China Market Commentary: June 2021

Here are this month’s highlights: The MSCI China and MSCI China A Onshore indices were down 6.9% and 2.2%, respectively. On the macro front, the Chinese Yuan appreciated strongly in May to a three-year high against the US dollar. China has delivered multiple multi-billion-dollar companies to match the size of their American peers. China is the only country, after the US, to achieve this.

China in May

In May, Chinese equities experienced considerable volatility in the market but ended the month in positive territory along with other major global markets. Rising commodity prices and weaker than expected credit growth data triggered a sell-off in the first half of the month. At one point, the MSCI China and MSCI China A Onshore indices were down 6.9% and 2.2%, respectively. Market concern was eased later in the month after the Chinese government announced their plan to control commodity prices and inflation. The two indices finished the month up 0.8% and 6.3%, respectively.

“Offshore Chinese stocks, particularly the ones listed in the US, underperformed their onshore counterparts as the internet and education sectors came under pressure due to heightened regulatory scrutiny as discussed in last month’s edition. Information Technology, Machinery and Home Appliances also detracted, while cyclical sectors such as Raw Materials and Chemicals performed well.”

On the macro front, the Chinese Yuan appreciated strongly in May to a three-year high against the US dollar. Northbound flows on Stock Connect also saw net buying reaching a 12-month high, demonstrating demand for China A shares. April exports grew by 32% year-on-year, again exceeding market expectations. On the other hand, total retail sales growth slowed down in April from the last month.

This month’s edition focuses on technology. As the table below shows, China has delivered multiple multi-billion dollar companies to match the size of their American peers. China is the only country, after the US, to achieve this. Why? We unpack the key ingredients more in the next section.

Source: Bloomberg. Data as of 4 May 2021.; market cap in USD bn

* Not yet listed. Valuations from recent private trades / analyst estimates.

The making of a technology giant

China is in the unique position of being the world’s largest population with first world characteristics. Despite all their progress, it remains an emerging market with most of the population living in poverty. Its rising middle class is contributing to increased consumption alongside other emerging economies. On the other hand, it is a command-driven economy with first world infrastructure that is superior to most developed countries.

Many key ingredients are required to create a technology giant —see diagram below. They are all a prerequisite and the lack of one can create headwinds.

China’s edge in e-commerce, China leads in every aspect of the ingredients required. Firstly, it is the world’s largest internet population. They speak the same language; the culture is largely homogenous and there are no trade barriers. Whilst Europe has a common market, each country has different cultures, consumer habits and languages. Similarly, whilst India’s population is rapidly catching up with China, the penetration of internet access is not consistent across the country, and it has the most number of languages spoken in any one country.

“Furthermore, the Chinese population is technology savvy and is well used to digital payments like Alipay and Wechat in a way that is beyond any other country in the world. They are also well ahead in the roll-out of 5G, where even smaller cities are already covered.”

The Chinese consumer is also not replacing traditional commerce like in the case of developed markets. The roll-out of physical retail is not as advanced in China especially outside of the major cities. Therefore, the adoption rate of technology-enabled consumption is faster.

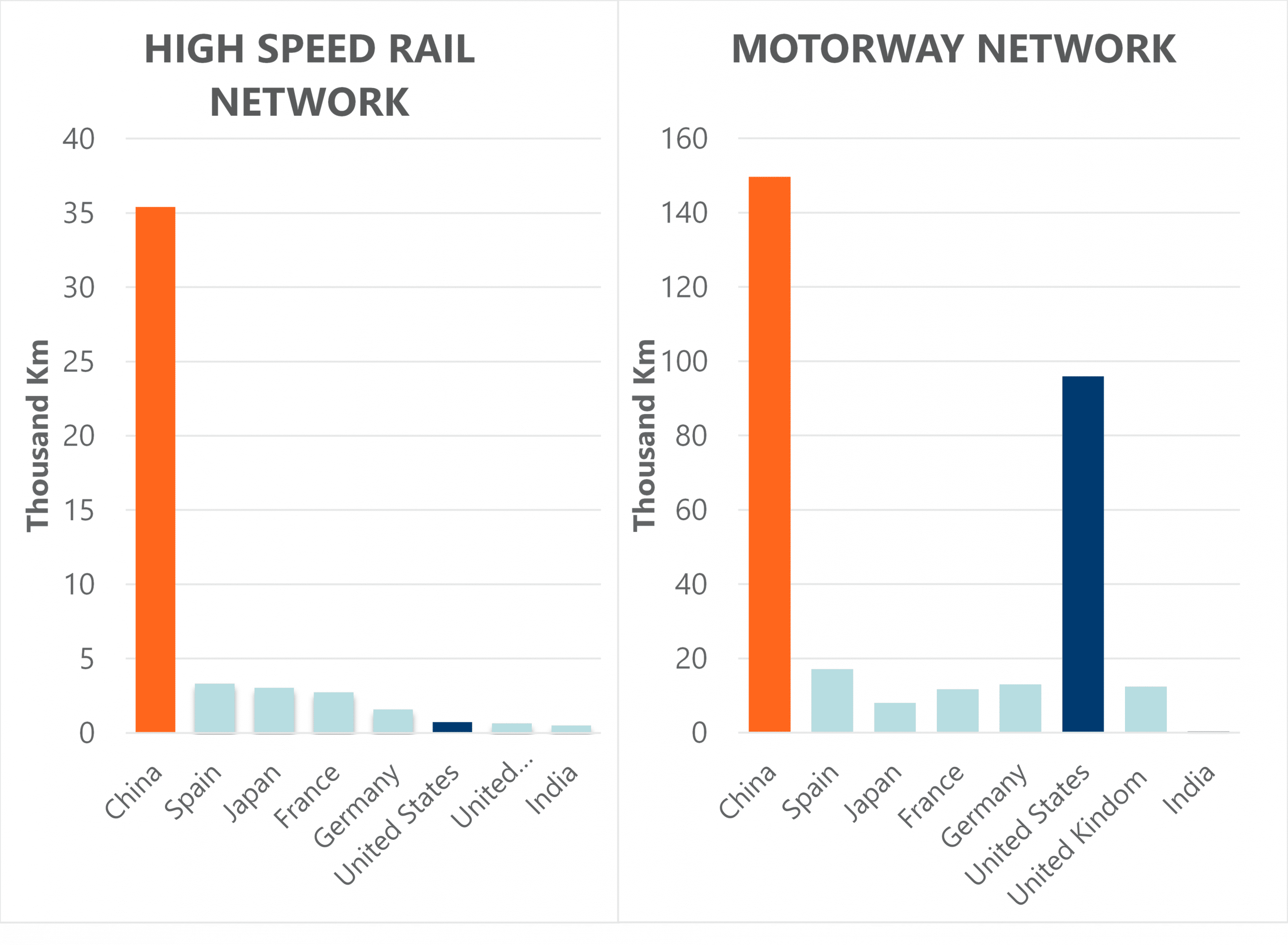

Lastly, their first world infrastructure means that a consumer can purchase an item in a distant small city and have it delivered from Shanghai or Beijing within a day or two. The following chart shows the sheer scale of China’s edge in physical infrastructure:

Source: UIC, The Worldwide Railway Organization, Wikipedia

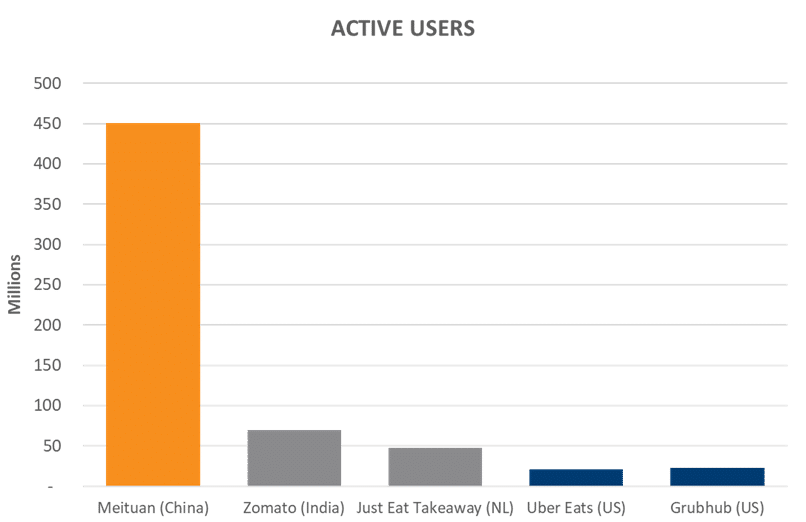

Imagine the power of being able to sell anything anywhere in a country with 850 million internet users. A Chinese company doesn’t need to expand globally to become a $100bn company. The following chart shows how China’s Meituan dwarves the size of other food delivery companies in other parts of the world:

Source: Deloitte

China’s edge in building a technology company

It is also important to have the means to build a technology company and grow it to be able to take full advantage of the market opportunity. The country has experienced entrepreneurs, the science, skills and the growth capital to build out a company and in some instances many times. There are many instances of serial entrepreneurs that have now built their second major company

“The venture capital infrastructure in Beijing is only second to Silicon Valley with many serial entrepreneurs who have angel investors to back a business plan, hundreds of venture capitalists to finance their growth and then many private equity and strategic investors to attract the large amounts of capital required to help the company grow its dollar sales from hundreds of millions to tens of billions.”

This scale is extremely important in times of hardship as capital dries up rapidly during a recession. Time after time we have seen European start-ups suffer when venture capitalists have to cut back and focus on their larger allocations in the US. China has major strategic investors to help smaller promising companies through thick and thin, whether it’s the locals such as Tencent, Alibaba and Hillhouse or the international investors like the sovereign wealth funds and Softbank. Then there is a government that is willing to financially support certain sectors. It is also important to note that this sector has largely grown over the last decade where Chinese headline economic growth has been lacklustre.

“Finally, there are the unique aspects of language, culture and regulation that make it far harder for global competitors to step in. The person who built Uber’s business in China told us that they had to completely recreate the app for China whereas the same app is used everywhere else in the world.”

On the other hand, Indian start-ups have to tackle competition against global companies and the larger family conglomerates such as Reliance Industries. It is very hard for a company to emerge from such fierce competition and often the very best is acquired by a larger competitor before they reach a scale of significance.

Regulation

In closing, a few words on regulation, the threat to the technology sector in China. The communist leadership will always reign down on what it sees as malpractice or any initiative that goes against its strategic goals. Almost every sector has had its turn under the spotlight whether it was online gaming a few years ago or Alibaba and the education sector more recently. This risk always needs to be monitored closely although over the longer term it helps the quality companies to emerge more successfully as inferior competition is wiped out. The better run companies will always grow if there is an appetite from the consumer.

In summary, China has both scale and the key ingredients to continue churning out large technology companies at a far faster pace than other countries.