Market Commentary: March 2022

Global Market Themes: Ukraine dominates sentiment, tensions escalate between Russia and NATO-allied nations Further sanctions, supply chain disruptions boost global energy prices United States (US) announces the release of crude oil reserves, somewhat tempering surging oil prices US stocks close 3.7% higher, but volatility remains elevated US Federal Reserve Bank (Fed) sounds a more hawkish tone as it raises the repo rate by 25 basis points (bps) Bank of England follows suit, as United Kingdom (UK) inflation ticks higher. European Central Bank (ECB) takes a wait-and-see stance China lags Emerging Market (EM) peers, MSCI China 8% lower in USD, amidst the resurgence of Covid-cases in Shanghai SA Market Themes: Local equities continue their climb during March, Capped SWIX gains 1.5% To combat higher inflation, South African Reserve Bank (SARB) hikes interest rates as expected Financials deliver stellar performance, advance more than 11.5%, boosted by SARB decision Year-to-date gains in resources subsector pared by 1% dip during March Rand posts solid gains against major currencies South Africans heave a sigh of disappointment as lockdown extended until April 2022

Market View

Global Market Themes

Amidst faint hopes of a resolution to the Russia-Ukraine conflict, global markets witnessed a muted relief rally at month-end. The MSCI World closed the month 2.7% higher, led by solid gains in United States (US) equities. Emerging Markets (EM) were mixed: Strong gains from oil-rich nations such as Brazil were offset by a dismal performance from Chinese equities. The MSCI EM closed 2.2 % lower overall, with an 8% drop in the MSCI China eclipsing gains elsewhere in EM.

For United States (US) equities, the first quarter of 2022 has proven to be the worst since the start of the pandemic in 2020, with the S&P 500 down 4.6% for the quarter. Nonetheless, March saw stocks rebound, and the index closed nearly 3.6% higher. All 11 sectors of the S&P500 were positive for the month, and the market appeared to stop fretting about higher interest rates and inflation. Energy stocks continued their hot streak, having posted just short of 38% for the year-to-date. The solid monthly gain is partly attributable to expectations of a largely positive results season: thus far earnings, sales, dividends and buybacks have beat expectations. Indeed, the reported earnings results for Q4 2021 have set a new quarterly record. Despite the turnaround in March, the S&P is still down 4.95% for the year-to-date.

The last week of March saw the publication of several key economic indicators: Non-farm payrolls showed that job growth fell short of expectations (431 000 versus 490 000), but unemployment continued to trend lower. US consumers, despite the ebbing of Covid concerns, appear to be pessimistic.

“The University of Michigan’s consumer sentiment index was revised lower to 59.4, which is its lowest reading since August of 2011.”

Inflation expectations continue to be the main culprit: most respondents expect that price pressures will lower their standards of living, and their one-year-ahead expectations of inflation are the highest in 40 years, at 5.4%. Half of the consumers also viewed current policies in an unfavourable light. This speaks to the growing certainty that the Federal Reserve Bank will be less accommodating and more hawkish in its stance going forward.

While the Fed had for some time telegraphed its intentions to start hiking interest rates, to some extent the tone was dovish. This changed in March. Post a meeting of the Federal Open Market Committee (FOMC), Fed Chairman Jerome Powell not only announced a 25 bps rate hike but also signalled that (for the first time in memory) interest rates may be pushed above the “neutral” interest rate. The neutral rate is a rate that doesn’t boost growth nor dampen demand (i.e. policy-neutral), and according to the Fed’s estimate, 2.4% is the neutral rate. The FOMC view calls for a total of six more rate hikes, bringing the rate to 2.8% in 2023. The Fed’s stance immediately raised the spectre of a recession, which Powell was quick to wave away. Economists are less sanguine.

European equities, after a dismal February, closed out the month nearly flat. Initial optimism about the possibility of a peace deal being brokered between Russia and Ukraine faded at month-end and choppy trading resulted in elevated volatility. The ongoing tension resulted in the European blue-chip index closing out its worst quarter in two years, at more than 6% lower.

“The European Union and the G7 nations have maintained a tough stance on President Vladimir Putin and Russian businesses. President Putin signed a decree that stipulated that from the first of April foreign buyers would have to pay for Russian natural gas in Roubles, partly to stem the depreciation of the currency and depletion of state coffers.”

The G7 unanimously rejected the decree, and German Chancellor Olaf Scholz set in motion an emergency plan for rationing natural gas should deliveries from Russia be compromised.

Eurozone inflation has continued to accelerate, with annual inflation hitting a record high of 7.5% in March (a 1.6% spike from the prior month). The European Central Bank (ECB) has maintained a cautious stance and appears to be taking its time in adjusting its policy trajectory. ECB President Christine Lagarde has reiterated that the Bank will conclude its bond purchases by the end of September and that rates will only rise “some time” after that. This implies that the ECB will only start its rate hiking cycle in the fourth quarter of 2022, considerably later than its peers. There are concerns that this will be too little, too late.

“In addition, projections for Eurozone growth have been slashed and some market watchers cite fears of a stagflationary environment (stagflation means that an economy is in a low-growth, high-inflation, high-unemployment equilibrium). “

In this type of environment, the traditional monetary and fiscal policy tools are rendered largely ineffective.

The United Kingdom (UK) stock market continued to benefit from the steady upward march of energy and mining stocks. The FTSE100 closed the month 1.4% higher in pound sterling. UK GDP growth for the fourth quarter of 2021 was revised higher to 1.3%, although this appears to have been driven largely by a post-Covid normalisation. As elsewhere, UK consumer and business sentiment has ebbed to fresh lows. Manufacturers indicate that they are facing intense cost and price pressures, while consumers are wary and weary of rising food and fuel prices. The Bank of England was one of the first amongst its Developed Market peers to adjust rates in response to inflationary pressure, with a combined 50 bps hike over the quarter.

“The Office for Budget Responsibility (OBR) projects that the UK Consumer Price Index (CPI) will hit a whopping 8.7% in the fourth quarter of 2022 (a far cry from the previous projected maximum of 4.4%).”

In his Spring Statement, Chancellor Rishi Sunak has consequently announced several measures designed to support the UK consumer. This includes a reduction in the Value Added Tax (VAT) on fuel and 50% business rate relief for eligible properties.

Emerging Markets (EM) posted mixed returns and the MSCI EM closed the month 2.2% in the red. The major culprit in the index’s poor performance is the particularly poor performance of Chinese equities. The MSCI China and MSCI China A Onshore closed 8% and 8.9% lower in USD. Chinese stocks remained under pressure, as investors fret about dual-listed companies’ potential delisting from the US exchange.

“The Holding Foreign Companies Accountable Act (HFCAA) stipulates that US regulators must be allowed to inspect listed companies’ audits. China has refused.”

Amongst the cohort facing delisting: China’s biggest search engine Baidu; and Yum China, which operates the KFC and Pizza Hut brands in the world’s largest consumer market. Investors are also jittery due to the terse (at-best) political dialogue between China and the US. The former has thus far refused to be drawn into condemning its fellow BRICS nation Russia, which has added to the tension. Manufacturing and Services Purchasing Managers’ Indices fell into contractionary territory during March, dampening the country’s growth prospects.

“This is partly attributable to the reintroduction of strict lockdown measures in economic hub Shanghai, amidst a resurgence of Covid-19 cases. More than 32 000 new cases were reported during March, which is the biggest spread of the infection in the country since it was first detected in Wuhan.”

Elsewhere in Emerging Markets, commodity exporters continued to benefit from surging prices. Brazilian equities were 6% higher in local currency terms and Latin American counters generally fared well. Russian equities, perhaps somewhat perversely given the country’s starring role in the conflict, closed the month 9.4% higher in local currency terms. The gain is somewhat misleading, as it reflects a confluence of factors. The market had been suspended for nearly a month, so trading was likely to be brisk upon its eventual reopening (on 24 March). Then too, foreigners had been banned from selling their holdings until at least 1 April. The energy sector, which has been booming, also bolstered returns.

Oil prices continued to tick higher, closing at 6.9% for March. Gains were somewhat tempered by US President Joe Biden’s announcement that the US would release some of its crude oil reserves to ease supply-side constraints. In other commodities, metals were broadly higher with silver, copper and safe-haven gold 1.4%, 4.5% and 1.5% higher. Palladium, which is widely used in industrial production, lost 9% as industrial production in major economies softened slightly.

South African Market Themes

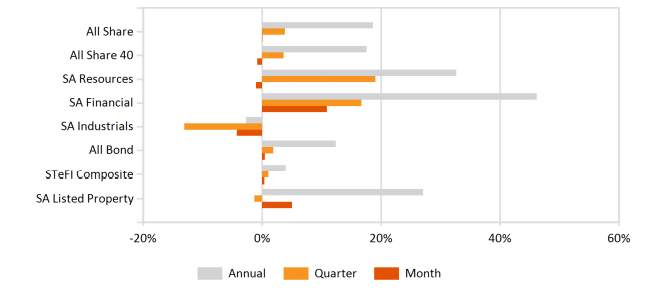

South African equities remained resilient in the face of global investor jitters and the Capped Shareholder Weighted Index (SWIX) ticked 1.5% higher.

South African inflation has continued to tick higher, largely due to cost-push factors. Energy prices remain elevated, with a knock-on impact on transport costs and the cost of manufactured goods.

“Moreover, food price inflation is rising relatively quickly. This is partly attributable to the Russia-Ukraine conflict, as these two countries are major suppliers of grains, oilseeds and fertilisers.”

Although South Africa’s direct imports from these countries are relatively limited, it is inextricably linked to the global market. The Food and Agriculture Organization’s global food price index hit an all-time high in February, having gained more than 20% over a year and 3.9% in January alone. Although the South African inflation rate remained steady (at 5.7% in February 2022), the South African Reserve Bank acted pre-emptively to rein it in. At its March Monetary Policy Committee meeting, the Bank elected to implement a 25 bps increase in the repo rate. The move was expected, as the SARB has been intentional about broadcasting its forthcoming actions to market participants.

The Financial subsector was a major beneficiary of the SARB’s announcement, and the sub-index gained more than 11% for the month. Resources, after a stellar February, closed modestly lower, with the sub-index losing just over 1%. Industrials remained the wayward child: the subindex closed the month 4.3% lower, bringing the year-to-date loss to 13.1%. To be fair, this is to a large extent attributable to matters unrelated to South African stock market fundamentals. Naspers/Prosus’ fall from grace was further exacerbated during March by the poor performance of Chinese parent Tencent. Naspers itself lost more than 13% on the local bourse over the month.

South African consumer confidence has remained weak, with households pessimistic about their financial position and the general economic outlook.

“The FNB/BER Consumer Confidence Index fell a further four points to -13 in the first quarter of 2022, well below the long-term average of two.”

Business confidence ticked up to its highest level since the second quarter of 2021. The improvement in sentiment amongst manufacturers is partly attributable to the nascent normalisation of all spheres of production. Strong domestic sales and an improvement in exports boosted sentiment, although the Russia-Ukraine conflict is likely to filter through in the second quarter reading.

South Africa’s terms of trade showed a vast improvement, registering a surplus for the 22 consecutive months. This signals the longest period of a positive balance of trade in more than a decade and the largest margin in 25 years. The strong run in commodities has been the major driver of the trend. Reliance on oil imports remains problematic. As March ended, it was forecast that April would herald increases in the prices of petrol and diesel by around R2 and R3.

“Finance Minister Enoch Godongwana consequently announced that the general fuel level would be slashed by R1.50 per liter to cushion the blow to cash-strapped consumers and businesses. “

The move was welcomed, but it is a temporary reprieve. The state has indicated that it is considering several proposals to deal with rising fuel costs in the future but has given no clear guidance on what is being considered or what the anticipated time frame is.

The local currency, supported by the favourable terms of trade and by the ongoing surge in commodity prices, gained significant ground against major currency pairings. At month end, the Rand was at R14.61 against the greenback, an appreciation of 4.93%. It was also trading roughly 7% and 6% stronger against the Pound Sterling and the Euro.

There are other data points that emerged during March which are worth considering and which are somewhat troubling.

“Statistics South Africa reported that Gross Domestic Product (GDP) growth for the fourth quarter of 2021 came in at 1.7%. This was in line with expectations but was significantly lower than for the previous reporting period.”

The latest publication of South Africa’s unemployment rate saw another unthinkable high, at 35.3% for the fourth quarter of 2021. Coupled with rising inflation, it is feared that the spill-over from the Baltics will delay or even derail the nascent economic recovery.

Performance

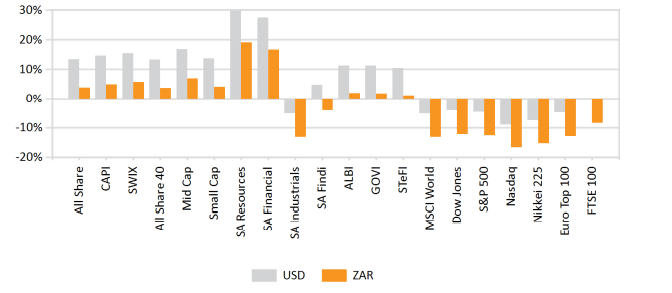

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices