Market Commentary: May 2021

Global Market Themes: Improved COVID-19 numbers boost global growth prospects US equities post solid performance, while UK and European stocks outperform Emerging markets outperform developed peers for the first time since January 2021 Divergence between China Onshore and China A shares — domestically-driven growth continues at steady pace Stronger commodities aid EM rally, particularly in Latin America SA Market Themes: SA equities post gains, but fixed income outperforms Naspers-Prosus share-swap proposal is widely criticised Sharp rise in local, global inflation, in line with higher input prices Rand rallies against major global currencies, stays below R14/$ Coronavirus cases surge, stricter lockdown and ongoing corruption allegations Loadshedding hits businesses and sentiment hard

Market View

Global Market Themes

Capital markets were relatively quiet in May, with markets appearing to be less frothy than in recent months. The MSCI World closed 1.4% higher, with European and UK markets outshining their US peers, and Emerging Markets (EM) seeing a nice uptick at 2.32% higher.

The US recovery appears to be on track and several states have fully reopened. The US’s vaccine roll-out is progressing at a rapid pace, allowing for the lifting of many COVID-19 restrictions.

“US Purchasing Managers’ Indices, measured by the IHS Markit indices for both manufacturing and services, rose to their highest levels on record, coming in at 62.1 and 70.4 respectively.”

An interesting feature of the US labour market was highlighted by the recent jobs data: The April jobs report showed that an additional 266 000 people were employed, which is well below the consensus expectation for one million. This, however, is likely a result of a reluctance to work, rather than a reluctance to hire. Due to the COVID-19 induced boost in unemployment benefits (set to expire in September), the reservation wage (the level required to spur people to seek employment rather than draw benefits) has increased to a historic high. Some states have consequently announced that they will be ending unemployment benefits early.

US inflation has risen rapidly, reaching 4.2% year-on-year during April, beating consensus expectations. This led to some jitters regarding the size of stimuli, and even the Fed acknowledged that it would think about tapering its bond purchasing programme at some point. There was a partial intra-month reversal in equities as investors bid up cyclical stocks and commodities in a reflation trade. Overall, the trend during periods of strong economic growth and inflation, however, favours value stocks and the MSCI World Value (equities) Index rose 3%, versus the MSCI World Growth (equities) Index’s 0.1% decline. Toward month-end, however, high-priced US growth stocks were again in favour. The S&P500 gained 0.7% for the month.

“UK equities outperformed their US counterparts, with the FTSE100 gaining 1.1% for the month. March data showed that the UK recorded its strongest GDP growth rate since August 2020, registering 2.1%.”

The Organisation for Economic Co-operation and Development (OECD) has consequently raised its growth forecast for the UK to 7.2% for 2021. Optimism was somewhat overshadowed by the emergence of the COVID-19 variant first detected in India, and by fears that inflation is running hotter than expected. At 1.5%, however, inflation is still below the Bank of England’s target of 2% and it is unlikely to curtail stimuli.

The STOXX All Europe fared even better, gaining 2.8% in Euro terms. The vaccine roll-out in the Eurozone was initially relatively slow (particularly versus the US and UK), but has picked up. As at the end of May, around 0.8% of the population received a dose of the vaccine daily. Eurozone business and consumer confidence rose sharply in May, rising to above pre-COVID-19 levels for the second consecutive month. Unemployment, at 8% for April, has also declined somewhat. The Eurozone export sector is likely to continue to benefit from stronger global demand and improved growth in China, hopefully shrugging off the double-dip recession rapidly.

“Chinese equities saw a large divergence between the MSCI China and The MSCI China Onshore Index. The latter gained 6.3%, noticeably outperforming the 0.7% of the MSCI China. The month was marked by a V-shaped movement in equities.”

The first half saw heightened scrutiny of tech stocks leading to outflows, while the second half saw a (seemingly contradictory) flight to the relative safety of equities. The latter movement is due to the efforts by regulators to crack down on cryptocurrency speculators and to “talk” down rapidly rising commodity prices, two asset classes that are used as alternative investment destinations. Investors, therefore, piled into more defensive stocks with steady cashflows, particularly consumer staples. Liquor giant Kweichow Moutai Co., mainland China’s biggest stock, rose by 6%. Political mud-slinging and Sino-US tensions simmered on the backburner as the pandemic took centre stage. But with both global powerhouses appearing to return to normality, rhetoric may soon take on a sharper tone.

EM outperformed their developed peers for the first time since January, boosted by strength in commodities and an apparent improvement in COVID-19 numbers. Latin American markets performed particularly well, with Brazilian equities benefiting from an uptick in global growth and consequent higher demand for key commodities. The BOVESPA index gained more than 6% in local currency terms. Mexico saw positive spillover effects from the US recovery, as manufacturing exports surpassed pre-pandemic levels. Russian equities also improved off the back of higher oil prices, with the IMOEX index closing just over 5% higher. India’s equity markets were markedly higher, as the country’s transmission rates, which have been amongst the highest in the world, have finally started improving. The SENSEX index gained 6.7% in local currency terms.

Commodities continued their upward trend: Oil prices ticked 3.8% higher during May, bringing the year-to-date gains to just under 34%. Safe-haven gold rallied 7.8%, while Iron Ore, a key industrial input, saw its price tick 5.8% higher.

South African Market Themes

The South African All Share Index posted 1.56% for the month, with Financial equities the strongest performers. The Financials sub-index gained 9.3% during June. Naspers and Prosus once again made news during May.

“Toward the end of the month, Naspers and Prosus announced a seemingly complex new share-swap, enabling Naspers shareholders to swap their shares for new Prosus shares.”

This is an apparent attempt to narrow the gap between the valuation of Naspers shares and the implied value due to the company’s holdings in Chinese tech giant Tencent and other businesses. The Tencent share was initially purchased for USD 32 million in 2001 and is now worth roughly USD 200 million. The new offer should see Prosus grow larger and Naspers shrinking. It will temper the latter’s dominance of the South African stock market, with Naspers representing roughly 25% of the JSE, meaning considerable concentration risk. It has, however, been widely criticised, with many prominent South African asset managers vocally opposing the move. There are suspicions that the deal is a way for Naspers to “internationalise” its Tencent share, as Prosus is dual-listed in Amsterdam. A less pressing concern is that South Africa would not earn its fair share of the potential capital gains tax – estimated to be around USD 40 billion.

“Naspers’s CEO Bob van Dijk, however, was quick to reassure investors that the deal does not change anything about the company’s tax status in South Africa. This has presumably been affirmed by the South African Reserve Bank, which would be hesitant to allow a transaction that takes such a substantial asset base outside the SA tax net.”

Fixed income continued to outperform local equities, as the ALBI gained 3.7% and Inflation-Linked Bonds (ILBs) added 3.3%. ILBs, given the concern about local inflationary trends, have remained an attractive hedging mechanism and the inflation carry potentially offers enticing returns (particularly where investors are jittery about growth prospects). Despite current rand strength (implying a lower cost to the imported input components of goods and services), inflation has been trending hotter over recent months. The rand has improved considerably against the greenback, ending the month at R13.72/USD. South African consumers and producers alike, however, have had to contend with the sharp oil price rise. At its latest Monetary Policy Committee meeting during May, the SARB expressed the view that the uptick in inflation was largely expected, and that headline inflation is expected to remain well within the 3%-6% target band. Another risk to the inflation outlook is that the public sector has continued to agitate for above-inflation wage increases.

Major agencies held back on any negative revisions to South Africa’s sovereign credit ratings. Moody’s, Fitch and Standard and Poor were largely aligned, seeing improvements in growth prospects, better-than-expected revenue collection and contributions from higher commodity prices, in a positive light.

“The reality, however, is that the country faces serious hurdles in its return to a sustainable economic growth path. Recent data releases indicated that there was a notable improvement in sentiment during the second quarter of 2021. The FNB/BER Building Confidence Index improved to 39, its highest level since the first quarter of 2018.”

More than 60% of respondents, however, are still dissatisfied with current business conditions. The RMB/BER Consumer Confidence Index also improved markedly, from 35 to 50 points. The latest round of loadshedding, however, will no doubt have a detrimental impact. Additionally, South Africa saw new COVID-19 cases surge, officially entering the third wave. The country has also been seriously lagging in its acquisition and roll-out of vaccines, and the process is highly-politicised.

Part of the current low interest rate environment is that local cash has become a considerably less attractive asset class. The STeFI provided 31 basis points (bps) return during May 2021, compared to 47 bps for the same month in the preceding year.

Performance

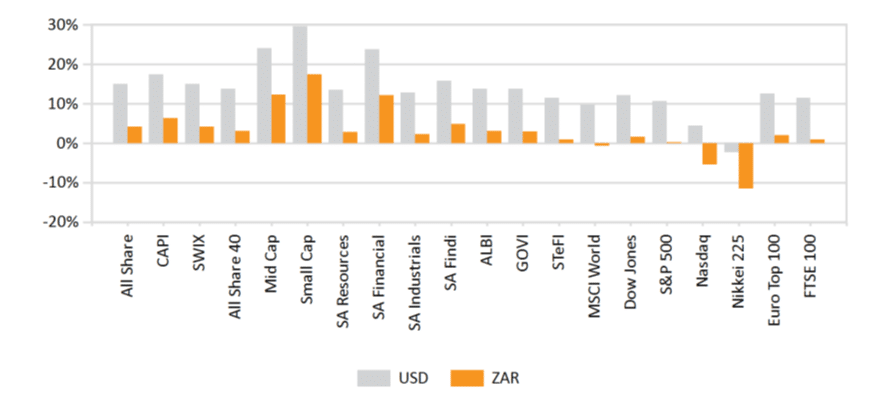

World Market Indices Performance

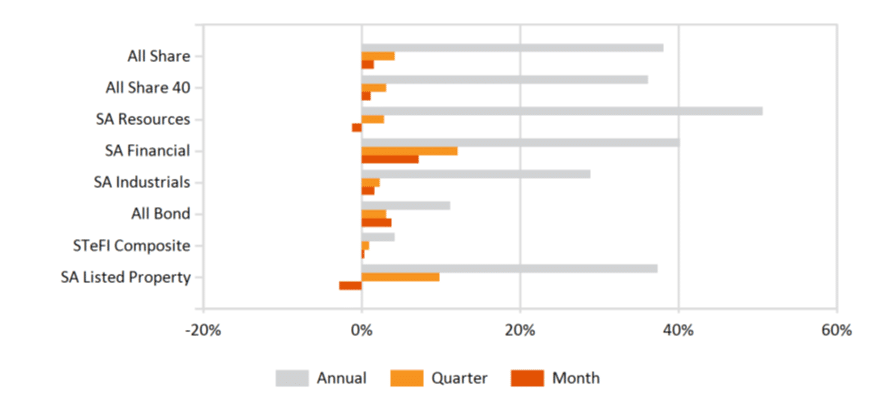

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices