Market Commentary: February 2022

Global Market Themes: Heightened tension, volatile markets as Russia invades Ukraine European equities largely lower, UK boosted by oil giants Sanctions and threats, frozen asset-holdings hit Russia and its political elite Risk aversion weighs on Emerging Markets (EM) Commodity-rich EM buoyed by higher oil and metal prices SA Market Themes: South African equities post solid gains, as resources surge Higher oil prices put consumers under pressure, and inflation ticks higher Cyril Ramaphosa’s State of the Nation Address delivers few surprises, muted response Budget 2022 – Godongwana’s tough love stance

Market View

Global Market Themes

Global markets were sent into a tailspin when Russia launched its invasion of Ukraine on Thursday, 24 February. Even though tensions had been simmering for some time, there had been hope (albeit faint) that President Putin would stay his hand. Over the month, the MSCI World lost 2.5%. Emerging Markets (EM) delivered a widely divergent performance. The boom in selected commodity prices boosted net exporters, but some EM countries suffered from being tarred with the same brush as Russia. The MSCI EM closed 3% lower, while the MSCI BRIC (Brazil, Russia, India and China) lost a whopping 6.3%.

In the United States (US), volatility reached two-year highs following the invasion of Ukraine. On the day the news broke, the Nasdaq swung by 6.8%, its largest intra-day move since the World Health Organization declared the start of the pandemic in March 2020. At one stage the S&P500 also traded at nearly 15% lower than its January peak.

“As a stark example of the volatility: Tesla added USD 100 billion in one day (24 February) but lost 5.5% over the last week of February.”

Consumer discretionary stocks underperformed, as uncertainty about international travel weighed on the tourism and travel-related stocks. The communication services sector was supported by resilient internet giants Alphabet and Meta Platforms (parents of Google and Facebook). Corporate earnings for the fourth quarter of 2021 provided some comfort to equity investors: US companies registered nearly 30% earnings growth year-on-year (y-o-y). In aggregate, companies are reporting earnings that are 8.6% above estimates. Expectations for the first quarter of 2022 are for muted growth.

Although economic data largely took a backseat to the geopolitical tensions playing out on the global stage, growth appears after the Omicron-induced lull. The IHS Markit Manufacturing Purchasing Managers’ Index (PMI) ticked higher to 57.3, signalling a strong upturn in the manufacturing sector. Moreover, output expectations have been buoyed by manufacturers’ predictions of greater continuity in the supply chain and labour conditions (many were hit by stay-at-home requirements and/or the adverse incentive of the COVID-relief grant). The Federal Reserve Bank’s preferred gauge of inflation, the core personal consumption expenditures price index, ticked 5.2% higher y-o-y from January 2021. Simultaneously, the latest headline inflation figure, for January 2022, hit 7.5%. The US labour market, despite Omicron-induced shutdowns, has remained healthy. The latest figures showed that non-farm payrolls increased by 467 000 jobs and wage growth came in at 5.7% (versus the same period in January 2021).

The tumultuous situation in Europe is likely to push global inflation higher. Coupled with strong job gains, it may lead the Fed to be more aggressive in its hiking cycle. Federal Reserve Chair, Jerome Powell, in a meeting with the House Financial Services Committee, indicated that the Fed would be more aggressive in hiking rates if inflation hotted up again in response to the conflict.

“US inflation is currently at its highest level since the 1980s. Powell acknowledged that the Bank will need to be nimble, given the highly volatile geopolitical situation.”

Analysts now expect that the Fed will deliver six rate hikes by the end of the year. Geopolitical tension saw investors flee to traditional safe havens, and US Treasury yields ticked lower, while the US dollar (USD) posted strong gains.

European equities took a beating during the latter part of February, and the STOXX All Europe lost 4.3%. The continent is facing an energy crunch, which has heavily weighed on investor sentiment, as well as on expectations of future growth and earnings. Around 40% of the European Union’s (EU) natural gas are imports and Russia is the EU’s biggest oil trading partner.

“The conflict with Ukraine, the escalating hostility between Russia and European counterparts, and the myriad sanctions are likely to send energy prices to new heights. Russia supplies natural gas to Europe through three main pipelines, Nord Stream 1, Yamal-Europe and Brotherhood. “

The supply chain was set to expand with the onboarding of Nord Stream 2 within this year. However, Germany had by month-end already halted the approval of the Nordstream 2 pipeline. Gas prices in the EU soared by nearly 70% in the last week of February 2022. Oil prices have also climbed to their highest levels since 2014, hitting more than USD 100 per barrel toward month-end. The knock-on impact on input costs will push inflation even higher. Eurozone inflation had already hit a new high of 5.6% y-o-y in January 2022. More than 50% of this is attributable to energy inflation. The European Central Bank (ECB) has indicated that it will take a calm and gradual approach to hiking rates, but the current inflationary shock may force the Bank’s hand.

Against this backdrop, there are fears that Germany, a powerhouse in the EU, is facing a recession. The country, which is manufacturing-heavy, has been badly hit by global supply chain disruptions and stay-at-home measures. The conflict will exacerbate supply chain bottlenecks and add to the price-crunch facing German consumers. The International Monetary Fund (IMF) has slashed Germany’s predicted growth rate for 2022 by 0.8%, and the German economy registered a 0.7% decline in GDP in the fourth quarter of 2021. A second period of contraction will signal a recession.

United Kingdom (UK) equities weathered the global storm better than European counterparts. The FTSE100 bucked the trend, gaining a modest 0.3% for the month. This is largely due to the significant weighting of energy and mining stocks in the index. The energy and basic resources subsectors account for just over 20% of the Index. The UK is consequently also less dependent on Russia for its energy needs, a boon to investors and its near-term growth prospects.

“UK output dipped by 0.2% in December, according to the latest monthly GDP data from the Office of National Statistics (ONS) for December 2021. The decline is attributable to renewed Omicron-induced restrictions.”

As restrictions were lifted, activity rebounded in February. The IHS Markit/CIPS UK Composite PMI surged to an eight-month high, driven by an acceleration in new orders and accompanied by a rapid improvement in the employment rate. While the energy boom is good for equity markets, it is also driving input costs and consumer prices to new heights. UK inflation hit a 30-year high in February. The Bank of England consequently raised interest rates by 25bps, and the market expects that interest rates will rise from 0.5% to 1.5% by the end of the year.

Emerging Markets (EM) were broadly lower, with global risk aversion sending investors fleeing to safer havens. The most obvious casualty of the Ukrainian conflict, Russian equities closed 30% lower in local currency terms. Global counterparts have introduced a slew of sanctions targeting Russian companies, the political elite and Russian financial institutions.

“By the end of February, roughly 80% of the Russian banking system was under sanctions, with little to no ability to settle international transactions.”

Putin has seemingly achieved pariah status in a matter of days, yet the end-game between Russia, Ukraine and the West is far from clear-cut and is likely to take a long time to play out. For a detailed analysis of Russia’s invasion of Ukraine click here. Observers have also noted that some EM countries, notably fellow BRIC members (China, India and Brazil) have largely refrained from outright condemnation of Russia’s actions. As energy prices soar, net oil importers such as India also dipped meaningfully, as did Chinese equities. China’s rapid-fire regulatory changes hit several sectors very hard throughout 2021, but economists foresee fewer major changes (or so-called crackdowns) in 2022. Beijing appears to have shifted its focus to defending a 5% growth target, potentially plotting a more predictable policy path for the coming year.

Against a backdrop of higher commodity prices, net exporters such as Brazil, Colombia, the United Arab Emirates (UAE) and Qatar all delivered solid gains for February. Oil prices were 9.8% higher at month-end, safe-haven gold gained 6.2% and industrial metals registered similarly impressive gains. Agricultural commodities, a sometimes-overlooked subsector, also delivered strong gains. Russia and Ukraine account for around 30% of global wheat exports and wheat prices have soared to their highest levels since 2008.

South African Market Themes

The global appetite for safe-haven gold and industrial metals proved to be a boon to the South African equity market. The Capped Shareholder Weighted Index (Capped SWIX, in which the weight of Naspers/Prosus are capped) closed 2.7% in the green. The Resources subsector was the natural outperformer, gaining a stellar 16% for the month. Financials also delivered a solid 3.8% return, while Industrials lagged substantially (losing 7.4%).

Higher oil prices, an uptick in the price of safe-haven gold and higher industrial metals prices once again boosted local companies. Due to the uncertainty around the Russian oil supply, oil-giant Sasol’s share prices have gained a staggering 1 130% since their 2020 pandemic low. For February, the gain was a far more modest 1.64%. Most other index constituents’ performance, however, was dwarfed by share-price jumps in gold and platinum miners. Sibanye Stillwater delivered 26.3%, Anglogold was 22.6% higher, Impala Platinum gained 25.5% and Angloplat fell just short of being 30% higher at month-end. Conversely, Naspers had a dismal month, with the share price dropping nearly 20%. This is partly attributable to weakness in China (Tencent), but also due to the company’s holding in Mail.ru (now known as VK).

“VK is a key internet player in Russia and Naspers pumped roughly R380 million into the company over 2020, taking its stake to 27%. It also, alongside Prosus and Tencent, took part in an R9 billion debt issued by the Russian company.”

The Naspers/Prosus stake was worth roughly R7.6 billion at the end of February. The London Stock Exchange has since suspended trading in VK Group, but not before its share price had plunged to under USD 1 per share.

Consumers continue to feel the pinch of higher energy costs – the latest blows include sharp hikes in pump prices and electricity tariffs. Petrol prices increased by nearly R1.50 per litre in the first days of March, while Eskom has been granted a tariff increase of 9.61%, effective from the 1 April. Granted, the National Energy Regulator of South Africa (NERSA) pushed back against the proposed 20% increase the power utility had requested, but beleaguered consumers will find it hard to swallow (particularly since loadshedding is a regular occurrence). Cost pressures remain severe, and local firms marked up their output charges to the greatest extent in nine months. The IHS Markit PMI nonetheless rose to a three-month high in February 2022, the second consecutive month of expansion as business activity continued to normalise. It is hoped that this normalisation will continue, as the lifting of the national state of disaster seems to indicate. President Ramaphosa, in his State of the Nation Address (SONA), announced that the disaster regulations which had been in place for nearly two years would be allowed to lapse by the 15 March. During the address, which was delivered in Cape Town’s City Hall after the suspected arson at National Parliament, the President also announced that the R350 per month cash grant would be extended for another year. The grant, while offering much-needed support to the poorest of the poor, has also placed a significant strain on government finances.

Finance Minister Enoch Godongwana delivered the Budget Speech (on the 23rd of February) against this rather sombre backdrop. Economic growth has been revised downward from 4.8% in 2021, to 2.1% in 2022 and averaging at 1.8% over the subsequent three years.

“The budget deficit is projected to narrow from 5.7% in 221/2022 to 4.2% in 2024/25. Public debt, however, is predicted to increase steadily over the next three years before stabilizing at 75% of GDP in 2024/2025.”

Godongwana had some harsh words and warnings for State-Owned Enterprises, indicating that the era of large-scale bailouts was set to end. The Speech also included some tax relief measures, enabled by commodity-spurred growth in tax revenue. One of the key highlights is a slight reduction in the corporate income tax rate, a move which is seemingly in line with a key message from SONA: namely that the private sector will be a growth engine in the economy. This message has not gone unnoticed by international investors, but has simultaneously come under heavy fire from political opponents. The Economic Freedom Fighters (EFF), for instance, continue to push for nationalisation and are opposed to the view that the private sector will drive economic growth.

Key takeaways from both SONA and the Budget Speech: the country is poised for a return to normality. What the new normal will look like will depend on the formulation and steadfast implementation of sound economic and fiscal policies.

Performance

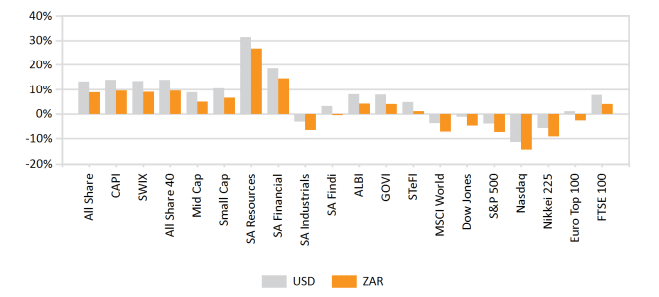

World Market Indices Performance

Quarterly return of major indices

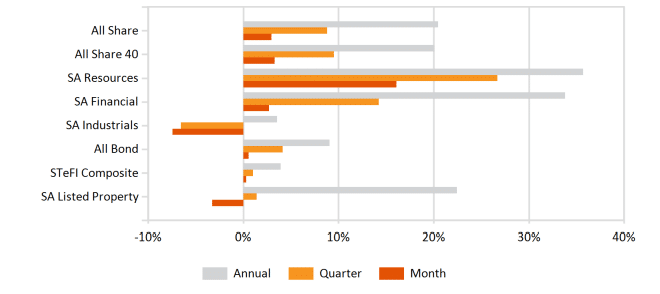

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices