Market Commentary: April 2019

Here are this month’s highlights: Global equity markets put in a strong showing in April. Concerns around global growth ebbed, as key players including China and the US registered stronger-than-expected GDP growth rates for the first quarter. The still-dovish tone of Central Banks supported overall risk-appetite: Emerging Markets closed higher, government bond yields rose and high-yield bonds outperformed investment grade and government peers. South Africa was one of the best performing Emerging Markets, rallying ahead of the May election.

Market View

Cash

South African cash gained 63 basis points (bps) in April. As expected, higher oil prices and the weaker rand continued to drive pump prices higher. Year-on-year, prices have therefore soared for transport with fuel 8.8% higher (year-on-year). This has led to inflation hitting a three-month high in March, with the latest reading at 4.5%.

“The South African Reserve Bank (SARB) still sees room for upside surprises, notably in food price inflation.”

The SARB indicates that food price inflation, having bottomed out in 2019’s first quarter, is likely to peak at 5.9% in the second quarter of 2020.

This estimate, however, fails to take into account any impact of recent extreme weather conditions. Flooding in KwaZulu-Natal and the Free State contributed to a 43% jump in potato prices during April. The forecast for core inflation (excludes food, fuel and electricity) is at 4.8% for 2019, 4.9% in 2020 and 4.5% for 2021. The Quarterly Projection Model, which is part of a suite the SARB uses to quantify the consequences of its actions on the economy and highlight the trade-offs, predicts one more rate hike of 25 bps for 2019.

Bonds

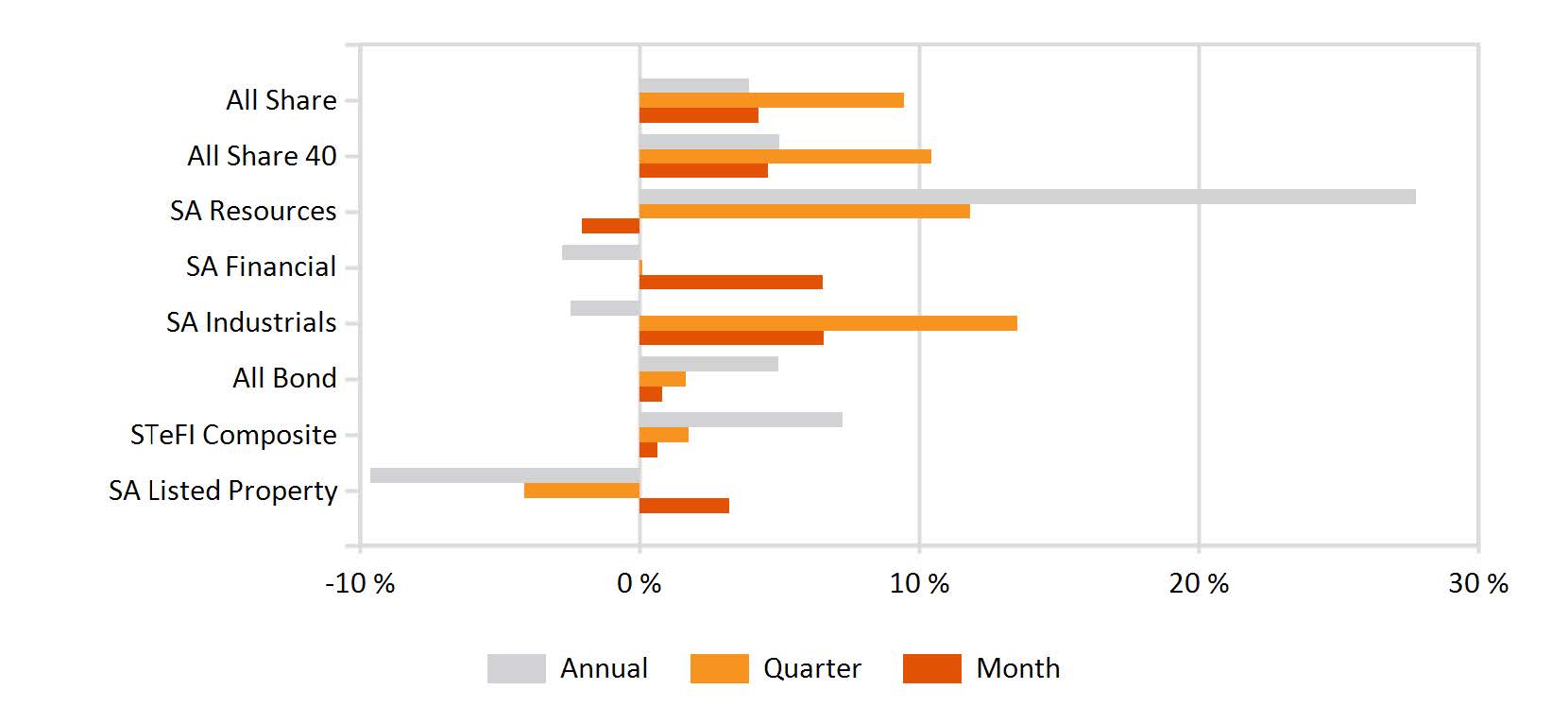

South African bonds yielded a return of 0.8% for the month, outstripping global peers. Inflation-linked bonds (ILB) registered a particularly solid 3.47% return, as ILB yields fell sharply. ILBs’ valuations remain attractive on a relative basis versus fixed coupon an on absolute fair value basis.

Internationally, the stance of central banks continued to soften – minutes from the Federal Reserve Bank’s March policy meeting indicate that rates are likely to remain unchanged; Canada has all but abandoned its bias for higher interest rates; Australia has pushed out the timing of any interest rate hike; and the Bank of Japan has committed to extremely low interest rates until spring 2020.

“UK governor Mark Carney, unsurprisingly, has repeatedly stressed the Brexit-path dependency of British monetary policy.”

The European Central Bank in turn, and not unexpectedly, left rates unchanged. With some return of risk-appetite, developed market government bonds underperformed Emerging Market counterparts (near flat) and high yield bonds.

The US interest rate curve steepened, and 10-year T-bill yields closed the month at 2.5%, with prices dipping by 0.3%. A temporary reprieve on Brexit (until October 2019), saw UK 10-year gilts dip 1.6%, while German counterparts were 0.6% lower; and peripheral markets in Spain and Italy, despite the latter’s ratings being kept at BBB, provided a return of 0.7% and 0.5%, respectively.

The spread between investment grade corporate bonds and high yield bonds tightened, mainly driven by the uptick in government bond yields. Global investment grade bond markets had another decent month, providing a return of 0.5%. High yield, however, easily outstripped counterparts, with oil-heavy US High Yield bonds providing a return of 1.4%, matched by European counterparts.

Equity

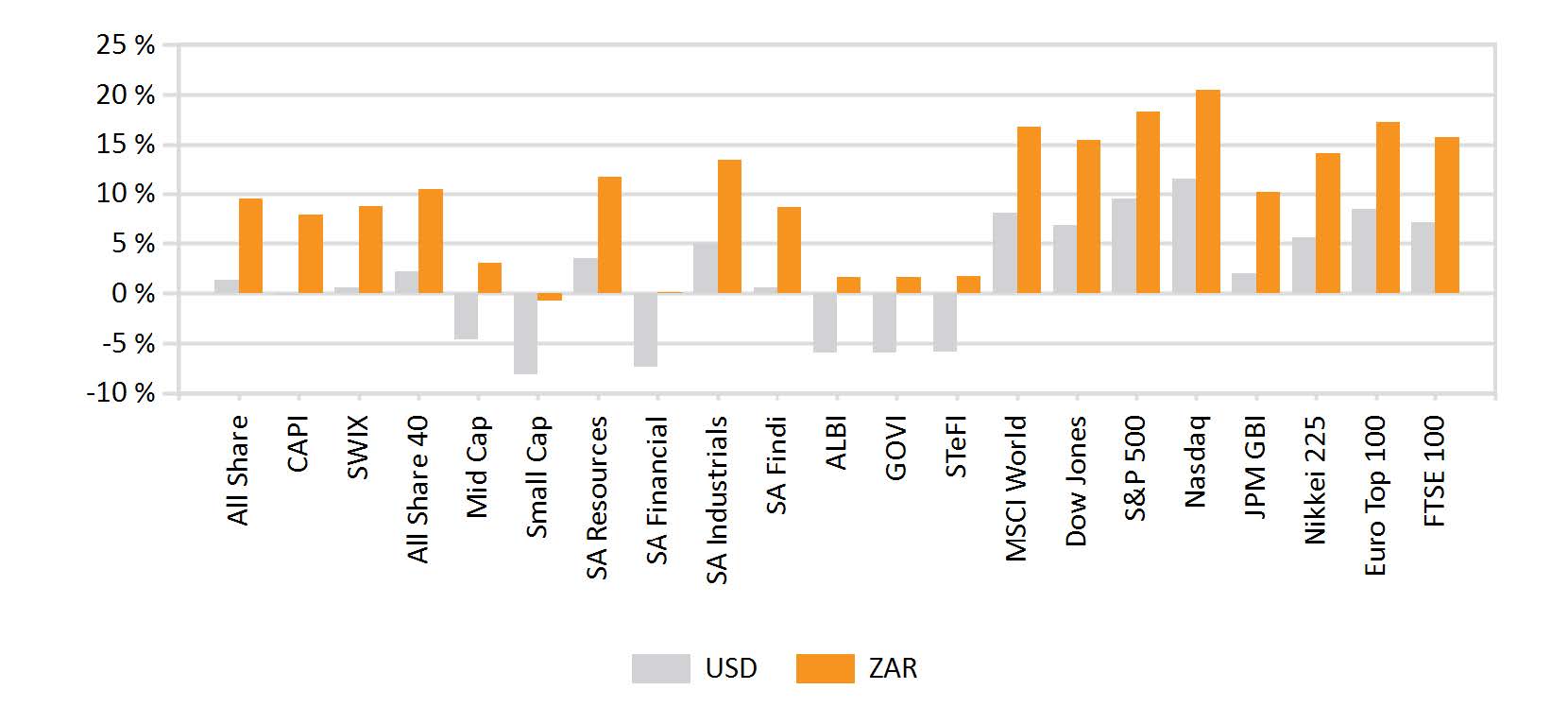

South African equities tracked global indices higher. The MSCI world gained 3.55%, while the All Share Index closed the month 4.23% higher. On the economic and political front, news was mixed.

“The International Monetary Fund lowered South Africa’s projected GDP growth to 1.2%, 20 bps below the previous estimate.”

This leaves the country as the regional laggard in sub Saharan Africa.

The RMB/BER Business Confidence Index fell three points to 28 for the first quarter, the lowest level since the second quarter of 2017, and the consumer confidence index dipped to its lowest reading since the fourth quarter of the same year. While arguably weighed down by the intensification of loadshedding during the survey period (March 2019), other factors weighing on sentiment included sharp fuel price hikes, higher personal tax rates and slowing wage growth. As an indicator reflecting general consumer appetite for spending and debt, it is useful to look at the rate of growth of total vehicle sales.

The combined impact of poor economic prospects, increased fuel prices and uncertainty ahead of the election saw a 22% decline in April. Ahead of the local election, investors have to some extent, felt themselves to be on tenterhooks with ratings agency Moody’s.

The ABSA Manufacturing Purchasing Managers’ Index (PMI) for South Africa, however, saw its first increase after a quarter of persistent decline. At 47.2, however, manufacturing remains in contractionary territory. The Composite PMI was more encouraging as it climbed into expansionary territory, at 50.3.

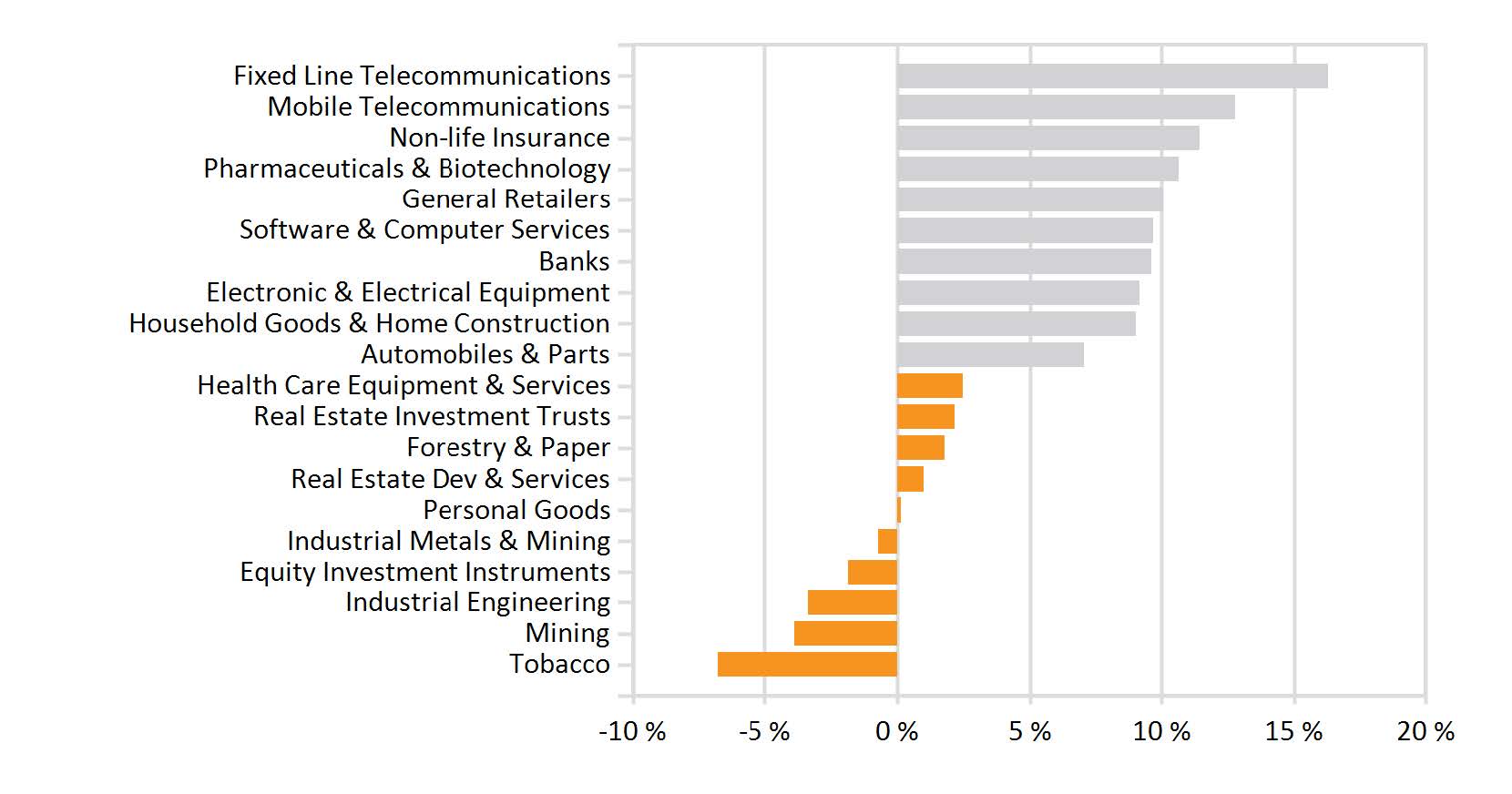

“On a sectoral basis, Financials and Industrials did well, while Resources lagged (6.5% and 6.6%, versus -2%).”

Industrials were driven higher by rand-hedges, against the backdrop of a volatile local unit. A 9.2% return on Naspers shares also boosted the local bourse considerably.

Amongst Financials, and within Banking, the FirstRand Group led the pack on solid underlying data with shares ticking higher. The FTSE JSE resources index, however, dipped as commodities struggled. The USD price of gold fell to a four-month low, as investors rotated away from safe-havens to put some risk back on the table. Palladium prices were lower, but Platinum was positive. According to the latest data (for February 2019) Mining Production declined by 7.5% year-on-year, showing the continued strain on the sector.

Labour unrest, which has weighed on sentiment, seems to have abated somewhat. April finally heralded an end to the five-month strike by AMCU at Sibanye Stillwater, but this was not enough to lift the company’s share price. It lost 12% during April, while peers including Harmony Gold and Anglogold Ashanti lost 4% and 6%, respectively.

Property

South African listed property managed to claw back prior month losses, gaining 3.17% for April. With the IMF downgrading its projected growth forecast for SA GDP, slower economic growth is expected to continue to hamper the local property market. Conversely, however, the sluggish economy has proven a boon to the tourism industry, with hospitality-focused tenants and landlords experiencing a revival.

“Investment activity in the sector has recovered somewhat, with R19 billion in 2018 versus R11.6 billion in the previous year.”

This increase is a function of the transaction size, rather than the number of transactions, which has shrunk as investors remained skittish ahead of local elections and amidst talk of land expropriation without compensation. Analysts predict that a resounding victory for President Cyril Ramaphosa will prove a boon to the local market, as it signals greater policy certainty. A clear win solidifies his ability to push his policy agenda and better deal with corruption.

The share price movement of bellweather Growthpoint perhaps reflects tempered optimism, as it gained 1.7% during the month. According to the latest FNB Property Barometer, house price growth remained below inflation, at 3.8% year-on-year. Within the office sector, local players are focused on retaining longer-leased stable tenants, given the over-supply in certain central business districts. An interesting feature of the South African property market of late, which is encouraging from a gender equity perspective, is that the number of single female buyers has increased rapidly, and at a faster pace than couples and single men.

“Globally, listed property underperformed the South African market, the FTSE EPRA/NAREIT Developed Rental index giving up 0.86% for April.”

Analysts identify several key risks to the outlook for offshore listed property: Rising interest rates, especially in the US; a slowdown in global growth; stretched valuations; the rise of populist politics; and the so-called Amazon-effect (online competition for retailers, higher demand for industrial space and logistics).

The UK housing and office market continues to struggle, as currency uncertainty has compounded Brexit woes, though a no-deal scenario has been (at least) delayed. The Hong Kong property sector was a somewhat unexpected beneficiary of the trade war between the US and China, with local investors opting for a market less likely to feel the fallout of ongoing tensions, and Hong Kong REITs were the best performing over the past year. The US housing market remained under pressure: The housing market fell by 1.2% in April, touching a three-year low.

“Moreover analysts fear a crash, premised on the high rate of flipping.”

Flipping, seen as a leading indicator for property prospects and economic growth, is defined as owning a home for less than two years before reselling it. The gauge is presently at 10%, levels similar to those reached prior to the 2008 financial crisis.

Some of the above risks have been priced in, with prices coming down noticeably in retail REITS. Astute fundamental investors may therefore find pockets of value in global retail REITs, and unlisted property remains a favoured investment channel.

International Markets

US stocks reached fresh record highs in April. European equities registered their strongest start to the year, leaving Developed Market equities nicely higher. Rekindled risk appetite, on the Fed’s still-dovish tone, solid corporate earnings and better-than-expected Developed Market growth data boosted global Emerging Market equities too, albeit to a lesser extent.

“The MSCI WORLD closed 3.5% higher and the MSCI EM gained 2.11.”

The MSCI BRICS showed more modest returns (1.65%), as India gained 0.93% and Brazil managed only 0.98%, offsetting stronger Russian, Chinese and South African markets.

US equities registered record highs in April, largely spurred by better-than-expected corporate earnings releases and stronger-than-expected US economic growth (3.2%) for the first quarter. The March labour market report went some way to calm recessionary fears, as unemployment remained at 3.8%, payroll gains exceeded expectations and wage growth ticked up 3.3% year-on-year.

Purchasing Managers’ indices signalled an economy still in expansionary territory, albeit growing at a slower pace. The ISM Manufacturing Index coming in lower at 52, the softest expansion in Factory activity since June 2017, and the non-manufacturing PMI at a softer 55. Consumer confidence beat expectations, but nonetheless dipped from March to April. The latest retail sales data (for March, showing a jump of 1.6%) belies the still-healthy appetite amongst domestic consumers.

“The S&P500 closed 4.05 % higher. On a sectoral basis, Financials and banking stocks were particularly strong, jumping by 13% after extremely solid first-quarter earnings.”

Technology stocks also put in a strong showing: Microsoft became the third company, alongside Apple and Amazon, to top the US 1 trillion valuation.

Eurozone growth has proved more resilient than expected, with key markets reporting stronger first quarter GDP figures than had initially been projected. France, after suffering under the Gilet Jaune protests toward the end of last year, managed to maintain activity steady at 0.3% quarter-on-quarter, GDP growth picked up by 0.1% in Spain, and Italy emerged from a 0.1% decline for Q4 2018 to register 0.2% growth in the first quarter.

The good set of growth figures (0.4% for the zone as a whole) has dispelled the fear that the Eurozone is entering recession and supported the strong performance of European equities. The STOXX All Europe gained 3.9%.

UK markets continued their strong showing, boosted by energy counters, strong earnings reports and appeased sentiment. The FTSE100 gained 2.33%. Manufacturing PMI jumped to 55.1, its highest reading in a year, and retail sales for March increased for the third consecutive month.

The strong consumer was supported by positive labour market data. UK employment has remained robust, reaching record highs, and unemployment has dropped to a 45-year low. Despite stronger sales data, the High Street continues to struggle, with Debenhams the latest casualty. The firm saw its creditors take control, signalling several store closures and a change in management.

Japanese equities ended the month modestly higher, as investor confidence regarding a resolution to US-Sino trade disputes grew. The Bank of Japan has also pledged, in line with global peers, to keep interest rates at ultra-low levels for at least one year. The nikkei gained just short of 5%, lead by consumer discretionary and communications services on a sectoral basis.

“Steady progress in US-China trade talks saw Chinese stocks continue their upward drive, and the MSCI China and China A onshore indices closed 2.23% and 0.22% higher, respectively.”

Macroeconomic data was somewhat mixed. The manufacturing PMI disappointed expectations, falling to 50.2, but still in expansionary territory. The services sector PMI increased for March, Industrial Production growth rose from 5.3% to 8.5% year-on-year and retail sales ticked higher.

Moreover, consumers and businesses have proven willing to take on debt: total social financing of RMB 8.2 trillion easily exceeded previous years. This is a key signal that easy monetary policy and accommodative fiscal measures are feeding through to consumer, business’ and investor behaviour. Analysts’ concerns that the People’s Bank of China would dial back said measures, have thus far proven unfounded.

Reflecting some of this concern, there was a pull-back in Emerging Asian markets towards the latter half of the month. Nonetheless, Asian equity markets ended broadly higher, given a fillip by the better-than-expected positive growth data from China as Q1 GDP came in at 6.4%. Indian markets were modestly higher, boosted by an interest rate cut just before India was set for the polls. Singaporean banking stocks and Taiwanese technology counters, however, boosted their respective bourses to the top of the Asian pack. Latin American markets were more mixed. Despite stronger oil prices, and progress on its reform agenda, Brazilian returns were somewhat lacklustre.

Supply concerns, continued disruption and tension in Venezuela (an attempted coup) and the US administration’s intention to resume sanctions on Iranian supplies, sent the oil price higher in April. This proved a boon to oil-exporting countries in the Middle East and Emerging Europe (Russia), but has detracted from the performance of importers.

“Within Latin America, Argentina consequently lagged, whereas Mexico shrugged off growth concerns and ended higher.”

In Emerging Europe, Middle East and Africa, net importer Turkey continued to suffer. The country’s inflation woes were exacerbated by the higher cost of importing oil, the continued depreciation of the lira, and the apparent ineffectiveness of central bank policy. Nonetheless, EMEA markets rebounded in April and the region proved to be the strongest performer, with Egypt, Greece and Russia leading gains.

Russian equities extended their strong start to the year, with banks, consumer staples and energy counters doing well. Investor confidence in Greece has reached a new high, as the oft-painful reform process bears fruit and the country returns to growth.

“African markets were a disappointment (aside from South Africa), despite some notable corporate developments on the table.”

These include Olam International’s bid for Dangote Flour Mills in Nigeria, the listing of MTN Nigeria on the Nigerian Stock Exchange, and the listing of Africa-focused e-commerce platform Jumia on the New York Stock Exchange. The firm, which started operating in Nigeria in 2012 and covers customers in 14 African countries, saw its share price jump by 75% on its first day of trading.

Amongst African Markets, falling copper prices hurt Zambia, with the market losing 3.53% in USD terms for the year-to-date; Nigeria failed to capitalise on higher oil prices, closing the month 4.4% lower and oil-importer Egypt proved one of the better performers.

“In Emerging Europe Middle East and Africa (EMEA), year-to-date gains were pared back by weak performances in Turkey, Russia and South Africa.”

Currencies and Commodities

In currencies, the USD Index was higher by 0.2% in April. With New Zealand still reeling from the mosque shootings and a dip in metal prices, the New Zealand dollar was one of the biggest losers (-1.9% against the USD).

Emerging market currencies were mixed: Mexico, Russia and South Africa all saw their currencies appreciate (2.6%, 1.8% and 1.4 % respectively).

“The rand was volatile during the month, fuelled by concerns about power utility Eskom, and the uneven path of the US dollar. “

Conversely, the Turkish lira continued its slide, depreciating by a further 6.7% and taking year-to-date losses to double digits.

The overall GSCI commodity index closed 2.8% higher, led once again by gains in Energy. The subsector surged by 6.4%. Metal prices (Industrial and Precious) were lower and Gold dipped by 0.8%.

Performance

World Market Indices Performance

Monthly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance