Market Commentary: December 2021

Global Market Themes: Mounting Omicron cases in Europe, United States (US) despite highly vaccinated population Developed Market (DM) equities stage a recovery and end the year with double-digit gains Chinese equities slump, Chinese and US regulators remain at odds Major Emerging Markets (EM) rally, but still end the year 2.5% lower SA Market Themes: Global peers recognise prematurity of bans, ease restrictions Economic data paints a rather gloomy picture South African equities tick higher, Financials lead the way Precious metals and Industrial metals post solid gains, lifting miners Local inflation hedges – listed property and Inflation-Linked bonds – post solid gains Rand shows modest improvement against major currency pairs

Market View

Global Market Themes

Omicron struck fear into the general populace, with case numbers rising rapidly in Europe and the US. Since it was first reported in November 2021, Omicron has been detected in more than 90 countries and the World Health Organization (WHO) estimates that Coronavirus cases involving this variant have doubled every 1.5 to 3 days globally.

“Equity markets were remarkably sanguine. It appears the new variant has not derailed the underlying economic recovery.”

On the one hand, the pandemic may continue to affect sentiment and act as a headwind; policymakers are dialling back support measures, and inflation is ticking higher in much of the world. On the other hand, household and corporate fundamentals look solid enough to support an upward trend in global growth.

On the equity front, the MSCI World regained prior month losses, ending 4.27% higher for December. Amongst Developed Markets (DM), Europe was December’s star performer, with the STOXX All Europe posting more than 5.1% for the month. It has indeed been a stellar year for global equities: The MSCI World ended the year more than 20% higher, as did US equities and European equities. Solid earnings growth was the largest driver of higher returns.

US corporate earnings were particularly impressive: Corporate earnings rose 3.4% in the third quarter of 2021 (the latest available data) to a fresh record high of USD 2.52 trillion. The US also posted robust Gross Domestic Product (GDP) growth for the first, second and third quarters, with third quarter GDP growth coming in at 4.9%. The composite Purchasing Managers Index (PMI) remains above the critical 50 point mark, at 57 points, signalling a healthy expansion in manufacturing and service activity. Of note, however, is that the Institute of Supply Managers’ Markit Manufacturing PMI fell by three points in December, the weakest growth in factory activity since January 2021. This reflects record-long lags in delivery or access to raw materials and capital equipment, critical shortages of some materials, high commodity prices and transportation or logistical challenges. US inflation is also ticking higher, a trend which the Federal Reserve Bank (the Fed) is hawkishly watching.

“Core inflation jumped by 4.9% in November 2021, which is the largest annual increase in core consumer prices since June 1991.”

The Fed’s tapering of support has been escalated, with the Federal Open Market Committee (FOMC) announcing plans to accelerate the schedule from USD 15 billion to USD 30 billion per month, kicking off in January. US equities nonetheless posted solid gains, and the S&P500 closed the month 4.4% higher bringing gains for 2021 to a whopping 28.7%.

Europe has been hard-hit by the emergence of Omicron, and several countries imposed new restrictions on movement toward year-end. To name but a few: France imposed significant travel restrictions, especially on travellers from the UK; The Netherlands entered a total shutdown, with some of the most severe restrictions since the start of the pandemic; Germany declared a 14-day mandatory quarantine on visitors; Denmark has closed public venues. European economic data indicated declining optimism about the Eurozone’s growth prospects. Consumer confidence for the European Union fell to its lowest level since March 2021, coming in at -9.6. The Composite IHS Markit Eurozone PMI stood at 53.3 for December, showing the softest expansion in private sector activity since March. Annual inflation accelerated for the sixth straight month to 5%, a record high. Supply chain disruptions and high energy prices continue to drive prices higher.

“The rapid increase in oil prices, the increased cost of Russian gas, falling investments in thermal energy and ongoing work on nuclear power plant has led to a sharp rise in energy-input costs (including electricity). “

Overall, the economic sentiment indicator dropped by 2.3 points in December 2021 to a seven month-low. Equities, however, appeared to be largely unaffected, and the STOXX All Europe posted a monthly gain of 5.2%. Its annual gains (25.7%) are second only to the US’s. The performance has largely been driven by a blow-out year for corporate earnings – after surging 67% in 2021, corporate earnings exceeded pre-pandemic levels. As an example, steelmaker ArcelorMittal posted USD 14.5 billion of earnings, higher than the past 13 years combined. Higher profits are likely to fund much-needed decarbonisation efforts, simultaneously strengthening companies’ balance sheets and leaving shareholders likely to benefit from chunky dividends and potential share buy-backs.

The United Kingdom’s FTSE 100 ended the year on a high note, with the bourse gaining nearly 4.8% in December. Initial fears around Omicron appeared to ebb, even as additional measures to contain its spread came into effect. The Bank of England raised interest rates for the first time in three years in a bid to try and keep inflation, which is at a decade-high of 5.1%, under control. The Monetary Policy Committee, at its December meeting, also voted to bring quantitative easing to an end at the end of 2021. This is despite the fact that the UK has thus far lagged DM peers in its recovery. While the eurozone’s growth has nearly recovered to pre-pandemic levels, UK growth has been lacklustre. Revised figures for the third quarter show that the economy grew at only 1.1%, lower than the previous estimate of 1.3%.

Chinese equities painted a different picture, as indeed did China’s growth prospects and policy responses. The MSCI China closed 3.2% lower in December and had lost more than 21% by the end of the year. The MSCI China A Onshore, however, posted monthly and annual gains of 0.8 and 4% respectively. The MSCI China A Index tracks the largest and most liquid Chinese A-shares, denominated in Renminbi, which are listed on the Shenzhen and Shanghai stock exchanges. It, therefore, reflects Mainland China A-shares’ performance from a domestic investor’s perspective. The difference partly reflects the considerable impact which the collapse of property developer Evergrande had on global sentiment toward Chinese equities, as well as the impact of authorities’ interventions in several sectors.

In addition, the ongoing tug-of-war between US regulators and Chinese authorities has put considerable pressure on Chinese companies which are listed in the US, or which are not listed on other Asian exchanges. The reason is that a new US law, the Holding Foreign Companies Accountable Act (HFCAA), was signed into law in December 2020, and has set the cat amongst the pigeons.

“The Act requires foreign companies trading on US exchanges to submit to inspections of their auditors’ work by a US regulatory body, the Public Company Accounting Oversight Board (PCAOB). Failure to do so will result in a delisting from US exchanges, after three consecutive years of non-compliance.”

The PCAOB has already determined that China and Hong Kong are non-cooperative jurisdictions, although the China Securities Regulatory Commission (CSRC) indicated as lately as December 2021 that talks were ongoing. Nonetheless, the demand for Chinese stocks which are dual-listed in the USA has fallen sharply over the past year, as has the number of Chinese companies listed on US exchanges. The total market cap of such companies slumped from May 2021 to December 2021, from roughly USD 2.1 trillion to USD 1.5 trillion. DiDi Global Inc, China’s version of Uber, recently offered a rather stark example of the fall-out from the falling out between Chinese and US regulators. DiDi’s board had been warned, according to reports, that the ride-sharing app’s books and its substantial database were regarded as sensitive information by Chinese authorities, information that should not be subjected to the HFCAA. The company was therefore discouraged from listing in the US, but elected to go ahead. DiDi was the largest initial public offering (IPO) of 2021 in the US. It raised USD 4 billion from investors in its IPO, and at its peak had a market cap of around USD 80 billion.

“Mere days after listing in the US, however, the IPO fell apart and Didi is in the process of delisting from the New York Stock Exchange and listing in Hong Kong instead.”

This is largely due to the fact that Chinese authorities remain uncooperative in allowing the PCAOB to audit companies’ books, a stance that is unlikely to change. Companies will therefore be forced to delist and are therefore opting for the path of least resistance, which means not listing in the US in the first place. Investors are consequently left wondering what will happen with popular stocks such as Alibaba Group Holding Inc. And as investors fret, affected companies’ valuations are taking a nosedive. Alibaba, for instance, lost roughly half of its valuation over 2021.

On the monetary policy front, the People’s Bank of China (PBOC) appears to have taken a vastly different tack than DM peers, exhibiting a significant easing bias. In early December, the PBOC cut the reserve requirement ratio (RRR) by 50 basis points and lowered the re-lending rate by 25 bps in a bid to support agricultural businesses and Small to Medium Enterprises (SMEs).

Elsewhere in Emerging Markets (EM), Latin American equities outperformed the broader EM region. Mexican equities received a boost from strong US markets, while Brazilian equities closed 2.8% higher off the back of strong commodity prices. Russian equities, on the other hand, failed to capitalise on the improvement in the oil price, and the bourse closed 2.6% in the red in local currency terms. Tensions have continued to run high between the US and Russia regarding developments in Ukraine, and there is little sign of a resolution. Despite a poor showing from major markets, China and Russia, the MSCI EM managed to gain just under 1.9% in USD over December.

South African Market Themes

The South African government dispelled fears that a stricter lockdown was imminent over the December holiday season, and Mzansi breathed a sigh of relief. Several destinations also lifted their bans on South African travel to and from the country, giving some hope to the beleaguered tourist industry and stranded visitors. New cases of Omicron appeared to have hit their peak in the first two weeks of December and declined rapidly – from 26 000 new cases on the 14 December, to 15 000 new cases on the 21 December. Accordingly, the National Coronavirus Command Council (NCCC) not only did not implement more restrictive measures, it instead lifted several restrictions at the end of the month. Most notably, the midnight to 4 am curfew was lifted just in time for revellers to see in the new year. In other COVID-related news, the price of obtaining a COVID-19 test was slashed to R500, after an investigation by the Competition Commission, making it more accessible to get tested.

The latest economic data, in contrast to the data on the epidemic, was unsettling. The South African economy contracted by 1.5% quarter-on-quarter in the third quarter of 2021, according to the latest release from the Bureau of Economic Research (BER). The setback is largely attributed to the civil unrest in July, and the stricter lockdown measures which were in place during the third wave of the pandemic (Delta).

“On an annual basis, GDP growth slowed to 2.9% in the third quarter. The composite Purchasing Managers Index (PMI), at an unchanged 48.4 for December, is also indicative of the economic contraction.”

The slowdown, and the expectation that Omicron will take a toll on fourth quarter numbers, means that the country is unlikely to hit its 5% GDP growth per annum target for 2021. In the manufacturing sector the impact of the prolonged strike in the mining and engineering sector, as well as intermittent bouts of loadshedding was clear from the latest data (for the third quarter, as of October) which saw production slump by 8.9% year-on-year. The Absa Manufacturing Survey showed that overall business confidence dipped by three points to 38 during the quarter. Consumer confidence, according to the FNB/BER Consumer Confidence Index (CCI), edged up slightly during the fourth quarter of 2021, but it remains well below the average reading. The annual inflation rate accelerated to 5.5% in November, hitting its highest level since March 2017 and coming in well above the South African Reserve Bank’s (SARB) target rate of 4.5%. The increase was underpinned by higher transport costs and fuel price hikes.

“In more positive news, the South African trade surplus widened to R 35.83 billion in November 2021, well above market expectations. Exports were boosted by sales of base metals, precious metals and stones and vehicles and transport equipment.”

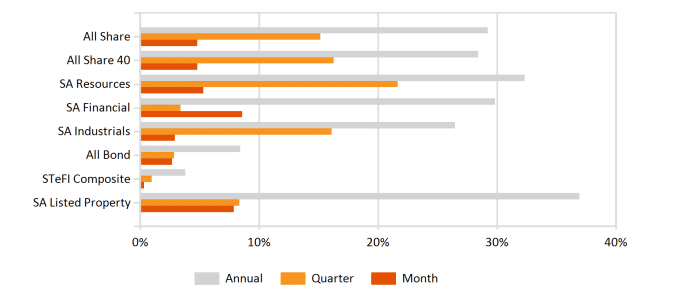

Despite the somewhat dour economic outlook, the Johannesburg Stock Exchange (JSE) ended the month in the green. The Capped Share Weighted Index (SWIX) gained more than 4.8%, boosted by a glittering performance from Financials. The subindex gained more than 8.6%. Resources were 5.3% higher, while Industrials gained a more modest 2.9%. Overall, perhaps the biggest detractor over the year has been the rapid drop in the share price of bourse-behemoth Naspers. Naspers, which is the largest local victim of the Chinese government’s crackdown, lost more than 18% over 2021. Nonetheless, 2021 has proven to be the best year for the South African stock market since 2009, largely on buoyant global sentiment. Richemont, the luxury group, was the biggest single driver in terms of index points, with shares climbing by more than 80% over the year. Anglo American and BHP Billiton also posted substantial gains, as did Sasol, driven by an increased demand for commodities.

Local listed property continued to rebound, and the All Property Index (ALPI) gained a further 7.8% in December, bringing its annual gain to an astonishing 37%. Inflation-linked bonds (ILBs) performed well in December, reflecting the market’s expectations that inflation will trend higher and that some degree of protection is advisable. The Rand remained volatile and ended the month at R15.90 to the USD. Over the year, the currency has continued to lose ground, ending at 2.1% lower to the greenback than in January 2021.

Performance

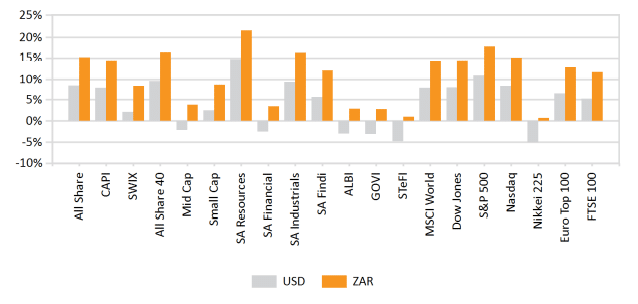

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices