Market Commentary: September 2022

Global Market Themes: Equity and fixed-income markets experience more pain in September Bank of England abruptly reverses course on Quantitative Tightening Japanese Yen sees first currency intervention in 24 years US Federal Reserve remains resolute in raising rates SA Market Themes: Local markets follow global peers lower Loadshedding continues to take its toll on economic activity The Reserve Bank adds a further 75 basis points

Market View

Global Market Themes

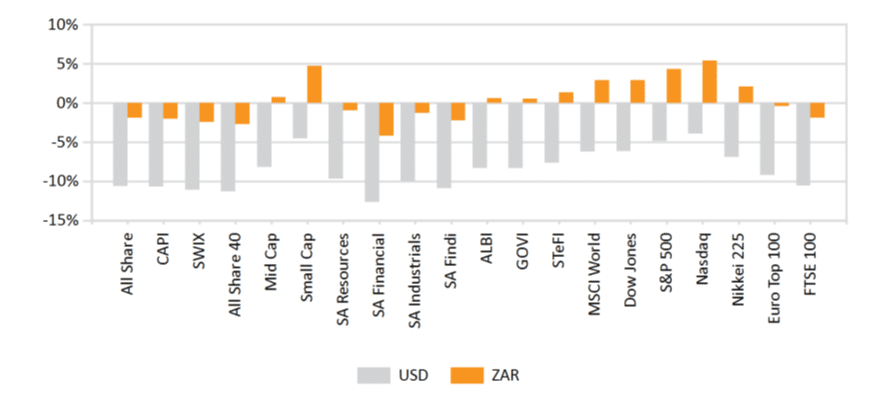

The final month of the third quarter was painful for investors. Inflation remains the dominant market theme – chiefly US inflation, which remains stubbornly high. More broadly, global inflation continues to surprise to the upside, with central banks continuing to hike short-term interest rates in response. As a result, markets remain depressed, with investor sentiment in the doldrums. Both equities and fixed income assets continued their declines. The MSCI World Index lost 9.3%; its Emerging Market equivalent index (MSCI EM) was down 11.7%. This brought performance for the third quarter to declines of 6.1% and 11.5%, respectively. Global bonds (such as the Bloomberg Barclays Global Aggregate Bond Index) fared worse over the quarter than Developed Market equities, which were down 6.9%. The September loss of 5.1% continues to mark the pain bondholders have felt this year as elevated levels of inflation have made this asset class highly unattractive.

Unsurprisingly, the US Federal Reserve raised rates by 75 basis points, bringing the upper bound of the short-term Funds Rate to 3.25%. This rate has now risen by 3.0% in approximately seven months, the fastest rate of change in history. This is important as the Funds Rate is in effect the global reference for the price of money. Such a dramatic and rapid change here will likely have material economic impacts over the coming six to nine months; cracks have begun to show in the US housing market in the past few months. Market consensus currently is for a further 1.25% rate increase by the end of the year, bringing the Funds Rate to 4.5%. The Federal Reserve remains steadfast in its intention to reign in US inflation using short-term interest rates. However, the real test of its resolve likely lies ahead. In the coming months, it is likely to face a choice between continuing to fight inflation, raising rates or supporting a weakening labour market and, by extension, a weakening economy by pausing or reversing its hiking cycle.

In late September, the British Pound fell to its lowest level against the US Dollar in recorded history.

The exchange rate reached an intraday low of 1.0350. This astounding move was the market’s response to the UK government’s latest fiscal plans. The market was indicating its unhappiness, to put it mildly. To deal with its cost-of-living crisis and rampant inflation driven primarily by energy costs, the government took the radical step of cutting taxes and made plans to issue new debt. It basically doubled down on increasing its debt load. Such action is rare and has historically only been seen during periods of war. The Resolution Foundation, a UK think-tank, estimates these measures will add £411 billion to the government’s debt load over the next five years. This addition is approximately 10% of Gross Domestic Product (GDP), with the UK’s debt-to-GDP ratio currently at 96%. It is therefore understandable that both the currency (GBPUSD) and bond markets (UK government bonds or gilts) responded to this news with sharp and severe sell-offs.

The above events catalysed a series of unintended consequences for the UK financial system and its central bank, the Bank of England (BOE). These events are emblematic of the interconnectivity and complexity of modern financial systems regionally and globally. The BOE was forced to take a hasty about-turn on its balance sheet reduction programme – Quantitative Tightening (QT). The rapid market sell-off in UK gilts, which lowered bond prices and increased bond yields, resulted in a liquidity crisis for UK Liability-Driven Investment (LDI) funds. In order to meet their return objectives, these funds hold leveraged positions in UK gilts on behalf of UK pension funds. The LDI funds were facing sudden, sharp losses on their bond holdings due to rapid downside movement in gilts. The BOE was required to step in as the lender of last resort and buy gilts in order to save the LDI funds and, by extension, the UK pension system. Thus, in a mere few hours the BOE undid nearly one year’s worth of QT and began buying bonds again, Quantitative Easing, to preserve the UK’s financial system. This change is profound, not only in speed but also size. The BOE is in effect doing unlimited QE, meaning it will buy as many gilts as necessary to ensure a functioning market, that is yield-curve control. This is the same policy that the Bank of Japan (BOJ) has undertaken to support its bond market by keeping yields of the 10-year Japanese government bond at or below a yield of 0.25%.

The European Central Bank continued its fight against inflation, raising rates by 75 basis points in September to bring the region’s primary rate to 1.25%. This remains well below annual inflation, which is running at 10.0% according to the latest September print. The average Eurozone saver has thus lost 8.75% on their cash in the bank over the past year. On economic data, forward-looking indicators, such as the composite Purchasing Managers’ Index (PMI), printed a third consecutive month below 50, coming in at 48.2 for September. PMIs are based on survey data from firms in the manufacturing and services sectors. A reading below 50 indicates contraction, while one above 50 signals expansion.

Japan intervened in its currency market to stem the Yen’s relentless decline against the US Dollar, the first such intervention in 24 years. The Yen has fallen more than 20% against the US Dollar over the past year; a very rare move for a major currency pair such as USDJPY – again an indication of the extreme levels of uncertainty prevalent in markets today. This matters as Japan imports both energy and food, meaning consumers have experienced, and continue to face, rising inflation locally via a weaker currency. The intervention is marked by the BOJ, on behalf of the Ministry of Finance, selling US Dollar assets for Yen. Prime Minister Fumio Kishida has indicated that this intervention is to remain open-ended, depending on future market conditions. The general track record for such actions is poor, with further intervention historically having limited and short-lived effects. Japan would likely need to raise short-term interest rates, and thus close its rate differential with the US to properly address its weakening currency. However, this is unlikely in the short to medium term, as BOJ Governor Haruhiko Kuroda remains steadfast in keeping short-term interest rates negative, -0.1%, given that debt-to-GDP remains well north of 250%. This means the Japanese economy can likely not sustain materially higher interest rates in the medium to long term.

On commodities, the S&P Goldman Sachs Commodities Index (GSCI) recorded a negative month and third quarter, driven lower by declining prices for energy, precious and industrial metals.

The energy component was the worst performer. Brent Crude oil lost 8.8% in September and was down 23.4% for the quarter. Natural gas plunged 25.9% in one month. However, it was up 24.7% over the quarter; the volatility here was a function of the Russia-Ukraine war and energy security concerns in Europe. Gold and silver both declined over the quarter, and were down 8.1% and 6.2%, respectively. Within the industrial metal segment, tin and aluminium led declines in September and for the quarter, losing 9.5% and 8.5%, respectively, last month. The price decline of industrial metals is typically a useful leading indicator of slowing global economic activity.

All returns above are in USD.

South African Market Themes

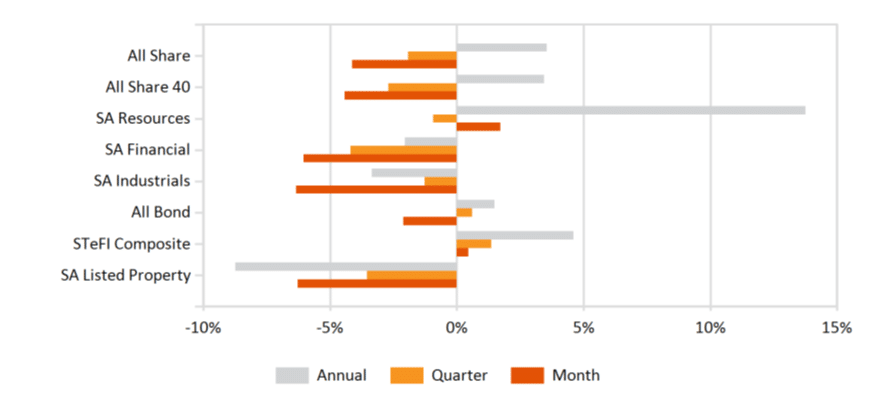

Local equities followed global market declines in September: the All Share Index was down 4.0%, while the SWIX declined by 3.9%. This weakness was centred on large cap counters as the Mid-Cap and Small-Cap indices realised small losses of 2.8% and 2.0%, respectively. In terms of economic sectors, Industrials fared the worst, down 6.1%, with Financials losing 3.2%. Resources posted a gain of 1.7%, with the currency weakness likely adding to the potential attractiveness of resource companies that earn the majority of their revenue in US Dollars. The Rand lost 5.6% against the greenback, closing the month at R18.09/$, a level last seen during the height of global lockdowns and peak global market uncertainty. The local currency lost 11.1% in the third quarter, in line with other currencies versus the US Dollar. Fixed income assets provided no shelter, the All Bond Index lost 2.1%, while the Composite Inflation-Linked Index declined by 2.2%. Similarly, listed property, per the All Property Index, lost 6.5%.

Rolling blackouts made an unwelcome return in September. While the business impacts of this latest round of loadshedding are yet to show up in the data, earlier rounds have taken their toll on the mining sector, with mining production declining for the sixth consecutive month, down 8.4% year on year to the end of July. Meanwhile, the latest manufacturing data showed a 3.7% rise in production compared to last July. This print is coming off a low base, however, given the social unrest which the country experienced in July 2021.

The latest manufacturing PMI data showed a move back into contractionary territory in September, printing at 48.2 versus August’s 52.1 figure.

Forward-looking data such as this suggests the economy may have entered into recession in the third quarter, with the outlook for the final quarter already poor due to loadshedding which resulted in the longest period of rolling power cuts. Other factors, such as weak business and consumer confidence as well as a lack of material progress on policy reforms to support economic growth, further add the weak outlook.

Annual inflation eased slightly to 7.6% in August, 0.2% lower than July. This fall was largely expected due to recent declines in fuel and food prices. The SA Reserve Bank continues to see inflation risks to the upside when considering the outlook. It therefore raised interest rates by a further 75 basis points at its September meeting. The bank continues to suggest that further rate hikes lie ahead, given that inflation remains well above its target band of 3% to 6%, bringing the repo rate to 6.25% and the prime lending rate to 9.75%.

All returns above are in ZAR.

Performance

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices