Market Commentary: March 2021

Global Market Themes: Global equities higher on vaccine hopes Biden’s stimulus bill and infrastructure plan steady markets, despite rising Treasury-bill yields Federal Reserve Bank foresees no rate hikes until 2023 Additional lockdown restrictions loom in Europe, but stocks rally SA Market Themes: Better than expected outlook for SA growth, and GDP expands by 6.3% q/q in final quarter SA Corporates show improved performance Local bonds do not escape global jitters Sharp increase in energy prices in April Limited additional restrictions for Easter break, boon to local business

Market View

Global Market Themes

Positive sentiment drove global markets higher during the month. Vaccination programmes in developed markets are surging ahead: At month-end over 58% of British adults and over 37% of US adults had received at least one dose of the COVID-19 vaccine. Simultaneously, central banks and the fiscus have maintained the unprecedented stimulus measures put in place to jumpstart pandemic-hit economies.

“In the US, President Joe Biden’s $1.9 trillion stimulus bill (The American Rescue Plan) was signed into law on 11 March. The president also announced a $2.25 trillion infrastructure plan, which would see massive increases in spending on internet and transportation infrastructure.”

A second package, which would focus on healthcare, childcare and education, is expected in April. Growth expectations were boosted by largely positive economic data. The Conference Board announced that consumer confidence had increased by the most in 18 years, albeit from a low base, and reached its best level since June 2019. Toward month-end, US jobless claims fell to the lowest level since the pandemic began, aided by the accelerating pace of COVID-19 vaccinations. The Department for Labour reported that 379 000 workers had re-entered the workforce in February 2021, and a further 347 000 joined in March. At the height of pandemic-related slowdowns and shutdowns, more than six million people exited the labour force.

The rapid recovery has spurred some fear that the economy is overheating. Traders are therefore closely watching the Federal Reserve Bank for any sign that Governor Jerome Powell will change his dovish tone. To date, however, the Fed is sticking to its stimulus guns. At its March Federal Reserve Open Markets Committee (FOMC) the Fed kept rates anchored near-zero and committed to continue buying at least $120 billion of bonds per month. It also announced that it did not foresee any interest rate hikes till 2023.

The rosy glow of positive sentiment saw the S&P flirt with a high of 4000 at month-end, and the index closed 4.3% higher in US Dollar terms. The technology-heavy Nasdaq rallied at month-end, with semiconductor and hardware stocks and Facebook leading the resurgence.

Expectations about US infrastructure spending, as announced in President Biden’s infrastructure plan, boosted stocks elsewhere. The plan will require considerable input from, inter alia, materials suppliers in Europe and Asia.

“European shares rose to near-record highs at month-end, despite concerns about the longer-than-expected lockdown in major European economies. France has announced its third lockdown, and Germany remains in lockdown, likely until the end of May.”

European Central Bank President Christine LaGarde, however, reaffirmed the ECB’s commitment to stimulus measures: her comment that the end of the Pandemic Emergency Purchase Programme is “not set in stone” suggests that it would be extended well-beyond initial expectations. March saw the STOXX All Europe gain more than 6.3%.

The UK recorded a decline in COVID-19 related deaths and new infections, bringing hope that the economy would be able to open up further and at a faster pace. The FTSE100 closed 4.1% higher in Pound Sterling. Value stocks continued to outperform their growth counterparts. UK large-caps have been a standout performer for the year-to-date, but a booming UK housing market helped mid-caps to an outstanding March. The extension of the stamp-duty holiday, which was announced in the Budget in early March, saw housebuilders Vistry, Bellway and Persimmon close 32%, 21% and 18% higher, while DIY companies also benefited from the continued forced staycations.

“Chinese equities lost ground, despite some positive economic data. Reports of manufacturing and industrial profits came in strong. The National Bureau of Statistics reported that profits for large industrial enterprises had surged by 179% from their COVID-19 lows in January/February 2020.”

The announcement of an additional tax reduction of RMB 550 billion should also go some way to consolidate the economic recovery. FTSE Russell confirmed the inclusion of Chinese Central Government Bonds in the World Government Bond Index (with a 36-month phasing in from September 2021), further cementing China’s position as a global contender. Chinese equities, nonetheless, closed the month lower in local currency terms, with the MSCI China and China A Onshore losing just over 6%.

Emerging markets lagged their developed counterparts, and the MSCI EM closed 1.5% lower in US Dollar terms, partly due to the poor performance of Chinese equities. Unease also exists due to the still-rapidly increasing rate of COVID-19 infections in countries such as Brazil and India.

The vaccine, and vaccine nationalism, have also entered the geopolitical realm. European Union Internal Market Commissioner Thierry Breton announced that the bloc would not allow the AstraZeneca vaccines produced in the EU to be exported until the company had fulfilled its commitments to the EU. Meanwhile, Russia’s Sputnik vaccine has gained traction, especially amongst emerging market buyers. A Kremlin announcement that French President Emmanuel Macron and German Chancellor Angela Merkel had held talks with President Vladimir Putin gave lie to Breton’s comment that Europe did not need the Sputnik V vaccine.

South African Market Themes

South African equities, although lagging global peers, closed the month in the green as the All Share Index gained 1.5%. Small-cap shares shone, with the subindex closing 7.6% higher. This is partly attributable to the nascent domestic economic recovery, as more domestically focused stocks (small and mid-caps) regained lost ground.

South African fixed income assets were mixed. Nominal bonds had a poor month, with the ALBI giving up 2.5%. The local market did not escape the global bond meltdown unscathed. In the first three months of 2021, foreign selling amounted to R38 billion, largely in response to global developments but partly also in reflection of poor local fundamentals and debt metrics.

“The property market continued to improve, with a further 1.6% uptick meaning it has gained 8% for the year-to-date. From its historical lows, the ALPI has shown an encouraging 34.1% improvement as listed property companies cleaned house, mergers and acquisitions continued, struggling companies strengthened their balance sheets and listed companies off-loaded some of their non-performing assets.”

Inflation-Linked Bonds (ILBs) were modestly higher, with the CILI gaining 0.6% for the month.

The domestic growth outlook has improved somewhat as the economy continues to reopen. Stats SA reported that Gross Domestic Product had expanded by 6.3% quarter-on-quarter in the final quarter of 2020. The South African Reserve Bank reiterated its more dovish stance at the March Monetary Policy Committee meeting, electing to keep the repurchase rate unchanged at 3.5%. The bank cited a relatively benign inflationary outlook, the nascent economic recovery and the likelihood of a Third Wave as reasons for remaining accommodative. In terms of the inflation outlook, however, the sharp increase in fuel prices will have a downstream effect (as the impact on supply-side prices filters through) and will hit consumers’ pockets hard in the coming month. Coupled with a relatively weak rand, the global increase in energy prices saw pump prices increase by over R1 in early April. The rand nonetheless showed an improvement against the Greenback in the month, appreciating from R15.05 per dollar to R14.79 per dollar at month-end.

“The South African vaccination roll-out continues to face heavy criticism from opposition parties, the public and the private sector. While it is encouraging that the government reportedly recouped the full amount paid for the AstraZeneca vaccine (proven to be inadequate in combating the South African strain of the virus), the situation regarding procurement and distribution is untenable.”

By the end of March, only 120 000 healthcare workers had been vaccinated. The initially laudable target of having herd immunity by September 2021 seems like a mirage, unless the private sector is allowed to get involved. In the US, where companies such as Walmart are a key part of the roll-out, the programme is progressing in leaps and bounds.

South Africans were left somewhat conflicted about the restrictions put in place over the pending Easter break. While most welcomed the few additional restrictions imposed, the increases in the numbers of people allowed to attend large gatherings (including religious services) were greeted with concern from some quarters. The fear is that non-adherence to social distancing, larger gatherings and the cross-border movement of people will accelerate the pace at which the expected Third Wave hits the country. New cases are expected to tick up about two or three weeks after the Easter holidays. The country can ill afford a return to higher levels of restrictions.

Performance

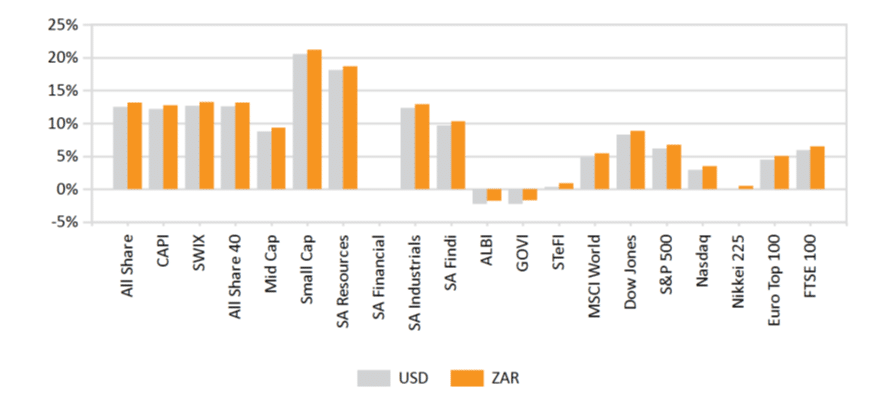

World Market Indices Performance

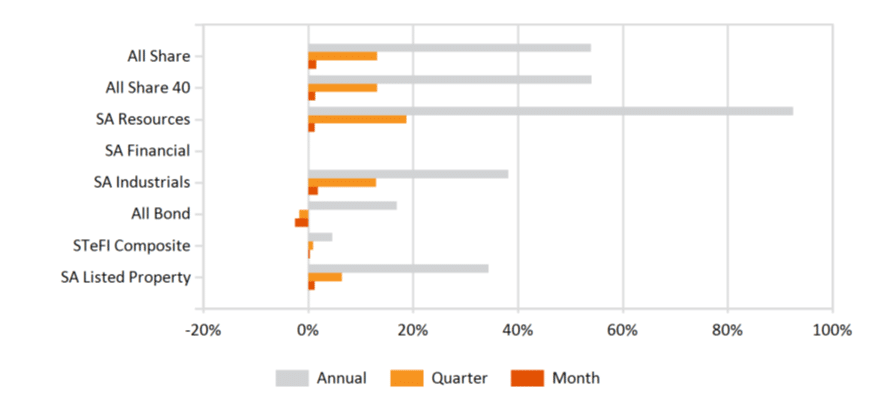

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices