Market Commentary: June 2018

Here are this month’s highlights: The second quarter of 2018 ended on a bumpy note. Global trade tensions, the stalemate between Britain and the EU, and geopolitical spill-overs made headlines. Sentiment-driven emerging markets, technology stocks and cyclicals were noticeably volatile. South African equities, after an initial sharp sell-off, recovered toward month-end to close higher. Local bond and fixed income investors remained jittery, and the currency depreciated sharply against the greenback.

Market View

Cash

South African consumers came under significant pressure during June. Currency weakness and higher oil prices weigh heavily on the pocket, the ongoing industrial action could see wage-inflation rise sharply and domestic demand figures are proving to be a disappointment. Consumer Price Index (CPI) and Producer Price Index (PPI) inflation are therefore likely to hit the upper limit of the South African Reserve Bank’s (SARB) target range. Cash-strapped consumers should expect no rate-reprieve in the near future. South African Cash posted a 0.6% gain for June.

Bonds

South Africa fixed income posted losses for the month, as Emerging Market (EM) sentiment soured and ‘Ramaphoria’ continued to wane. The ALBI posted a loss of -1.19%, significantly undershooting the BarCap GABI, up more than 7%. Inflation-linked bonds (ILBs) were also weaker, losing nearly 2% and erasing year-to-date gains.

Tense trade rhetoric, the uneasiness in the Middle-East, currency weakness and grassroots dissent in a several emerging markets saw sentiment towards emerging sovereigns sour further.

“South African bonds were not spared – the first half of the year has been noted for record outflows of R40 billion, and June was no different.”

With bond prices and yields moving inversely, rapidly selling action caused a sharp spike. The impact has been more noticeable at the longer end of the curve (leading to a steeper slope), and the yield of the benchmark R186 settled at 8.84% at month-end. A weaker inflation outlook typically tends to support demand for inflation protecting assets, and the relatively benign South African environment saw demand for ILBs taper. June, despite inflationary jitters, saw a continuation of this trend.

Global government bond markets were subject to significant periods of volatility during the first half of 2018: A number of monetary policy moves were priced in — tightening US rates, tapering of Eurozone quantitative easing and Japanese monetary policy diversion.

As expected, the US Federal Reserve increased rates by 25 bps at its June meeting. The 10-year T-bill yield, after hitting a high of over 3%, eased back to 2.8% at month-end and investment grade and high-yield spreads widened. Geopolitical spill-overs made for a more sentiment-prone bond investor. Emerging markets and Eurozone peripherals were hurt by renewed risk-off sentiment, as trade tension escalated toward month-end and investors sought safety in Developed Market Sovereigns. The 10-year Bund yields fell 20 bps to 0.3% at quarter-end (moving in inverse to demand and price), in contrast to Italian ten-year yields which posted a 90 bps increase to 2.68% over the same period.

EM debt saw little respite in a tough quarter, with currency weakness and country-specifics adding to vulnerability, and the JP Morgan Emerging Market Government Bond Index lost 3.5% over the quarter. Higher oil prices were a boon to selected Emerging Markets, but High-Yield Debt fell victim to risk-off sentiment and additional OPEC-related uncertainty.

“The spread between investment grade, corporate and high-yield debt widened again during June.”

There was a marked difference in European and US High-Yield, however, with the latter outperforming Corporate Bonds during the quarter, and the former significantly underperforming.

Equity

South African equities did not escape the Emerging Market route during June, but recovered nicely toward month-end. The ALSI closed 2.8% higher, led by an uptick in Resources and Industrials at 5.96% and 4.18%, respectively. While currency weakness boosted these export-oriented industries, it weighed on the performance of Financials, with the broad index closing 2.9% softer on banking sector weakness.

“Prospects of interest rate cuts may be off the cards. However, future earnings prospects are likely to improve.”

In addition, confidence in the banking sector, at grass roots was boosted by the SARB’s pro-active response to the VBS saga. It sees Nedbank stepping in to make good on withdrawals for select depositors though excluding municipalities, it mitigates the impact on the man-on-the-street.

Although the outlook on South Africa was largely benign, investors are tempering their expectations. Several factors continue to weigh on the domestic economic environment, as reflected in the first quarter GDP figures — a contraction of 2.2% according to Statistics SA. National Treasury and local policymakers have taken steps forward, but still face a daunting task in addressing structural impediments and restoring investor and popular confidence.

Business confidence in South Africa was lower during the second quarter of 2018, according to the RMB/BER Business Confidence Index. Tense wage negotiations in a variety of sectors and at various institutions (Eskom, SASSA, the Post Office) have the potential to further derail positive momentum.

“Consumers, already struggling under the VAT increase, will also feel the pinch of petrol price increases, which filter through to the basic goods basket quite rapidly.”

While the weaker rand weighed on consumer sentiment, a number of dual-listed hedges and resource stocks took the opportunity to shine — British American Tobacco ticked up nicely as did Diversified Miner BHP Billiton posting nearly 7%. Richemont, a traditional rand-hedge, was somewhat hurt by weakness in Asian markets, and managed a modest 1%. Conversely, Naspers, despite its substantial exposure to China via Tencent, posted nearly 9% for the month.

A flight to safety may be the more knee-jerk reaction, but South African fundamentals remain little changed, if not much improved. SA Inc, while not out of the woods, is likely to recover better than its Emerging Market peers.

The current investment environment appears highly sentiment driven and volatile. Consequently, equity investors need to be particularly aware of the cyclical nature of markets, of being agile in their allocation, and of building sufficiently diversified portfolios.

Property

Listed property markets closely tracked South African bond movements, declining noticeably during June. The South African Listed Property Index slid 3.45%, and the year-to-date loss has hit over 20%. The sector is struggling to recover from a quadruple-blow — some analysts regard it as overvalued prior to December; the sharp deterioration in the Resilient Group highlights the risks in the concentrated index, the bond-market sell-off has spilt over, and concerns over land expropriation have stinted foreign inflows.

The June decline may partially reflect some rebalancing, as benchmark tracking funds shift from the SAPY to the ALPI, in line with the JSE’s changes. SA-centric companies have continued to trade at positive yield spreads to the South African long bond, while offshore companies are trading at attractive forward yields to their respective long-term government bond yields.

“Given some oversupply, catch up in South African rentals will take time, even in a tenuously improved macroeconomic environment.”

The FTSE EPRA/NAREIT delivered 2.18% for June, with the US showing the best performance among its listed real estate peers. Investors shunned the sector in a rising yield environment, but the Federal Reserve’s interest rate cut saw a dip in US 10-year T-bills. REITs were therefore back in favour, as real assets spoke to increasing risk-off sentiment.

“Demand for industrial logistic space continues to grow apace.”

Despite the political rhetoric around tariffs and potential trade wars, the US has seen manufacturing growth. Online retail sales growth is expected to continue at mid double-digit growth rates for a prolonged period, both in the US and in Europe. One of the unintended consequences of trade wars, and relocation of businesses post Brexit, may be to further speed up the online sales and services growth.

“Developing logistics hubs can prove to be a significant opportunity.”

The growing need for a concerted European response to the migrant crisis may also create opportunities in lower-cost housing segments, though residential property remains under pressure. Exploiting these niches is likely to fall to the unlisted property sector, further strengthening the argument for gaining exposure to property via this asset class. Careful selection, timing and monitoring is crucial in this regard.

International Markets

The quarter ended on a tense note for global equity investors. June saw the optimism that bloomed during May wither, and global developed equities ended largely flat.

“As investors sought safe havens, Emerging Markets, continued to slip.”

The MSCI World was down 0.05%, easily outstripping the MSCI EM, down 4.15%.

Despite concerns around trade protectionism, and the pace of Federal Reserve Bank rate hikes, US equities ended the month in positive territory. The S&P 500 closed June 0.62% stronger, after earlier hitting its lowest level since the surprise Brexit vote in 2016.

