China Market Commentary: March 2021

Here are this month’s highlights: Chinese equities started February strong but dropped towards the end of the month Investor sentiment dampened by Hong Kong government’s move to increase equity trading stamp duty Southbound trading saw record daily outflows since the inception of Stock Connect The indices ended the month down with Technology stocks diving 15.2% as measured by the Hang Seng Tech Index

China in February

In February, market volatility returned on the back of growing inflation expectation and surging U.S. treasury yields. Chinese equities started the month off strongly and rallied into the Chinese New Year holiday. However, late February Chinese equities experienced a sharp sell-off along with global markets, particularly technology-heavy markets like the Nasdaq. For the offshore “H-shares”, investor sentiment was further dampened by the Hong Kong government’s move to increase equity trading stamp duty. Southbound trading (from the Chinese mainland to Hong Kong) saw record daily outflows since the inception of Stock Connect, a big reversal from January.

Overall, the MSCI China index slumped 9.6% while the MSCI China A Onshore index fell by 7.6% during the week of 22 February. The indices ended the month down 1% and 0.8%, respectively. Technology stocks suffered the most, diving 15.2% measured by the Hang Seng Tech Index. Consumer Discretionary, Communication Services and Healthcare also had significant pullbacks, particularly the “Nifty 50” stocks that were widely held by mutual funds. Conversely, previously out-of-favour sectors such as Utilities, Commodities and Banks outperformed.

This month, as part of our China market commentary, we continue with the subject of ESG.

Consequences of ignoring the ‘S’ in ESG

In our previous edition, we argued that in emerging markets ESG and financial return can be closely related. Many export-oriented companies have global customers who are sensitive to reputational risk. China’s OFilm Group, a camera module-maker, is a good recent example of this. In March this year, the company told investors it had received a notification from a “particular overseas client” (said to be Apple) saying the client would be cutting its business ties. It was responsible for over 20% of OFilm’s operating income.

“The company has been under scrutiny since allegations arose of poor labour practices. Its share price has more than halved over this period. None of our managers had any exposure to the company.”

The TCFD report

The Task Force on Climate-related Financial Disclosures (TCFD) was created by the Financial Stability Board in 2015 to develop consistent climate-related financial risk disclosures for banks, companies and investors. From early 2021, UK asset owners and institutional investors will need to adhere to a five-year plan for mandatory climate-related financial disclosures.

“The TCFD report is also a great starting point for assessing the financial impact of climate change in China. We have shared it with our Chinese fund managers to draw their attention to it if they already had not seen it.”

To help identify the information needed by investors, lenders, and insurance underwriters to appropriately assess and price climate-related risks and opportunities, the Financial Stability Board (an international body that monitors and makes recommendations about the global financial system) established an industry-led task force.

It was asked to develop voluntary but consistent climate-related financial disclosures that would be useful to all stakeholders in understanding the material risks they face.

The 32-member task force is global and includes large banks, insurance companies, asset managers, pension funds, large non-financial companies, accounting and consulting firms, and credit rating agencies. Industrial and Commercial Bank of China is part of this group.

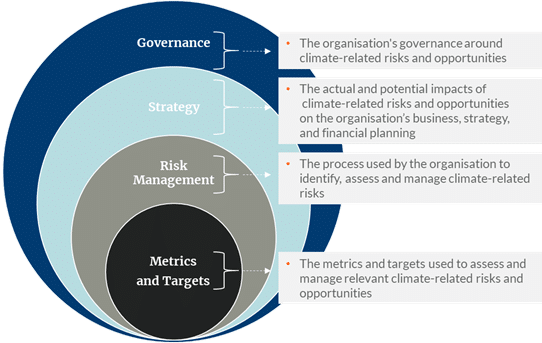

“The task force developed four widely adoptable recommendations on climate-related financial disclosures that apply to organisations across sectors and jurisdictions.”

These should be adoptable by all organisations, included in financial filings, forward-looking information on financial impacts and have a strong focus on the risks and opportunities related to the transition to a lower carbon economy.

Importantly, the task force’s recommendations apply to asset owners and asset managers who are at the top of the investment chain and, therefore, have an important role in influencing the organisations in which they invest to provide better climate-related financial disclosures.

“Through better disclosures, it is anticipated that companies will be motivated to improve their “climate performance” as stakeholders can better compare different enterprises with each other, and pressure the weaker ones into making meaningful changes.”

The core elements of the recommended climate-related financial disclosures are around governance, strategy, risk management and metrics.

Core element of recommended climate-related financial disclosure

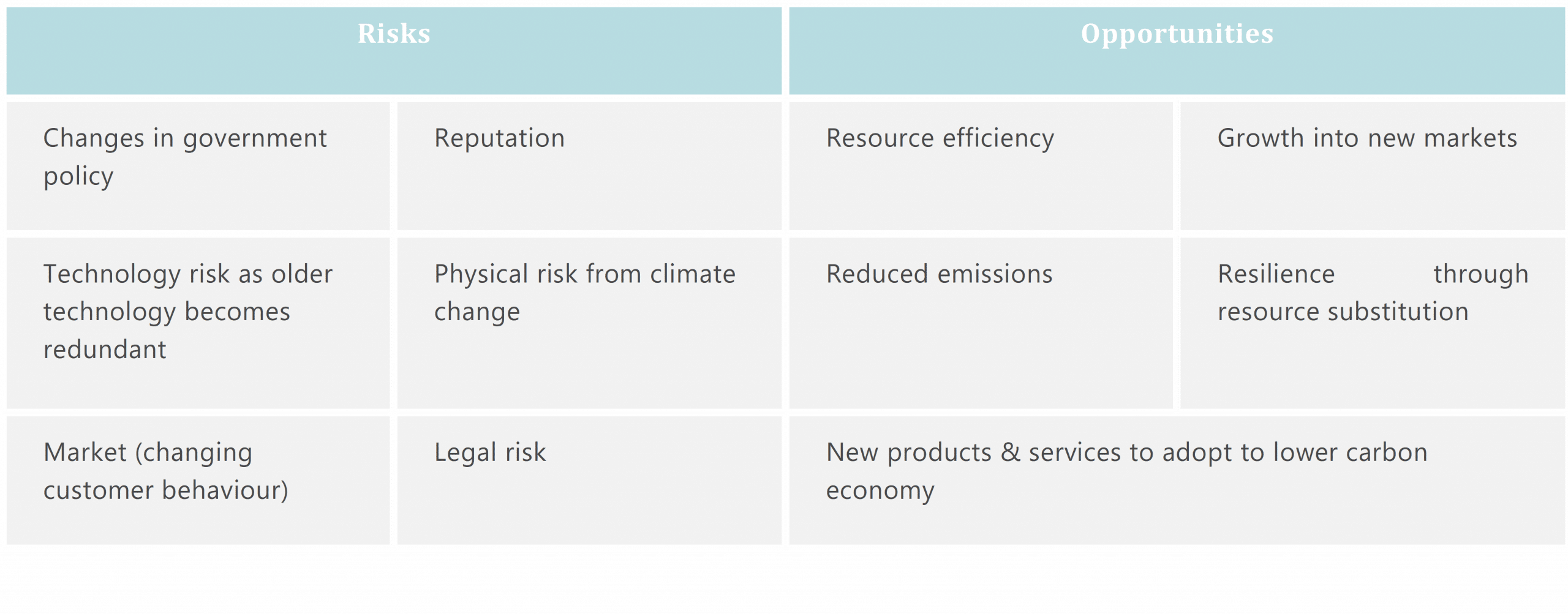

The report provides useful examples of the types of risks and opportunities that arise from the transition to a lower carbon economy. At this stage, it remains voluntary and therefore falls short of prescribing any reporting standards. Chinese companies are still lagging behind their global peers. According to CDPWorldwide, a global NGO that focuses on carbon disclosures, there are 1300 Chinese companies across 11 industries that provided the recommended environment disclosures in 2020, an improvement of 30% over the previous three years. This compares to a global total of 9000 companies. The quality of disclosures is also improving although from a very low base.

For us as investment manager researchers, the report also provides a useful framework for researching investment managers and ensuring that they are in turn looking at the right elements when assessing companies. Some examples of risk and opportunities are set out in the table below.