China Market Commentary: February 2022

Here are this month’s highlights: The MSCI China A Onshore index fell by 8.8% and the MSCI China index had a 3% decline. There are very few fund managers operating in the smaller companies’ space despite the vast investment opportunity.

China in January

Global equity markets had a rough start in 2022 on the back of a more hawkish Fed and rising inflation concerns. Chinese equities were not spared with the MSCI China A Onshore index falling 8.8%, while the MSCI China index, consisting of mostly offshore listed companies, held up better with a 3% decline. A sharp rotation from growth to value manifested across the world, including China, as most growth sectors experienced big corrections while ‘traditional’ old economy sectors posted modest gains.

At the macro level, the slowdown in the property sector and weakness in consumer spending continued to weigh on economic growth. Manufacturing edged down although manufacturing investment and exports remained resilient.

“The policy reflation cycle has started with the Peoples’ Bank of China cutting interest rates and banks accelerating loan approvals.”

We expect further easing and stimulus measures, in the form of both monetary and fiscal, to be announced soon, possibly at the upcoming National People’s Congress in March. Given a positive policy and growth outlook, coupled with very attractive valuations, we are constructive on Chinese equities in 2022.

This month’s newsletter focuses on smaller companies in China. They should be a beneficiary of the “Common Prosperity” initiative that we have written about in previous newsletters, as the crackdown against monopolistic behaviour by larger companies creates a more even competitive environment. There are very few fund managers operating in the smaller companies’ space despite the vast investment opportunity. Given a lack of information about smaller companies and a universe of thousands of stocks, small cap investors need to operate like private equity fund managers where they must do all the work including building strong relationships with management teams. It is difficult, if not impossible, to exploit this opportunity without expertise on the ground.

Opportunities for small cap investors

Small businesses have an immense opportunity to grow into multi-billion dollar companies through a combination of one of the largest economies with the largest single consumer market in the world, first world digital and physical infrastructure, access to a skilled workforce and investment capital . A company in the UK or South Africa can’t grow beyond a certain level without international expansion. Even within the EU single market, a company has to deal with multiple languages, cultures and tastes.

“Furthermore, given that China is a developing economy, there is often no mature commercial ecosystem to disrupt or displace.”

For example, the e-commerce sector didn’t have to displace an established physical retail industry, or a new emerging restaurant chain doesn’t have to compete against multiple established global franchises to the same extent as they would in the UK or US. Physical retail is simply not as advanced in China, especially outside of the major cities – the old and new forms of retail can co-exist.

The combination of all of the above makes the Chinese stock market unique where it is possible to invest in companies that have the potential to grow their revenues and profits by fivefold or even tenfold over periods as short as 3-5 years.

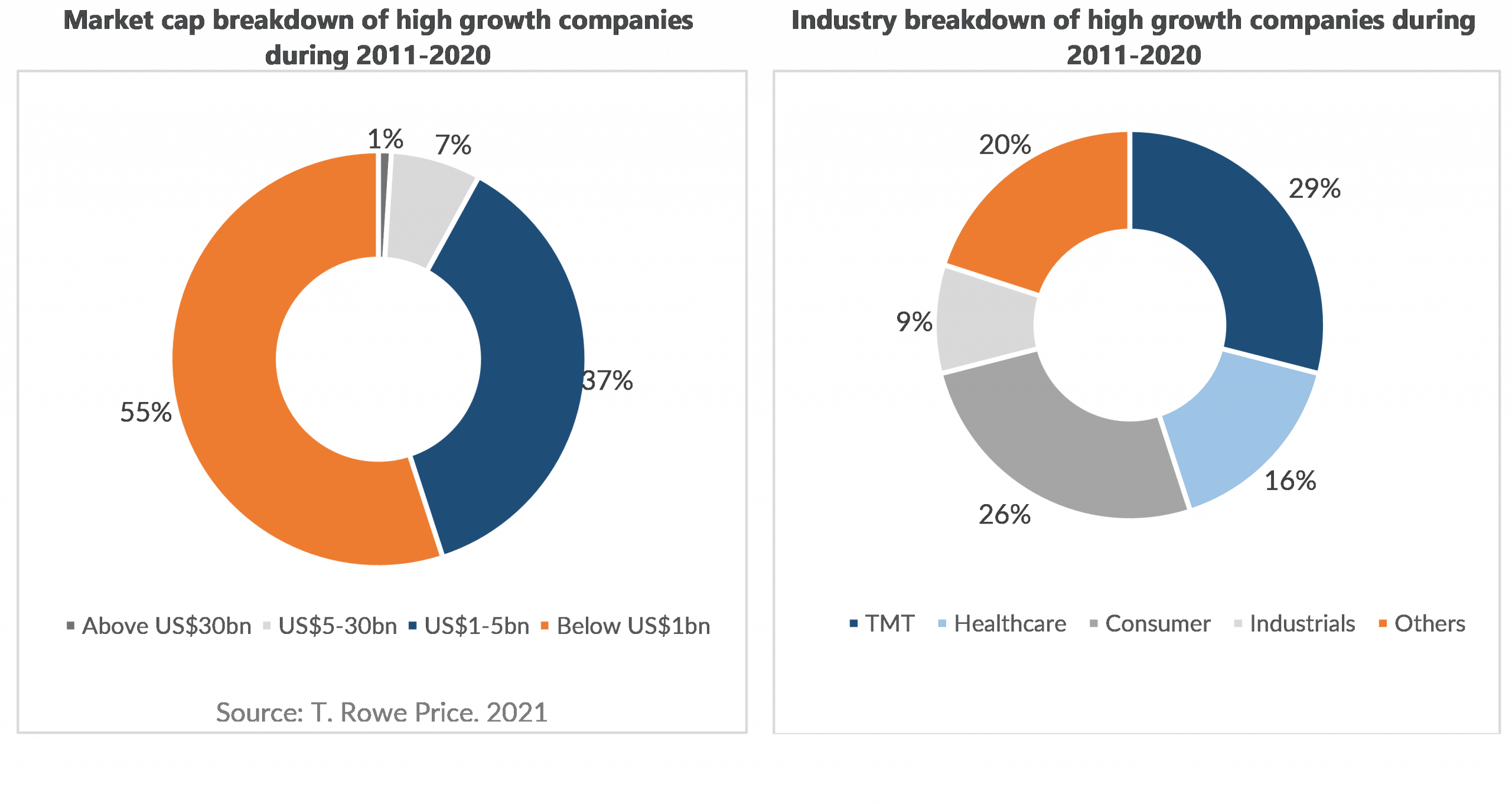

If we take a closer look at the Chinese companies that have delivered consistent above-average growth (which we take as compounding at an annual growth rate of over 20% for 10 years), we find that the companies in this subset are predominantly from the small-cap segment (see chart below). The other interesting feature is that these companies are spread across multiple sectors and not just vogue sectors like technology or healthcare. In fact, we expect to see more emerging winners from the Industrials sector as China bolsters the development of future manufacturing leaders, also known as the “Little Giants”.

A small business in China can grow into a much bigger scale at a faster speed than its peers in other parts of the world given the size of its population. Take fast-food as an example. Yum China, the largest fast-food chain in China, operates over 10 000 outlets in the country. This compares to 1 000 McDonalds outlets in Brazil, which is also the nation’s largest chain and has been operating for longer. Jiumaojiu, a Chinese restaurant chain and a small cap company when it listed in January 2020, is opening 150-200 new restaurants every year and is expected to continue at this rate for the next 5 to 10 years. In contrast, Burger King is considered “fast-growing” in Brazil at 50 new outlets a year. This simple example demonstrates the significant opportunity a young Chinese company has if it is well managed.

Investing in China small cap

Successfully investing in small-cap in China is difficult because the universe is large with very little written or even known about it. There are 2 500 companies in the MSCI China All Shares Small Cap Index compared to 1 856 in the US. Most of these are mediocre companies; in fact, the small-cap index has not gone up over the last five years and underperformed the broader larger-cap indices over ten years. And, yet, there are significant winners within the universe – but finding these few exceptional companies is like finding a needle in a big haystack!

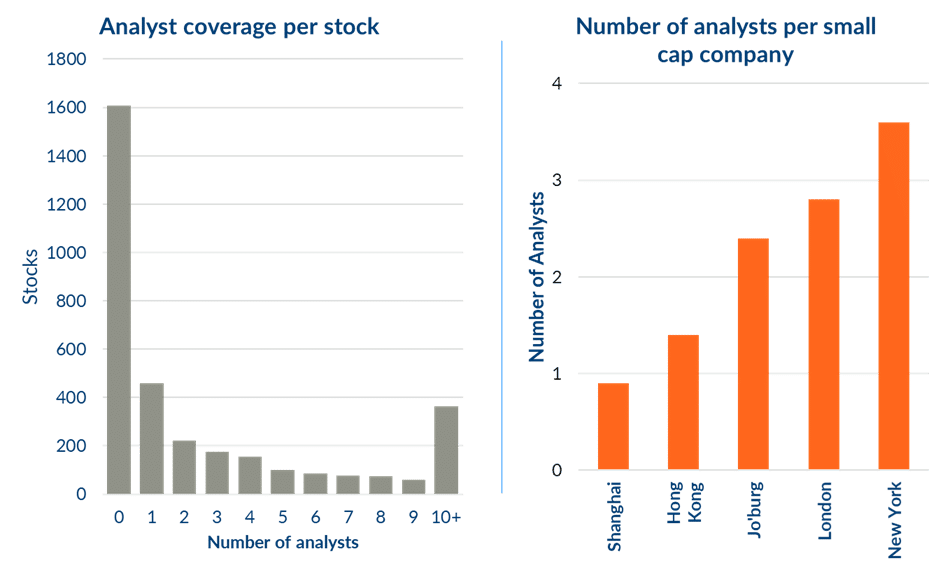

As seen in the chart below, over half of the securities listed on the mainland exchanges had no analyst coverage at all in late 2018. The same thing is evident when comparing the number of analysts covering the average small-cap company in severalmarkets (small-cap here being stocks with market values of USD100m – USD1bn).

Source: Wind and AB, Bloomberg, Cederberg Capital; data as of Sep 2018

The lack of information on smaller companies in China, the higher governance risks and the time it takes to fully research a company are similar to what is required in private equity investing. It is a highly specialised task that very few managers are interested in doing. That is why those who are willing to put in the effort can find rapidly growing companies at low valuations. The same would not be possible in developed markets or even English-speaking emerging markets such as India.

China small cap managers

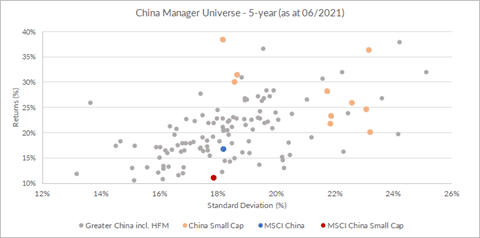

Given these challenges, there are not many managers that focus on small-cap investing in China. There is no formal China small-cap mandate class as it exists in developed markets or even in India. However, whilst the small-cap manager universe may be small, it has delivered strong returns. The graph below shows the performance of a sample of China Small Cap equity products against the wider All China universe:

Source: eVestment, HFM, RisCura data; as of Jun 2021. Some of the small cap track records are carve out of broader mandates

The few managers that operate in this area have delivered strong returns by operating like private equity managers. They use their networks to source strong management teams, build relationships with them and invest with them at an early stage. Many have track records of investing with companies where their market capitalisation increased from less than USD500m to double-digit billions of dollars. These managers have delivered returns in excess of 20% per annum over a period where smaller companies underperformed globally and especially in China.

In summary, we believe that China Small Cap is an underlooked area that holds a lot of potential. But the key is to find a manager who is willing to do the work to identify the best companies. Simply making a passive allocation is unlikely to succeed.