Market Commentary: July 2019

Here are this month’s highlights: Geopolitical factors and monetary policy action gave investors pause for thought this month, and global equities closed modestly higher. The Federal Reserve Bank lowered interest rates as expected, trade tension simmered and the UK saw a new Prime Minister elected. Developed Market equities outperformed Emerging Markets, with South African equities notably lagging peers.

Market View

Cash

South African cash investors gained 64 basis points (bps) by the end of July. The annual inflation rate was unchanged at 4.5% in July 2019. Housing and utilities registered the fastest pace of increases from 4.5% to 4.9%; recreation and culture 0.4% to 0.9 %; food and non-alcoholic beverages (a 50 bps increase to 3.7%) and alcoholic beverages and tobacco from 5.6% to 6.1%. There was a noticeable easing in transport costs, with fuels making the most significant contribution dropping from 11.6% to 7.4%.

Against a backdrop of poor economic growth, the South African Reserve Bank (SARB) was under pressure from trade unions and politicians to cut interest rates, with a view to stimulate growth. Stable and cooling inflation data, however, has left the SARB with more room to manoeuvre.

“The Monetary Policy Committee at its meeting on the 18 July, cut the repo rate for the first time since March 2018.”

The move was largely anticipated, and the SARB pre-empted movements abroad, thereby moving in lockstep with the US Federal Reserve (the Fed).

Bonds

Bond markets ended the month on a muted note: local bonds closed 70 bps lower, underperforming global government bonds (the BarCap GABI posted a modest 0.23% gain). Inflation Linked Bonds (ILBs), too, posted a modest gain of 0.43%.

Globally, investors were buying Emerging Market Debt, in response to a more dovish Fed, and Emerging Market Debt (as measured by the JP Morgan EMBIG) provided a 1.2% return for the month. South Africa’s deteriorating fiscal position and concerns about State Owned Enterprises (SOEs) bailouts took their toll on foreign investors’ perceptions.

“During July (and indeed since May 2019), foreigners were net sellers of South African government bonds (in contrast to other Emerging Markets, such as Brazil).”

The country is still not out of the woods regarding a ratings downgrade – a threat that is likely to loom unless South Africa gets its fiscal house in order. ILB yields remained elevated, with inflation within its 4% – 6% band and the SARB implementing a 25 bps rate cut.

Global bond markets performed well, as global monetary policy remains accommodative. The Fed, in a widely anticipated move, cut the Federal Reserve rate by 25 bps. Some analysts had hoped for a more aggressive 50 bps cut, but this was broadly seen as an unlikely capitulation. The Bank of England (BoE) has stuck to its mantra that rate-paths will be Brexit-dependent. However, the replacement of Theresa May by Boris Johnson (with his definite oft-stated commitment to Brexit) may see greater certainty in this regard. Analysts are forecasting that the BoE will implement at least one rate-cut, and 10-year Gilt yields ended lower.

In Europe, the European Central Bank (ECB) reiterated at its July meeting that it was ready to keep interest rates lower for longer. Anticipation of easy money helped support the European bond market:

“The German 10-year yield reached an all-time low of -0.44% at month-end, while peripheral Italy’s sovereign yield fell below 1.5% for the first time since 2016.”

Corporate bonds have also benefited from easier monetary policy, the last week of July seeing robust issuance in investment-grade corporates. Data from Deutsche Bank shows that roughly Euro600 bn worth of European corporate debt now has a negative yield (implying that prices have ticked up steadily, as the number was virtually zero at the start of the year).

Market activity subsided ahead of the Fed meeting. High yield bond markets were somewhat more buoyant, but also showed signs of tapering, as investors focused on corporate earnings reports and the pending Fed announcement. Energy bonds came under pressure, on oil price volatility, and as S&P announced that it would downgrade the natural gas sector.

Equity

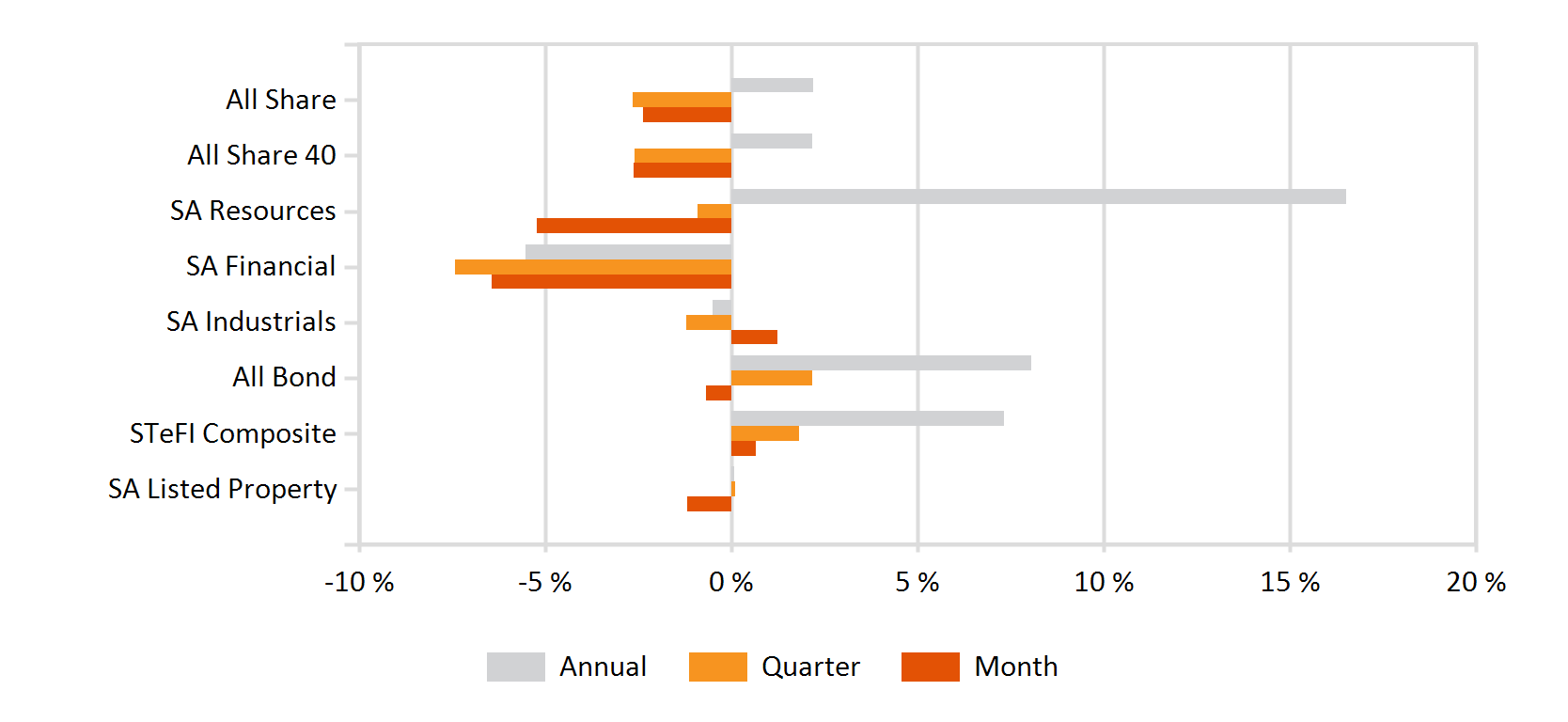

Local equities were weaker for July, with the SWIX losing 2.21% and underperforming Emerging Market peers.

Macroeconomic data was discouraging and the growth outlook remains depressed. At its July Monetary Policy Committee meeting, the SARB, in addition to implementing a much-anticipated 25 bps rate cut, lowered its outlook for 2019 growth. It cut its forecast from 1% year-on-year to 0.6% year-on-year.

The latest jobs data from StatsSA highlights one of the key challenges facing the local economy, as unemployment reached a record high of 29%. Lagging growth, relatively high labour input costs and contractions in sectors like mining and agriculture saw the economy less able to absorb the growing number of new jobseekers.

Business confidence remains depressed, reflected in staffing decisions. Corporate credit growth continued to show signs of slowing down, hitting 6.1% in June, down from 8.4% in May. Private sector credit extension also slowed, with consumers deferring spending on big ticket items. The latest data on new vehicle sales reflects the generally cautious to pessimistic sentiment: July 2019 sales contracted by 3.7%, reflecting consumers’ limited purchasing power and propensity to spend on durable goods.

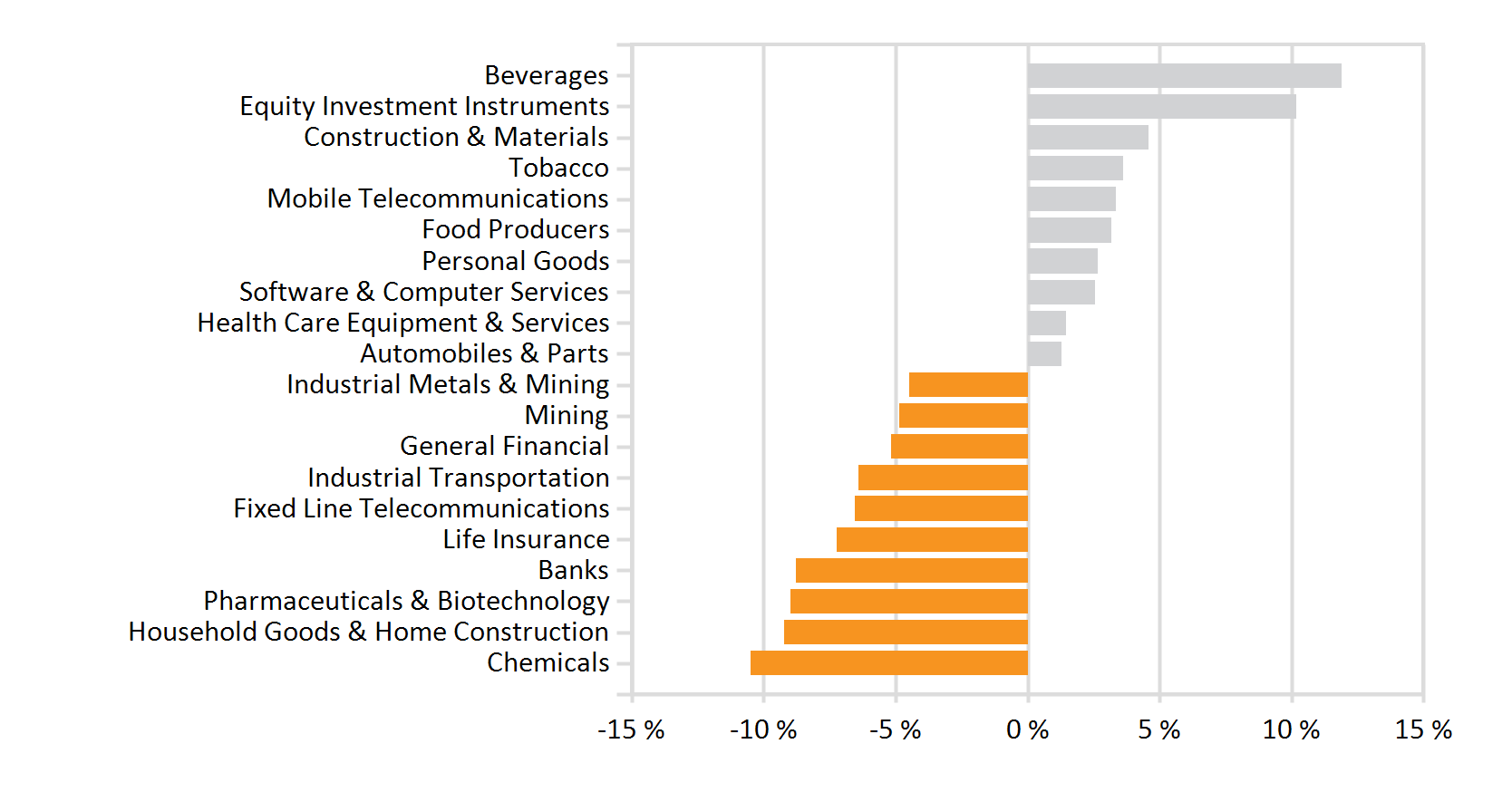

“By sector, Industrials was the biggest gainer (+1.23%), while Resources and Financials posted substantial losses (-5.24 and -6.44%, respectively).”

Mining and resources were poor, led by losses in gold miners. Anglo American PLC lost just over 12% during the month. Diversified miners BHP Billiton fared somewhat better, but ended the month 4.7% lower. SASOL share prices continued their slide, losing a further 11% in July. The firm reported more bad news from its Lake Charles Chemicals Project in the US. Cost overruns at the Louisiana-based cracker and derivatives unit are largely to blame for the group writing down its assets by over R18 billion. Shareholders have lost nearly 35% over the past three months.

On the flipside, industrial Rand hedges were strong against the backdrop of a volatile Rand: Naspers and Richemont gained just over 2.5%, and British American Tobacco recovered by 3.6%. Defensive stocks and telecommunications did relatively well, with MTN shares registering a 5.5% gain, boosted further by positive corporate earnings results.

Despite the pessimistic economic outlook, there are substantial opportunities to pick up quality investments at depressed prices. Astute investors stand to gain from being nimble in their allocation to selected SA Inc shares. Should the noise around the Public Protector and President Cyril Ramaphosa subside, speculation about an IMF bail-out fizzle out and the path for SOEs become clearer, there is significant upside to take advantage of Foreign investors, however, will remain cautious.

Property

The South African listed property market closed July in the red, with the SAPY registering -1.2% and the ALPI -2.6%. The latter’s more pronounced underperformance is attributable to its larger exposure to UK markets, particularly Hammerson, Intu and Capital&County. Hammerson and Intu both took a hammering on the bourse this month, dipping by 24.5% and 37.7%, respectively.

Earnings season has officially kicked off, and it appears that the sector may have turned the corner after a tough two years. Post the clean-up and rerating of the sector, the quality of earnings was improving. There are also prospects for further consolidation of the sector. July saw the Community Property Fund put in a cash offer for Safari, and SA Corporate receive expressions of interest from Dipula and Emira. Both Safari and SA Corporate share prices were boosted by the news, ticking up 25.9% and 12.1%, respectively.

As much as e-commerce is a threat to traditional bricks and mortar, there is still a need for physical space. In South Africa, as elsewhere, this is reflected in consumer’s willingness to pay for a hands-on shopping experience, particularly at the high-end of the consumer spectrum. Conversely, traditional retail landlords remain under pressure, with shopping malls still in oversupply and local retailers under pressure.

The office sector too, shows few signs of recovery, with vacancies ranging between 10% and 13%.

“Cape Town has the lowest office vacancy rates amongst the five largest metropolitan centres, and the city’s house prices have also proven the most resilient to the general downturn.”

Deteriorating affordability continues to shift the conditions from a seller’s market to a buyer’s market, with sellers no longer able to dictate prices.

In global property markets, the FTSE EPRA/NAREIT Developed Rental Index posted a positive return of 0.77% (in USD) easily outstripping the local market. Hong Kong proved to be the worst performing listed property market, recording a USD return of -6.74%. The US housing market remains robust, despite jitters regarding a possible recession. Estimates suggest that 1.1 million new homeowners entered the housing economy in 2019’s first quarter, and the number of renters increased by nearly 500 000 (following a decrease during the last quarter of 2018).

Much of this is attributable to a Millennial boom: following the Global Financial Crisis, most Millennials (born between 1981 and 1996) delayed homeownership. As conditions improved, and this cohort grew more comfortable within a stable and steadily growing economy, the trend reversed. In 2018, Millennial buyers became the largest cohort for home purchases, accounting for nearly half of mortgage applications.

Elsewhere in Europe, the UK housing market has continued to tread water in the maelstrom of Brexit. London property prices fell on average 4.5% in the 12 months to May 2019, the sharpest slide since 2009.

“Overall, house prices dipped 0.2% month-on-month for July, and real estate transactions, in general, have remained sluggish and protracted as sellers come to terms with the new market realities.”

Conversely emerging Eastern European counters have continued to do well, as many businesses and industries have sought alternative production centres. Real estate fundamentals remain healthy, with decent medium-term growth prospects, despite global growth jitters. The estimated forward Funds Available for Distribution yield for the sector comes in at 4.69% and the sector has yielded a year-to-date return of 15% in USD terms. There was some notable divergence within and across regions, with European and UK markets lagging North America and Asian peers. Selectivity in offshore listed real estate therefore remains essential.

International Markets

Global equity markets paused for breath in July, posting modest returns against a backdrop of opposing geopolitical and economic factors: Trade tensions between the US and China, after a temporary reprieve, returned full force; Troublespots between the US and Russia, Iran, Mexico and Venezuela show little sign of disappearing; Boris Johnson’s election as UK Prime Minister saw a substantial reshuffle in the UK Parliament and a ramp-up of Brexit rhetoric.

On the other hand, central banks maintained their dovish tone: the Fed lowered interest rates for the first time in over a decade, the ECB all-but-committed to lower-for-longer rates and the Bank of Japan unanimously voted to maintain its asset purchase programme.

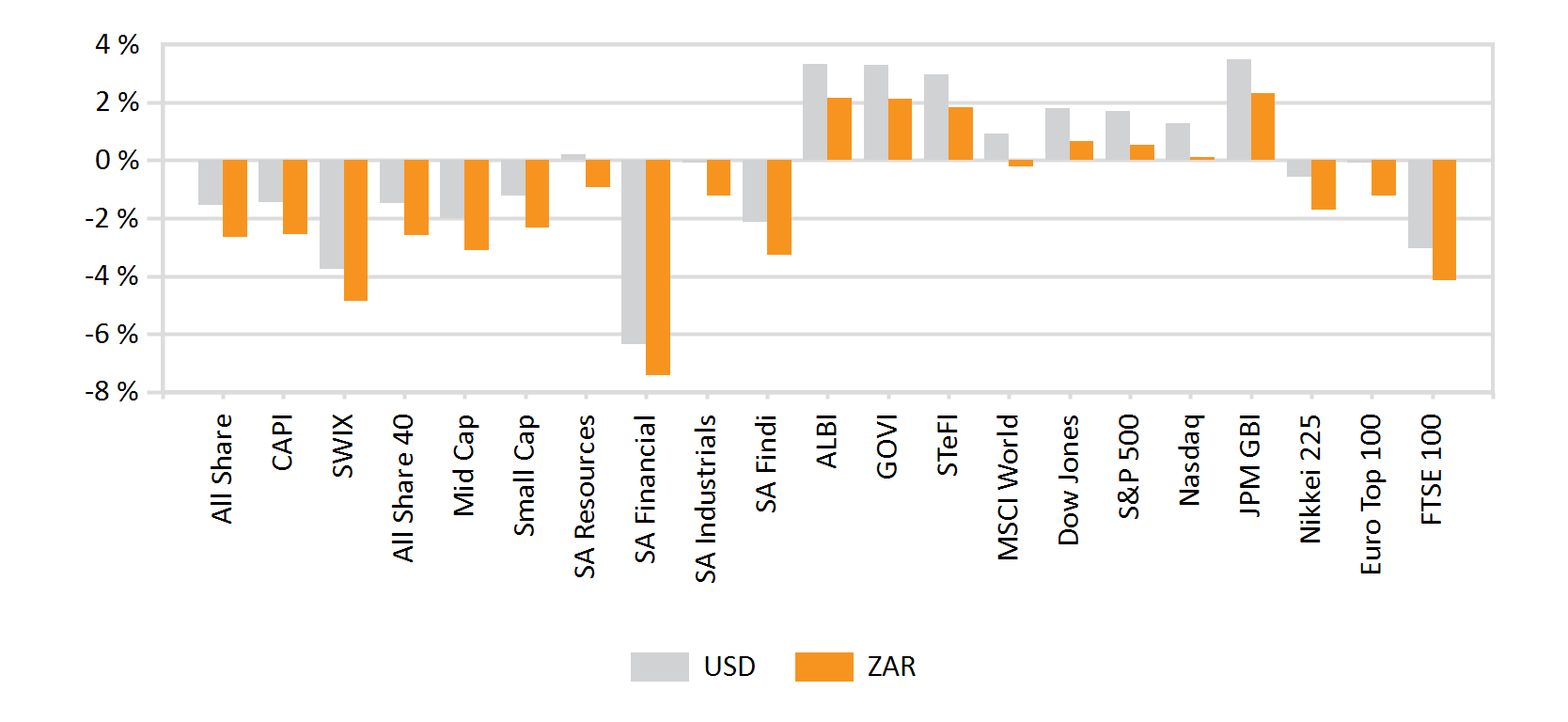

“Developed market equities outperformed Emerging Market peers. The MSCI World closed modestly higher, at 0.5%, while Emerging Markets registered a 1.22% loss.”

US equity markets closed the month in positive territory: the S&P500 ended 1.4% higher, after hitting fresh highs during the month. Macroeconomic data was somewhat mixed. The jobs market bounced back from a disappointing June showing: payrolls increased by 164 000 during July, wages ticked up 3.2%, topping expectations, and a broader measure of unemployment (the ‘real’ rate, which accounts for discouraged workers and the underemployed) dropped to 7%, an 18-year low.

Second quarter GDP grew at a quarter-on-quarter annualised rate of 2.1%, beating analysts’ expectations. Consumer confidence showed little change, perhaps as a reflection of the ongoing drag of tit-for-tat trade tariffs on sentiment. Retail sales ticked up a modest 40 bps month-on-month, and the IBD/TIPP Economic Optimism Index edged lower. The Sino-US trade wars have also weighed on business sentiment: The ISM Manufacturing Purchasing Managers Index dipped to 51.2, pointing to the weakest pace of expansion since August 2016.

The US earnings season is now in full swing, with over half of S&P500 companies having reported by the end of July. Most corporates look set to deliver low single digit earnings growth for Q2. While several companies beat analysts’ expectations, partially a reflection of pessimistic forecasts and also driven by substantial share buybacks. On a sectoral basis, tech stocks put in a solid performance, boosted by strong earnings and an improved outlook. Energy stocks lagged, as oil prices slumped on concerns about a dip in global demand. Traditionally, defensive stocks such as healthcare and utilities, were also lower.

A new Prime Minister began his occupation of No 10 Downing Street, as Boris Johnson took over the reins from Theresa May mid-July. He unveiled a new Cabinet peopled with pro-leave figures, and reasserted his ‘do or die’ stance regarding Britain’s exit from the European Union by 31 October.

“Sterling subsequently fell to a two-year low against the dollar.”

Macroeconomic data was mixed: On the positive front, employment remained robust in the first half of 2019 and consumer confidence improved modestly, as did retail sales. The Composite PMI, on the other hand, showed a deterioration in business confidence and dipped into contractionary territory in June (the latest reading).

The Bank of England voted to hold the Bank Rate steady at its latest Monetary Policy Committee meeting, and reaffirmed its pledge to gradual and limited hikes, under the assumption of a smooth Brexit. It lowered its GDP forecasts for 2019 and 2020.

“The FTSE100, despite the political noise and weakness in energy counters, managed to outperform European and US peers, registering a 2.24% gain.”

The STOXX All Europe managed a gain of 40 bps, with month-end trade rhetoric paring back earlier gains. Trade-driven economies such as Germany were hardest hit, and the most recent manufacturing surveys show some of the weakest activity in a decade.

Despite the ongoing uncertainty regarding Brexit, and the trade war spill-over effects, the underlying economic data for the Eurozone proved resilient. The latest data shows that unemployment fell, consumer confidence increased modestly and retail sales ticked up nicely. Business confidence, however, took a step backward, as heavyweights in the Union saw sharp declines. The Ifo Business Climate Index in Germany fell to its lowest level in six years, French manufacturing output contracted and sentiment dipped, and Italy’s manufacturing confidence index registered its worst reading since 2014. On a sectoral basis, non-cyclical areas of the market fared better, with Consumer Staples and Utilities leading the back. As elsewhere, Information Technology closed higher, and Energy proved to be a significant detractor.

Japanese stock markets closed modestly higher, the Nikkei gaining 1.16% for July. The Bank of Japan trimmed its economic outlook, forecasting 0.9% for 2019. An important issue facing the Japanese government is the implementation of a hike in value-added tax. At the time of its introduction in 2014, there was a sharp reduction in household consumption and a subsequent economic contraction. Analysts predict, however, that the impact will be far less pronounced, as the government has put a Yen 2 Trillion package of consumer and retail stimulus in place and as the Bank of Japan keeps easing measures in place.

Chinese equities ended the month on a low note, surrendering early gains as the temporary ceasefire between Presidents Trump and Xi Jinping collapsed at month-end. The MSCI China lost 0.54%, and the MSCI China A Onshore gained a modest 49 bps. Economic data was mixed: Industrial production and retail sales beat expectations and consumer confidence and spending ticked up. The manufacturing PMI remained in contractionary territory, although there was a slight improvement. Second quarter GDP growth came in at 6.2%, its lowest level in 27 years. The widely-held view is that this will prompt further stimuli from the Chinese government, potentially a boon to riskier assets and Emerging Markets.

Elsewhere in Asia, Indian and Korean equities were the biggest laggards. Indian Prime Minister Narendra Modi, in the first national budget since his re-election, proposed harsher taxation of foreign portfolio investors and high net worth individuals, somewhat spooking offshore investors.

The SENSEX slumped by 4.6%. Korean equities struggled in the face of regional trade frictions, a deterioration in the economic growth outlook and increasing tension with North Korea (who launched a series of missiles in a show of power).

Emerging Middle Eastern, European and African Markets were mixed. Turkey generated healthy returns, posting over 11% in US Dollar terms. Investors reacted favourably to substantial interest rate cuts, aimed at stimulating bank lending and propping up the ailing economy. Poland, the Czech Republic and Russia closed lower. The Russian bourse closed 0.95% lower, partly as a reflection of a general aversion to Emerging Europe and partly due to the slowdown in energy counters. The Nigerian stock market was also hit by the slump in oil, with the Nifty closing 7.5% lower. The MSCI EFM Africa ex SA gave up 2% for the month.

In Latin American markets, outcomes were mixed. Brazilian markets closed modestly higher, gaining 0.84%. Investors reacted favourably to the approval of the pension reform bill, as well as the central banks promise of more stimulus. Mexican markets, despite the news that Mexico and the US had avoided further tariffs, were lower. Foreign investors were unsettled by the resignation of the country’s finance minister, that has reawakened the spectre of a potential ratings downgrade. The Andean markets of Chile and Peru also lagged.

Currencies and Commodities

Commodity markets saw a modest downturn in July, with the GSCI index down 0.2%. Gold prices were once again higher, albeit by a more modest 1% for the month. Precious metals and industrial metals were also higher, by 1.5 % and 0.6%, respectively.

Within each sector, silver (+7.1%) and Platinum (+4.7%) were the biggest gainers. Despite concerns regarding global growth and demand, energy prices ticked up, with oil gaining just over 2% during the month. Demand was boosted by a recovery in Asian refining margins and increased demand ahead of a major change in marine fuel standards in 2020. The change, which is likely to benefit particular grades of oil, entails that the International Maritime Organisation bar ships from using fuels with over 0.5% sulphur (to curb pollution). Soft commodities and agriculture were generally lower, with Coffee and Wheat posting the biggest losses, as improved harvests boosted supply.

The US Dollar Index gained 2.5% in July.

“Sterling, off the back of ongoing Brexit wrangling, was one of the poorest performing currencies, registering a 4.2% loss.”

Emerging market currencies were mixed, with political hotspots and growth-laggards posting losses.

Consequently, the Korean Won and South African Rand were notable losers. The rand was proving particularly volatile, as controversy continues about President Ramaphosa’s campaign financing, worries around the country’s fiscal position become more acute, and the resolution of SOEs woes seems to drag on Conversely, gains corresponded to improved foreign sentiment, with the Turkish Lira appreciating by 3.7%.

Performance

World Market Indices Performance

Monthly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

Monthly Industry Performance