Market Commentary: July 2017

Market View

Cash

June saw a further moderation in inflation. The Consumer Price Index hit 5.1% and Producer Price Index inflation fell well below expectations to 4% year-on-year for the same month. Food and fuel price dynamics were the key drivers responsible for this drop. The South African Reserve Bank (SARB), surprising a number of market-watchers, implemented a rate cut towards the end of June. Despite the weak domestic environment, the Monetary Policy Committee cited the ongoing moderation in its inflation forecast in implementing the 25 bps rate cut. However, it remains cautious, noting that the upside risks – Rand weakness, further uncertainty around credit downgrades, above-average wage settlements and a potential supply-side shock to electricity prices (July 2018) – will be closely monitored. While consumers are enjoying some relief, the easing cycle is likely to be shallower than had initially been hoped. Should Moody’s maintain its present outlook (the next revision is due early in August), and the outlook for domestic GDP remains constrained, the SARB may implement a further 25 bps rate cut in September. The oil price, however, has already seen some volatility (pump prices rising by 19 cents in August) and geopolitics and domestic spill-overs may yet come into play. Cash returns were 0.62% for July.

Bonds

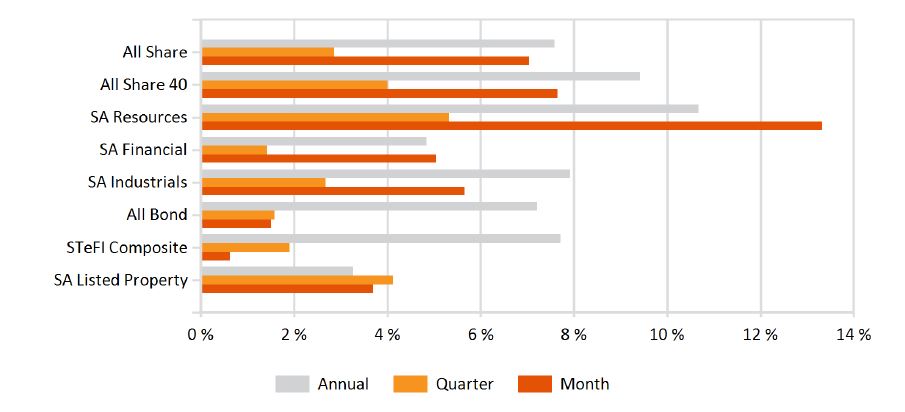

South African Bonds, despite a somewhat volatile domestic and global political environment, held steady during July. The ALBI registered a 1.5% gain, while ILBs were nearly flat, and global bonds rose by 1.68%. South African bonds rallied by 14 bps over July, fuelled by Dollar weakness after the Federal Reserve’s less hawkish tone on US inflation. The first half of 2017 has already seen record flows into Emerging Market (EM) bonds, with cumulative net inflows into developing nation-bond-funds of about USD 61 billion this year. This has mainly been fuelled by the desire for investors to take advantage of the spread, and the appeal of developing nation carry-trades. As developed nations start a hiking cycle and a number of emerging markets move to ease (Brazil, Mexico, Russia and India), the carry-trade will see pressure. For the time being, however, slowing inflation is adding to gains and the spread remains extremely attractive. A Citigroup index shows that the majority of emerging market inflation reports are undershooting expectations, while a number of developed nation Central Banks are keeping rates lower for longer.

Investors kept a wary eye at President Mario Draghi’s tone at the European Central Bank’s policy meeting on 20 July, but his comments proved to be on the dovish side. Citigroup analysts in turn estimate that South African real yields are still so high that the SARB could implement a further 75 bps cut before seeing much currency pass-through. US Treasuries closed the month at 2.29%, little changed from June’s 2.31%. UK gilts and German Sovereign equivalents were similarly stable, closing at 1.23% and 0.54%, respectively. Investment grade corporates were supported by a strong technical background, as US earnings were generally in line with expectations and markets showed surprisingly short-lived reactions to Fed and Whitehouse noise. The premium that corporates pay, over government bonds, is now at its lowest level since 2015.

Property

Up 3.7%, SA listed recovered nicely during July after a relatively tough second quarter. Domestic investors remain hampered by a low-growth environment and tight credit condition. Foreign buyers, however, have been more resilient, buoyed by relative Rand weakness and seemingly having priced in credit downgrades. Recent sentiment surveys indicate that the domestic outlook is still recovering from first-half doldrums, with the Absa Homeowner Sentiment Index showing that 74% of the existing and prospective homeowners surveyed were positive on property market conditions (down from 81% in 2016 Q4). The survey covers sentiments around buying, selling, renting, investing, and renovating. House price growth, often a leading indicator for economic conditions, has slowed for a third consecutive month and the rate remains in negative territory in real terms. Given the divergence in sectors, some areas may therefore see a recovery (resale; ready-to-rent; student housing and other niche sectors) or remain strong (Cape Town).

The SA REIT Association, whose membership comprises listed REITS with a Market Cap of R400 billion, remains upbeat on prospects. Forecast returns are likely to be between 8% and 10% due to a high degree of offshore exposure (30-40% of earnings), low gearing levels and extensive interest hedging. SA Reits have typically hedged about 80% of their interest exposure, with an expiry profile of three to four years, leaving them less vulnerable to interest rate and currency movements. This means that the asset class can better weather the short-term noise. A number of BEE transactions have also come to market following the amended Property Sector Code. Redefine Properties sold its 22.8% stake in Delta Properties to a women-led BEE consortium, while Emira Property Fund shareholders approved a R364-million BEE transaction for 5% of its shares. Selectivity, nonetheless, remains key, since double-digit returns are no longer a safe assumption. As a diversifier, and certainly for inflation hedging prospects, unlisted exposure may offer an attractive alternative to institutional investors.

Equity

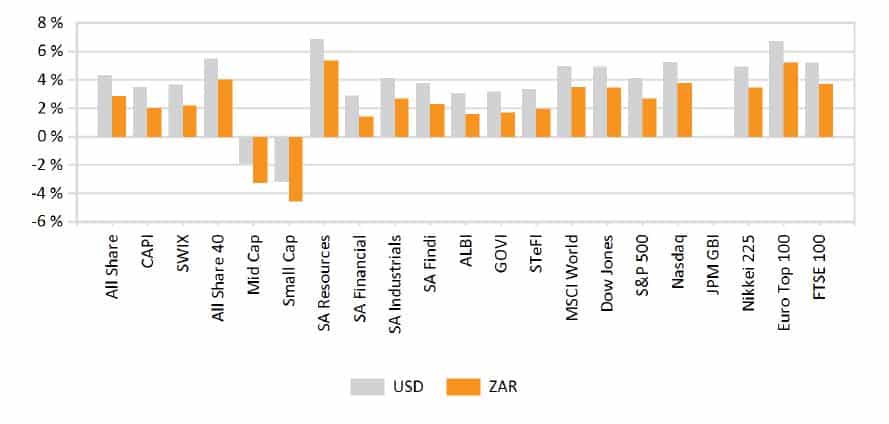

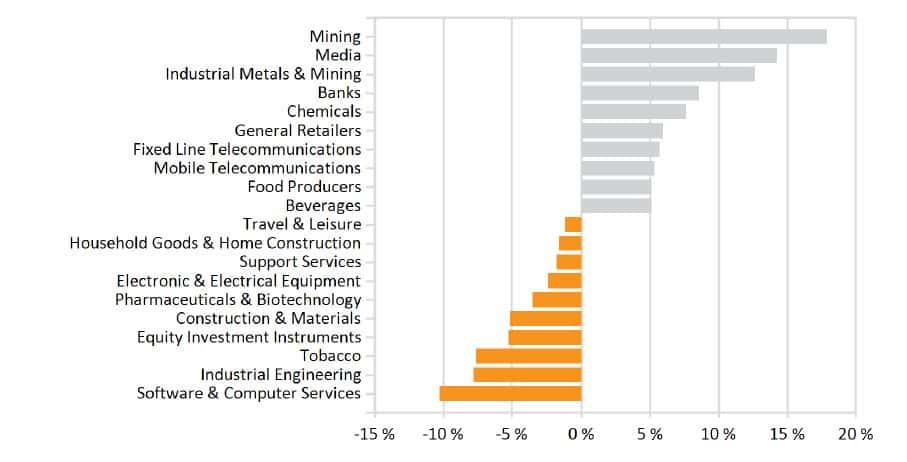

The Johannesburg Stock Exchange staged a recovery in July, registering solid gains across sectors. The ALSI just overshot the 7% gain, while the SWIX was 6.3% higher. Resources were the biggest winner on a sectoral basis. Underpinned by a recovery in precious metals, the index soared by 13.3%. Mining firms, too, were boosted by a ‘stay in execution’ of the revised Mining Charter and the likelihood that it would not be implemented as announced. As the SARB cut interest rates in pursuit of its inflation targeting mandate, Financials clawed back some of the prior month’s weakness, on improved profitability and a reaffirmation of the Bank’s independence. Retail shares were modestly higher, as the interest rate cut slightly boosts consumers’ pockets.

The retail sector proved more resilient for the year-to-date. During May, sales grew 1.7% year-on-year, versus an expected contraction of -0.3%. This, however, was driven by food and pharmaceuticals. Private sector credit extension remains depressed, with consumers diverting cash away from non-essential items. General dealers, clothing and furniture (semi-durables) are still in a slump. The retail index rose just over 5% in June. Industrials closed 5.5% higher. Dual listed stocks, which make up more than half of the JSE’s market value, gained substantially from month-end Rand weakness. Aside from the noted Naspers surge, big names Richemont and BAT have gained 24% and 8% over the course of the year.

Domestic equities considerably outperformed global peers, with the MSCI World gaining a more modest 2.39%, the MSCI EM gaining 5.96% and the MSCI EFM Africa ex SA gaining 4.92%. BRIC nations, however, left counterparts in the dust, gaining nearly 9%. Investors in South Africa, remain concerned about further rate cuts. Moody’s is likely to maintain its rating unchanged, but may yet elect to change its outlook if local politics remains unsettled. The trade account, largely boosted by stronger commodity prices and a concomitant weaker Rand, improved during June. The cumulative surplus totalled R27.7 billion for the first half of the year, in contrast to a R5-billion deficit for the same period in 2016. Domestic corporates’ and consumer confidence remain depressed, and unlikely to enable an economic turnaround – corporate credit extension moderated to 10.3% in June, down by over 3% from the prior month.

Subdued household credit growth is expected to remain a key constraint to household consumption growth, which is forecasted to see a modest improvement of 1% year-on-year, up 0.2% from 2016. Further recent noise around parastatals – SAA’s potential bail-out, the firing of Eskom CFO Anoj Singh, a pending no-confidence vote in President Zuma and still unresolved issues around state capture – have done little to restore confidence. Nonetheless, a number of market players are identifying opportunities for bargain-hunting in undervalued sectors. There remains significant opportunity in SA Inc, but selectivity and nimble allocation, within a well-hedged diversified portfolio are essential.

International Markets

Global markets ticked higher during July, following favourable corporate results and promising Asian economic data. The year-to-date EM-rally shows little sign of slowing, with the MSCI EM outperforming the MSCI World by more than 3% (5.96% versus 2.39%). BRIC nations were particularly strong. The index gained 8.63%. Emerging Latin America led the surge with stronger commodities, a weaker dollar and improved domestic politics providing tailwinds to the Brazilian bourse. Inflation dropped by more than 7% since the start of 2016 – sitting at a relatively manageable 3% — and the Central Bank has been able to cut interest rates by a further 100bps.

Emerging Asia was stronger, with Indian and Chinese markets both putting in a solid performance. Indian equities closed 5.44% higher, spurred by decent earning reports, softer inflation data and positive newsflows around the implementation of the Goods and Services Tax, and a move toward a coalition Bihari government. Chinese equities were supported by an uptick in momentum on the economic front: retail sales and industrial production data was positive for July, while second quarter GDP growth trumped expectations at 6.9%. A correction in tech stocks dragged slightly on Korean and Taiwanese markets, while sentiment toward Emerging Europe was somewhat soured by the likelihood of further US-Russia sanctions. Despite this, the Russian bourse closed just over 2% higher. Hungary and Turkey put in solid performances, on evidence of improved growth and inflation prospects in Western Europe and a settling-down of political tension.

In developed markets, the Japanese bourse edged higher, though positive earnings momentum was tempered by still-weak inflation data and by the defeat of the ruling Liberal Democratic Party in the Tokyo Metropolitan Assembly election. UK economic data was mixed, and the FTSE closed only 0.86% higher, significantly lagging its peers. The Bank of England is set to publish its August Inflation Report, with an updated forecast to its growth and inflation outlook. To date, the Bank has been consistently optimistic on growth and wages, but may temper its expectations. Unemployment is at its lowest levels since 1971 (when records began), but wage growth has been at an anaemic 1.8% (annualised weekly earnings) since 2013. Consumer spending growth reportedly slowed from 11.4% in April to 3.1% in June.

Earnings reports from retailers such as M&S support a view of diminished consumer confidence. The company reported a fall in quarterly clothing revenue and missed estimates for food sales as inflation continues to squeeze. Utility/energy-related stocks, however, benefited from the announcement of a ‘safeguard tariff’, which could mean that the election manifesto pledge (a broad-based price cap) is off the table. The BoE is therefore expected to maintain interest rates until well into 2019, particularly as the UK continues the uncertainty about its post-Brexit prospects. The UK government published a range of papers outlining its position on Brexit negotiations, but the topic is set to dominate the political backdrop for the foreseeable future. Not only are Eurozone counterparts not overly conciliatory (no amicable divorce), domestic pressure is building for a new Referendum. Eurozone markets were largely unchanged in local currency terms and the STOXX All Europe closed the month at 0.19% lower.

Peripherals such as Italy put in a solid 3.8% performance, while dominant Germany and bellwether French stocks lagged -1.5% and -0.5%, respectively. On the macroeconomic front, steady seems to be the watchword for the Eurozone. Unemployment continues to tick down, reaching 9.1%. Private sector surveys show robust growth across the manufacturing and service sectors. Industrial production grew at its fastest pace in six years during July and the consensus growth forecast for 2017 was revised upward to 2% during July. Inflation, however, remains the key indicator in determining the future path of European monetary policy. Headline inflation was stable in July, at 1.3%, and the ECB is likely to maintain its accommodative stance. The Federal Reserve, while recently adjusting interest rates, has also signalled that it would take a gradual approach in doing so. Market reactions were muted, with strong earnings a bigger boon to the S&P. The index closed about 2% higher, after more than 80% reporting companies exceeded expectations. On the macroeconomic front, US growth picked up steam in the second quarter, up 2.6% from 1.2% in Q1.

Retail sales have also shown evidence of improved consumer confidence. On a sector basis, technology, materials and energies remained buoyant. On the Commodity front, Iron Ore climbed to a four-month high, boosted by positive Chinese economic data and benefiting steel-producers. Crude oil prices strengthened to 10-week highs, buoyed by indications that stockpiles had extended declines, positive news from Saudi Arabia on maintaining production caps and better-than expected results from companies such as BP and Exxaro. Overall, Energy-stocks gained 8.1% for the month, while Industrial Metals were 3.1% higher. Gold was modestly stronger at 2%. US jobs data is certainly hitting the sweet spot.

After the US economy added a higher-than-expected 220 000 jobs in June, the Department of Commerce reported that the further addition of 209 000 jobs in July signals an 82nd straight month of expansion, and brings unemployment to a 16-year low. US President Donald Trump has promised that there is more to come, but investors are becoming increasingly less sanguine about his ability to deliver. The latest failures by Republicans to repeal Obamacare, allegations around a Russian-connection to the younger Trump and unsavoury in-house fighting are all casting doubt on the feasibility of further pro-growth policies. US markets have thus far largely withstood much of the fall-out, but rising diplomatic tension (North Korea, China, Russia) will have an impact on US companies’ future profitability. A developed market recovery seems well underway, and there is little sign that the emerging market rally is grinding to a halt. Attractive valuations and momentum present unique opportunities for the astute investor within a diversified portfolio

Currency

Fading ‘Trumpflation’ trade and ebbing confidence in President Trump’s campaign promises, saw the US Dollar Index soften by 2.9% in July. Energy and commodity linked developed market currencies – including the Norwegian Krona and Australian Dollar were notably stronger by 6.2% and 4.1%, respectively. Emerging market currencies were mainly stronger too. The Brazilian Real saw substantial gains of 5.8%, boosted by commodity strength and interest rate cuts. Positive macroeconomic data from Mexico lifted the Peso by 1.8%. Asian currencies were modestly stronger, boosted by technology earnings and Chinese spill-overs, with the Korean Won gaining 2.8% against the dollar. The Russian Rouble, amidst ongoing political tension, lagged the majority of its peers (-2.3%) despite strong oil prices. Retaining a rein on the currency by keeping the official rate artificially low to ensure fuel importers get cheap dollars, the Nigerian Central Bank has made substantial progress towards unification. In July, it was announced that Banks would quote the Nigerian Autonomous Foreign Exchange Rate Fixing (NAFEX) rate, which is published daily by Lagos Based Trading platform, FMDQ OTC Securities. Since then there has been a substantial convergence, evident from the rate at which forward contracts based on the official rate are trading at (342). Though full unification is still some way off, the MSCI has also moved to value its Nigerian holdings at the NAFEX (effective 1 August), signalling greater policy credibility. The Rand, holding up well for the year-to-date, is wearying under continued domestic and political pressure. Down 0.7% against the dollar for July, bearish bets are stacking up for the currency.