Market Commentary: February 2018

Here are this month’s highlights: Developed and Emerging market equities, in a particularly volatile month, closed mostly lower. Investors were unsettled by prospects that the Federal Reserve may hike interest rates at a faster than expected pace and talk of trade-wars. Boosted by local political developments, however, South African equities outperformed global peers. The Rand and local bond markets rallied in response to a disciplined budget, and a reformist Cabinet reshuffle.

Market View

Cash

Annual inflation moderated to 4.1%, slightly below market expectations of 4.2%. This is the lowest rate since December 2011, and well within the South African Reserve Bank’s (SARB) target range. The Budget Speech took place on 21 February despite jitters that it may be postponed.

“The speech, which outlined measures for additional revenue-collection by the South African Revenue Service (SARS), potentially has a number of implications for consumer prices in the near term.”

These include: The Value Added Tax (VAT) increase (effective 1 March 2018) will have an immediate impact on food prices, while basic items are still zero-rated, a measure to ameliorate the impact on the poor, additional taxes on luxury goods are likely to hit the disposable incomes of wealthier pockets. Sin-taxes, as expected, have risen at a faster pace than inflation.

Simultaneously, personal tax and medical allowances for individuals have not kept pace with inflation, increasing the revenue base but also decreasing disposable income. The 52 cent increase in the fuel-levy is effective from April, and will have a knock-on effect on transport costs (and therefore an overall inflationary push). It is true, however, that the impact may be somewhat tempered by a stronger rand, with pump prices due to fall by 38 cents in March 2018.

Market participants have speculated that improved perceptions, and improved growth prospects have set the scene for SARB to cut rates at its next monetary policy meeting towards month-end. A wait-and-see policy may be the more prudent course at this time, particularly as the tax-impact filters through. South African cash returned 0.54% for the month.

Bonds

Local political events, and the 2018/2019 Budget Speech, appeared to ward off the spectre of a further ratings downgrade: Yields on South African benchmark government securities dropped to their lowest level since May 2015 during February. On the last Tuesday of the month, following the much-anticipated Cabinet reshuffle from South African President Cyril Ramaphosa, foreigners piled into the country’s government bonds. Trading was the most active since October 2012. The ALBI closed the month with a gain of 3.93%, easily outstripping local asset class peers. Inflation-linked Bonds yielded 1.3% for February.

Global bond markets were considerably more volatile. The Barcap GABI ended the month 1.47% lower. Market watchers awaited the first official speech from new US Federal Reserve Bank chairman Jerome Powell for firmer guidance on US interest rates.

“Recent positive growth and inflation data has fueled speculation that the Fed will start hiking interest sooner and more rapidly (four times, instead of the expected three times this year).”

Despite reassurances, US T-bill yields jumped toward record highs at month-end, reaching nearly 3%. Shorter dated notes remained under pressure and the flattening of the yield-curve continued. As a counterweight to a more hawkish Fed, comments from the European Central Bank (ECB) and Bank of Japan provided some reassurance as to still-easy money. Despite improving Eurozone growth prospects and inflation, the ECB has signalled that the 1.4% inflation rate achieved is still under its 2% target. It is in no hurry to drop its easing bias. Italian bond yields rose noticeably to over 2%, as uncertainty ahead of the elections saw selling action (bond prices and yields move in opposite directions).

Greek bonds rallied, as credit ratings agency Moody’s upgraded the country’s rating (yields hovered at 4.4% toward month-end). An upgrade to Russia’s sovereign debt rating proved a boon to European peripherals and Emerging Market Debt, with the latter outperforming Developed peers. The Barclays EM USD Aggregate returned -1.2% for the month.

UK Gilts were steady despite flaring Brexit tension, and German bond yields have steadied at near-2015 highs (though showing their first monthly decline for some time). The Bank of Japan has reiterated its commitment to reflation, though it seems increasingly likely that Prime Minister Shinzo Abe will need to rely on fiscal stimulus instead of monetary policy. The Bank, with Japanese inflationary pressures lagging those experienced in Developed peers, is already at risk of falling out of step with global peers should it maintain monetary easing beyond 2020. Corporate bond issuance was fairly strong, as new issuance was easily absorbed – US and Eurozone company earnings reports were mainly upbeat and business confidence has ticked up (as has capex). High Yield bonds, however again outstripped corporates, with High Yield bonds (measured by Bloomberg Barclays Global High Yield and Global Aggregate Corporate indices respectively) returning -1.28% and Corporates returning -1.92% over the course of February 2018.

Global bond investors are aware that the next few months contains a few crucial events, for both bond bulls and bears. Treasury is set to add an extra USD 1 billion to 10-year and 30-year notes in its auctions on the 12 and 13 March, as part of its ambitious borrowing and spending plan. Demand, however, has been weaker of late, especially amongst institutional investors. Italians go to the polls on the 4 March, while Germany’s Christian Democrat-leadership will learn the fate of their intended coalition with the Social Democratic Party on the same day. Japanese fiscal year-end is on the 31 March, which has in previous years signalled a sentiment-change toward T-bills for Japanese investors. The path of the USD and waning confidence in the Greenback is also likely to have an impact on rate-differentials, as non-US investors may look to repatriate assets over the coming months.

Property

The South African Property Market remained in the doldrums, with the listed index losing 9.9% in February. A January sell-off, initially sparked by fears that controversial Viceroy Research would target the Resilient Group, continued into that month. Despite not being the target of the Viceroy report (which proved to be Capitec), another report from a local asset manager caused serious concerns on company valuations and aspects of governance.

The sell-off saw share-prices in the Resilient Group (consisting of top counters Resilient REIT, Fortress Income, NEPI Rockcastle and Greenbay) earn a place as the worst performing REITS this year out of 199 global funds. The Group lost 35% to 45%. The report raised questions as to the cross-holdings of the Group and aggressive offshore acquisitions, as well as the use of creative accounting (which potentially distort the balance sheets and company valuations). Reference was also made to unsubstantiated rumours that management was manipulating share prices. The Group moved quickly to refute such allegations, and to reiterate its commitment to transparency and good governance. Steinhoff-shy investors, however, remained wary.

“While political developments at month-end, and National Treasury projections for domestic economic growth boosted sentiment toward SA property, the fundamentals still make for a more subdued asset class performance.”

In offshore markets, Developed Market Real Estate provided a more solid, albeit still uninspiring, return. US REITS responded poorly to fears of interest rate hikes, with the Bloomberg US REITS index yielding a negative return of -5.5%. This was mainly driven by large declines in US-Single Family home sales (which declined by 7.8% year on year) and a slow-down in mortgage applications, on Fed-hike jitters.

The EPRA/NAREIT index declined by 3.3%, though several markets continued to see pockets of strength. In the UK, while London office space is facing Brexit-headwinds, UK first-time homebuyers posted record numbers. Lower mortgage rates, record-high employment and the government’s Help-to-Buy scheme have encouraged new entrants. Europe, Hong Kong, Macau and Canada have also continued to experience strong appetite for residential property, with Hong Kong seeing a surge of 12.81% in 2017. The Hong Kong A-grade office space remains a bright spot: Low vacancy rates and healthy rental growth (1.3% month-on-month) saw an uptick in corporate transactions (with considerable input from mainland Chinese companies). Elsewhere in Asia, Japanese investors are starting to look at offshore real estate. The Japanese REIT market, long regarded with some trepidation as to the nature of holding-company-structures, seems to have peaked. With stable growth domestically, and higher yields available in overseas markets, analysts estimate that outbound flows will exceed USD 12 billion in 2018, with a renewed focus on Europe.

Equity

Local markets experienced an edge-of-the-seat February, as domestic political and economic events dominated the South African investor’s stage: The country saw its new President Cyril Ramaphosa deliver his inaugural State of the Nation Address, a tough balancing act in the 2017/2018 Budget Speech, and a Cabinet reshuffle that struck a compromise between new brooms and old alliances. As market participants and foreign investors cheered local political developments, local equities rallied toward month-end, outstripping most Developed and Emerging Market peers. The All Share Index slid 2% in February, lagging local ILBs and bonds.

The Budget Speech, though not eliciting a unanimous overjoyed response (particularly on the VAT increase that is being challenged by political parties) has been widely heralded as pro-investment. It holds out the promise of reducing the fiscal deficit by raising the revenue generated from ad valorem taxes, the fuel levy, and (the usual culprit) sin taxes. A framework for free higher education, and measures regarding the governance and turnaround-plan for state owned enterprises, are also thought to explicitly signal the need to crack-down on fiscally irresponsible behaviour. The Cabinet reshuffle ushered in a number of reformist appointments, although many political analysts noted the apparent compromises with some of the ‘old guard’.

“Both the Budget Speech and Cabinet reshuffle were well-received by ratings agencies. Fitch and Standard and Poors have been cautiously optimistic. The country may yet avoid a downgrade from Moody’s, which is set to release its review on the 23 March.”

South African government bonds, the rand and sentiment toward SA Inc were noticeably boosted by improved growth-prospects (echoed in National Treasury’s upward revision to estimates).

Resource shares and rand hedges were troubled toward month-end. Resource counters were hurt by worries regarding Chinese growth and simmering trade-wars. The Global Commodities Index (GSCI) declined by 3.3% for the month, with Industrial and Precious metals noticeably lower (-2.9% and -2.1%). Mining stocks Anglo American PLC and AngloGold Ashanti lost between 2.5% and 3% at month-end, and the resources index closed the month 4.8% lower. The strong performance of the rand, boosted by local political developments, also hurt rand hedges. The FTSE/JSE Industrial Index ended -3.02% in the red, echoing the decline in Naspers shares (-3.3%). Embattled Steinhoff saw further bad news, as the German authorities announced on 16 February that the Financial Market Authority was formally launching an open-ended investigation into insider trading at the firm. Steinhoff share prices plummeted by a further 15% during that month.

The JSE Financial sector, on the other hand, was boosted by a spill-over of positive sentiment post the reshuffle – the FSTSE/JSE Financial Index bucked the overall trend to close the month 2.58% higher. Capitec benefited from the overall recovery, and its management of the Viceroy allegations, adding nearly 4% for the month.

“It is, however, still early in the post-Zuma era, and South Africa (in particular its currency) remains vulnerable to domestic political noise and global sentiment swings.”

Toward month-end, the National Assembly adopted a motion for land expropriation without compensation, and the rand sank 0.7% to a two-week low. While analysts suggest that the decline is more a reflection of the correction in the USD, it does nonetheless highlight how fragile the country’s recovery may be. Investors will keep a close eye on further political developments, and on Moody’s toward month-end. Agility in responding to volatile local and global markets will remain essential.

International Markets

Major risk assets had a mixed month, with volatility taking centre stage on equity markets. US stocks tumbled at month-end, adding to the gloom of the worst month for equities in two years. European shares were lower, as investors fretted about Chinese output data. The S&P500 lost 3.69% in February, the Stoxx All Europe similarly slid by 3.67%, and Asian giants Japan and China were solidly lower (-4.41% and -5.9%, respectively).

Robust US growth data saw investors become increasingly jittery as to a faster-than-expected rate-hike trajectory. The testimony delivered by newly-elected Federal Reserve Bank chairman Jerome Powell, whilst designed to reassure investors, gave rise to speculation as to four rate-hikes during the year (versus the promised three). Market stresses were reflected in the sharp spike in the Chicago Board Options Exchange Volatility Index (CBOE VIX), which reached 37 points toward the end of February (In contrast to an average of 10 points and below over the course of 2017). The technology-heavy Nasdaq received a boost from better-than-expected earnings results from Hewlett-Packard, but other sectors were lacklustre. Earnings misses from Walmart and major retailers were another indicator of technology’s disruptive power, while substantial losses in Energy (-5.6% for the month) dragged on US and UK bourses.

Brexit nerves too continued to weigh on the FTSE100. At month-end, Prime Minister Theresa May took a hard line on the proposed draft Brexit treaty published by the European Union. The ‘divorce’ is set to be acrimonious, with issues around the Northern Ireland border and customs agreements particularly prickly. The FTSE dropped to its lowest point in three weeks, closing the month 3.4% lower.

UK business confidence too, has taken a knock, despite the reassurances from the Bank of England regarding better-than-expected growth. Consumer confidence has been in a two-year slump (bouncing between 0 and -13 since February 2016) and remains at near-record lows (-10, as recorded by global research firm Growth for Knowledge). A string of announcements regarding firms going under administration, implying potential plant closures and threatening job security, have further weighed on sentiment.

Since December 2017, Tescos, Debenhams, New Look, Sainsbury’s and Marks and Spencer have all announced staff cuts, while construction company Carillion folded. The most recent announcement of ‘game over’ came from Toys R Us, which announced that they had gone under administration, threatening at least 3000 UK-based jobs. Electronic specialist Maplin, too, has fallen prey to the on-line drive, short-circuiting on the same day (and putting a further 2500 jobs at risk).

Major European exchanges were negative for much of the month, despite the release of largely positive economic data and corporate earnings reports. The German DAX saw solid export data boost it at month end, though investors were still keeping a keen eye on whether Germany’s centre-left Social Democratic Party would form a coalition with Chancellor Angela Merkel and her centre-right Christian Democratic Union/Christian Social Union alliance. Peripheral markets were unsettled, with potential spill-over effects from Italian elections playing on investor sentiment. The fear is that a hung parliament or a fragile coalition (with the far right looking stronger than before) could further delay meaningful progress on growth-oriented policy reform.

Japanese equities have been sluggish in 2018 – the Nikkei lost about 6.95% since the start of 2018. Japanese data has been largely positive, with Japan’s manufacturing activity in expansionary territory, and buoyant exports rising by 12.2% in January year-on-year. The rise in exports, despite a slightly weaker Yen, has helped narrow the country’s trade gap to ¥943 billion versus ¥1,092 billion in January 2017. Economic growth, however, has not thus far translated into higher inflation. The index has held steady at 0.9%., well-below the target of 2%.

“Despite speculation, the Bank of Japan’s Governor Haruhiko Kuroda has reiterated that significant progress towards the target is a prerequisite for tapering its accommodative monetary policy.”

Chinese trading was thin, with domestic financial markets closed for much of the month for the Lunar New Year Holiday. The markets, however, reopened with a flurry of news, and the Shanghai stock exchange dropped -5.9% for the month.

Chinese President Xi Jinping has dropped term limits for the presidency, setting the stage for a multi-year reign (beyond 2025) and allowing for even-greater foreign policy manoeuvring. The Chinese government stepped up its campaign to crack down on excessive financial risk taking and rein in corporate debt. The intent was made clear when the government took control of Anbang Insurance Group Company. Anbang’s rapid growth has been fuelled by a number of acquisitive acquisitions, posing questions as to its financial stability. Separately, the company’s charismatic former chairman is also being prosecuted for fraud (shades of Steinhoff are present across the globe). Global investors have been further unsettled by reports that factory growth cooled noticeably in February – the official Purchasing Managers Index slumped to 50.3 (from 51.3). The reduction is partly attributed to a decline in New Exports, which raises questions as whether trade-war rhetoric had already started telling.

The concomitantly lower appetite for commodities and raw materials has had a knock-on impact on emerging markets elsewhere.

“The MSCI Emerging Markets Index closed 3.3% lower, with Asian stocks leading the losses. India, on the other hand, somewhat outperformed its Asian peers (though still declining by -4.89%): the country has overtaken China as the fastest-growing major economy, recording 7.2% annualised growth for 2017’s fourth quarter (versus 6.8%).”

Elsewhere, Emerging Latin American markets fared better, and Brazilian equities posted a modest gain of 0.5%. Mexican markets, conversely, bore the brunt of tough trade-talk from Trump, sliding -5.7%. Emerging European equities were solid, with the Russian market (despite the large decline in oil prices) recording a 0.3% gain. While Moody’s has taken a wait-and-see approach to South Africa’s credit rating, it had no such qualms for Russia. The country’s continued recovery has finally seen its sovereign credit ratings upgraded, boding well for capital flows.

African equities were mixed, though noticeably more steady than Asian and Latin American peers, partly boosted by US dollar weakness: Ghana has registered a solid year-to-date performance, as has Nigeria (up 12.11% for the year-to-date in USD). The MSCI EFM ex SA lost a relatively modest -1.10% for the month.

Currency

The US dollar had a particularly testing start to the year with 5% being knocked off the basket in the first few weeks. Comments from the new Federal Reserve Chairman, Jerome Powell, however, reinvigorated the unit. It rallied nearly 2% since mid-February and hit a six-week high at month-end.

The Eurozone, simultaneously, saw the release of softer inflation data temper expectations that the ECB would dial back its stimulus. The common currency declined and slumped by 5% – 6% from its almost three-year high of just a few weeks ago. Political uncertainties also hurt, as Italians and Germans take to the polls and the negotiating table, respectively.

A further slide, should sentiment turn negative following election results and Brexit negotiations, could turn brutal: Speculative long positions in the Euro were near all-time highs toward mid-month. Unwinding of these long positions will amplify any downward movements, and feed currency volatility. Sterling’s vulnerability was highlighted at month-end – as the EU released its draft divorce deal. The British Prime Minister was vocal in her condemnation and refusal of the terms. Markets are still eyeing the fall-out and potential future negotiations, but the pound slipped by 1% in the torrent of noise. The more upbeat trend in the dollar weighed on emerging market currencies, with most posting losses over the course of the month.

The MSCI Index of EM currencies declined by 0.7% in February. Currency traders, however, are not seeing the Greenback remain at lofty levels, and the prospects for EM currencies are therefore still favourable.

“Moreover, the South African rand proved to be the exception during February – the local unit reached a three-year high against the dollar and has appreciated by over 5% for the year-to-date.”

Commodity-backed currencies struggled somewhat. Oil prices ended their streak of monthly gains, as US Crude stockpiles were outstripped market-expectations. This has further fed speculation that a ramp-up in US production could scuttle OPEC’s attempts to rebalance the energy market. The US looks set to take over Russia’s spot as the world’s largest oil producer in 2018, having blasted past Saudi Arabia in 2017 (according to the International Energy Agency).

Gold, too, lost some of its lustre – with futures trading 1.8% lower at month-end, mainly dragged down by lack of appetite. While conventional wisdom holds gold as a safe-haven asset, expectations of rising interest rates and a stronger dollar (both in the wake of Powell’s speech) put pressure on bullion (which pays no interest).

Performance

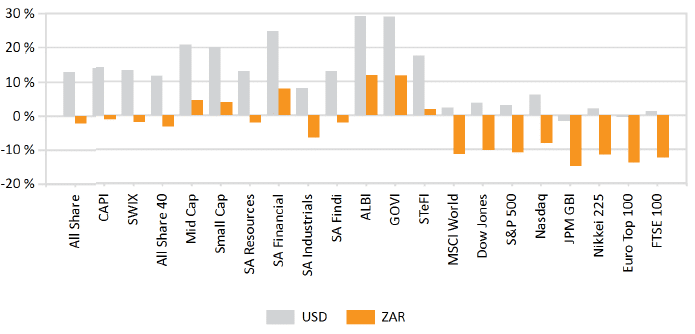

World Market Indices Performance

Monthly return of major indices

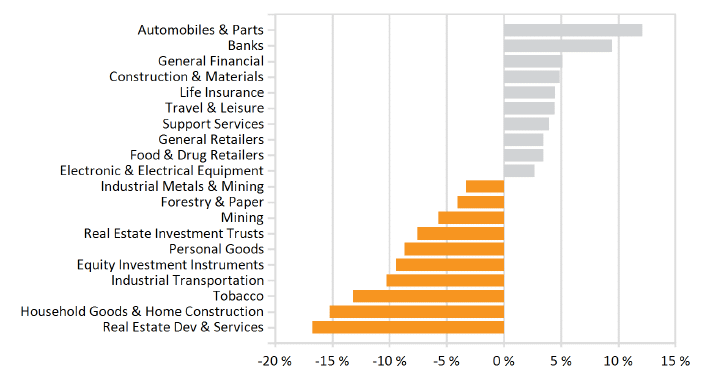

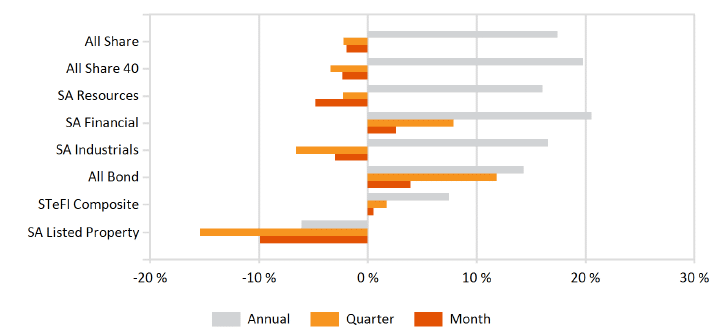

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance