for overall consumer spending patterns and manufacturing output growth, respectively. On the other hand, Goldman Sachs Group and Johnson and Johnson suffered sore disappointments. Stocks, nonetheless, piggybacked higher off more positive global sentiment. The S&P500 gained 1.03%, and solid month-end tech gains (S&P500 IT +2.52%) outweighed losses in the energy sector (-2.89%).

Weakness in energy giants weighed down the UK bourse. Although markets responded positively to Theresa May’s call for a snap-election and sterling rallied, the FTSE100 lagged peers and dipped by -1.33%. The latest UK car sales data, indicative of underlying consumer sentiment and appetite for big-ticket spending, shows a nearly 20% year-on-year decline in sales. Major Asian markets showed divergent results: Japanese equities rallied at month-end, the Bank of Japan revised its growth expectations upward and the Nikkei gained 1.52% for April. Chinese stocks, conversely, saw persistent weakness and the CSI 300 dipped -0.45%. The dip is despite a surge in industrial profits that saw steel mills, smelters and other industrial firms’ profits jump by 24% year-on-year in March. Concerns linger regarding the sustainability of a real-estate fuelled boom, though (in a perversely reassuring development) the rate of increase has slowed significantly from the prior months’ breakneck pace. The Chinese growth trajectory is slowing, but the Central Bank is doing its utmost to manage the trajectory. The broader Emerging Market (EM) peer group was boosted by investor appetite for risk/yield. Asian minnows Indonesia, Korea and the Philippines put in solid performances, despite the tension spilling over from North Korea.

The MSCI BRICs posted a more modest gain (1.86%), with Brazilian markets recouping some of the prior month’s losses, up 0.7%. Latin American markets elsewhere were under pressure, as Venezuela saw widespread protests against beleaguered president Nicolas Maduro. Turkish central bank authorities tightened monetary policy, spurring markets higher and the Lira to an annual high. International observers, however, remain uneasy with the extension of Turkish President Erdogan’s powers. Russian markets were put under pressure by Gazprom earnings misses and market jitters as its Prime Minister Medvedev signed into law a bill that state-owned entities should pay 50% of IFRS net income in dividends. As some investors heave a sigh of relief on French election outcomes, British and Italian elections are still looming and the geopolitical landscape is likely to remain bumpy. Selective emerging market exposure, albeit with due awareness of hidden country-risks and unintended global spill-overs, presents unique opportunities within a diversified portfolio.

Currency

The turn-around in the US Dollar continued in April, with the index giving up -1.8% in that month. Sterling was one of the strongest developed market currencies as markets welcomed the call for a snap-election in June. The Yen moved only modestly (-0.9%) as the Bank of Japan maintained an unchanged policy, providing some breathing room for exporters. A broad basket of Emerging Market currencies posted gains against the dollar, with the strongest performance in the Turkish Lira (2.4% higher on monetary policy changes). The Korean Won, Rouble and Mexican Peso struggled (-1.8%, -1.3% and -0.51%), as geopolitical tension spilled over into currency markets. The Nigerian Central Bank announced that it would add another window for investors and analysts in its closely-watched currency market. Analysts are sceptical as authorities hope that the addition of a small business window will lure foreign investors back to the country.

It has, however, allowed the CBN to readmit three of the previously banned banks into the spot and wholesale forward segments (Guaranty Trust Bank, United Bank for Africa and FirstBank). On 3 May the Bank removed 48 additional items from the banned list, seemingly a prelude to a wider deregulation. Despite the urging of international bodies, the Bank has been reluctant to give up its hold on the forex market and the wide disparity in parallel, black market and official rates for various trading parties remains problematic. Officially, the Naira closed 1.37% higher against the USD. The Rand was volatile, although notably more stable than in previous political episodes. The local unit closed the month 0.33% firmer against the USD.