Market Commentary: November 2021

Global Market Themes: Markets roiled by the emergence of new COVID-19 variant (Omicron) United States (US) equities lower, nonetheless outperforming Developed Market (DM) peers Emerging Markets (EM) bear the brunt of global risk aversion Chinese equities mainly lower, on “zero-tolerance” and regulatory uncertainty Oil prices slump, hit 20-month low, on Omicron fears SA Market Themes: Local election results deliver notable surprises in major metros South African scientists report new COVID-19 variant, Omicron, sparking reinstatement of travel bans South African equities seemingly shrug off global fears, close higher led by resources and industrials South African Reserve Bank (SARB) implements first interest rate hike Rand tumbles to fresh lows, closing at more than R16/USD

Market View

Global Market Themes

The emergence of a new COVID-19 variant, dubbed Omicron, set global markets roiling toward in November. Relatively little is known about Omicron, which was first brought to light by South African scientists, but it appears to be highly transmissible and more likely to affect younger age groups. Heightened risk-aversion brought the hitherto stellar performance of many Developed Market (DM) stock exchanges to a stuttering halt. The MSCI World, which was trundling along nicely and looked set to gain another 1% in November, saw a sharp inflexion point post 24 November. It ended the month 2.2% lower. For the most part, DM markets followed suit. Emerging Markets (EM), however, bore the brunt of investor jitters and equities sold off sharply in key markets. The MSCI EM was 4% lower.

“BRIC (Brazil, Russia, India, China) took a plunge and the MSCI BRIC lost over 4%. Even worse affected, Africa, to some extent scapegoated as the origin of the new variant saw its equity markets tumble.”

The MSCI EFM Africa ex-SA closed nearly 5% in the red. US equities managed to escape some of the fall-outs, and the S&P500 closed (only) 0.7% lower, outperforming DM elsewhere. US equities had, however, looked set to achieve a blockbuster month, on the back of better than expected economic data and the passing of President Joe Biden’s trillion-dollar infrastructure spending bill. The tech-heavy NASDAQ broke through the 16 000 point level for the first time. US employment data was part of the reason for the ongoing rally in equities: the country managed to add a further 531 000 jobs in October; the number of people filing for unemployment benefits fell to a 52-year low and the unemployment rate fell to 4.6%.

Consumers and policymakers are concerned about rising inflation. The University of Michigan’s consumer sentiment survey showed that consumer sentiment fell to a 10-year low, amidst concerns that higher inflation was eroding consumers’ purchasing power. The Consumer Price Index Inflation measure (CPI inflation) jumped by 0.9% in October – at 6.2% year-on-year, the highest reading in 31 years. While industrial activity, as measured by the IHS Markit US Manufacturing Purchasing Managers’ Index (PMI), remained in expansionary territory at 58.3 for November, it is nonetheless the weakest pace of expansion since December 2020. The manufacturing industry reports being hamstrung by supply-side bottlenecks, surging input-cost inflation and greater freight and transportation costs. The Federal Reserve Bank (the Fed), which is to remain under the stewardship of Jay Powell for the next four years, has signalled that it is considering a swifter tapering of asset purchase programmes. The current plan is for monthly bond purchases to be reduced by USD 15 billion per month, reaching zero by the end of June 2022. Whether the Fed will speed up its plan, is somewhat hanging in the balance, as the world waits to assess the impact Omnicron. US Treasury yields fell from 1.56% to 1.46% (bond yields and prices move in inverse directions) as the price of safe-haven assets pushed higher amidst Omicron-induced risk aversion.

European economic data was mixed, COVID-19 concerns and the reintroduction of some restrictions weighed on risky assets. The STOXX All Europe lost 2.8% for the month. The heavyweight German bourse, the DAX, lost a relatively muted 2.6%, but peripheral markets such as Italy bore the brunt of the sell-off with the MIB nearly doubling that loss (at 5.1% lower). On a positive note, the Eurozone flash composite PMI closed at 55.8%, firmly in expansionary territory and bucking three consecutive months of a decline. The Euro Area seasonally-adjusted unemployment rate edged down to 7.3%, its lowest since April 2020.

The source of many policymakers’ headaches, the inflation rate, has risen sharply. Core inflation in the Euro area reached 2.6% in November 2021, its highest since March 2002, commensurate with an annual inflation rate of 4.9%.

“This is the highest inflation rate since the monetary union began, and well above the European Central Bank’s (ECBs) target of 2%.”

While the ECB has indicated that it believes that the current price pressures are transient, investors are wary of pending rate hikes. Consumers too are feeling the pinch and fretting about future restrictions, with the consumer confidence indicator declining to its lowest level since April 2021, Financials performed poorly, as did sectors that are sensitive to the reopening of the economy (travel and leisure, aviation inter alia). The energy sector also performed particularly poorly, with oil prices plummeting during the month.

The FTSE 100, the main stock exchange of the United Kingdom, closed 2.2% in the red. As elsewhere, economically sensitive areas, including financials, underperformed. The substantial fall in oil prices also didn’t help the resource-heavy British bourse. Business confidence is subdued, with business owners citing serious concerns regarding inputs. The Confederation of British Industry (CBI) reports that almost two-thirds of firms are concerned about the availability of materials and components, additionally, 40% of firms are worried about a shortage of skilled labour. Fuel shortages have exacerbated worries about supply-side constraints and both manufacturing and services sectors are facing acute cost and price pressures. Unsurprisingly, core inflation has been ticking steadily higher in the UK, and the core inflation rate reached 3,4% as of October 2021 (the latest published data), which is a decade-high. Given this trend, it was widely anticipated that the Bank of England (BoE) would be the first DM central bank to raise interest rates. Governor Andrew Carney, however, confounded expectations, leading to a bounce from some domestically focused stocks. The emergence of the new variant is likely to stay in the Bank’s hand for longer, but inflationary pressure is undeniably heating up.

Chinese equities were sharply lower, and the MSCI China Index closed nearly 6% lower. This is partly due to fears that the new variant further fuels a “zero-COVID” regime from the Chinese authorities. The regime sees large swathes of the population locked down even if there are only a handful of cases detected. Other countries, particularly in the West, have largely abandoned such stringent measures, in attempts to minimise the ongoing crippling economic costs.

“Chinese policymakers face an inflationary headache: a recent report showed that prices paid at factory gates had risen by 13.5% to their highest level in two decades. This is partly attributed to rising energy prices, partly to the supply chain disruptions caused by multiple extended lockdowns. “

Industry giant Evergrande has continued to teeter on the edge of default, following Beijing’s efforts to curb the excessive use of high debt levels to fuel growth in the sector; it is set to forge ahead in its restructuring plans. The plunge in its shares has abated somewhat, but volatility in other real estate companies has continued. Kaisa shares popped by 20%, albeit briefly, on news that it would stave off default. Bonds in developer Shimao plunged by 30% on the same day.

“Investors in China are lamenting the lack of direction and transparency, both with regard to the property sector and with regard to any new regulatory crackdown on, for instance, the tech sector.”

At month-end, tech giant Didi saw its share prices plunge on news that Chinese regulators had asked it to delist in the United States (US). Japanese equities also felt the pain. Shares in SoftBank, which owns more than 20% in Didi through its Vision Fund, also closed 5% lower on the day. Overall, Japanese equities did an about-turn at month-end, as initial optimism about the reopening of markets were dealt a sharp blow by the emergence of the Omicron variant. The TOPIX was 3.6% lower. A key learning from the developments in China is that, despite its intention to build confidence regarding financial reforms, the government’s lack of clear communication is doing exactly the opposite. Foreign investors are spooked, and the market feels that it is largely being left in the dark.

In other Emerging Markets (EM), the slump in oil prices hit many countries hard. Oil prices closed a whopping 17.3% lower in November. Expectations that the Organization of Petroleum Exporting Countries (OPEC) would maintain a steady increase in output have ameliorated supply-side concerns. Demand-side pressure may also ease if new lockdown measures are introduced. US President Joe Biden’s comments indicating that the Federal Trade Commission, to curb rising inflation, would push back on market manipulation of energy prices, also dragged on oil prices. Russian equities consequently lost just over 6.2% in local currency terms and Brazilian equities were 1.5% lower. Overall, the MSCI EM dipped by just over 4% in November.

South African Market Themes

The local elections delivered many surprises: The African National Congress (ANC) saw the erosion of its broad support base, and key metros went to opposition parties and coalitions, notably, the all-important Johannesburg, Tshwane and Ekurhuleni metros are in opposition hands. What this bodes for decision-making and effective governance is yet to be determined, as some of the necessary coalition agreements appear tenuous at best. Arguably, however, the counterbalance to the ruling party is a necessary prerequisite for a mature democracy.

Even as South Africans became accustomed to greater freedom under Lockdown level one regulations, news of the emergence of a new variant of the Coronavirus rocked the world.

“South African scientists were the first to flag the Omicron variant. Research is ongoing, but initial indications are that Omicron is highly transmissible but potentially less virulent than the Beta and Delta variants.”

Case numbers globally started ticking steadily higher, following the pattern already reported in South Africa. Global governments were quick to implement travel restrictions, and Southern African states saw travel bans reintroduced with almost-immediate effect (a move which has been widely criticised).

The South African government and the National Coronavirus Command Council (NCCC) has been hesitant to introduce stricter lockdown measures, no doubt aware of the crippling impact on the economy. Instead, there has been a renewed emphasis on vaccination. Several universities have already implemented vaccine mandates, effectively meaning that unvaccinated students will be unable to attend, barring certain acceptable exceptions. So too have public spaces, including sporting events and concerts. Moreover, more companies have come out and indicated that employees will not be able to work on their corporate premises unless they are vaccinated. This included, as at the end of November, Discovery, Curro and Sanlam. The NCCC is due to discuss vaccine mandates in more detail at a meeting in December.

Investor sentiment toward South African equities was boosted by a largely positive response to Finance Minister Enoch Godongwana’s first medium-term budget speech, in which he pledged to accelerate reforms and bolster the economy, within a framework of fiscal restraint. The speech touched on the reforms that would be needed to diversify energy generation and alleviate the electricity supply shortages which hamstring the economy. Ironically, Eskom hit South Africans with nearly four days of Stage two load shedding in mid-November. The company announced that it had lost five major generation units, partly due to breakdowns and partly due to planned maintenance. This resulted in the loss of nearly 20 000 MW of generating capacity.

“The South African Reserve Bank (SARB) raised its repo rate by 25 basis points (bps) to 3.75% at its November meeting. The move, the first-rate hike in three years, was largely expected by informed market observers, given the steady upward trajectory of inflation and inflation expectations.”

In October, headline inflation had risen to 5%, above the SARB’s mid-point level of 4.5% for the sixth consecutive month. The SARB foresees a gradual path of rate hikes, with a 25bps hike expected in each quarter of 2022. It also lowered its forecasts for GDP growth for 2021 (to 5.2% from 5.3%). The impact of the looting and riots is likely to be evident in the publication of third-quarter GDP numbers.

The impact was evident too in the latest unemployment numbers: The jobless rate hit a new record high in the third quarter of 2021, rising to 34.9%. According to the expanded definition (which includes discouraged workers) nearly half of the adult employable population is unemployed (46.6%), a truly frightening statistic. In an otherwise rather dismal November, aptly perhaps a month in which Black Friday is celebrated, there were very few positive data points.

“One such is that the IHS Markit South African Purchasing Managers’ Index (PMI) swung back into expansionary territory during November, to reach its highest level since May 2021.”

Consumer sentiment also remained surprisingly resilient and the SARB’s forecast for GDP growth in 2022 remained largely on track. The country’s rapid response to the emergence of the Omnicron variant has also been widely lauded in international circles.

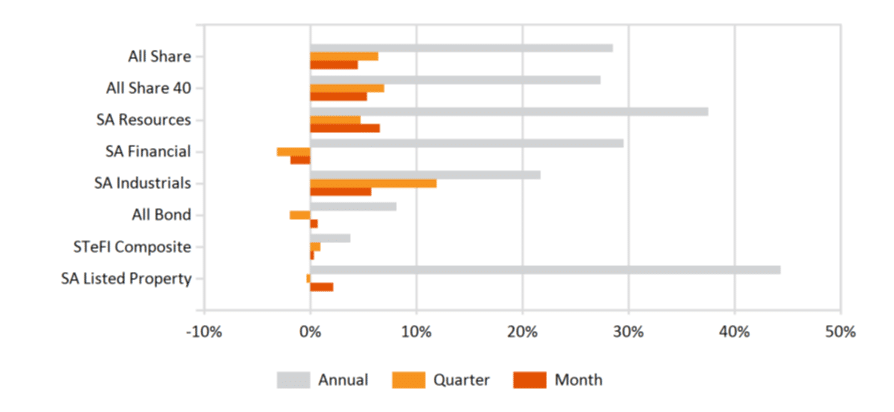

Despite the turbulence engendered in global equity markets, and Omicron-induced investor jitters, South African equities closed higher. The All Share Index added 4.4% for the month, with the Weighted Index, the Capped SWIX, eking out a more modest 0,9%. Resources and Industrials posted substantial gains, with the subindices delivering 6.5% and 5.7% respectively. Precious metals and mining shares closed more than 10% higher. South African listed property has also continued its year to date upward march, with the All Property Index gaining more than 2.1% and bringing the year-to-date gains to nearly 29%. Inflation-linked bonds were flat, despite the looming threat of inflation, but are likely to see an increased uptick in the coming months. For the year-to-date, appetite has been relatively healthy, and linkers have provided just under 10.5% return to investors. The Rand, however, bore its share of emerging market weakness and performed poorly against major currencies, ending the month at just below R16 to the greenback.

Performance

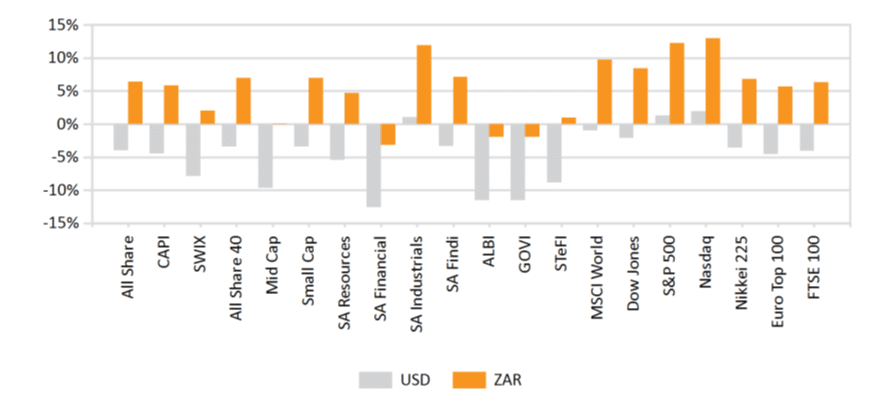

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices