Market Commentary: September 2021

Global Market Themes: US stocks pull back on interest rate and inflation fears, uncertainty over stimulus. US narrowly avoids a government shutdown, though concerns about debt ceiling linger. Fears of low-growth-high-inflation equilibrium dampen European investors’ enthusiasm. Chinese jitters spill over to global equity markets. Evergrande saga unsettles market participants, sends global property markets lower. Oil prices rise to three-year high, as some OPEC countries renege on production commitments. SA Market Themes: South Africa moves to lockdown level 1, with significant easing of restrictions. South African markets fare modestly better than global peers, amidst China fall-out. Resources bear the brunt of the sell-off, while Financials gain ground. Rand avoids a taper-tantrum. Electioneering continues apace ahead of local government elections on the 1 November.

Market View

Global Market Themes

An eventful month for markets and economic news saw Developed Markets (DM) and Emerging Market (EM) equities decline sharply. The MSCI World gave up 4.1%, while the MSCI EM was just under 4% lower in US Dollar (USD) terms.

United States (US) equities were sharply lower, with the S&P500 giving up 4.6% in USD and major US indices registering their worst month since the onset of the pandemic. The Federal Reserve Bank issued a seemingly hawkish policy statement toward month-end, leaving investors fretting about the imminence of interest rate hikes. Consumers too, appear to be fretful about rising inflation, with researchers from the University of Michigan noting that consumers are concerned about rising inflation and slower wage growth.

“The Economic Optimism Index in the US also plunged by 5.1 points to below the critical 50-mark in September, as the latest COVID-19 wave pushed back job recovery at the same time as the federal income supports are ebbing.”

The Index measures the average American’s outlook and opinions on the economy, based on a nationwide survey of 900 adults that assesses their economic outlook, personal financial outlook and confidence in federal economic policies. The fiscal environment appeared unsettled: A last-ditch agreement between the Senate and the House of Representatives averted another looming shutdown. No agreement was reached by month-end regarding raising the federal debt limit, although most market observers agree that a US debt default is highly unlikely. An agreement was eventually reached in early October, but not without sending jitters through the stock market. Political brinkmanship saw the USD 1 trillion infrastructure bill hanging in the balance, with the vote, which was scheduled for month-end, temporarily suspended due to in-party differences.

Amidst rising uncertainty regarding the sustainability and pace of the US economic recovery, safe-haven T-bills were volatile. The yield on the 10-year bill spiked to a three-month high toward the end of September, before falling back to end the month roughly unchanged. High yield bond issuance slowed down rapidly against the uncertain macro backdrop (high yield bonds are typically riskier than investment grade bonds or government bonds, and fare better in a risk-on environment). The negative headlines about Chinese property developer Evergrande, higher energy prices and the gridlock in Washington all weighed on investor sentiment.

Troubled investor sentiment also weighed heavily on European stock markets. The STOXX All Europe ended the month 2.9% lower. Shares in major European markets fell back sharply on fears that the Eurozone economy might be entering into a period of low growth and high inflation.

“Presently, the fact that the unemployment rate remains relatively low has quelled fears of stagflation (a high unemployment-high inflation-low growth equilibrium).”

An interesting and rather troubling fact, however, is that the previous bout of stagflation was partially triggered in the 1970s by rapidly accelerating oil prices. And energy prices have indeed been skyrocketing in 2021, due to a confluence of factors. For the year-to-date, the black gold price rose by over 51%. During September, oil prices shot up by 9.3%, partly because OPEC nations did not abide by the agreement to gradually increase production. Analysts are speculating that the global energy crunch may last longer than initially anticipated.

Germany, one of the most influential economic players in the European Union, experienced a volatile month on the markets. The left-of-centre Social Democratic Party (SPD) won the general election by a small margin. This means that the support of smaller parties, the Green Party and the liberal Free Democrats, is needed to form a majority coalition government. The resulting political wrangling is likely to take a long time and add to market uncertainty. The DAX closed the month 3.9% lower.

Higher oil prices proved to be a boon to United Kingdom (UK) stock markets, with the FTSE posting a modest loss of 0.16%. UK markets appear to be recovering faster than their US and European peers: twelve-month earnings estimates for the FTSE rose by over 50% since the depths of the pandemic, and UK GDP has staged a strong recovery.

“In the second quarter of 2021, GDP growth, which was languishing at the bottom of the pack, exceeded that of developed and emerging market peers.”

Andrew Bailey, Bank of England governor, issued a cautionary statement indicating that the bank was keeping a close watch on inflation expectations and the labour market for signs that temporary price pressures were becoming entrenched. Supply bottlenecks have put a cap on UK growth, and the latest – a shortage of natural gas and fuel – grabbed headlines during September. The supply-side squeeze is driving inflation higher, impacting on interest rates, and interest rate expectations and boosting financial stocks. On the flipside, Asian-focused banks (such as HSBC) lost considerable ground.

Japanese equity markets bucked the trend and ended the month more than 5.5% higher in local currency terms. This is partly the result of strong corporate earnings and improved investor sentiment post the resignation of Prime Minister Yoshihide Suga. Suga, who came under heavy criticism for his handling of the pandemic and the Olympic Games, was succeeded as LDP leader by Fumio Kishida, who becomes Japan’s 100th Prime Minister. Kishida is regarded as a safe pair of hands to guide the country through its next phase of post-COVID-19 recovery.

Chinese markets were left reeling after cracks appeared in the façade of property giant Evergrande, and as Chinese authorities continued their regulatory onslaught. The MSCI China ended the month more than 5% lower. The impact also spilt over into global property markets, with the FTSE/EPRA NAREIT ending the month 6% in the red.

“The importance of Evergrande lies beyond property development. The company is also a conglomerate that makes electric vehicles, owns amusement parks and owns a soccer team. It is a major employer in China and has high levels of liabilities.”

Its importance was underscored by a People’s Bank of China (PBOC) report as far back as November 2018: it stated that Evergrande was one of the few financial holdings conglomerates that could cause systemic risk to China. Were it to go bankrupt, it would leave all its debtholders, its shareholders, its creditors and its employees in a difficult position, as well as potentially causing contagion effects beyond Chinese borders. This proved true when the company issued a warning on 24 August that it was unable to service all its debt, and asked for assistance from the government.

“The government appeared to adopt a laissez faire attitude, leaving investors fretting about prospects for the heavily indebted behemoth and the potential spill-over effects of its downfall.”

Some analysts even pointed to the possibility of another Lehman moment. These fears are likely exaggerated. Worries about Evergrande subsided toward month-end: the company was able to make one of its interest payments, the PBOC intervened with a liquidity injection, and the sale of 20% of the company’s stake in Shengjing Bank Co to a state-owned enterprise (SOE) for USD 1.5 billion was announced to reduce the debt load. The consensus amongst informed observers is that Evergrande is unlikely to be allowed to fail, but that it is likely to undergo significant restructuring. There is speculation that the Chinese government will introduce additional fiscal stimulus through bond issuance for infrastructure, or that the PBOC will cut the reserve requirement ratio in an attempt to boost faltering economic growth and restore waning confidence in the country’s property sector.

Despite measured progress in the Evergrande saga, Emerging Markets sold off on the back of global investors’ risk aversion. The MSCI EM closed the month nearly 4% in the red. Amongst individual countries, however, returns were disparate. Brazilian equities sold off dramatically, as its above-target inflation continued to rise and the central bank responded with further interest rate hikes. Industrial metal prices, of which the country is a major exporter, were lower and dragged on major index-constituents’ performance. Second-quarter growth numbers proved disappointing, and the country seems to be lagging in its vaccination drive. The Brazilian equity index, the BOVESPA, was 6.5% lower for the month

“Asian minnows such as Taiwan and Korea were hit hard by negative sentiment toward China and by concerns about the effect of the Chinese power-crunch on production and supply chains.”

Taiwan also has troubles looming on the political front, with heated exchanges between Chinese leader Xi Jinping and Taiwanese President Tsai Ing-wen regarding its reunification with China. Indian and Russian equities, however, bucked the trend. The SENSEX was 2.7% higher, while the Russian IMOEX gained 4.1%. Indian markets were buoyed by a slew of recent initial public offerings (IPOs) and by the news that the country is on track to deliver at least one dose of vaccine to 70% of its massive population by November. Oil-rich Russia’s stock market was given a fillip by rising oil prices.

On the commodities front, industrial metals were notably lower, with Palladium and Iron Ore losing over 20% for the month (largely as a result of potentially waning demand from large import market China). Gold delivered a lacklustre performance as investors found better prospects in higher yielding government bonds. Oil prices continue to rise and increased by a further 9.3% in USD/barrel. A potentially worrying trend in food commodities, which is likely to have a knock-on effect on global inflation, is the rapid increase in world food prices. The Rome-based Food and Agricultural Organisation (FAO) tracks international prices of the most globally traded food commodities. Its food price index has reached a 10-year peak, driven by gains in staples such as cereal and vegetable oil. The combined inflationary impact of increasing transport costs (oil) and food prices is likely to come to the fore in the last quarter of 2021.

South African Market Themes

Good news arrived at month-end for lockdown-weary South Africans, as it was announced that the country would move to lockdown level 1 as of 1 October. COVID-19 infection rates are steadily declining, and new infections hover at just below 1000 daily. The vaccination programme is also gathering speed, with almost 30 per 100 people having received at least one dose of a vaccine by month-end (up 12 per 100 at the end of July). While there is still some way to go, sentiment has become more positive. KPMG South Africa’s 2021 CEO Outlook, conducted in partnership with Business Leadership South Africa, indicates that leading business people’s confidence was restored to pre-pandemic levels. The survey draws on the perspectives of 50 chief executive officers (CEOs) across 10 industries.

“Some 70% of respondents indicated that they were confident about the economy’s growth prospects over the next three years.”

The latest GDP growth numbers, for the second quarter, indeed beat estimates. The economy grew by 1.2% over the three months to June of 2021, outstripping market expectations for a 0.7% growth rate, and six out of ten industries reported positive growth rates for the quarter. This trend will hopefully accelerate with the further easing of restrictions.

South African markets were not spared the spill-over effects from China and uncertainty about global monetary policy. The local bourse reached its lowest level since January in mid-September, before staging a modest recovery. Local equities fared better than most of their global counterparts. The All Share Index closed 3.1% in the red, with the resource subsector the biggest drag on performance, closing 9.3% lower. With demand from China slowing down, industrial metal producers were left reeling. Impala Platinum shares plummeted by just short of 23%. Diversified mining group BHP Billiton saw its share price drop by 15.8%. Goldminers, which are often regarded as the safe bet, didn’t fare much better, with AngloGold losing 2.5% during the month.

On the financial front, the subsector delivered the best performance for September, closing 2% in the green. Insurer Discovery, which has exposure to the Chinese market via a partnership with its counterpart Ping An, went through a tumultuous time. The stock shed more than 6% at mid-month (around the 20 September, when Evergrande jitters were at their height). It staged a rapid recovery and ended the month with a 6% gain. Banks were generally stronger, as the South African Reserve Bank (SARB) announced at its September monetary policy meeting that interest rates would remain at the record low level of 3.5%.

“The SARB, however, cautioned that inflationary pressures were building, notably from higher fuel and food prices.”

The SARB also downwardly revised its 2022/23 economic growth forecasts. It has maintained its forward guidance for a 25 basis points rate hike in the last quarter of 2021, although most analysts deem it unlikely.

Naspers, with its well-known ties to Tencent in China, had lost 6.3% by mid-month. Nonetheless, the industry heavyweight rallied. Naspers ended the month near flat, with a monthly gain of 0.6%. The industrials sub-index was a relatively modest 0.7% lower by month-end.

The country’s trade surplus widened to R 42.4 billion in August, beating market expectations and notching 9.7% growth in exports. Precious metals were a large driver of this growth, as were base metals. One of South Africa’s key export destinations, however, is China. As growth in the Eastern behemoth slows down, the trade surplus is likely to shrink. The Rand, often regarded as a barometer for investor sentiment toward EM, was volatile during the month. There was significant selling pressure ahead of the Federal Reserve Bank’s meeting, with investors fretting about the Fed’s hawkish tone. The local unit recovered well, and ended the month 3.4% stronger, at R15.17 to the greenback.

Political wrangling is likely to muddy the waters during October, as South Africans are set to head to the polls on 1 November to cast their vote in local government elections. In addition, NUMSA (National Union of Metalworkers of South Africa) undertook strike action in the first week of October, downing tools after wage talks with employers hit an impasse. The action threatens to spill over into major sectors of the economy, including motor manufacturing and industrial production, threatening the country’s nascent economic recovery.

Performance

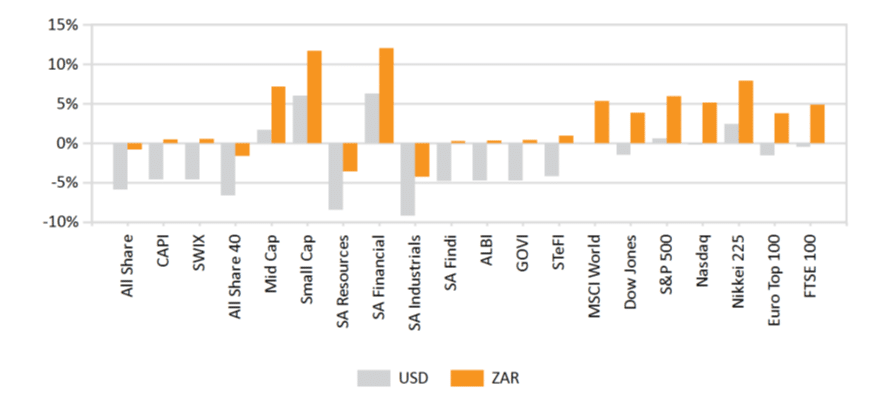

World Market Indices Performance

Quarterly return of major indices

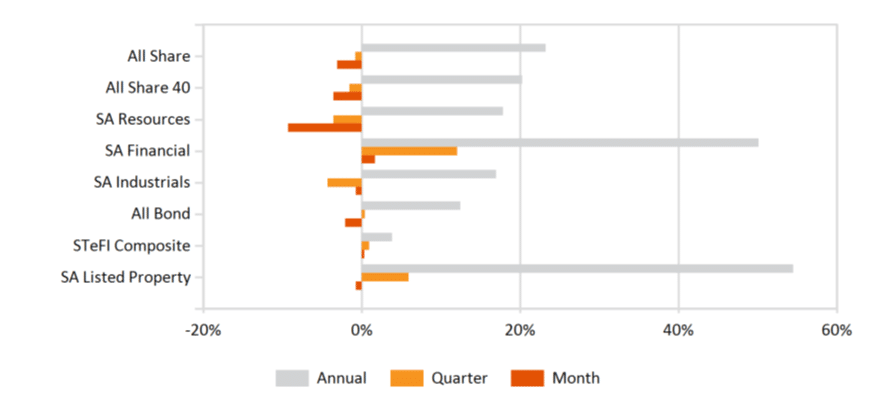

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices