Market Commentary: January 2023

Global Market Themes: Pace of US Fed interest rate hikes slowing down. Global markets rally off a low base, led by China. China economy reopens along with pro-growth policy, ushering in risk-on sentiment. Natural gas prices fall further following a mild winter. SA Market Themes: JSE All Share rallies 8.9% along with emerging markets. CPI reading for December 2022 prints in at 7.2%. SARB increases Repo rate by a further 25bps. Rand depreciates 2.4% against the Dollar due to worsening loadshedding conditions.

Market View

Global Market Themes

Markets embraced the “January effect” as they started the year off well into the green. Springboarding off low bases set by the broad equity sell-off in December, markets soared into 2023. China led the charge on the global stage, with the MSCI China rallying 11.8% and emerging markets (MSCI EM) following suit with a 7.9% increase. Developed markets joined the rally, with the MSCI World moving up 7.1%. While these positive gains set the tone for the year, there is still plenty of work to be done to remedy the losses encountered in 2022. Last year saw major equity indices, such as the S&P 500 and the MSCI World, falling nearly 20% for the year and the tech heavy NASDAQ losing more than 33%. All the while the fixed-income markets provided little protection from the storm of rapidly increasing interest rates.

The US Federal Reserve (Fed) raised interest rates by 25bps on 1 February, continuing its attempt to slow demand and engineer an economic “soft landing.

This hike was half of the expected 50bps increase. The slowdown in rate hikes was welcomed by the market, coming out of a gloomy 2022. US CPI numbers came in below expectations, providing further evidence that inflation has indeed peaked, providing the Fed with some positive reinforcement around its interest rate decisions. However, conflicting economic data on unemployment rates (currently at a 53-year low of 3.4%) is likely to keep the Fed on its toes. High employment levels are likely to sustain price growth, as wage increases match labour supply, potentially adding to a sustained CPI rate above the Fed’s 2% target. Current headline CPI inflation in the US is sitting at 6.5% – it is expected that interest rates will remain high for at least the first half of 2023.

From the demand side of the economy, consumer spending continues to soften as higher, economy-wide, interest rates impact activity and uncertainties around a possible recession remain. Current consensus is that the depth of this potential recession is likely to be far shallower than in 2008 or during the Covid-19 hard lockdowns.

A milder than expected winter in Europe has eased the pressure on the continent’s energy crisis. As the northern hemisphere comes out of this season, the European Union (EU) still maintains large natural gas reserves. These will go a long way in mitigating further deterioration of household purchasing power by keeping a lid on energy costs, given lower supply constraints. As a result, natural gas prices came down again this month, dropping 40%. Coal, as the major resource for electricity generation globally, dropped 25.5% month on month, easing pricing pressures on the supply side. The Eurozone’s Purchasing Manufacturers’ Index (PMI) improved for the third consecutive month to 48.8, signalling an improvement in business confidence for the region. This positive sentiment transferred into the equity market, with the MSCI Europe ex UK rallying 8.1% for the month.

In the UK, inflation dropped marginally from 10.7% year on year in November to 10.5% year on year in December. Analyst consensus predicts a recession is imminent for the UK and the International Monetary Fund (IMF) has projected that the economy will contract by 0.5% this year. The Bank of England (BoE) has warned that if the current inflation downtrend reverts, further monetary policy tightening would be required.

China markets herald in a risk-on environment, as regulators followed through with reopening the economy. Additionally, pro-growth policies ended the tech sector clampdown. Although traders were quick to take advantage of this risk-on sentiment, any unexpected news in this area and that goes against the status quo will likely punish markets severely. If Covid cases in China spiral out of control, the Chinese Communist Party (CCP) may decide to put a hard stop to reopening the country. The positive news from the CCP brought to life the likes of Tencent and Alibaba rising 20% and 9.5%, respectively. However, these gains were mild in comparison to the tech stocks in the market related to artificial intelligence (AI).

The hype around OpenAI’s ChatGPT took the internet by storm, driving a buying frenzy across all AI-related tech companies.

The technology orientated NASDAQ posted a solid gain of 10.7% for January, with the broader S&P 500 index gaining 6.3%. Meta Platforms, Facebook’s parent company, experienced its biggest daily gain of 23%. The social media giant beat revenue expectations for the quarter and CEO Mark Zuckerberg delivered an optimistic outlook for the year ahead. This positive price movement follows some drastic cost restructuring among most big tech companies. Citing a “changing economic climate”, companies issued job cuts across all major divisions, demonstrating that shareholder value remains a priority.

The broad European index, STOXX All Europe, was up 6.6% for the month. However, GDP forecasts heading into 2023 remain bleak. Inflation in the Eurozone is high, with the likes of France reporting 6% in January, up from 6.7% in December, and Spain coming in at 5.8%, well above analyst expectations of 4.7%. The European Central Bank (ECB) is expected to keep raising short-term interest rates to contain inflation across the region until its target of 2% is in sight.

The US Volatility Index (VIX), which tracks market sentiment relating to the S&P 500, subsided this month, declining 2.3 points to close January around its long-term average of 19.4. The drop in volatility suggests more predictability within market dynamics, namely a more predictable future path for Fed rate hikes. Although volatility in the market has decreased, business confidence on the ground, as measured by PMI data, still has a way to go before it returns to more normalised production levels. US Manufacturing PMI for January came in at 47.4, while emerging markets on the other hand have fared slightly better, with the EM Manufacturing PMI rising 0.1 points to come in at 49.9 (a reading below 50 implies economic contraction within the specified sector, and a reading above 50 indicates economic expansion).

Both the Euro and Pound lost ground against the Dollar this month, depreciating 1.5% and 2%, respectively. The gold price gained ground for a third month running, up by 5.7% in January. However, the prices of platinum and palladium fell 6.6% and 8.7% month on month, respectively.

All returns above are in USD.

South African Market Themes

Total returns for SA equities were positive in January, following global trends in emerging markets and arguably not paying much attention to the critical electricity shortages which are now embedded within South Africa’s operating environment. From a market perspective, South African equities as measured by the FTSE/JSE All Share Index posted a solid gain of 8.9%.

Within equities, the Industrials sector was the star performer, delivering a return of 12.8%. PPC started the year off with a bang, emerging as January’s best performer. PPC rocketed off its low base, which saw the share price drop off by 56.8% in 2022. PPC had been under pressure, with demand for local infrastructure spending being suppressed during economic downturns. Investors took advantage of the bargain as market optimism returned.

Other top performers in January were Truworths and Spar, gaining 20% and 21%, respectively. Despite record loadshedding and increasing pressure on consumers, the retailers’ sales grew materially over the second half of the financial year. Resources gained 6.3%, with expectations of China’s economic reopening renewing demand for raw materials. Financials rallied 4.7%, whereas South African listed property lost ground in the month, coming in at -1%.

Some of the other big movers on the market were Prosus (17.9% month on month) and Naspers (18.5% month on month). These two companies were pulled upward by the Chinese tech giant Tencent. Tencent soared 20% off the news of the Chinese government easing the two-year tech clampdown. The luxury goods firm Richemont gained 18.3% for the month, and MTN rose 15.4% on reports of double-digit subscriber growth in Nigeria and the resolution of its tax disputes in Ghana.

The SA Reserve Bank (SARB) raised interest rates by 25bps in January, setting the country’s Repo rate at 7.25%. This takes the prime lending rate in the country from 10.5% to 10.75%. SARB Committee members had conflicting views on hikes, with two out of five advocating for a 50bps increase (in sync with earlier Fed hikes) and the remaining three advocating for a 25bps increase. Citing loadshedding as a catalyst for downside risk to the economy, forecasts around South Africa’s GDP growth are currently at 0.3% for 2023. South African inflation data for December reported an annual CPI of 7.2%, down 20bps from the previous month. With a mandated target of between 3% and 6%, the SARB is expected to follow suit with its central bank peers until the target band is reached.

The Rand depreciated 2.4% against the Dollar as concerns of ongoing loadshedding increased, starting the month at around the R17 level and closing the month at R17.43. January saw a record high in total blackout hours, the worst to date.

The seasonally adjusted Absa Purchasing Managers’ Index (PMI) came in at 53 index points in January – nearly unchanged from 53.1 in December. The index had to deal with conflicting data from a decline in employment and a drop in new sales orders being offset by higher manufacturing activity and improved inventories levels. Reports also indicate that imports from China have been delayed, creating downstream setbacks – a consequence of CCP policies put in place last year.

From a valuations perspective, the South African All Share Index’ (J203) earnings per share remains well above the price index as at the end of January. Although this spread has begun to narrow as a result of January’s rally, the All-Share Index continues to appear attractive on a price-to-earnings valuation basis. The South African Volatility Index (SAVI) echoes the subtly lower volatility of the broader market, decreasing from 21.68 in December to 19.62 in January. This sentiment likely reflects the lower levels of uncertainty regarding the future path of equity prices.

All returns above are in ZAR.

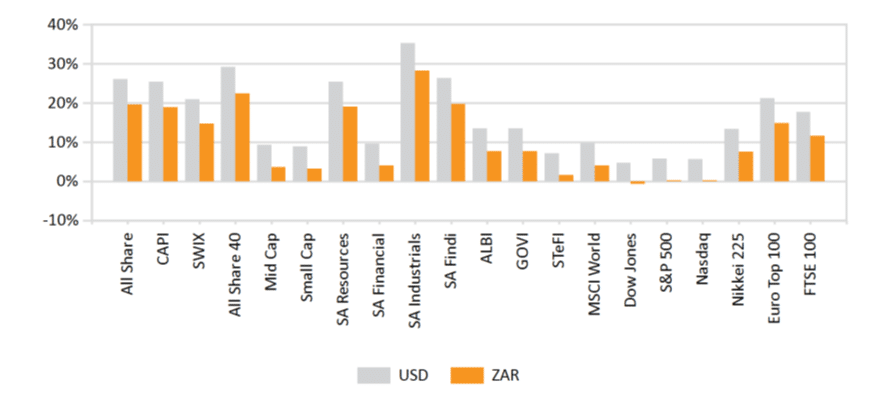

Performance

World Market Indices Performance

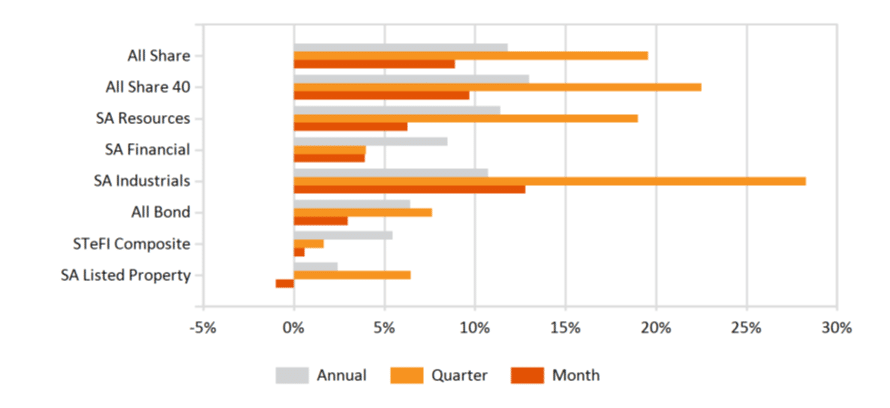

Quarterly return of major indices

Local Market Indices Performance

Returns of the FTSE/JSE sectors and indices