Market Commentary: July 2022

Global Market Themes: Global equities bounce back with the MSCI World gaining just short of 8% United States (US) equities lead the charge (+9.2%), closely followed by European counterparts (+7.9%) Emerging Markets were modestly lower (MSCI EM -0.3%), but widely divergent within EM performances – MSCI BRIC 3.6% lower, as MSCI China dips nearly 10% Politics at play in the United Kingdom (UK) as beleaguered (ex) Prime Minister Boris Johnson leaves office Oil price softens modestly, industrial metals gain ground SA Market Themes: Unprotected strike action leads to unprecedented levels of loadshedding Efforts s to alleviate pressure on existing grid ramped up Shifting political landscape under the spotlight as President Cyril Ramaphosa’s farm robbery continues to make headlines Some respite for motorists at the petrol pump South African inflation continues to tick higher, further rate hikes on the cards Financials consequently continue strong year-to-date (YTD), performance, but Industrials deliver the strongest sectoral performance.

Market View

Global Market Themes

July brought respite to global equity investors, with most major markets delivering solid gains. The US led the Developed Market bounce-back, with the S&P500 gaining more than 9.2%. Emerging Markets were modestly lower (MSCI EM -0.3%), with a poor performance from Chinese equities (MSCI China -9.5%) spilling over to other Asian markets.

Second-quarter Gross Domestic Product (GDP) growth rate in the US came in at below zero for the second consecutive quarter, meaning that the powerhouse has officially entered a technical recession. Investors were left pondering whether the Federal Reserve Bank (the Fed) would continue with its aggressive path of interest rate hikes. The rationale is that the combination of higher interest rates and rising inflation erodes the average citizen’s purchasing power (given that debt is also more costly to service), reduces domestic consumption and potentially impacts GDP growth.

“Nonetheless, the Fed temporarily put that debate to bed by raising interest rates by a further 75 basis points (bps).”

The latest hike affirms the Fed’s commitment to bring rapidly rising inflation under control: at 9.1% US inflation is at a 40-year high. Despite negative economic growth, the US labour market has remained remarkably robust, with the unemployment rate remaining at 3.6%. US equities seemingly shrugged off the recessionary fears and July’s solid gains pushed back June’s bear market. Earnings season (for those companies which had reported by the end of July) beat estimates. According to forward guidance Q2 will post a 7.3% increase over Q1.

Despite political turmoil in the UK for much of the month, the FTSE 100 managed to post its best monthly performance for 2022. After months of furore, Boris Johnson announced his resignation as Conservative Party leader, and is set to step aside as prime minister in September. UK inflation has hit a 40-year high, at 9.4%, largely driven by energy and food prices. Bank of England Governor Andrew Bailey has not ruled out the possibility of a further 50 bps rate hike in August.

Elsewhere in Europe, upbeat earnings pushed shares to their best monthly performance for 2022, led by information technology and the real estate sector. European GDP figures are surprisingly on the upside, with second-quarter growth at 0.7%. The headline number, however, disguises a vastly different experience for the Mediterranean bloc and Germany.

“Germany’s trade balance has continued to worsen, given the country’s reliance on oil and gas imports and the impact of the ongoing war between Russia and Ukraine.”

There were faint hopes at month-end that the former had softened its stance, as a new agreement was brokered by Turkey and the United Nations (UN) to allow the export of Ukrainian grain and other agricultural products via selected Black Sea ports. The agreement, however, is tenuous at best. In the meantime, rising food prices (in conjunction with higher energy prices) continued to push European inflation higher, as elsewhere. Against another record high (8.9%), the European Central Bank hiked interest rates by a further 50 bps.

Emerging Markets (EM) posted divergent returns, but a poor performance from Chinese equities proved to be a drag on the overall index. In China, concerns about the macro-economic outlook persisted – the fact that the Politburo (the Communist Party’s central decision-making body) cut its GDP growth estimate for 2022 is perhaps the most telling indicator of trouble ahead. In addition, the Politburo appeared hesitant to commit further to stimulus measures, although the Chinese Central Bank pledged monetary support toward month-end. There are fears that the instability in the Chinese property market will spread to broader financial markets (with homebuyers refusing to pay mortgages on properties where construction has been halted). A renewed crackdown on internet companies, and the pervasive Covid-19 regulations, also soured market sentiment. Latin American equities, on the other hand, posted positive returns, despite a dip in oil prices. Brazilian equities closed the month 4.8% higher; while Mexican equities were boosted by a promising earnings season to date.

South African Market Themes

South African equities shrugged off the Eskom-induced doom and gloom, with the Capped SWIX delivering a solid 2.8% for July.

The gloom was certainly in full force as South Africans experienced one of the worst bouts of loadshedding in recent history. Unprotected strike action and ongoing breakdowns at major power stations saw the country endure stage six rolling blackouts. The government has pledged to ramp up efforts to alleviate pressure on the existing grid, but whether it is too little too late is yet to be seen. Among these efforts: Bid Window 5 of the Renewable Independent Power Producer Programme would be doubled, which should allow an additional 2 600mW to be connected to the grid within 18 to 24 months; licensing requirements for independent power producers were lifted beyond the 100mW mark and permitting requirements would be streamlined to reduce waiting times; and Eskom would introduce a feed-in tariff. The tariff would effectively mean that households and businesses that can invest in energy generation facilities (such as rooftop solar panels) could sell excess energy into the grid. This scheme has been tried and tested in several European countries. Unsurprisingly, alternative energy, as a subsector of the equity market, made whopping gains of just over 21% for July.

President Cyril Ramaphosa, while fighting to keep the lights on, is also facing increased political pressure. South Africa’s Public Protector issued a deadline for the president to answer questions regarding the robbery at his Phala Phala farm in 2020.

“Several political parties, including the Economic Freedom Fighters (EFF), Democratic Alliance (DA), Inkatha Freedom Party (IFP), have called for a Section 89 Enquiry and a No Confidence Motion to hold the president accountable.”

Section 89 allows for the National Assembly to remove a president from office, should it be deemed that he is in serious violation of the law, or unable to perform the functions of his office.

South African motorists are set to have some respite, with fuel prices set to decrease by as much as R1.32 per litre in August. The Automobile Association of South Africa has also indicated that the outlook for fuel prices is positive, with another price drop likely in September. However, higher fuel and food prices have continued to exert upward pressure on local inflation. Food price inflation, by the South African Reserve Bank’s latest estimates, is likely to come in at 7.4% for 2022 (up from 6.6%). Core inflation is also forecast to be higher, at 4.3% in 2022, and average inflation expectations have increased to 6% for 2022. One of the difficulties with higher inflation expectations is that they can serve as a self-perpetuating mechanism: higher expectations lead to vendors and other market participants hiking their prices ex-ante. The SARB, however, has remained one of the more credible financial institutions globally, and has been highly successful in broadcasting policy and consequently in anchoring inflation expectations. In keeping with this observation, the Monetary Policy Committee raised the repurchase rate by 75 bps at its July meeting. The interest rate hike proved a boon to Financials, which closed the month nearly 3.9% higher. Industrials were the major gainers, with the Metals and Mining and Industrial Transportation subsectors delivering solid gains.

Performance

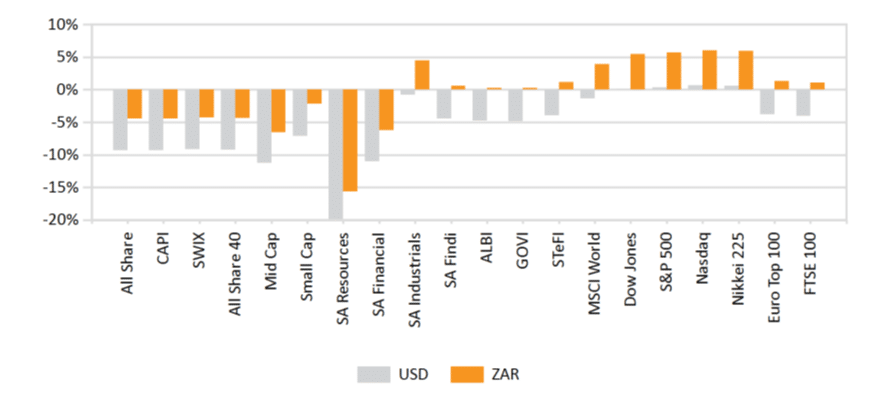

World Market Indices Performance

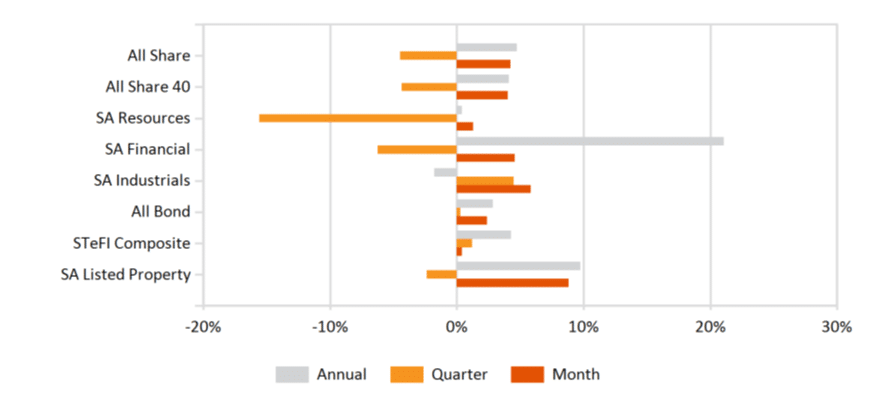

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices