Market Commentary: December 2022

Global Market Themes: Central Banks continue their fight against inflation and global growth continues to slow Chinese economic reopening buoys Chinese equities despite unclear path ahead New UK Prime Minister helps stabilise UK markets Bank of Japan surprises markets with overnight monetary policy change SA Market Themes: Local markets follow global markets lower Return to Stage 6 loadshedding CPI inflation hits a five-month low of 7.4% but remains stubbornly high

Market View

Global Market Themes

December saw a loss of market momentum as investors placed more emphasis on the potential of a global recession in 2023 thus curtailing their risk appetite somewhat in the face of such concern. Other notable events included further rate rises by major Developed Market (DM) central banks, the appointment of a new prime minister in the United Kingdom (UK) who is perceived by the markets as fiscally responsible, further relaxation of Covid restrictions, the resumption of more economic activity in China, and, finally, the surprise decision by the Bank of Japan to tighten its monetary policy.

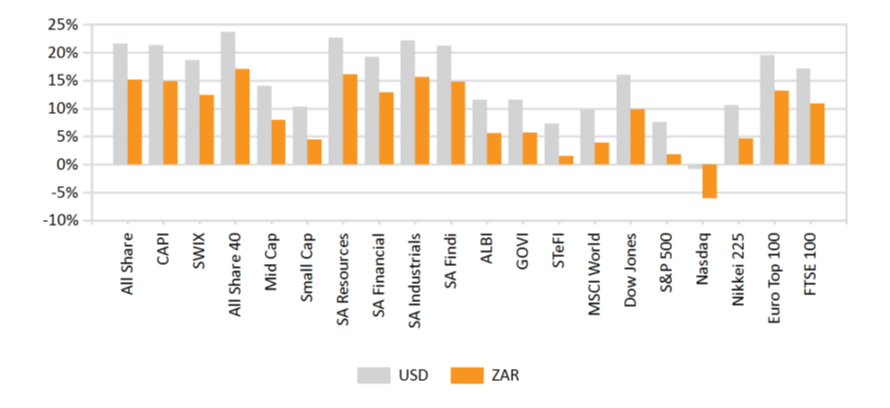

These factors, among others, saw the MSCI World index lose 4.2%, with the MSCI EM index down 1.5%. Regional equities showed great variance. US indices suffered the worst as the S&P500 and technology-focused NASDAQ closed 5.8% and 8.7% lower, respectively. European equities fared better, with the German DAX 30 marginally up by 0.4% while the UK FTSE 100 was effectively flat on the month at -0.2%. Asia fared the best with the Chinese Shenzhen CSI 300 returning 3.5% on the news of markets reopening. This market theme will likely continue to play out over the coming quarter.

Government bond yields broadly rose, led by the US 10-year bond yield moving approximately 0.2% higher and the German 10-year Bund (the proxy bond for Euro area countries) moving nearly 0.7% higher.

Despite the declines in G10 sovereign bond prices (recall that yields and prices are inversely related), there appears to have been broader demand for bonds overall. The Barclays Bloomberg Global Bond Index, which is comprised of corporate and municipal/SOE issues as well as sovereign G10 debt, added 0.5%, while the JP Morgan EM Bond Index added 2.1% in December, implying an investor preference for EM over DM sovereign debt.

The trend of a weakening US Dollar persisted, helping precious metals (Gold and Silver) post solid gains of 3.1% and 7.9%, respectively. As Silver has more industrial use cases, it not only benefitted from being an alternative store-of-value asset, but also had the tailwind of the Chinese reopening narrative, which boosted prices of most industrial metals. Copper, lead, nickel, and tin are all commodities which experienced gains of between 2.2% and 11.3% last month, likely due to this tailwind.

In the US, the Federal Reserve once again raised the key reference rate. This time by only 50 basis points, which is a notable decrease in magnitude from other recent hikes. The bank reinforced its messaging of needing to keep short-term rates higher for longer, continuing to imply a willingness to tolerate economic pain, in the form of rising unemployment, until it considers inflation well-contained. The November Consumer Price Inflation (CPI) report surprised to the downside as annual headline inflation slowed to 7.1%, with market consensus expecting 7.3%. Core CPI, which excludes items such as food and energy, also slowed to 6.0% from 6.3% in October on an annualised basis. Factory activity fell into contractionary territory for the first time since May 2020 as the Institute of Supply Management’s Manufacturing Purchasing Managers’ Index (ISM Manufacturing PMI) fell to 49 in November. Despite this slowdown, the services sector remains robust, with the ISM Services PMI moving higher to 56.5 in November from 54.4 the month before. Respondents to the monthly survey noted improvements in supply chains as a key reason for this rebound.

Across the Atlantic, the European Central Bank (ECB) also stuck to its guns, hiking interest rates by 50 basis points to 2.5%. It remains well behind the Euro area inflation, however, which was 10.1% as of the end of November. In essence, this means that savers are losing approximately 8% per annum in terms of their real purchasing power. The ECB, therefore, has a long way to go and bank President Christine Lagarde noted that it was far from done with its current hiking cycle. The latest growth data showed that the eurozone economy grew by 0.3% quarter over quarter in Q3, slowing from 0.8% growth in Q2. Forward-looking indicators continue to point towards contraction, although the rate of decline appears to have moderated. The composite PMI for December was 48.8, up from 47.8 in November. This was thanks to falling energy prices and milder-than-expected weather in the early part of winter, which helped to alleviate some cost pressures.

In the UK, the appointment of Prime Minister Rishi Sunak, who previously served as Chancellor of the Exchequer with a reputation of fiscal conservatism, helped to restore stability to domestic bond and gilt markets and, in turn, short-term interest rate expectations. This further helped to aid those segments of the UK equity market that are highly rate sensitive. This comes off the back of the unexpected announcement in September by the then UK leadership of a large-scale fiscal stimulus package to support an economy facing far higher energy prices. The issue which gilt markets had with this plan was, that it was not clear how this package would be funded. This new uncertainty led to major volatility in both bond and currency markets.

The annual inflation rate in the UK slowed to 10.7% in November due to falling prices in the second-hand car market and the price of motor fuels. Food inflation, however, reached a level last seen in 1977, reflecting a 12-month increase of 16.5%. Although inflation has begun to show signs of peaking, the Bank of England (BoE) raised rates by a further 50 basis points, to 3.5% to counter the effects of a tight labour market. This means that the bank wishes to be proactive in curtailing any wage inflation – a likely outcome when demand for labour exceeds supply, which may feed through into overall CPI inflation. The BoE governor noted that the bank now expects inflation to start falling at a faster pace by the middle of Q2.

In a move which took most investors by surprise, the Bank of Japan (BOJ) increased the limits of its target band for the 10-year government bond from 0.25% to 0.5% and -0.25% to -0.5% last month.

This change led to a sharp increase in domestic bond yields as bonds sold off due to the widening of the band. The BOJ has pursued a highly accommodative monetary policy, negative interest rates and effectively infinite Quantitative Easing for years. However, the severe weakening of the Yen against the US Dollar and other major trading partners like China, seen earlier in 2022, has meant the authorities have needed to take more aggressive measures to prevent further Yen weakness. The move by the BOJ, and its surprise execution, appears to have worked in supporting the local currency in December.

With the easing of Covid restrictions in China, a large rise in new infections has presented itself and is likely to place negative pressure on investor sentiment and short-term economic growth prospects. However, investors appear to be looking past these risks given the relatively strong equity market performance in December. Only time will tell if this reopening will play out smoothly and be to the net benefit of Chinese equity holders. Possible supply constraints, as experienced by other countries in their reopening processes, would need to be largely avoided, along with offsetting the slowdown in global demand given current and continued tightening by major central banks. The highly indebted property sector also remains another large looming question mark for Chinese authorities and investors.

On the growth front, the Chinese economy grew by 3.9% quarter over quarter (annualised) in Q3, slightly above market consensus (3.5%) and well above the previous quarter’s -2.7% print. Manufacturing PMI data moved up marginally to 49.4 in November, which was above market forecasts of 48.9 but still in contractionary territory. General services PMI data fell to a six-month low of 46.7 in November, down from 48.5 the previous month.

All returns above are in USD.

South African Market Themes

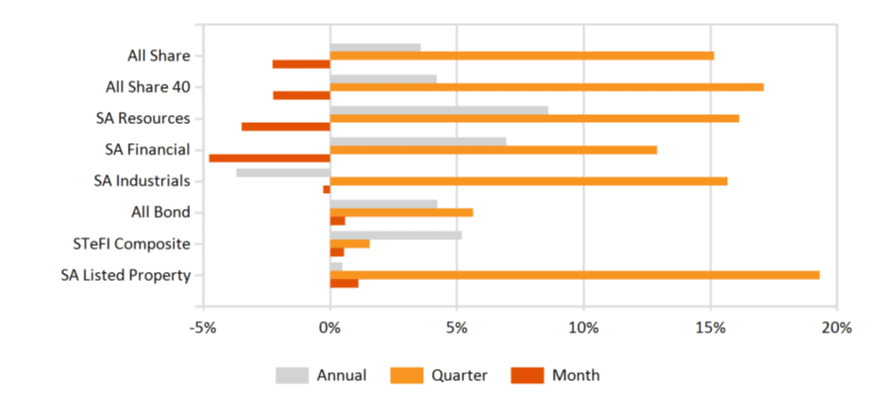

Domestic markets largely closed the year weaker, in line with global markets. The All Share Index lost 2.3% while the SWIX closed 2.7% lower. This weakness was concentrated in mid-capitalisation shares with Mid-Cap and Small Cap indices returning -2.9% and -1.4%, respectively. In terms of sectors, Resources led the declines, down 3.5%, with Industrial counters closing 0.3% lower and Financials down by 2.5%. The Rand strengthened by 1.0% against the US Dollar, closing the month at the R17.04 level. This strength was rather due to US Dollar weakness than local factors driving domestic currency strength. Meanwhile, fixed income assets, were largely flat to positive: the All Bond Index added 0.6% while the Composite Inflation-Linked Index posted a gain of 2.6%. Listed property, per the All Property Index, added 1.1%.

There was no December meeting for the SA Reserve Bank which had raised short-term rates to 7%, up by 3% since the beginning of the year. The latest CPI print of 7.4% in November showed that the rate of increase in the general price level remains well above the Reserve Bank’s 3% – 6% target range. This latest print is, however, a five-month low in CPI.

The most recent inflation projections from the bank see headline CPI for calendar years 2022 and 2023 at 6.7% and 5.4%, respectively, with inflation slowing to the middle of its target band at 4.5% for calendar year 2024.

Domestic GDP grew by an annualised 1.6% quarter over quarter in Q3, beating market expectations of a 0.6% print. Eight out of 10 economic subcomponents of the headline number showed expansion over the period, with the agricultural sector making the biggest contribution to growth at 19.2%. Rolling power blackouts, as Eskom reintroduced Stage 6 loadshedding following breakdowns at multiple power-generating units, placed additional strain on its already-low diesel reserves and continued to weigh on growth prospects. The state-owned-entity’s troubles worsened after its CEO André de Ruyter resigned.

All returns above are in ZAR.

Performance

World Market Indices Performance

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices