Market Commentary: February 2020

Here are this month’s highlights: Cash was up 47 basis points in February and bonds were largely flat. South Africa entered a technical recession. The US and China lowered existing import tariffs per the phase 1 trade agreement. This was largely overshadowed by the spread of the coronavirus outbreak that saw global markets fall.

Market View

Cash

Cash added 47 basis points in February. Annual consumer price inflation (CPI) accelerated to 4.5% in January, from 4.0% the month prior. The latest reading remains below market consensus expectations – 4.6% – but at the midpoint of the South African Reserve Bank’s (SARB) monetary policy target. CPI has now not exceeded consensus expectations for the past 14 months.

“The latest CPI increase was driven by the following components: food and non-alcoholic beverages, housing and utilities, transport and miscellaneous goods and services.”

Bonds

SA nominal bonds were flat for February, per All Bond Index, while inflation-linked issues added 0.6%. The severe market turmoil – see international section for detail here – which occurred in the final week of February meant strong demand for global fixed income assets in a risk-off environment. The Barclays Aggregate Bond Index thus performed well, gaining 5.2% in ZAR and 0.7% in USD. Emerging Market (EM) bonds, however, suffered in line with other risk assets, falling by 3.2% in USD, per the JP Morgan EM Bond Index.

Finance Minister Tito Mboweni’s 2020/2021 budget appeared to be positively received by the market as a small step in the right direction for the country’s finances. The minister directly addressed the government wage bill, widely considered to be excessive and burdensome for the long-term sustainability of SA’s finances. He stated that his ministry would look to cut this bill by R160 billion over the next three years, including a R38 billion reduction in the current financial year. He further announced an effective income tax cut by raising thresholds for income tax bands, but increased sin, alcohol and tobacco, and fuel taxes.

“Whether National Treasury will achieve its aggressive reduction in the government wage bill remains to be seen given the strength of South Africa‘s labour unions.”

This does present a risk to its latest forecasts for the country’s main budget balance i.e. the difference between government revenue and expenditure. The department now forecasts the budget balance peaking at -6.8% in fiscal year 2020/2021, declining by 0.4% for 2021/2022 to reach a balance of -5.9% by the end of fiscal year 2022/2023. Gross government debt is now forecast to reach 72% of GDP by 2022/2023, from 62% as at end February 2020.

Equity

The Q4 2019 GDP figures fell by a larger-than-expected 1.4% quarter-on-quarter, meaning the country is now in a technical recession as Q3 growth was further revised downward to -0.8% quarter-on-quarter. Primary sectoral drivers for the Q4 figure were volatile mining and manufacturing production. The agricultural sector underperformed market expectations due to negative impacts from a bout of foot-and-mouth disease. The construction sector’s woes continued; it experienced a 5.9% quarterly decline in output, with government reducing spending in real terms as general government services detracted from GDP growth.

“The declining trend in economic growth remains in place with market participants and observers revising growth expectations for 2020 lower.”

The downward revision of credit-ratings agency Moody’s, from 1.5% previously to 0.7% for calendar year 2020, is of significance given its impending decision regarding SA’s credit quality in late March. The agency cited tepid consumer demand and Eskom’s power cuts’ negative impact on economic growth as the chief reasons for its downward revision of growth.

Given weaker-than-expected SA GDP growth for the last two quarters of 2019 along with the shift in global monetary policy towards great accommodation, to counteract the negative impacts of COVID-19 (coronavirus) on global growth. It is more likely-than-not that the SARB’s next move would be to cut interest rates. The next policy decision is set to take place in mid-March, with market observers suggesting a possible 50 basis point cut is on the cards.

“These local developments were largely overshadowed by global ones, chiefly the realisation by global markets that COVID-19 had become a global concern.”

SA assets thus followed global peers; SA equity fell by between 9.0% and 9.5% depending on the index; All Share and Capped SWIX respectively. Market capitalisation indices took a beating with mid and small cap indices declining by 12.9% and 13.4% each. Sectorally, Resources suffered the largest fall, -11.6%, with Industrials faring the best in relative terms, -7.0%.

Property

SA listed property was badly hurt by the risk-off environment – see international markets section for detail here – per the SA Property Index, this market fell nearly 16% in one month. This is the second largest monthly decline since this market started trading in 2004. Global property suffered a similar fate, the FTSE/NAREIT Developed Rental Index lost 8.2% (USD), as investors rotated away from yield proxies during the time of market turmoil.

International Markets

As of 29 February, for COVID-19, the total confirmed case count stood at 87 000 with nearly 3 000 confirmed deaths: most of these cases and deaths stemming from mainland China. The sudden and unexpected rise in confirmed cases in South Korea, announced over the third weekend of the month, appeared to have triggered the broad realisation by global financial markets that the virus had become global. The spill-over implication of this realisation for investors was what this may mean for global economic growth.

Late February saw a violent sell-off across global equity markets; the US flagship equity index, the S&P500 fell by 11.4% in USD while its European peer index, Euro Stoxx 600, lost -11% in EUR. Such downside volatility meant that global equity declined significantly for the month; the MSCI World Index lost 8.4% while the MSCI EM Index fell by 5.3% — both in USD terms. Emerging Markets performed better compared to their developed peers’ thanks, in part, to the Chinese equity market faring better than developed peer indices. Assets such as the US 10-year government bond and gold experienced strong rallies as investors sort safety during the market turmoil.

“Global government bond indices such as the FTSE World Government Bond Index gained 1% in USD, with the world’s leading precious metal, gold, surpassing the $1600 level, the first time in seven years.”

In China, since mid-month, the growth in newly confirmed and suspected cases began to stabilise, according to its official government data. This, as the number of patients recovering from COVID-19 increased steadily. The country’s central bank, the People’s Bank of China, cut key interest rates, both the one- and five-year prime lending rates, as a measure to provide economic stimulus. Signalling its willingness to ease further should it deem it necessary. The government, meanwhile, urged businesses to recommence operations following weeks of a government-imposed shut-down, adding that it too is prepared to undertake fiscal stimulus should the need arise.

“Effective 14 February, both the US and China lowered existing import tariffs per the phase 1 trade agreement.”

China reduced tariffs from 10% to 5% on selected US imports, while the US cut tariffs on approximately $120 billion worth of goods, largely apparel and electronic goods, from 15% to 7.5%. While this news item went largely unnoticed in February due to the prominence of COVID-19 in capturing headlines, it is unlikely to be a priority over the coming months. This could be due to the Trump administration not wanting to resume trade tensions with China, at least until after the US elections in November this year.

Currencies and Commodities

The Goldman Sachs Commodities Index (GSCI) experienced a second month of brutal declines, closing February down by -7.8% in USD. The COVID-19 fallout has meant investors allocating away from assets that are highly geared to the global economic cycle, such as the hard and soft commodities that comprise this index.

On currencies, the US Dollar, per the DXY Index, gained 0.8% in February. Global investors, during times of increased market volatility look to the US Dollar as a harbour of relative safety and stability. Other safe-haven assets include gold, the US 10-year government bond and the Japanese Yen. Each of these assets have security-specific reasons as to why an investor would favour them during a market period such as this, but a primary concern across is the liquidity or tradability of these assets.

“EM currencies again weakened against the US Dollar; the Rand weakened by 4.2%, although it faired marginally better than other EM currencies such as the Indonesian Rupiah and Russian Ruble, these fell 4.6% and 4.4% against the US Dollar, respectively.”

Performance

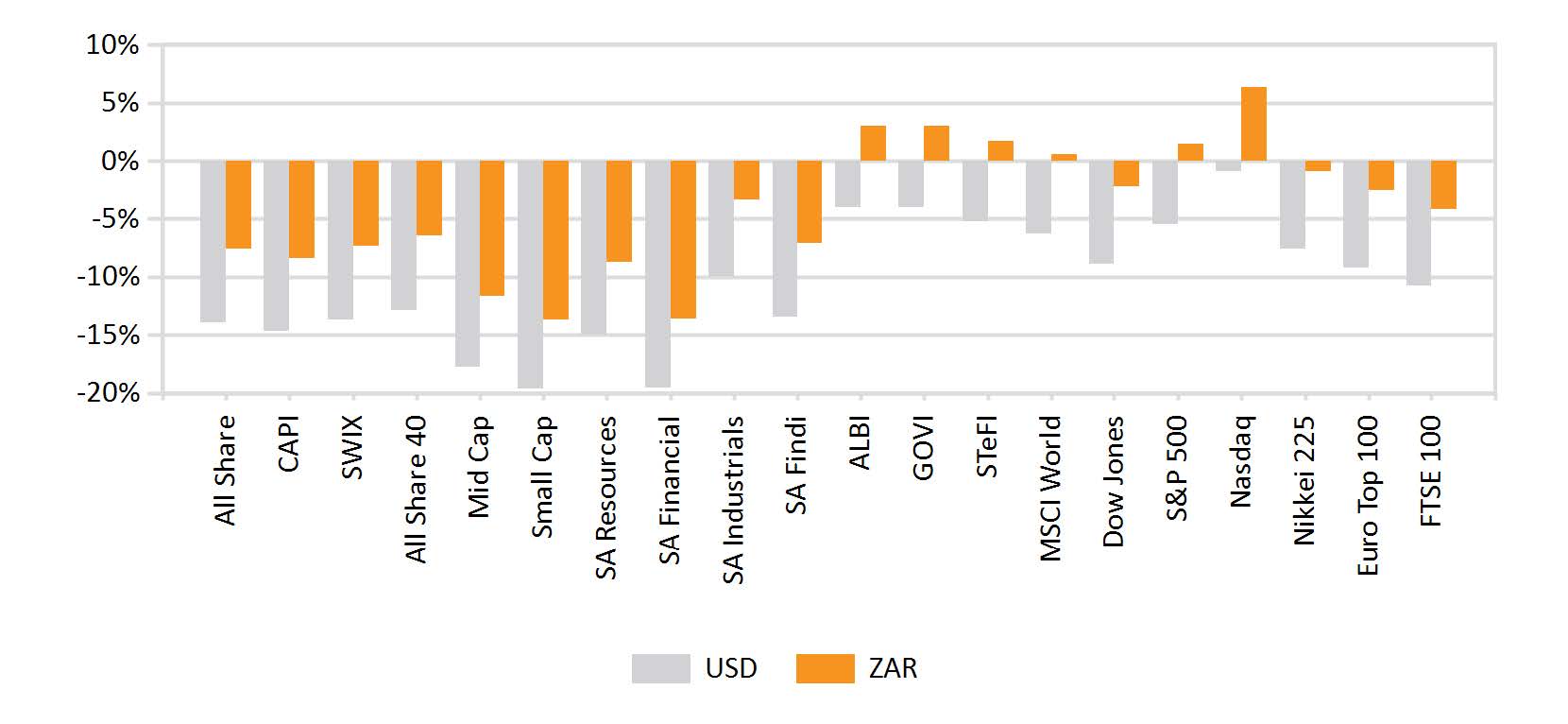

World Market Indices Performance

Monthly return of major indices

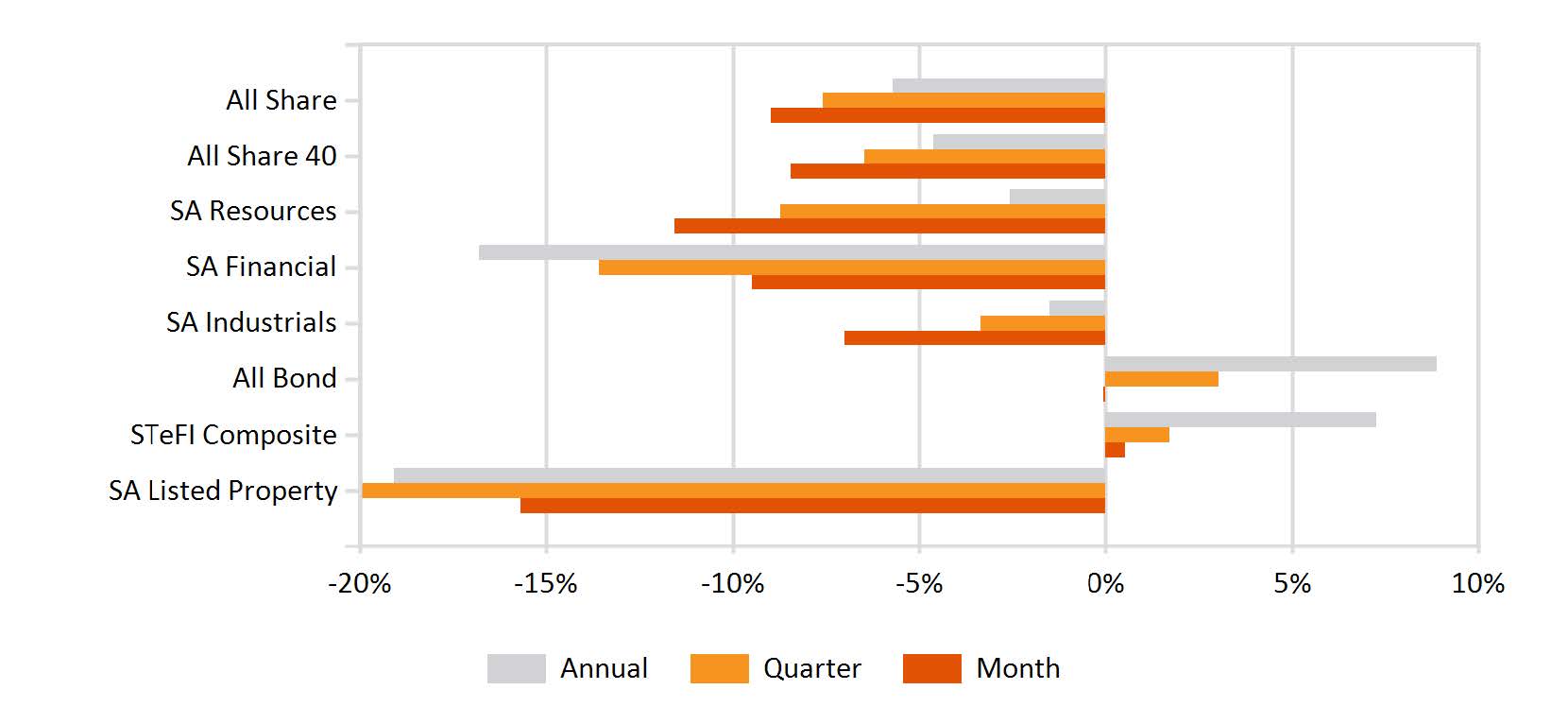

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices

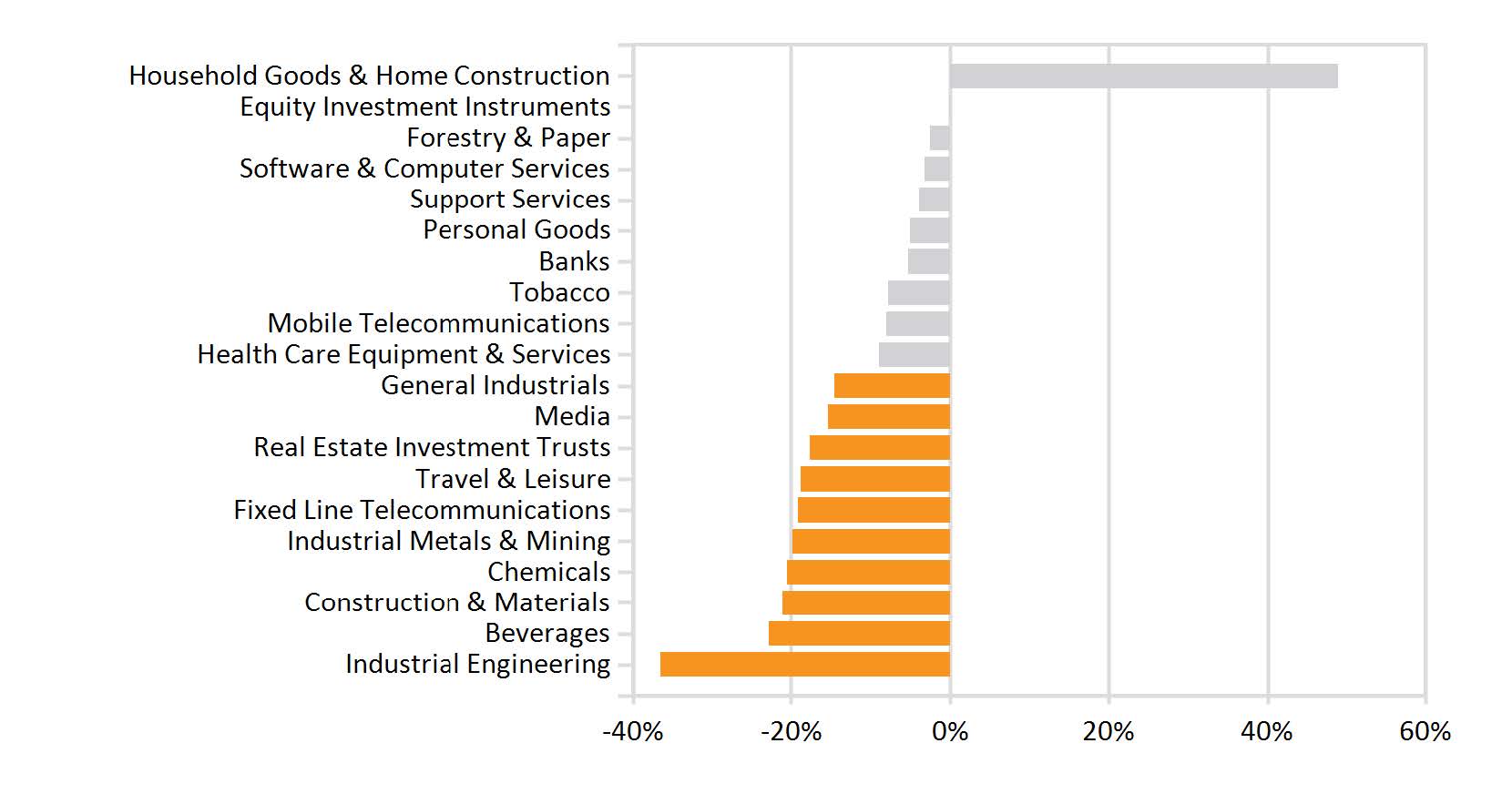

Monthly Industry Performance