Market Commentary: August 2022

Global Market Themes: Developed Market equities fall; Emerging Markets post modest gains The Federal Reserve doubles down on interest rate policy stance Eurozone inflation accelerates, exacerbated by soaring energy prices Chinese economic activity continues to slow, despite marginal policy easing SA Market Themes: Equities lose ground while bonds flat-to-positive Inflation accelerates to an annualised 7.8% in July GDP contracts in the second quarter SA faces potential grey listing by global money monitoring watchdog

Market View

Global Market Themes

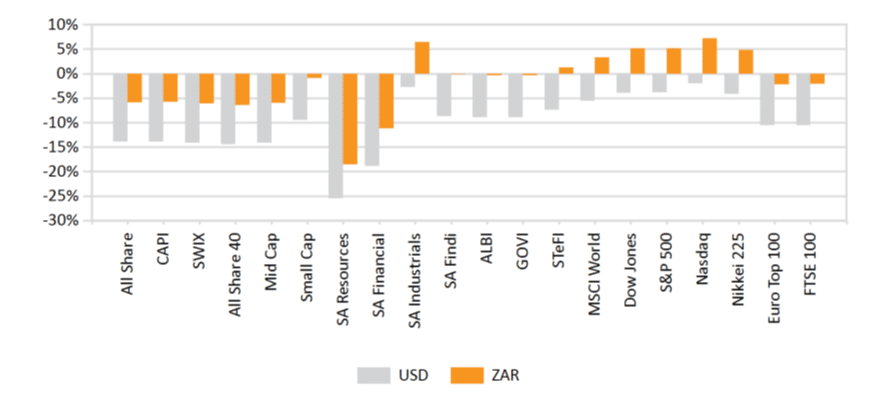

August was another month of declines across Developed Markets, with the MSCI World Index declining by 4.1%. Emerging Markets (EM) fared better, posting a modest 0.4% per the MSCI EM Index. The global bond market bellwether (Bloomberg Barclays Global Aggregate Bond Index) lost 3.9%, its single largest monthly decline since November 2016. Year to date, this fixed income index is down 15.6%, which is indicative of the pain bondholders have felt over the year due to the rapidly rising short-term interest rates globally. On commodities, the S&P Goldman Sachs Commodities Index (GSCI) returned -2.9% for the month, driven by weaker energy and precious metals prices. All returns are in USD.

US equities declined following comments by Federal Reserve (the Fed) chairman Jerome Powell that the bank would remain in a tightening monetary policy stance “for some time” in order to address rampant price increases. Markets sold off as the prospect of a more modest pace of short-term interest rate rises over the coming months was now likely firmly off the table. Volatility ensued as investors revised their expectations in light of this new information. The S&P500 Index closed August 4.1% lower, with long-duration equity indices down more – for example, the NASDAQ Composite Index closed at -4.5%. This is understandable as the latter group is relatively more sensitive to perceived and realised changes in interest rates. Besides technology shares, the real estate (-5.7%) and healthcare (-5.9%) sectors suffered the steepest declines; energy shares meanwhile bucked the broader market, posting a 2.2% gain.

Per the consumer price index (CPI), inflation in the US increased by 8.5% over the 12 months to the end of July. This was done from June’s 9.1% print. This closely watched metric surprised the downside relative to market consensus, which expected 8.7%. This surprise appears to have spurned a new market narrative that CPI inflation has now peaked in the US, catalysing a strong mid-month move higher in risk assets. As noted above, however, the Fed ended this party in late August. On the US labour market – as per non-farm payroll data, the key labour market reference series – payrolls grew by 315 000 jobs in August. This beat the market consensus figure of 300 000, indicating a still strong labour market despite signs of slowing growth – the August print was 200 000 lower than July’s 528 000 new jobs print.

In the Eurozone shares declined amid ongoing concern over accelerating inflation, particularly in energy and electricity prices. The MSCI European Economic and Monetary Union (EMU) Index, a broad and comprehensive measure of Eurozone shares, lost 6.3%, while the German DAX 30 Index declined by 6.1%. The same sectoral performances, as above, played out with technology, real estate and healthcare shares all posting large declines, while the energy sector showed resilience, gaining over the month.

August saw a further build up of the region’s energy crisis. Russia halted the Nord Stream 1 pipeline indefinitely, stating it has no plans to resume supplying gas to Europe via this key pipeline until sanctions posed upon it by Western countries are rolled back. Furthermore, a handful of nuclear reactors in France were down for longer than expected due to routine maintenance. Summer drought in parts of Europe has resulted in difficulties in transporting coal via the Rhine River to coal-powered plants. These factors have all placed tremendous upward pressure on the region’s electricity prices, not only current but also future prices – the cost of German electricity 12 months forward broke the €1 000 per megawatt hour mark for the first time.

Annual CPI inflation continued to accelerate across the region, estimated to be 9.1% for August. Inflationary pressures are most evident in the business sector; producer price inflation is up a staggering 37.9% compared to July 2021. The latest meeting minutes of the European Central Bank for July point to growing concern about inflation and that a further increase in the policy rate will most likely at its next meeting in early September.

Japanese equities gained in the first half of August thanks to strong quarterly company results and the expectation that US inflation has peaked. This positive performance unwinds in the second half of the month, mostly likely due to the more hawkish tone of the Fed. The Nikkei 225 Index returned -2.8%, while the Yen resumed its weakening trend against the US Dollar, reaching new multi-decade lows against the greenback by the end of the month. Initial second quarter Gross Domestic Product (GDP) data showed quarter-on-quarter annualised growth of 2.2%, which marginally lower than market consensus, but the detail here showed resilience in the business capital expenditure and consumption components of GDP. On inflation, the core index, which excludes fresh food, rose by 2.4% year on year to end July. This is a further tentative sign that moderate inflation may be becoming entrenched across the country following decades of deflation or falling prices.

The Chinese economy continued to slow over August; industrial production and manufacturing data missed expectations in July, the latter showing the larger relative miss. Retail sales, similarly, came in weaker than expected; annualised growth was 2.7% versus the expected 5.0%. The slowdown in activity here highlights weakening local demand, to which the Chinese central bank responded by marginally cutting the primary policy rate. The government announced additional fiscal stimulus in the same vein. However, these policy changes will likely be somewhat undermined due to a new round of Covid-19-related lockdowns, further hampering already sluggish domestic demand. Chinese shares, according to the Shanghai Shenzhen 300 Index, closed 4% lower in August.

Global commodity markets produced a mixed bag in August. Per the S&P GSCI Index, down 2.7% at the aggregate level, the energy segment was the worst performer with price declines in brent crude oil (-12.3%) and unleaded gasoline offsetting gains seen in the natural gas (10.9%), coal (2.9%) and heating oil (4.8%) markets. Silver was sharply lower in the precious metals segment at -11.6%, while gold posted a more modest decline of -3.1% respectively. Industrial metals such as copper and lead also posted losses of -1.5% and -4.2%, respectively. Only the agricultural segment posted gains: coffee, sugar and cocoa all rose between 2.0% and 10.1% for the month.

All returns above are in USD.

South African Market Themes

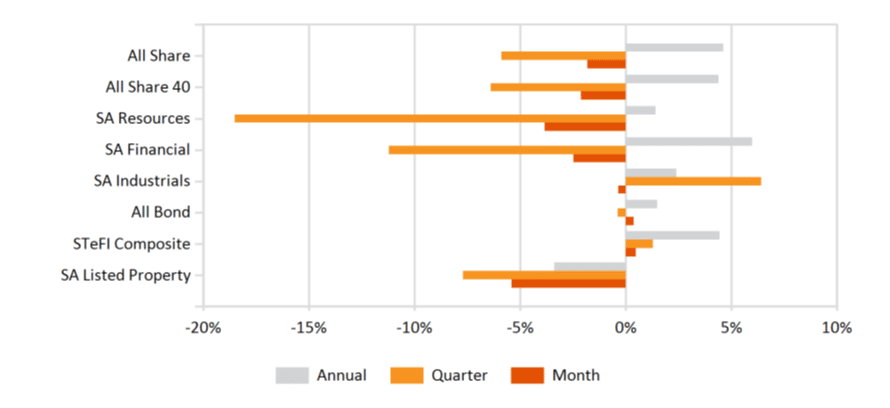

Local equity markets fared better than their Developed Market peers; the All Share Index lost 1.8% while the SWIX Index closed 1.3% lower. Much of this weakness came from large capitalisation shares as the Mid-Cap and Small-Cap indices returned -0.7% and 0.9%, respectively. In terms of economic sectors, Industrials fared the best on a relative basis, down a modest 0.4% compared to Financials which lost 4.7%, while the Resources sector declined by 3.7%. Fixed income markets posted gains, the All Bond Index closing 0.3% higher while inflation-linked bonds returned 2.5% per the Composite Inflation-Linked Index. The relative strength of ILBs versus nominals is understandable, given the environment of accelerating inflation locally. SA Property lost 5.9%, per the All Property Index.

Annual inflation rose to 7.8% in July, a 0.4% annual inflation increase relative to the June print. This was marginally above the consensus expectation of 7.7%. Economists can expect inflation to soften somewhat, given the recent global energy and food prices decline. Despite this, the SA Reserve Bank is most likely to remain on its hiking path as risks to inflation remain tilted to the upside in the short term.

In the second quarter GDP contracted by 0.7%. With the manufacturing industry being the largest detractor, it was negatively impacted by the floods experienced in KwaZulu-Natal during this period. Manufacturing is the largest industry in the province. Furthermore, loadshedding also weighed heavily on economic activity. Other contracted industries include mining and quarrying, trade, catering and accommodation. finance, real estate and business services segment was the largest contributing industry. Per this latest GDP print, the SA economy is once again smaller than its size pre-Covid-19 i.e. as of the fourth quarter of 2019.

South Africa’s potential grey listing by the Financial Action Task Force (FATF), a global money laundering and terrorist financing watchdog, added to market volatility in August. As of October last year, SA was given a 12-month window to address the high use of cash, address skills and capacity issues in state security and law enforcement agencies, improve the monitoring of cross-border flows and enhance beneficial ownership visibility. SA may be added to the grey list in February next year should the FATF not be satisfied with the progress the country has made in this regard by that point.

All returns above are in ZAR.

Performance

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices