Market Commentary: June 2017

Market View

Cash

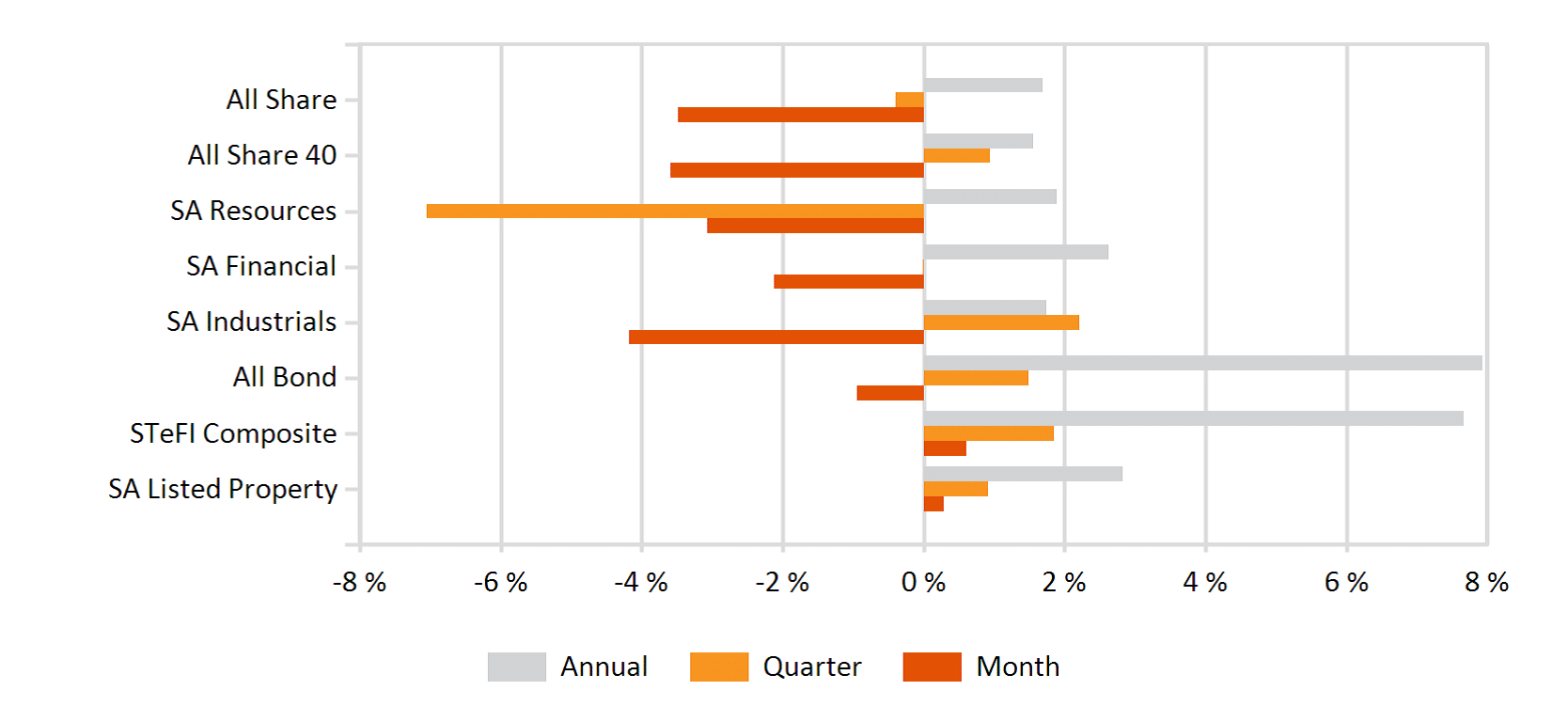

May saw a modest uptick in inflation, with Consumer Price Index (CPI) lifting slightly to 5.4% from 5.3% in April. The increase has largely been attributed to petrol and diesel price hikes in April and May. However, fuel-price pressures are expected to abate as June’s cuts feed through and pump prices are predicted to drop by a further 65 cents a litre in July. The after-effects of the El Nino have largely subsided. The prices of white and yellow maize are core staples, which serve as inputs further down the food supply chain, and have dropped by over 50% from their January 2016 peaks. Prospects are for a bumper harvest in 2017. Food price inflation is therefore likely to moderate further. The South African Reserve Bank (SARB) is nonetheless cautious — continued political spill-overs to the currency may yet prove destabilising, with the Rand hitting fresh lows against the dollar towards the end of June. The Bank projects that CPI inflation will be at the upper end of the target range in 2017, at 5.7%. Cash returns were 0.61% for June.

Bonds

South African Bonds substantially underperformed global counterparts, with the ALBI down by 0.95% and the BarCap GABI’s modest 0.09% loss. While the first half of 2017 has been marked by a high demand for Emerging Market (EM) bonds, with record year-to-date volumes, the appetite for South African government debt is likely to be volatile. Continued political uncertainty and pressure on ratings, with Moody’s recently downgrading the country’s foreign and local currency ratings to Baa3, with a negative outlook, is likely to weigh on foreign perceptions of South African debt. Government is quickly running out of borrowing capacity and recent news that it may apply to the International Monetary Fund and World Bank for funding has done little to reassure investors. The country’s national carrier, SAA’s bail-out was announced at the end of June and the ongoing political noise around Eskom also add to poor perceptions of governance and state capture of State-Owned Enterprises. In the last week of June, foreign investors dumped the most South African bonds since US President Donald Trump was elected, with average daily outflows in the past month at R52 million.

The Barclays ILB index was -0.19% lower, as May inflation ticked up modestly. The US Treasury yield curve flattened in June, and 10-year T-bills closed the month at 2.31%, up from 2.2% at May month-end. The Federal Reserve, in line with market expectations, raised interest rates at its recent policy meeting and detailed its plans for reducing its balance sheets further in the latter half of the year. The Bank of England also indicated that interest rates in the UK may need to increase, triggering a sell-off in government bonds. Conversely, the European Central Bank saw better-than-expected economic forecasts and hinted at potential interest-rate cuts in this cycle. Credit spreads between European sovereigns, peripherals and T-bills and Gilts widened, as did the spread on investment grade and high yield bonds.

Property

SA listed property ticked up a modest 0.29% during June. The local political newsflow, including the rhetoric around land reform, has raised concerns amongst offshore investors about the security of property ownership. Despite a weak Rand, domestic listed counters have therefore struggled to take advantage of the global search for yield. The sector, nonetheless, continues to see a wide disparity in regional and sectoral returns. In the residential sector, house prices have been stagnant throughout much of the country, but Cape Town’s residential market is booming. FNB’s house price index indicates that average Mother City house prices will continue to trend up, while other metros will have sub-inflation returns of 2% or 3%. Despite a tough environment, a number of niche players have emerged in recent months.

June saw the launch of Izandla Property, a majority black-owned property company, supported by Investec. The new company aims to further unlock and develop Broad Based Black Economic Empowerment opportunities in the property sector. The timing may be particularly fortuitous, given that the amended Property Sector Code, which requires a black ownership target of 27% for property-owning companies, came into effect on 28 June 2017. Similarly, specialist in nature, the Enyuka Property Fund, a partnership between Emira and One Property Holdings, aims to unlock the hitherto underserved rural retail segment. Foot traffic in traditional retail outlets has been under pressure and leasing negotiations in the office and retail space remain tough, after the economy slipped into a technical recession. Nonetheless, some companies are reporting above-expected earnings and distribution growth. Selectivity, however, will be key. The property sector still offers attractive value propositions, but the prospects are no longer for double-digit returns. As a diversifier, and certainly for inflation hedging prospects, unlisted exposure may offer an attractive alternative for institutional investors.

Equity

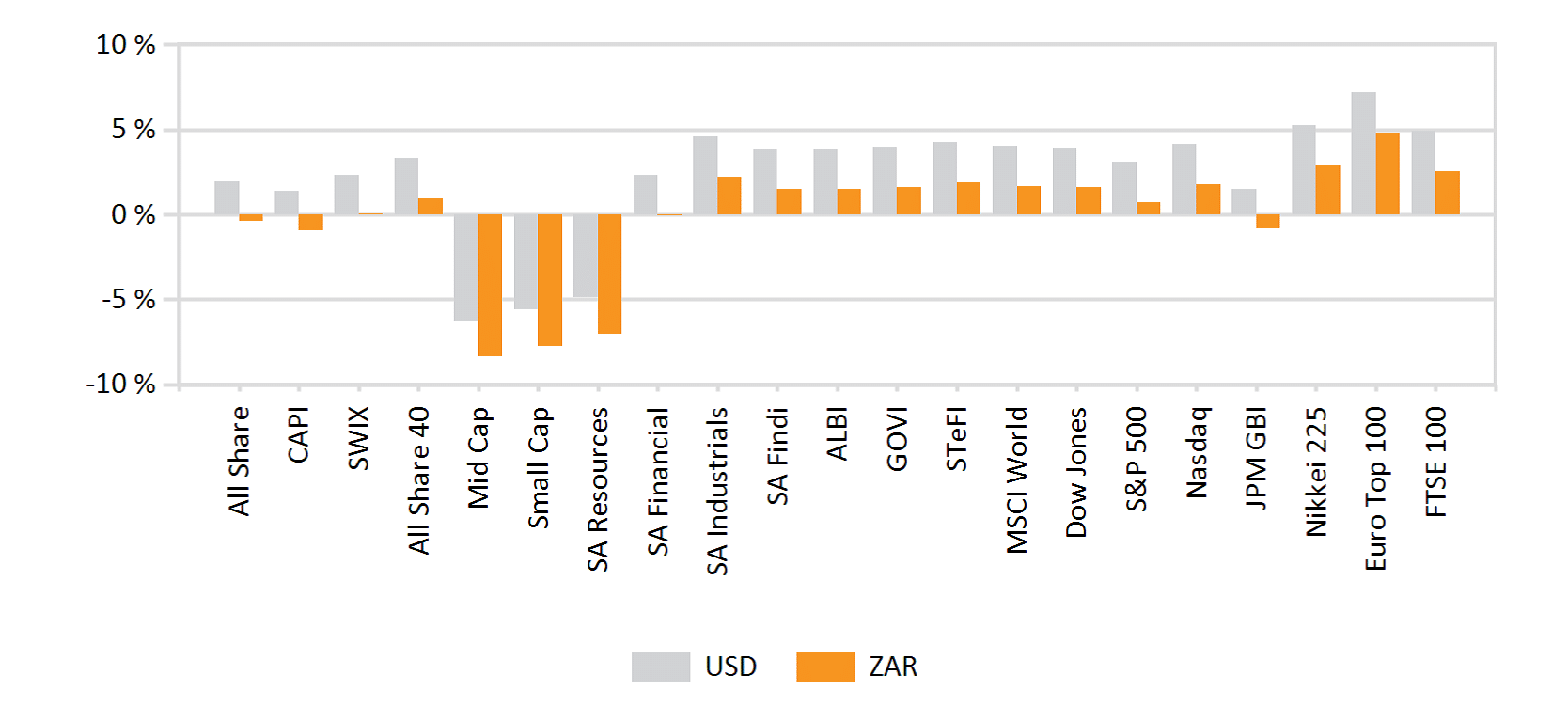

The Johannesburg Stock Exchange saw broad-based declines during June. The All Share lost 3.49%, with Industrials bearing the brunt of the decline (-4.18% lower, whilst Financials were 2.13% lower and Resources gave up 3.08%). The local exchange significantly underperformed developed and emerging market peers. The MSCI World nudged 0.4% higher and the MSCI EM gained just over 1%, while continental counterparts rose substantially (the MSCI EFM Africa ex SA gained nearly 5%). A flurry of unsettling economic and political news weighed on investor sentiment. South Africa officially slipped into a technical recession (two consecutive quarters of GDP decline) and unemployment remains at a record high, 27.7% in Q1. The Quarterly Employment Statistics Survey (QES) reports that employment levels declined by 58 000 jobs and that wage growth is barely keeping pace with inflation, down from 6.6% year-on-year to 6%. Consumers will therefore remain under pressure, as will company earnings. Ongoing in-party wrangles and a revised Mining Charter have done little to improve foreigners’ perceptions regarding the government’s effectiveness and security of their property rights.

On a lighter note, despite a tough consumer environment, new vehicle sales recovered modestly in June, posting year-on-year growth of 0.9% (versus a prior-month decline of -2.6%). May’s trade data indicated an improving trend, with the fourth consecutive monthly surplus mainly driven by increased mineral products and base metal exports. Boosted by a surge in Chinese demand, iron ore also returned to bull market territory, and Kumba Iron Ore continued its recent rally. The overall resource sector sank over 6% after the announcement of the revised Charter, but stabilised slightly as mining companies appealed to the High Court for a block. Rand Hedges such as Richemont, Naspers, and Anheuser-Busch were boosted by month-end currency weakness, but ended substantially weaker. Deteriorating earnings prospects continue to weigh on the index. The globalised nature of the South African economy – on the growth of Naspers, Richemont, BAT and Aspen to name a few ‘purely’ domestic counters are effectively about 25% of the bourse – means that local investors need to be ever-more conscious of their explicit and underlying offshore exposure. A diversified, well-hedged portfolio and nimble asset allocation remain essential.

International Markets

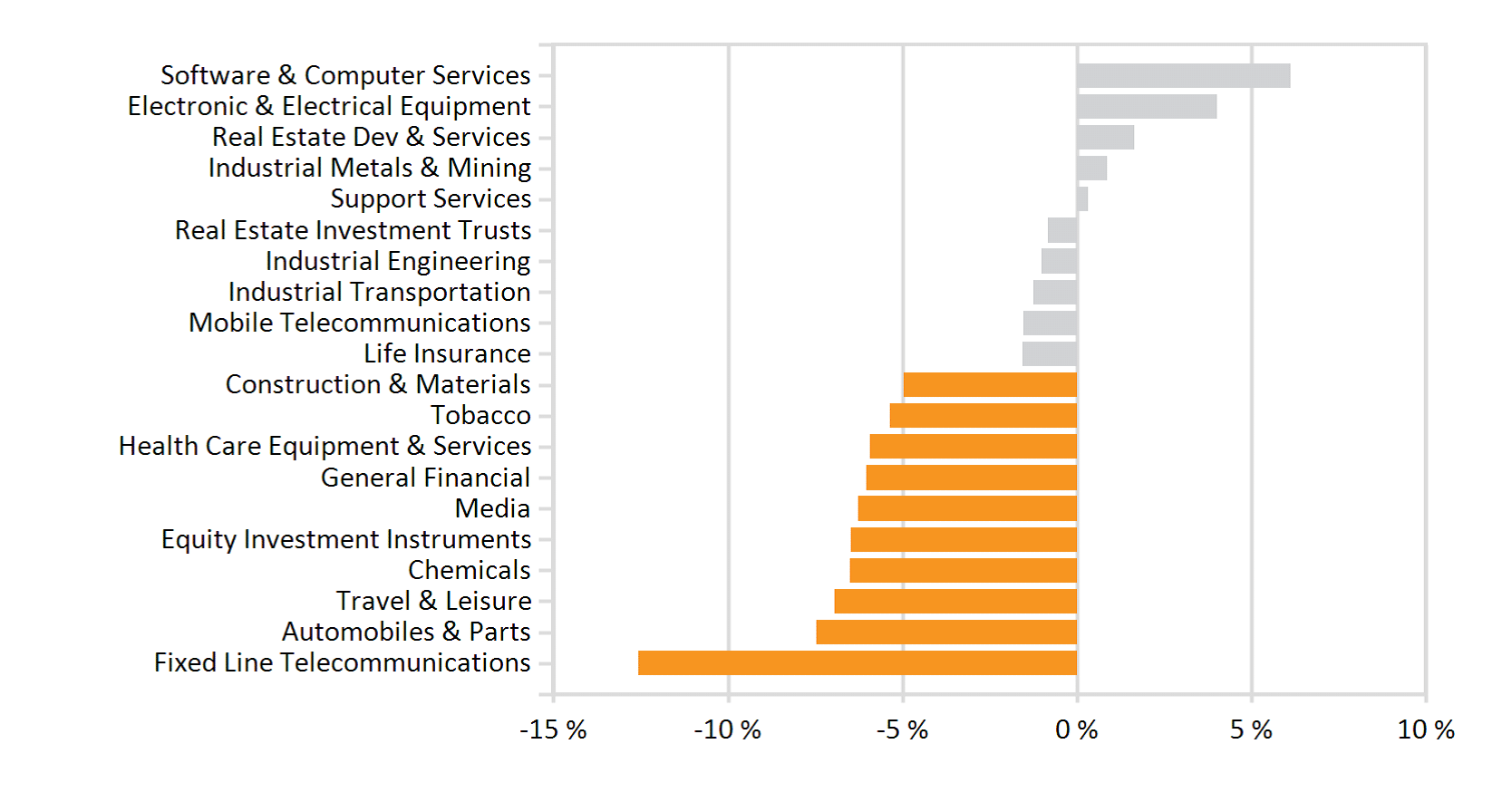

Developed market equities were mixed in June, while investor appetite for Emerging markets, Africa in particular, was unappeased. The MSCI World gained 0.38% for the same month, while the MSCI EM closed 1.01% higher and the MSCI EFM Africa ex SA was up 4.78%. The rhetoric of politicians and Central Bankers was under the spotlight. In the UK, pundits have bemoaned the outcome of Prime Minister Theresa May’s election gamble. A hung Parliament and the need for a coalition government unsettled markets and sterling was volatile. The UK FTSE slid -2.5%, with energy and banking stocks lagging amidst concerns around higher-than-anticipated global supply and a deepening diplomatic crisis in the Gulf (Qatar). UK investors, already uncertain of their bargaining power ahead of Brexit negotiations, were further unsettled by news of potential interest rate hikes, communicated by Governor Mark Carney late in the June. The Federal Reserve, conversely, clearly communicated that it intends to continue its tapering, with the European Central Bank likely to follow suit on still-stronger economic data.

Eurozone unemployment remains at low levels and the peripherals are experiencing healthy economic growth. Eurozone inflation ticked up to 1.2% in June, up from 1% in May. European stocks experienced some weakness at month-end, in response to Italy’s President Mario Draghi’s hawkish comments: the STOXX All Europe closed -2.45% lower, with both the French CAC declining by over 2% and the DAX hampered by a poor earnings outlook from chemicals and automakers. US unemployment has dropped to a 16-year low of 4.3% and inflationary prospects remain positive. Volatility on Wall Street, was boosted by a mid-month stutter in the momentum of tech-giants. However, the S&P ended the month 0.62% higher. The Japanese bourse rose 2.1%, as markets cheered the Bank of Japan’s decision to maintain its current level of bond purchases at Yen 80 trillion per annum.

Emerging Asian markets outperformed their regional peers, boosted by positive news from China. Official Purchasing Managers Indices indicated an acceleration in the manufacturing and services sectors. Industrial profits also rose by more-than-expected (16.7% year-on-year for May), speaking to continued healthy growth and earnings prospects. The inclusion of Chinese A-Shares in the MSCI index has been seen as a resounding nod that Chinese policymakers’ efforts at reform and liberalisation are paying dividends. The Shanghai CSI300 closed 5.59% higher, followed closely by near-neighbours Taiwan (+5.2%) and Korea (+3.2%). Indian equities were laggard, posting their first monthly loss for 2017.

Latin American markets have remained unsettled by populist tension. Despite the Brazilian economy finally emerging from its worst recession in history, new corruption charges have been levelled against President Michel Temer and violent protest action in Venezuela continues unabated. The Argentinian market was one of the poorest performing Latin American countries — while prospects are positive — as industrial production snapped a 15-month losing streak in May. The country’s inflation also slowed to just above 20%, with bricks-and-mortar investment slow to materialise, ahead of crucial mid-term elections. Equity investors may have been somewhat spooked by Central Bank comments, but an apparent steady global economic recovery underlies the hawkish sentiment. Attractive valuations and momentum in emerging markets, however, still present unique opportunities for the astute investor within a diversified portfolio.

Currency

The US Dollar, hampered partly by President Trump’s combative rhetoric, declined by a further 1.3% in June. Weaker US data and a fading of the Trumpflation trade has seen the Greenback give back much of its year-to-date gains. Emerging market currencies were mixed. The Mexican Peso surged by nearly 2.7%, while emerging Asian markets were mainly stronger — the Thai Baht and Singapore dollar both gaining nearly 0.5%. Conversely, the Rouble registered substantial losses (- 3.1%) exacerbated by energy weakness, geopolitical noise and allegations around US-election interference. The Brazilian Real softened (-2.5%) on commodity weakness, as forex markets were unsettled by new corruption charges and broad popular dissent and protest action in the Latin American region. The Nigerian Central Bank retains a tight rein on the currency and investors remain unsettled by the proliferation of parallel rates. While the official rate is presently pegged at N305 to the dollar, a number of parallel rates have been implemented, which is unsettling to offshore investors and local businessmen. Moreover, black market and quoted rates can range from between 314 to 360 to the dollar (as at 30 June). Sterling markets were volatile and initially caused a sharp drop due to a hung Parliament and the consequent need for a coalition government. The unit, however, steadied towards the latter part of June, and registered its best quarterly performance in two years (up 3.2% since April).

UK domestic political uncertainty has somewhat dissipated, but its bargaining power in Brexit negotiations and in bilateral agreements (including consequent pressure on the trade account) has been eroded. Conversely, political and economic newsflow from the Eurozone boosted the common unit to a 3.2% dollar-gain. Whilst major developed market currencies gained against the USD (commodity-linked Canadian, Australian and New Zealand equivalents rising between 3.5% and 4.1%), the Yen declined by 1.4%. The Rand, by all accounts, has held up remarkably well against the particularly poor local backdrop. Bearish bets, however, are stacking up, as the currency seemed to lose steam in June. A month-end poll saw analysts predicting -2.1% return for the Rand for Q3, versus the 3.1% gain in Q2. The local unit nonetheless managed a modest gain of 0.75% for June.