Economic data was mixed. Growth in the first quarter GDP was revised somewhat lower, while new homes sales jumped (indicating healthy demand for longer run capital outlay), house prices softened, and durable goods orders declined. Jobless claims ticked up, but personal income and consumer expenditure were higher during May.

Upbeat earnings reports spurred a rally in consumer areas, with Amazon soundly beating expectations. Rising oil prices boosted energy counters. Financials posted a solid recovery, partly in response to expectations of higher margins, as the Federal Reserve implemented its expected hike. These factors outweighed elevated trade-related concerns, stemming from the imposition of tariffs on over USD 50 billion of imported Chinese goods that saw substantial volatility in heavyweights such as Caterpillar and Boeing.

“Global trade tension, and an apparent stalemate in Brexit negotiations, weighed on UK and Eurozone equity markets.”

The FTSE100, after a solid year-to-date, lost 0.23% while the STOXX All Europe gave up 0.65%.

UK market news was mixed – the Royal Wedding and unusually warm weather boosted May retail sales. Conversely, House of Fraser became the latest casualty in a string of High-Street closures and Poundworld went into administration.

Eurozone automakers bore the brunt of trade war jitters, with looming tariffs and tough Brexit-talk weighing on the sector. European economic data remained supportive, as the PMI rose seven points in June, unemployment remained stable and consumer spending was in line with expectations.

“US-China trade tension continued to hamstring Asian markets, which ended mostly lower.”

While the yen depreciation supported Japanese exporters, equities were unable to take full advantage and the Nikkei posted a modest gain of 0.65%.

Japanese carmakers remain uncertain as to the impact of tariffs, and the fall-out from resurgent Korean tension. On the inflation front, progress has been encouraging, as higher energy prices and a 2.1% annual spring-wage hike feed through. The Bank of Japan has kept its policy largely unchanged.

Chinese equities were weak with the release of a final list of tariffs on USD 50 billion of goods, as well as a looming threat on USD 200 million.

“The Trump administration also announced its intent to limit Chinese investment in US firms, with the view that this would protect US intellectual property and technology.”

China has retaliated with its own restrictions, but as is the nature of tit-for-tat, there is unlikely to be a winner. China’s economic and manufacturing data has already delivered a downside surprise for May.

Elsewhere in Asia, higher oil prices dragged on oil-importers such as India, adding to trade woes. Korea posted one of the worst performances in the region.

“Latin American markets continued their decline, though Mexico was a surprising bright spot, up 7.3%.”

Argentinian shares plummeted by 22%, even as the International Monetary Fund stepped in with a US 50 billion loan, and Brazil was weak, down 5.3%, despite higher resource prices.

The EMEA region finished lower. A victory by Turkish President Recep Tayyip Erdogan did little to stem the tide of rising inflation and dissent. Greece is set for a graceful exit to its bailout agreement, buoying share prices.

Within Africa, mining stocks and weaker metal prices weighed on ore-exporters such as Angola, South Africa and Zambia, and the continent has taken a bit of a hammering. The MSCI EFM ex SA closed modestly higher, mainly due to a boost from oil-prices. However, as China is Africa’s largest trading partner and its investment into the continent may reach USD 100 billion (Moody’s estimates) by 2020, ever-sharper rhetoric and increased protectionism is foremost on investors’ minds.

Currency

The US dollar (USD) strengthened further in June. It was up 0.5% against a basket of currencies, as trading partners and Emerging Markets suffered the fall-out of tense trade rhetoric.

The Japanese yen depreciated 1.7%, and the Aussie dollar slipped in line with gold prices, while the Chinese yuan (partly in response to government interventions) lost 3.4%. Sterling was volatile – Brexit uncertainty was noticeably heightened during June.

Emerging market currencies again bore the brunt of risk-off sentiment with the Brazilian real depreciating 3.8%.

“The South African rand was one of the worst performers for the month, hitting year-to-date lows against the USD and showing a 7.5% depreciation.”

Commodities posted a positive return for the second quarter and the overall GSCI gained 1.4% in June. Oil prices, while volatile in the run-up to OPEC’s decision to increase supplies, continues to rally.

“Global pump prices have reached new peaks, sparking protests in a number of countries (from Germany, to Venezuela, to South Africa).”

Industrial metals and precious metals were somewhat weaker, partly reflecting the impact of heightened trade tension and tariffs. Agricultural commodities also declined, partly as a knock-on effect of tariffs. Perhaps one of the more interesting unintended pass-throughs is to US soybean producers, with China being their largest market. Prices declined by 15.3% during the month.

Gold posted a 3.7% loss in June.

Performance

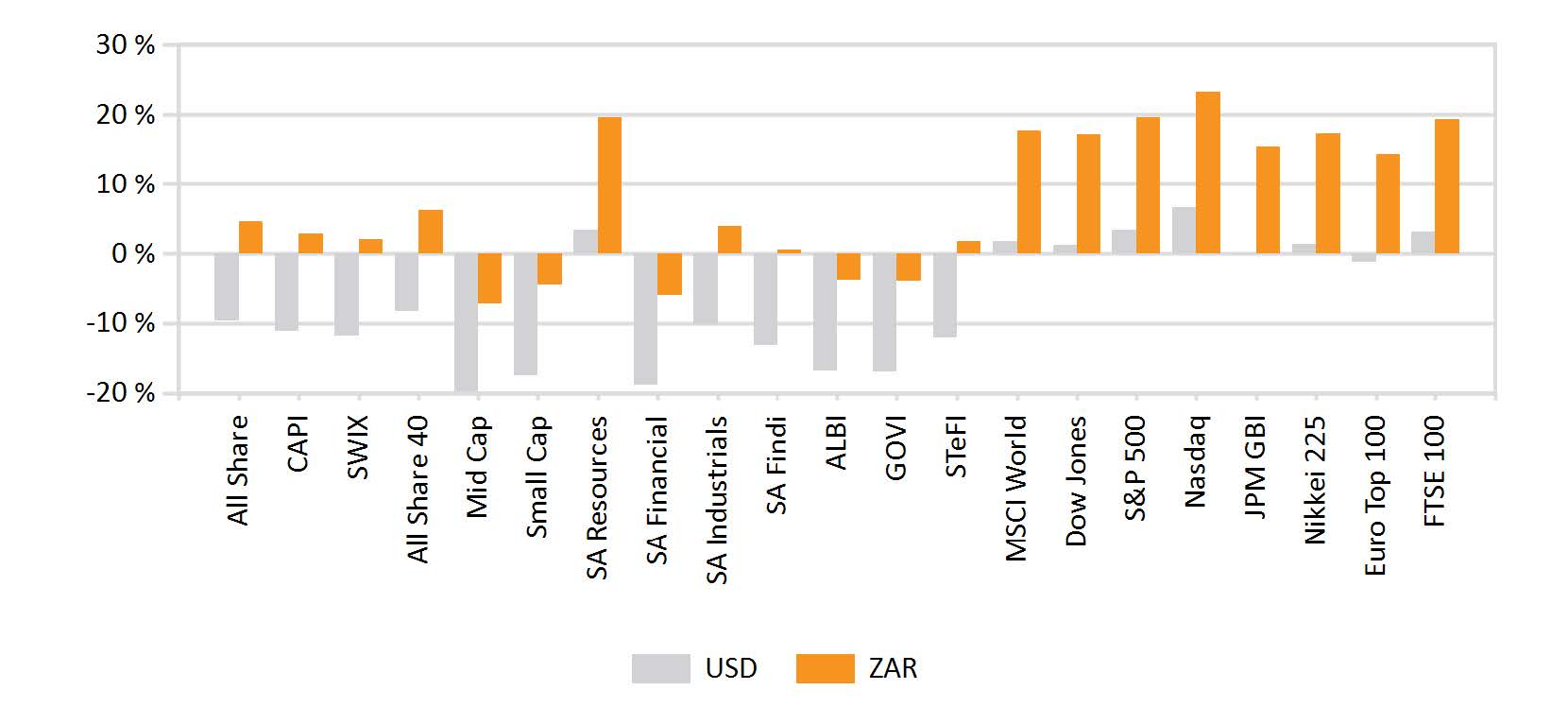

World Market Indices Performance

Monthly return of major indices

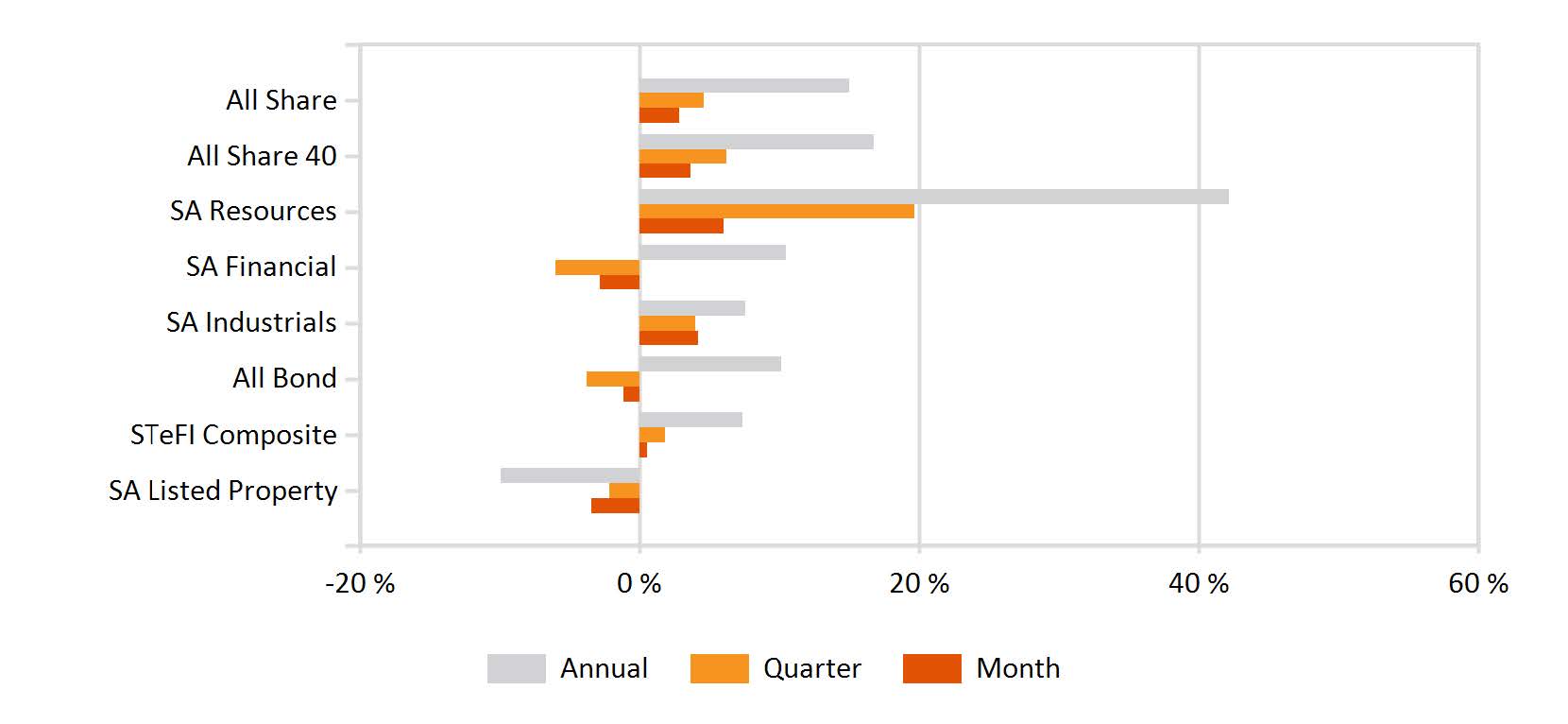

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

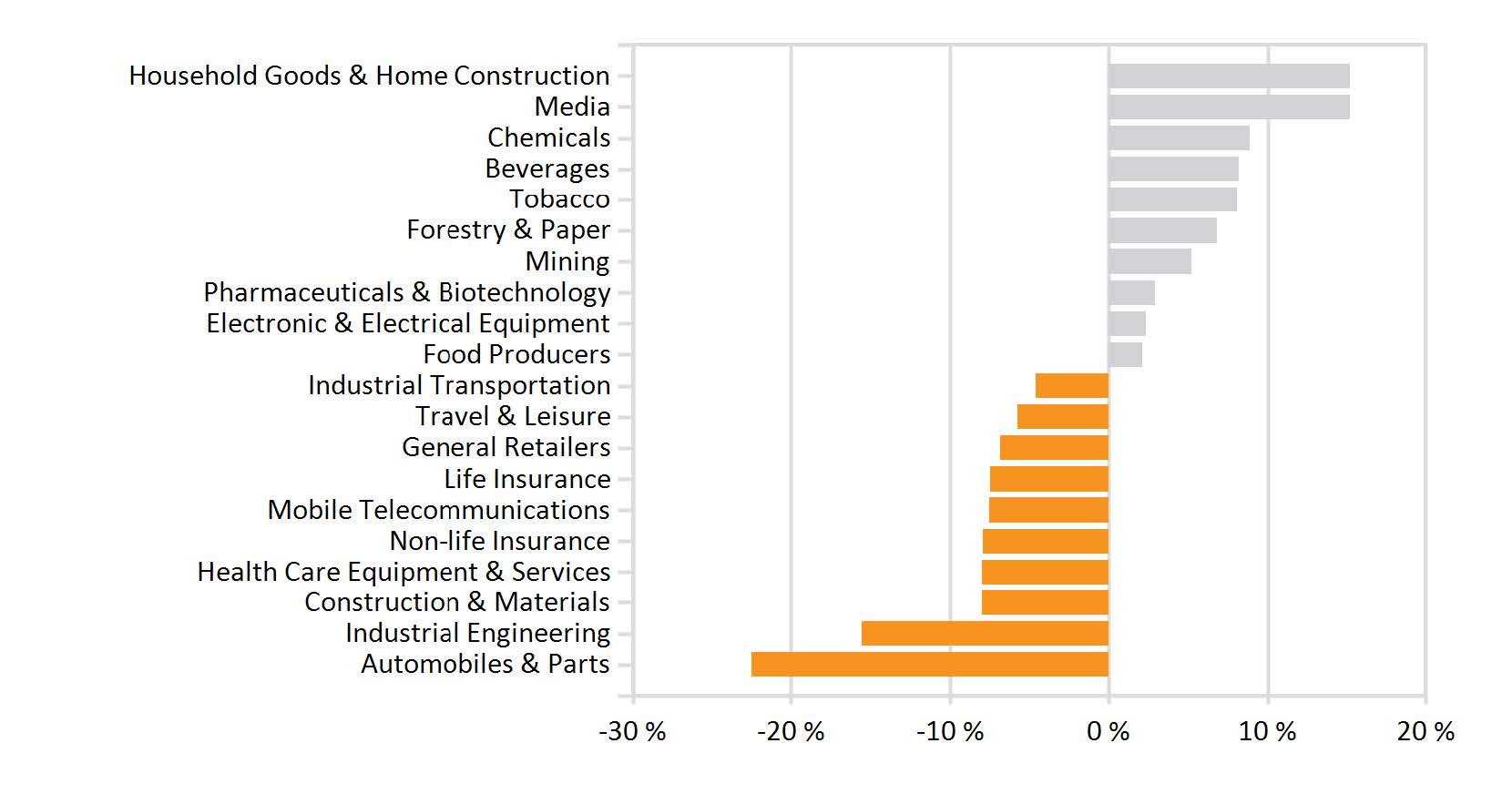

Monthly Industry Performance