Market Commentary: November 2017

Here are this month’s highlights: Cash still well-ahead of inflation, SA Bonds continue to fall, while SA Property sustains its uptick from October. Looking ahead, the ANC’s elective conference will grab the headlines in December, and the importance of transparent and clear thinking by economic decision-makers in 2018 cannot be overstated. November carried hope and high expectations for the global investor and a weak USD continued to provide a boost for multinational companies.

Market View

Cash

Despite the recent uptick in oil prices, year-on-year inflation is still within the 3% to 6% target at 4.63%. GDP slowed to 2% for the third quarter and the looming Moody’s currency rating and foreign debt downgrade is unlikely to help growth. Cash has returned 0.58% for November and is well ahead of inflation with a 7.57% one-year return.

Bonds

Continuing from its drop in October, South African Bonds sustained a further fall in November. The ALBI registered a 0.91% loss, whilst ILBs also continued their weak performance returning -5.03% for the month. South Africa’s 10-year yield rose sharply, post the S&P local currency downgrade, to a high of 9.5% before settling at 9.3% by month-end.

As the search for yield continues, South Africa remains a favoured destination of global investors, but this may change should Moody’s downgrade the country to sub-investment grade. If this happens, South Africa will be removed from the Global Bond Indices. There is an expectation that this will result in about R100 billion in outflows from the country’s bond market. US Treasuries and UK gilts remained stable for the month, closing at 2.4% and 1.26% respectively. As growth continues in most of Europe, the European Central Bank pushes ahead with its proposed unwind of its stimulus programme, citing improved regional conditions.

Property

In contrast to SA Bonds, SA Property continued its uptick from October returning 1.92% for November and 17% year-on-year. The local market recovered well over the last six months after starting 2017 on the backfoot. The weak economy, a volatile Rand and tenant struggles have meant most of the market has moved offshore. Growthpoint has also finally delved into the offshore market making a few acquisitions whilst also diversifying locally into Healthcare properties.

“The local market recovered well over the last six months after starting 2017 on the backfoot.”

SA’s retail sector has struggled over the last year, but has managed to carve out some growth in these tough times. Balwin Properties and Transcend Property Fund have entered into a partnership to develop 8 900 affordable rental apartments worth R6.4 billion over the next six years. Exposure to the German economy has helped players like JSE-listed Sirius Real Estate outperform over the last year.

Equity

Political events once again played a major part in the Johannesburg Stock Exchange’s performance, as the market slowed down from significant gains in October. South African Finance Minister Malusi Gigaba’s medium-term budget statement reinforced government’s stance on aiding struggling State Owned Enterprises.

This did not go unnoticed by S&P Global as the credit rating agency downgraded South Africa’s rand-denominated debt to junk status. The ALSI and the SWIX posted 1.46% and 3.09% respectively, enough to still outperform most Emerging Markets, as the MSCI EM slowed down to 0.2%. The local market outperformed Brazilian and Indian markets, which dropped by 3.15% and 0.15%, but lost ground to Russian and Japanese markets, which gained 1.76% and 3.26%.

“On an industry level, SA Financials was impressive despite the S&P downgrade, with 4.42% gains…”

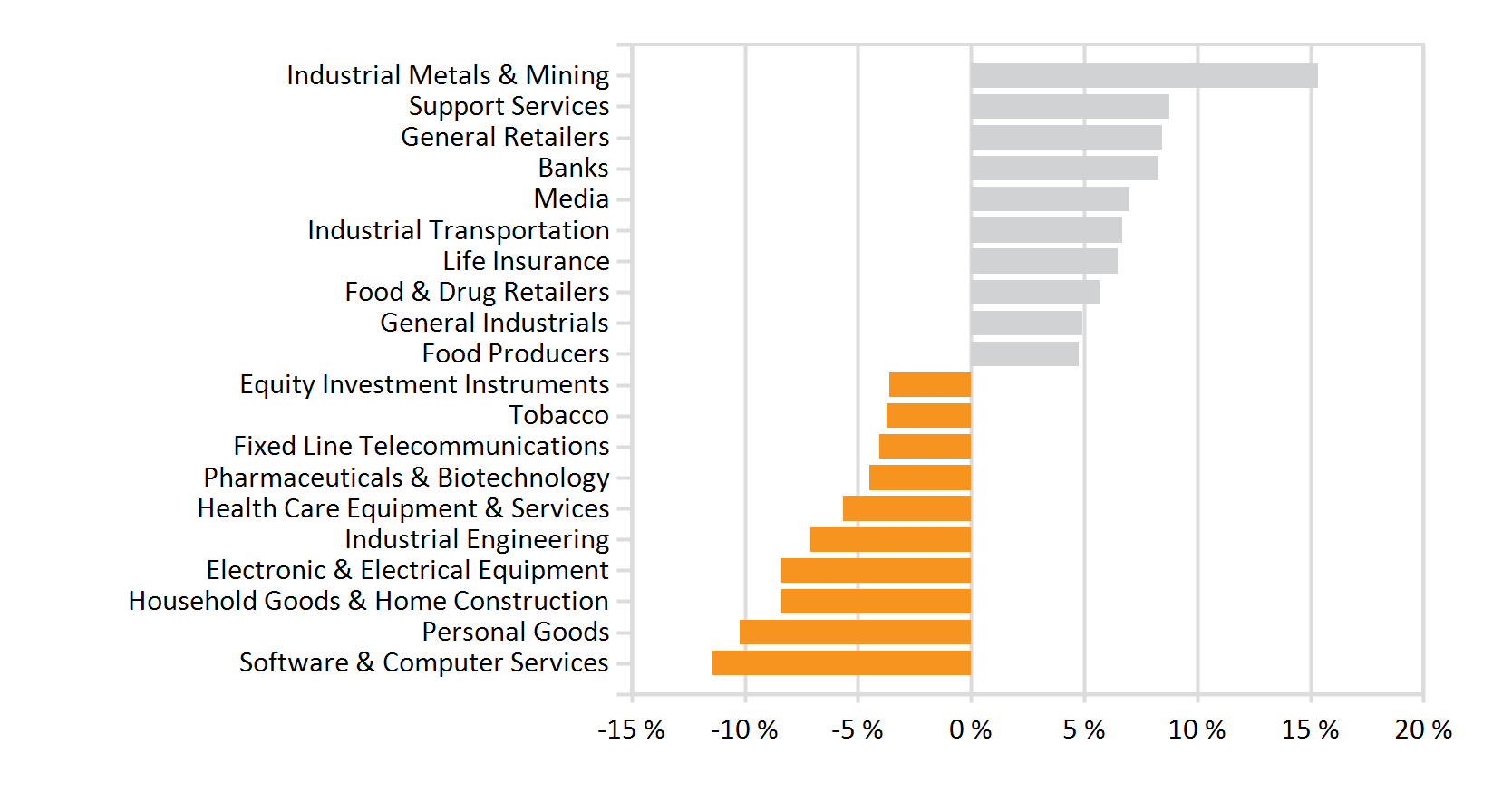

On an industry level, SA Financials was impressive despite the S&P downgrade, with 4.42% gains and as Moody’s provided some breathing room with their stable outlook pending results from December’s elective conference and February’s budget speech. Resources struggled even with their early month gains, attributed to higher commodity prices. The sector softened by 1.6% as the strengthening Rand hurt resource share prices whose income is priced in dollars. The best performing equity sectors were Industrial Metals (up 15.35%) and Food Producers (up 4.77%) while Forestry & Paper (down 2.66%) and Pharm & Biotech (down 4.49%) lagged.

“Despite announcing strong growth in net income, investors were more concerned with high-flying technology stocks being sold off in Asia on fears that the boom in microchips may have peaked.”

The market was once again heavily reliant on large caps, as the SWIX Top 40 posted a 3.58% return. Mid cap and small cap stocks lagged, with the latter down by 2.74%. Naspers dropped from its high levels in October to 7.05% for November. Despite announcing strong growth in net income, investors were more concerned with high-flying technology stocks being sold off in Asia on fears that the boom in microchips may have peaked. British American Tobacco struggled, dropping by 3.73% as Reinet Investments announced that it may sell shares to secure additional financial facilities. Anglo American was not immune to the struggles of the resource sector, as it lost ground, dropping by 4.64% in November.

Looking ahead, the ANC’s elective conference will grab the headlines in December as the outcome may well have a significant impact on the national policy roadmap. The economy will be relying on the agricultural and financial sectors to lift growth. With the latter being exposed to the ratings agencies, the importance of transparent and clear thinking by economic decision-makers in 2018 cannot be overstated.

International Markets

November carried hope and high expectations for the global investor, on the back of improved global growth prospects, boosted inflation in Emerging Markets and impressive progress on tax reforms in the US. This, despite political uncertainty in the Eurozone and Japan’s stagnant wage growth.

“The US equity market, as measured by S&P 500, delivered a strong 3.1% for November as the tax reform momentum supports market appetite.”

MSCI Developed Index returned 2.2% for the month, supported by strong performances from US and Japanese markets. The US equity market, as measured by S&P 500, delivered a strong 3.1% for November as the tax reform momentum supports market appetite. Black Friday and Cyber Monday also boosted retail activity. The unemployment rate remains low at under 4.1% and a rate-rise is on the cards for the December meeting. The Japanese Nikkei climbed up 3.3% as the economy continues to grow for the seventh consecutive quarter, representing the longest growth streak in 16 years.

In the Eurozone, economic momentum accelerated on the back of Germany’s impressive 2.8% growth and improved conditions in France and Italy. Euro Stoxx managed to limit their negative 2.1% return for the month despite political uncertainty in early November. The expansion of the quantitative easing programme has brought on expectations of new purchases and rising rates in the near future.

“Despite an inflation boost after reporting an eight-year low of 3% in July, Emerging Markets lagged Developed Markets this month…”

In preparation of Brexit, the UK has been tightening its fiscal policy with the Bank of England raising rates for the first time in a decade. This serves as a mechanism to support the economy throughout the negotiations. The UK market, as measured by FTSE 100, has delivered -1.79% for the month.

Despite an inflation boost after reporting an eight-year low of 3% in July, Emerging Markets lagged Developed Markets this month, due to the uptick in oil prices. MSCI EM delivered 0.2% for the month of November.

Low inflation globally, and accommodative forward guidance from central banks, contributed to the positive returns in many fixed income markets, while the pause in some high yield and emerging bond markets may still offer opportunities for fixed income investors.

Currency

“Europe has continued to build on its recovery during the year, with the repair work following the Eurozone crisis starting to bear fruit.”

The US Dollar Index softened by 1.59%, as a weaker dollar continued to provide a boost for multinational companies. The Federal Reserve’s plans to raise interest rates and reduce balance sheet risk constitutes the greatest risk, although the expectation is that they will continue to be cautious under the new chairman. Relative to other developed market currencies, the US Dollar had mixed results, with flat performance against the Canadian Dollar (-0.06%), up 2.3% on the Euro and down 1% on the Australian Dollar.

Europe has continued to build on its recovery during the year, with the repair work following the Eurozone crisis starting to bear fruit. Germany and Spain still lead growth, with Italy and France showing promise for 2018. The election of French President Emmanuel Macron and the subsequent planned reforms have been seen as positive signals going forward.

Emerging Market currencies performed favourably against the greenback as the Mexican Peso (2.82%), Japanese Yen (1.54%), Brazilian Real (0.09%), Indian Rupee (0.45%) and the Rand (3.66%) all posted significant gains. This can be attributed to the dormant inflation in the US and a bolstering of global trade due to key players like China being well-supported by the government. The Russian Ruble lost ground to its peers (-0.12%) as the economy continues to recover from the failure of large private banks in 2017.

Performance

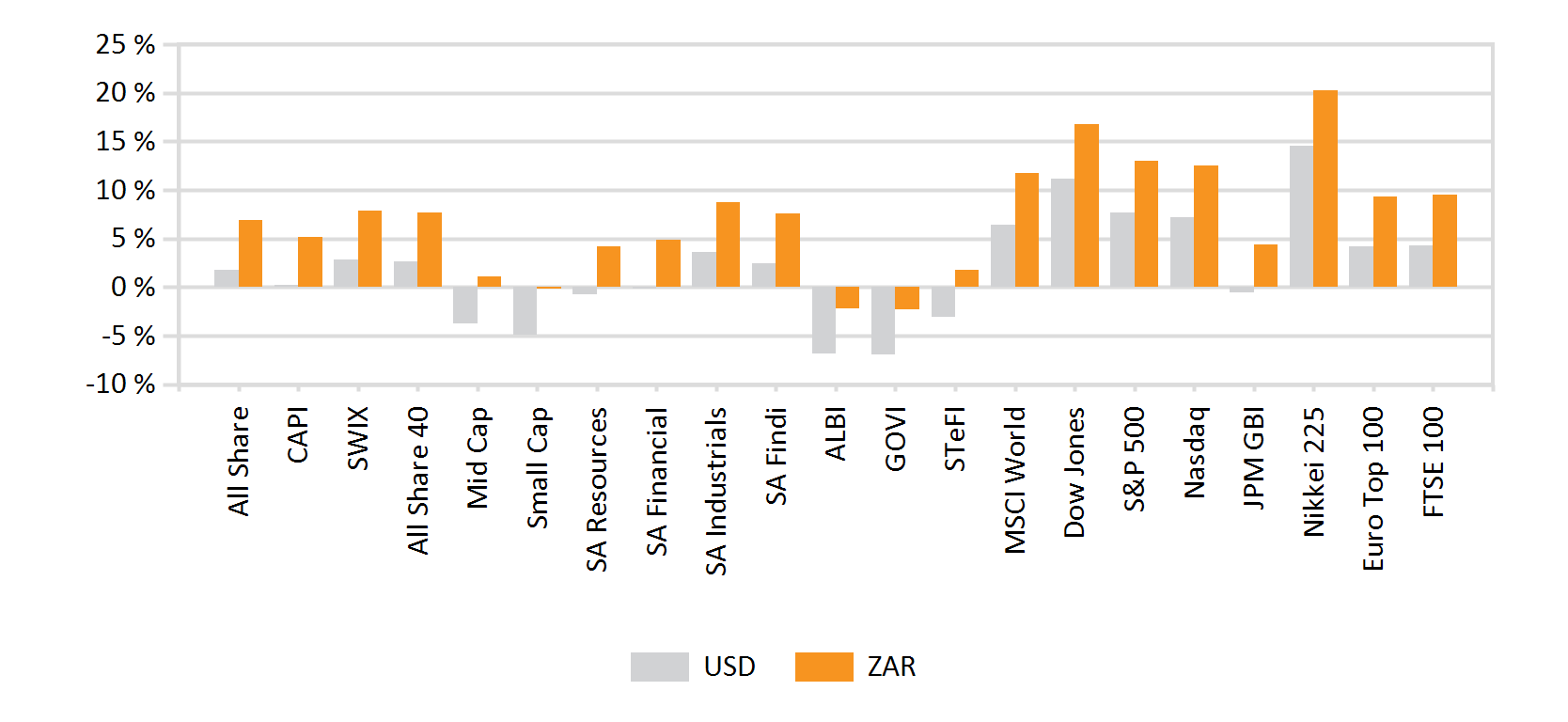

World Market Indices Performance

Monthly return of major indices

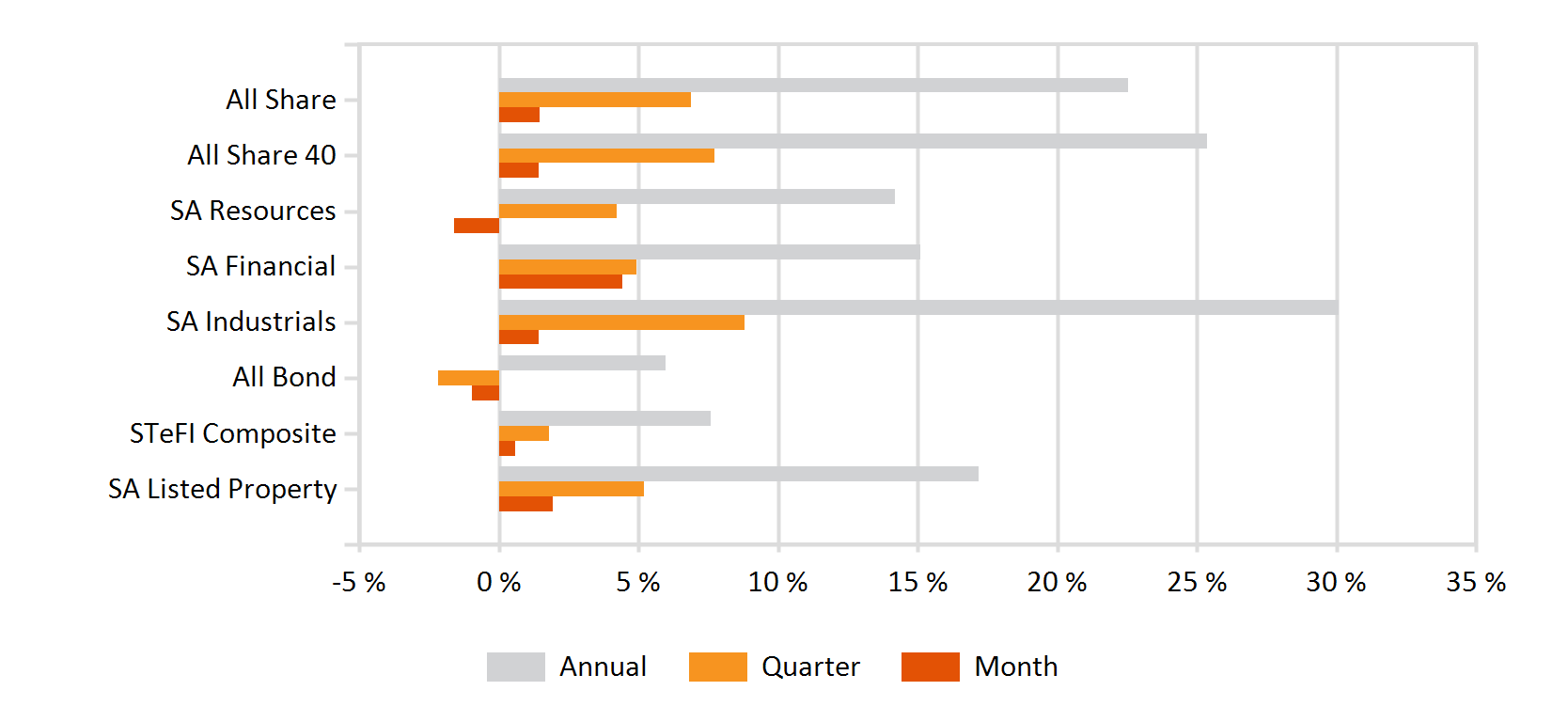

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance