Market Commentary: August 2021

Global Market Themes: Developed and Emerging Market equities post solid returns in August No new market guidance out of Jackson Hole Symposium Despite increasing regulatory scrutiny of US Big Tech, stock prices push higher Chinese regulatory crackdown continues, leaving investors fretting OPEC agrees to gradual boost in oil supply SA Market Themes: Impact of Naspers/Prosus evident in divergent local equity indices Naspers and Prosus fall materially on Chinese regulatory pressure in August Financials buck the trend, gaining more than 12% on positive earnings results Fixed income delivers solid performance, led by listed property South Africa still counting the cost of looting and unrest, economic news mixed

Market View

Global Market Themes

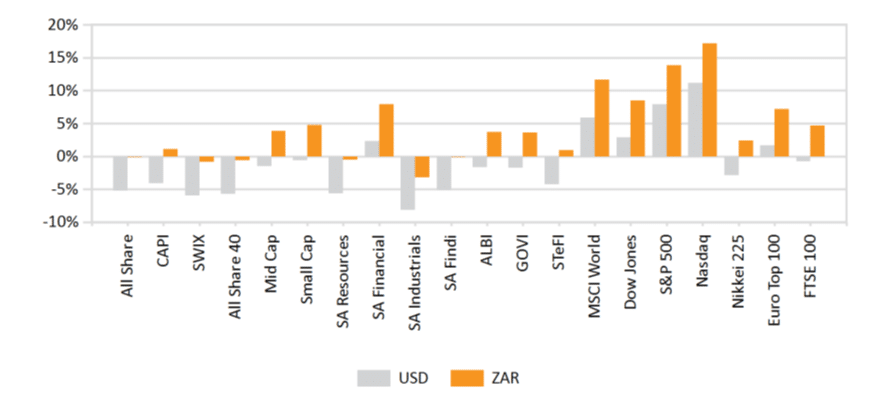

Emerging Market (EM) equities bounced back during August, with the MSCI EM Index delivering 2.6% in US Dollar (USD) terms. Developed Market (DM) equities were not far behind, as the MSCI World Index posted a solid 2.5% in USD.

US equities outstripped their DM peers, with the S&P500 nudging slightly over 3% higher. These gains come despite increasing regulatory pressure on technology stocks and political noise around the US military’s withdrawal from Afghanistan.

“On the other hand, the news that the Food and Drug Administration (FDA) had given full approval for the Pfizer-BioNTech COVID-19 vaccine, boosted sentiment.”

US economic data was largely positive: Weekly initial jobless claims came in at 340 000 during the last week of August, a fresh-pandemic low; existing home sales for July rose by 2%; and the Commerce Department estimates that second-quarter Gross Domestic Product (GDP) grew at 6.6% (seasonally adjusted annual rate).

Treasury yields pushed higher, as appetite for riskier assets such as equities dragged bond prices lower. There are also increasing calls for the US Federal Reserve Bank (the Fed) to start tapering its asset purchase programme, as the economic recovery takes hold. Fed President Jerome Powell, however, in his much-anticipated speech at Jackson Hole, gave no signal that the bank would deviate from its accommodative monetary policy earlier than anticipated (late 2021, early 2022). Jobs growth slowed during August, although the unemployment rate fell to a new pandemic-era low. One thing that will need to be monitored looking forward, is that federal aid will expire early in September. This means that millions of Americans will lose jobless benefits and it could result in a sharp pullback in spending.

The month was dominated to some extent by headlines about the increase in regulatory scrutiny of Big Tech stocks. US officials are reportedly preparing a second antitrust lawsuit against Google, focusing on the alleged abuse of its digital advertising dominance. Meanwhile, Apple’s anti-competitive practices are also coming into the spotlight: India has become the latest country to open an investigation into the company’s alleged practice of forcing developers to use its proprietary in-app purchase system. This comes as Apple lost its appeal to the Japanese Fair Trade Commission regarding its anti-competitive payment rules for media app developers. As part of the settlement, Apple will ease payment rules for developers such as Netflix and Spotify. The NASDAQ nonetheless continued to push higher, gaining 4.1% (USD) for the month.

“The secular growth and disruption themes remain the biggest driver of stellar returns. A recent report by Bank of America points out that the market cap of the so-called FAANG+ stocks (Facebook, Apple, Amazon, Netflix, Google and Tesla) equate to the third-largest country in the world in GDP.”

European equity markets posted positive returns, with the STOXX All Europe closing 2.3% higher. The European Union (EU) saw its infection rate stabilise, but the World Health Organisation (WHO) has noted that the high transmission rate is “deeply worrying” and called for the intensification of vaccination campaigns. In the meantime, given a steady increase in US coronavirus infections, the European Council has removed the US from its so-called safe list for travel.

With the initial boost from the lifting of restrictions largely dissipating, Eurozone economic sentiment measures fell, as did Purchasing Managers’ Index (PMI) data. Eurozone inflation accelerated more than anticipated, from 2.2% in July to 3% in August, outstripping the European Central Bank’s (ECB) 2% inflation target. The ECB has already sounded a hawkish tone, signalling that extraordinary COVID-19-related support is likely to come to an end soon.

Emerging market equities were partly driven by events in China. The MSCI EM Index closed 2.6% higher in USD, while the MSCI China A Onshore and MSCI China Indices closed 1% and flat, respectively. Chinese companies posted robust earnings for the June quarter, reporting a more than 30% increase in earnings per share. Resources, semiconductors and new-energy vehicle companies posted the strongest earnings growth, but Chinese consumer companies remained under pressure. Chinese regulatory changes continued throughout August and the tightening regulatory cycle has led to some investor uncertainty and market volatility. Foreign investors’ shares in domestic Chinese equities fell to a seven-year low in August. The regulatory clampdown follows a five-year blueprint, released by the authorities mid-month. It covers areas such as national security, technology and monopolies; and sectors ranging from food and drugs to big data and artificial intelligence (AI). Investors are struggling to make sense of the regulatory onslaught: over the past year, Chinese authorities have launched anti-monopoly investigations into some of the largest tech companies in the nation, such as Alibaba Group Holdings. The most recent sector to suffer has been the after-school tutoring sector (at an estimated worth of USD 100 billion), where profit-taking has now been banned. Investors consequently dumped shares of sectors that had received criticism in state media, fearing draconian regulation – from digital gaming to e-cigarettes to baby formula to property to alcohol.

“Despite China’s agreement to phase I of the Sino-US trade deal, tensions continue to simmer, particularly around the US’s sanctions of tech-giant Huawei. To read RisCura’s full China market commentary click here. You can also read RisCura’s insights on the Regulation of Chinese Techonology Companies here.”

Amongst other Emerging Markets, India proved to be the star performer, closely followed by Russia. The SENSEX gained 9.4% for the month in local currency terms, while Russian equities delivered 3.9%. Coronavirus cases in India have continued to remain low, despite the population’s increased mobility, while the vaccination roll-out continues at a healthy pace. Latin American stocks performed poorly, and bellwether Brazil saw the local bourse close nearly 2.5% lower. Inflation in countries such as Brazil, Peru and Chile has been hotting up recently, and authorities are likely to curtail the extraordinarily accommodative monetary policy soon.

There was a broad-based sell-off on the commodities front. Gold prices remained near the flat-line, but other precious metals were substantially lower. The biggest losers amongst the commodity sector were iron ore, where prices plummeted by 13.9%, and oil, where prices took a 5% dive. This is partly due to easing supply-side constraints, with OPEC agreeing to a gradual supply increase, and partly a reflection of a slower-than-expected pick-up in industrial demand.

South African Market Themes

South Africans greeted some good news in August, with the country coming out of lockdown level 4, and the vaccination programme opened up to the 18-34 age cohort. This has spurred cautious optimism that a semblance of normality will be restored sooner than some analysts had predicted. The take-up of the vaccine, however, remains troublingly slow, and government and social media platforms are making a concerted effort to dispel misinformation and fearmongering regarding its safety and efficacy.

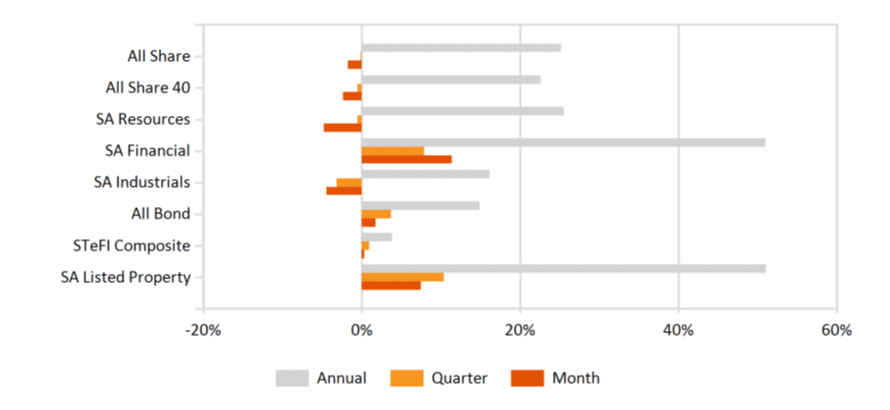

Local equities were on the backfoot, with the All Share Index losing 1.7% over the month. The impact of Naspers/Prosus’s weight in the local bourse was evident of late. The Capped Shareholder Weighted Index (Capped SWIX), in which their weights are capped at 15%, easily outstripped other local equity indices, gaining more than 2%.

“The JSE had record trading volumes on 17 August: Of the R148 billion traded, Naspers (NPN) and Prosus (PRX) accounted for R125 billion in value. The sell-off is largely off the back of the continued regulatory pressure on Chinese parent Tencent, with online education the latest casualty of the Chinese authorities’ crackdown.”

The recent drop in value saw their combined weight in the main indices drop from 20% to 15%. The resultant need for passive investment products such as ETFs and ETNs to rebalance their portfolios added to selling pressure, and the share price declined markedly for the month. A further knell was added after the South African bourse closed on 31 August, as new Chinese gaming rules drastically reduced the hours children would be allowed to play online, severely affecting Tencent. The hit saw NPN and PRX shares drop by a further 3% and 3.5%, respectively and the heavyweights ended the month with their share prices 17.4% and 7.5% lower (respectively).

“The resource subsector gave up some of the previous month’s gains, and lost 4.7%, with resource prices coming under pressure globally. Despite the decline in oil prices, however, South African motorists were in for a bumpy ride as petrol prices increased by 95c per litre during the month.”

The Industrials subsector was also considerably lower, losing 4.4%. Financials, however, bucked the trend, with the subsector gaining more than 12.2% for the month. This is partly a reflection of better than expected earnings results. Absa, for instance, posted an increase of over 1300% in its diluted headline earnings per share for the six months to the end of June 2021. The share price of the banking group subsequently climbed by more than 15% for the month. Standard Bank Group and First Rand results were also favourable and sent their share prices 20.3% and 13.8% higher, respectively. There remains some concern on the Financials front, as life insurers such as Momentum continue to see rising numbers of COVID-19 related claims.

Local property put in another stellar performance, with the All Property Index gaining 7.1% for the month, and bringing the year-to-date gains to 28.1%. Other fixed income asset classes also did well: the All Bond Index (ALBI) gained 1.7% and the Composite Inflation Linked Bond Index (CILI) gained 1.2%. Longer-dated bonds are finding favour, as the term premium is currently nearing an all-time high. This means that the compensation investors earn for taking on duration or interest-rate risk is extremely high in the South African environment. Longer-dated inflation linked bonds (ILBs) also strengthened over the past month.

“Analysts expect that South Africa’s inflation will edge higher in the long run (potentially even reaching 7%), given currency depreciation and a likely increase in unit-labour costs once the worst of the economic restrictions are phased out.”

This means that longer-dated ILBs will become particularly attractive. The current inflationary environment is relatively benign, with the South African Reserve Bank (SARB) indicating that the recent uptick is likely to be transitory. This has to some extent put a cap on the short-run returns from linkers.

On the economic front, news was mixed. Manufacturing PMI data rebounded during August, reaching 57.9 points versus the nadir in July (43.5 points). On the other hand, supplier deliveries dropped during August, suggesting that supply chains are still not working effectively, partly due to the July unrest. The IHS Markit PMI (a composite measure of the service and manufacturing sectors) also rebounded, but hovered just below 50. A reading of 50 is the tipping point, where an economy can be considered to be in expansionary territory. Service sector growth has been sluggish, with several restrictions still in place.

Analysts are predicting that the trend in rising resource prices is likely to start tapering toward the end of the year, and this seems to have been borne out in recent data. The South African Trade Surplus (a large contributor to the country’s relative fiscal health) dipped to its lowest in five months, partly due to lower exports in raw materials (with exports slipping 11.2% in July 2021).

“Meanwhile, unemployment has reached a new record high at 34.4% for the second quarter of 2021. The expanded definition of unemployment, which includes discouraged workers (people who have given up on looking for work) stood at 44.4%.”

Effectively, nearly half of the country’s working-age population are without ongoing means of support. Moreover, the impacts of the recent riots and looting are still being quantified. A recent press release from the office of the Premier of Gauteng estimates that, in Gauteng alone, the costs have topped R5 billion, with approximately 18 000 jobs being lost as a result of the unrest.

Performance

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices