Market Commentary: May 2018

Here are this month’s highlights: May saw little respite from geopolitically-driven volatility. Corporate earnings were largely positive, but global investors were left uneasy by the abrupt reversals in US rhetoric on Asia. Emerging markets bore the brunt of global risk-off sentiment. Whilst some markets were boosted by ever-higher oil prices, EMs with large current account deficits were particularly vulnerable. South African assets were not spared the broad-based sell-off. SA equities, fixed income and property markets all declined, and the rand slid against the dollar.

Market View

Cash

South African inflation remained within the South African Reserve Bank’s (SARB) target range, despite upward pressure from a weaker rand, higher oil prices and wage inflation. The SARB announced an improved outlook for domestic growth, likely to be driven by increased household consumption expenditure. Its repo rate remains unchanged. No rate reprieve is expected in the coming month due to imminent petrol price hikes (pump prices will hit record highs in June). South Africa Cash posted a 0.59% gain for May 2018.

Bonds

South African Fixed Income indices were mixed during May. The ALBI underperformed global peers, posting a 1.95% loss, relative to a 0.68% increase in the BarCap GABI. Inflation-linked bonds clawed back prior-month losses and inched 0.08% higher. The performance of South African bond markets, after a period of Ramaphosa-sparked buoyancy, fell back in line with other Emerging Markets (EM). On fundamentals, recent analysis from Bloomberg ranks South Africa at the bottom of the EM pack due to its substantial current account deficit, and further outperformance is unlikely at best.

“In terms of yield, South Africa appears to be in the middle of the pack – the benchmark bond yields more than India’s 7%, but noticeably less than Turkey’s 13%.”

Whilst difficult to compare the risk-return profile, it is worth noting that countries such as Hungary and Colombia, on similar S&P ratings levels, yield 3.3% and 6.6%, respectively. South African bonds are also particularly vulnerable to sentiment, with foreign holdings of government bonds well above the EM average.

Global government bond yields ticked up in May, though bond markets were notably volatile. Italian and Spanish political uncertainty triggered some wild swings in Eurozone markets. Peripheral yields spiked late in the month, as Italy looked set for fresh elections, and safer havens found favour. Month-end saw the Five Star and League coalition reaching consensus, Giuseppe Conte taking the reins as Italian Prime Minister and Pedro Sanchez oust Mariano Rajoy as Spanish Prime Minister.

Sentiment towards the Eurozone steadied, and markets recouped major losses. Europe’s political turmoil, renewed trade tension concerns between the US and its allies, deteriorating US-Sino relations and some see-sawing in the stance towards Korea sparked a flight to safety. A strong rally in German Bunds sent the 10-year yield down in the same month. US Treasuries rallied toward month-end, with the yield dipping sharply. US 10-year yields ended the month 9bps lower. In the UK, weaker growth and ongoing Brexit uncertainty saw the Bank of England’s Monetary Policy Meeting keep rates unchanged.

The Bank of Japan took advantage of lower yields to trim its purchases of 5- to 10-year Japanese government bonds for the second time this year. Risk-off sentiment and a stronger US dollar fed into a broader EM sell-off as fears about external account vulnerabilities were once again highlighted, and EM debt lost -1.1% (JP Morgan Emerging Market Government Bond Index). Similarly, risk aversion weighed on High Yield Debt, particularly in the Eurozone. The spread between investment grade and High Yield bonds widened noticeably during May.

Equity

South African equities, despite a month-end resurgence, lagged global developed counterparts. The All Share lost 3.48% during May, in line with the Emerging Market Peers, but outperformed several African peers. Resources were a notable outperformer on a sectoral basis, with the sub-index registering a 4% gain, partly aided by rand weakness and firmer platinum prices. Platinum miners Impala Platinum and Anglo American Platinum ticked up nicely at month-end, gaining over 5%.

Financials were weak, as increasing competition and relatively low interest rates put banks under earnings pressure. Telcos are posing noticeably stiff competition for banking sector dominance. The latest GMSA industry report shows that mobile operators are leading the pack, with 85% mobile penetration, on a continent where only 34% of the population hold bank accounts. The most innovative South African banks are therefore more likely to ride the wave, with FNB leapfrogging its peers in brand value according to survey results. Banks have done well in the post-Ramaphosa era – Nedbank’s stocks gained 24.7% in the past six months, Standard Bank nearly 20% and FirstRand about 8%. President Cyril Ramaphosa has reiterated his belief in the need for central bank independence and the efficacy and integrity of the country’s banking system. However, concerns still linger around state ownership of the SARB. The knock-on impact of the Viceroy report on Capitec, and the ongoing probe into VBS, have also rattled investors.

The domestic outlook was relatively benign: the SARB adjusted its prediction for GDP growth upward for 2018 and 2019 to 1.7%, in line with Reuters analysts’ forecasts. The progress since Ramaphosa’s election has been widely welcomed, but the SARB notes that significant structural headwinds remain. On consumer spending, things appear to be picking up slowly. New vehicle sales, often regarded as a gauge for appetite for durable goods, as well as propensity and ability to spend, were 2.4% higher year-on-year according to the National Association of Automobile Manufacturers SA.

Though it has been the subject of heated debate, positive perceptions regarding the National Minimum Wage Bill may further loosen the public’s purse strings. Tuesday, 29 May, saw its approval by National Assembly. The Bill, a first for the country, legislates an hourly minimum wage of R20. It is widely recognised that this is at best a starting point in lifting the living standards of the lowest tier of the labour market, but is seen as a positive step in addressing poverty and inequality.

Toward month-end, ratings agency S&P appeared to echo a more favourable outlook on SA’s economic prospects, though noting the challenges. The agency affirmed the local currency debt at BB+ and maintained foreign-currency debt at BB. Locally, political noise had died down somewhat, and domestic markets took guidance more from global developments than any changes in underlying fundamentals. The weakness in the local bourse during May has been dictated by global risk aversion. It once again shows how sentiment-driven, cyclical and concentrated the market can be.

Property

South African listed property slid during May, with the local index posting a 5.92% loss. The SAPY is down nearly 20% for the year-to-date, reflecting a combination of challenging local fundamentals, a correction from previously lofty valuations, and company-specific external market shocks. The most recent decline reflects the broader sell-off in bond yields, in South Africa and other Emerging Market peers.

The Monetary Policy Committee decision to keep interest rates flat, and the 10% home loan rate, was not unexpected and had largely been priced into the market.

“The sector, despite positive sentiment post the leadership change, has yet to see a significant uptick.”

The uncertainty around land expropriation has also weighed on foreign investor sentiment. But, there are some positives. Banks are receiving and granting more bond applications, signalling an improvement in microeconomic conditions.

At the macroeconomic level, improved growth prospects and sound fundamentals are likely to filter through in the medium run. The recent poor run in the sector may have allowed for a correction and listed property counters are likely to be nearing fair value. Gauteng property markets have picked up, signalling that confidence may be returning. Logistics and ‘green’ solutions remain in high demand. A number of SA Real Estate Investment Trusts are also continuing their forays abroad, with notable deals over R1 billion in May. Investec Property Fund entered Europe for the first time in a pan-European logistics portfolio, while Vukile Property Fund expanded its Spanish footprint. The offshore expansion trail of SA REITS has taken on such momentum that about 40% of assets owned by the top 20 constituents of the listed index are ex SA., and only two of the top 20 have zero offshore exposure.

In the offshore property sector, the FTSE EPRA/NAREIT delivered over 2% for the month, with US and Asian markets outstripping European peers. US home price gains continued to accelerate, appreciating by an average of 6.5% for the year-to-date and defying some analysts’ expectations. The rise is attributed to demand-side dynamics, supply-side constraints and an uptick in wages.

Logistics continues to be a global growth industry, with investment into the European sector for instance doubling in the past year. The growth in e-commerce and the structural changes in the retail market will continue to drive these sectors forward. The unlisted property sector has proven to be the preferred route to access European real estate, with 50% of global investors surveyed expected to increase their allocation to the sector. While access to suitable products is still limited, access to expert management is essential. Careful selection and management of locale and purpose is therefore critical, for domestic and global allocations, in the listed and unlisted sector.

International Markets

Global equities were mixed during May. Corporate earnings season concluded on a mainly positive note, with several companies exceeding expectations. On the diplomatic front, there were hurdles in progress toward resolving tensions on the Korean peninsula. A much-anticipated meeting between US President Donald Trump and the North Korean leader Kim Jong Un was cancelled, despite the latter’s widely publicised dismantling of nuclear facilities.

“Chinese-US trade tensions remain at a low boil throughout May and stalled after initial progress.”

China had agreed to a few concessions, and more talks are on the cards when US Commerce Secretary Wilbur Ross visits the country in early June. In a bid to narrow the trade gap, China had undertaken to purchase more goods from the US energy and agricultural sectors and promised that intellectual property rights would be better enforced, having tightened up its patent law. The measures, however, did not appear to satisfy President Trump. He also announced that tariffs on USD 50 billion of Chinese goods would move forward and that further restrictions would be placed on Chinese investment in US tech firms. The Shanghai composite witnessed its worst weekly performance in the run-up to month-end, losing nearly 2%.

US and European consumer and business sentiment remains upbeat against a backdrop of solid economic growth. Though recent US consumer sentiment readings are off their multi-year highs, investors remain upbeat on stock market prospects, particularly with strong earnings growth expectations (on tax cuts and rising share buybacks). Employment is at an 18-year low and the latest jobs report showed that April was the 91st consecutive month of job creation (164 000 non-farms jobs were added). Average hourly earnings rose 2.6% from the previous year.

“The Fed, sounding more dovish of late, released its May meeting minutes that show it may be willing to let inflation run a little hotter than its 2% target, reducing concerns around faster rate hikes.”

The S&P 500 returned 2.41% for May, though energies and financials were under pressure. European politics, with Italian Euroskeptics facing off against Pro-EU factions, rattled financial markets at month-end. The power struggle is the result of an inconclusive vote in March, leaving the Eurozone’s third largest economy without a government. Fiscal discipline has been sound, economic growth solid and unemployment low, but radical elements could still upset the stability of the Eurozone.

Brexit negotiations are plodding along, and Prime Minister Theresa May has been dealt a few House of Common defeats lately, so the dissenting voices within the Eurozone are assured of an audience. The Brexit timeline could be extended to 2023 as Prime Minister Theresa May reportedly requested a second transition period. Simultaneously, the Eurozone Purchasing Managers’ Index (PMI), a key survey of business activity, fell to its lowest level in over a year, calling into question the strength of Europe’s economic recovery. Inflation was soft in the UK, but retail sales were a bright spot. The FTSE100, on solid corporate earnings, came under pressure as energy prices fell toward month-end and Euroskepticism took centre stage. The FTSE gained 2.8%, outstripping European peers as the STOXX All Europe gained a modest 0.35%.

Asian markets were mixed – the US’s apparent reconciliation with China was offset by the sudden reversal on North Korea. These jitters have seen rotation toward the safe haven yen, which has weighed on Japanese exporters, as well as on inflation and earnings prospects.

“Japanese automakers also registered sharp declines amid reports that the Trump administration was considering tariffs of up to 25% on imported cars.”

But, Japan is looking good on many counts, with GDP growth picking up and surpassing its 1997 pre-deflationary peak. An aging population, long a concern, is not a challenge unique to the Japanese economy and Abenomics has made notable progress in making corporate governance more shareholder-friendly. Nonetheless, after hitting a 26-year high early in 2018, the Nikkei lost 0.53%% for the month.

Chinese stocks, despite the much-anticipated inclusion of Chinese A-shares in the MSCI’s global benchmarks, could not shrug off global risk aversion. The Shanghai Stock Exchange Composite Index registered a modest 0.42% gain. Several smaller Asian emerging markets, particularly those with highly tech-concentrated and export-oriented markets, were also in the line of fire. Singapore emerged as one of the stronger performers, while Taiwan struggled. Indian equities gained on positive sentiment toward automakers.

The stronger US dollar and rising treasury yields may have put the spotlight firmly on Emerging Markets, particularly those with large current account deficits. Within Emerging Latin America, Argentina was initially hard-hit by this perceived vulnerability. The government, under President Mauricio Macri, has implemented a positive pro-market agenda that removes capital controls, encourages inward investment and alleviates currency volatility. Brazilian markets are currently in a sweet spot. Growth has been picking up steadily, unemployment fell, and inflation and interest rates are trending lower. Brazilian equities have also benefited from the recent commodity-boom. It is clear that investors need to be wary of painting emerging markets with the same brush. Pockets of extreme vulnerability do emerge, with Turkey one of the most recent within EMEA. The Turkish lira lost another 5% during the last week of May, despite its central bank’s emergency 300-basis-point (3% points) rate increase and other efforts to stop the currency’s decline. The lira fell by about 25% this year.

Russia, on the other hand, despite the ongoing geopolitical tension relating to election-rigging, Syria and spygate, has held up well. The country has a 2% current account surplus of GDP, is experiencing record low inflation, and has benefited considerably from the substantially higher oil price. The MICEX dipped a modest -0.18%.

“A few African countries have similarly reaped the benefits of higher commodity prices, but were weighed down by local currency weakness and current account balance concerns.”

Nigerian markets, for instance, were unable to capitalise on higher oil prices and lost 8% in US dollar terms. An outlying star performer, the Zimbabwean exchange yielded 9.3% in USD terms.

Investors remain rightfully cautious, as geopolitical noise is likely to continue sparking episodes of extreme volatility.

Currency

The US dollar continued its run during May, up 2.3% against a basket of currencies. Emerging Market currencies had a somewhat devastating month, highlighting current account vulnerabilities. Geopolitical events added to monetary policy woes in a few regions.

“The Turkish lira continued to lose ground despite efforts to prop up the currency with aggressive interest rate action, while the Mexican peso dropped by 6% as tariff-jitters took hold.”

Though a rise in oil prices boosted the Russian ruble, the Brazilian real failed to capitalise and lost 6%. Sterling and the euro suffered from a lack of political clarity (regarding Brexit and peripheral elections), losing 3.4% and 3.2%, respectively. The rand too depreciated against the dollar, though showing resilience relative to trading partners (nearly 2% appreciation versus sterling and euro) in line with Emerging Market peers.

Commodities were mixed during May. Oil prices surged to a four-year high during the month, and hit the USD 80 per barrel mark after President Trump withdrew from the Iran nuclear agreement. The rise reflects continuing strong demand – with China and India’s growth engines needing increasing fuel and supply-side constraints. OPEC has remained committed to its targets, Iranian supply is likely to come off-line and Venezuelan output has collapsed on political upheaval. Oil prices retreated somewhat to USD 78 per barrel, as Saudi Arabia, Russia and North America look set to boost production. Industrial metals were stronger, while precious metals slipped. Gold lost 1.4% during May.

Performance

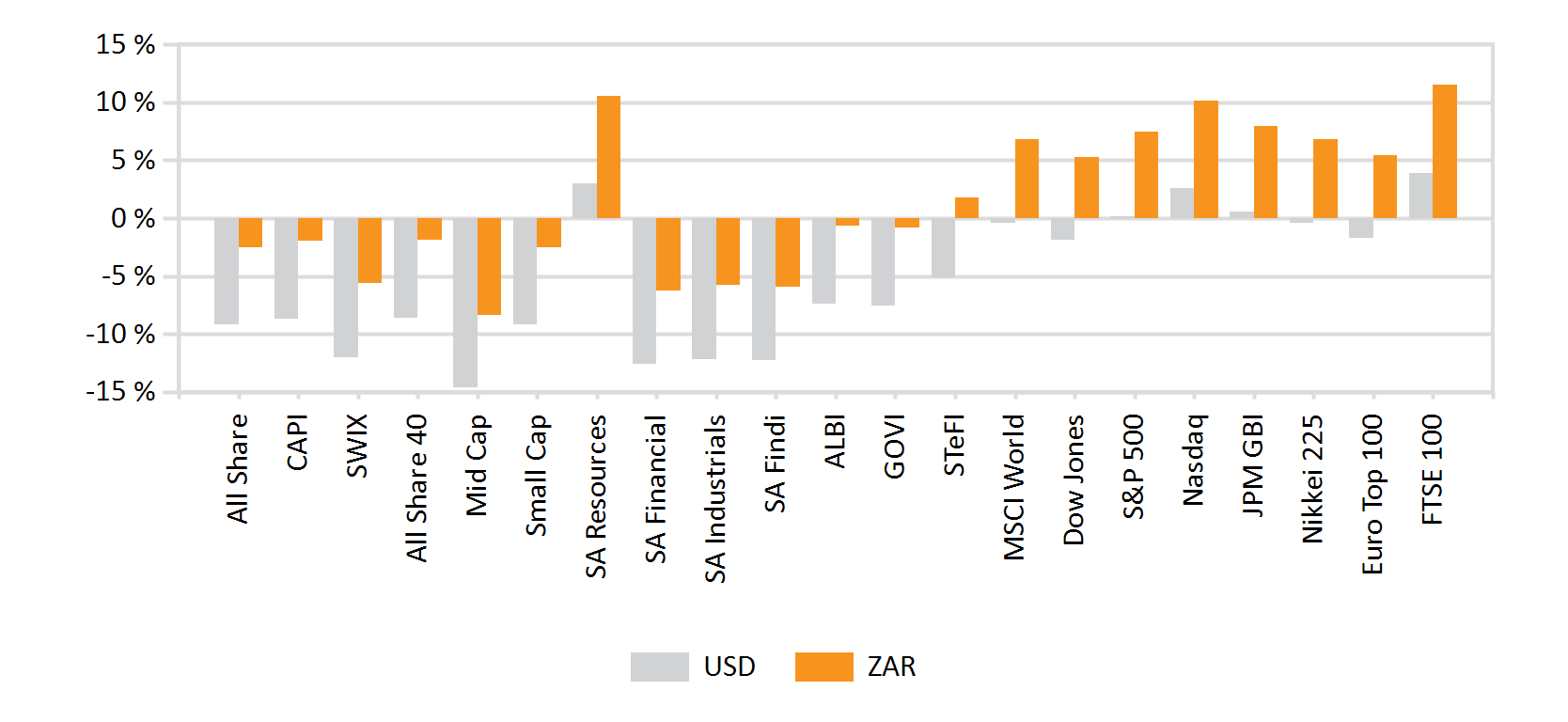

World Market Indices Performance

Monthly return of major indices

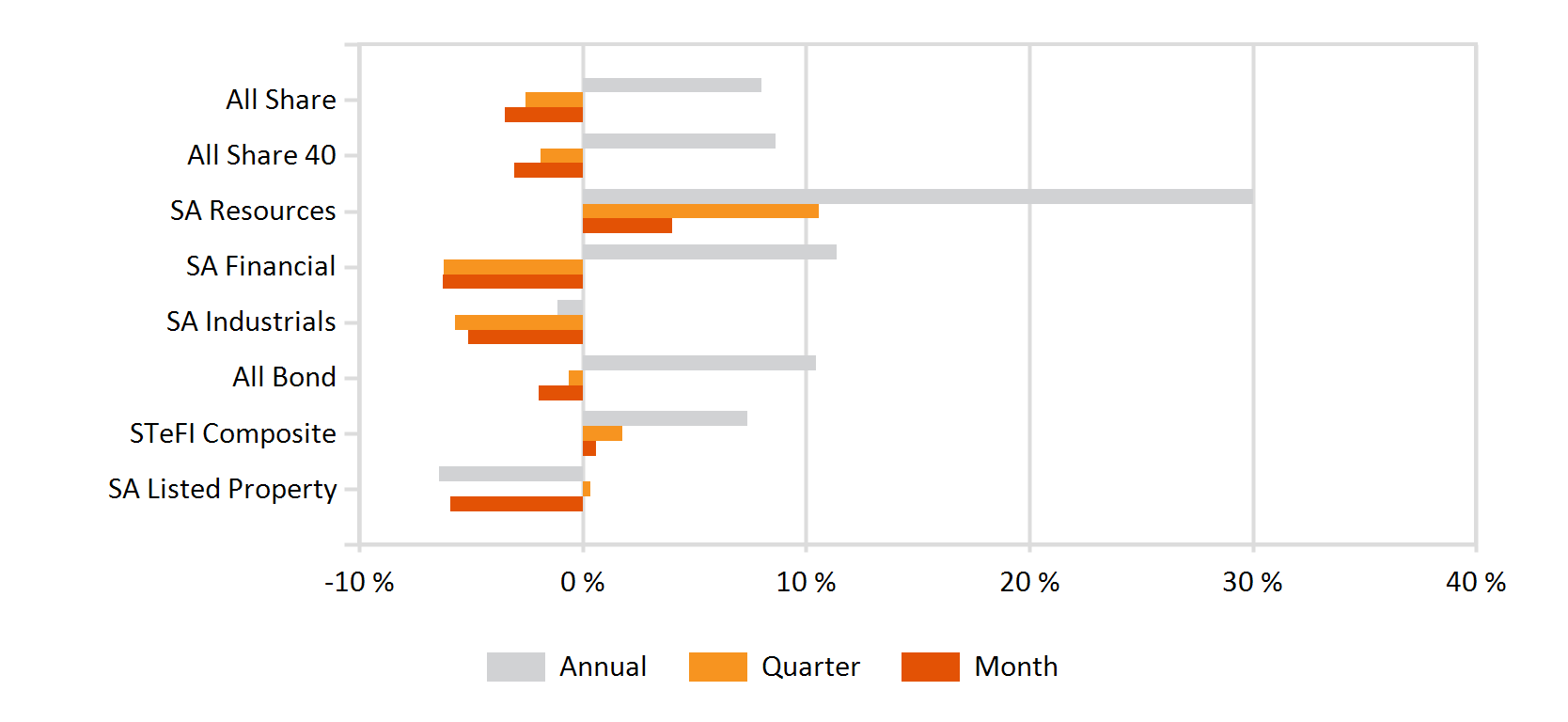

Local Market Indices Performance

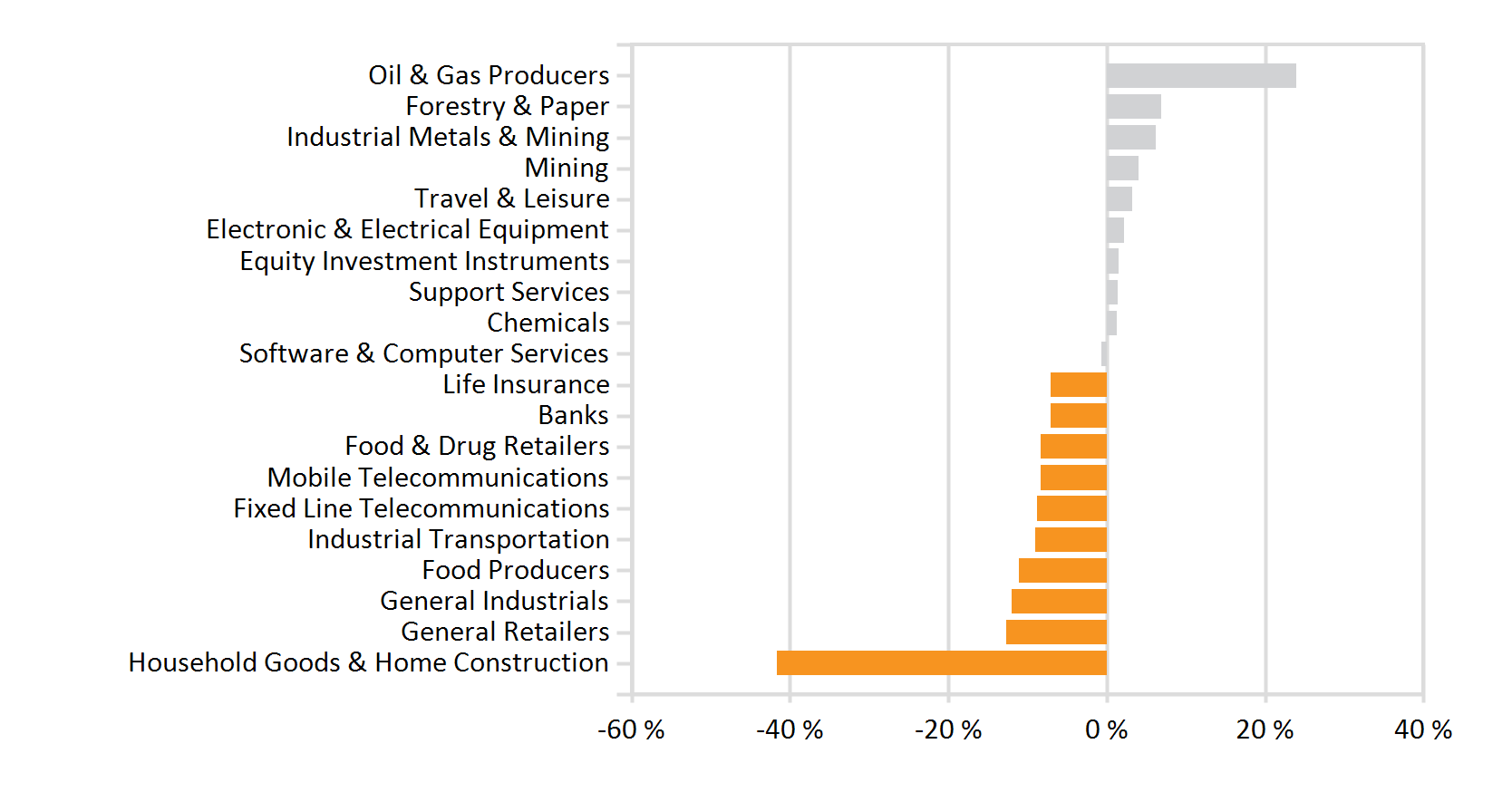

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance