China Market Commentary: April 2022

Here are this month’s highlights: To prevent a spike in deaths we expect lockdowns will continue in China and are likely to disrupt its economy. The most compelling reason to invest in China right now is the depressed valuations whilst fundamentals for many companies remain robust. China has a one-party system that can drive substantial change quickly if it wants to. Despite significant pressure for most of last year due to tight credit conditions, real estate will remain a dominant sector.

China in April

Chinese equities experienced a significant drawdown in the first half of March due to several domestic and external events hitting the market simultaneously. They subsequently recouped more than half of the losses after policymakers addressed several key market concerns, but still ended the month down 8.0% and 8.9% for the MSCI China and MSCI China A Onshore indices, respectively.

Many of the companies that did relatively better this month are poor quality state-owned enterprises that the one would normally underweight given ESG concerns.

Our managers’ performance was in line with the broader Chinese manager universe where performance also faced great pressure. Many high-profile managers suffered large drawdowns with media reports of some funds even reducing fees or changing their strategy in response.

COVID-19 lockdowns

In recent weeks, China has “doubled down” on its zero-COVID-19 policy to confront the worst infection surge since March 2020, leading to significant short-term economic costs. Lockdowns have been imposed in Shenzhen, Shanghai and many other cities across the country and have clearly dampened consumption, disrupted supply chains and affected many businesses.

China has not had multiple COVID-19 waves like the rest of the world given its zero-tolerance policy. As a result, it does not have herd immunity and many vulnerable citizens are not vaccinated.

“To prevent a spike in deaths we expect lockdowns will continue and are likely to disrupt the economy. However, we also expect China will fine-tune the controlling measures and eventually open up.”

The Chinese are experiencing what other parts of the world went through in March 2020 and this is reflected in the depressed valuations of Chinese companies. The rest of the world’s experience shows that the pain is temporary and there will be a recovery. Looking back, March 2020 was a great time to buy global equities.

Is China investible?

A current buzzword has been whether China is “investible”. Both sceptics and advocates have argued their cases. Regulatory changes, the Evergrande property company default, potential delisting of US ADRs, geopolitics and now COVID-19 lockdowns are all good reasons why Chinese equities have underperformed. Earlier this year the Financial Times interviewed James Kynge, its global China editor, on the subject: “Is China Investible?”. We would have answered the questions in that interview very differently. That is what we have done in this month’s newsletter.

“Does investing in China still make sense?”

Our short answer is yes. Firstly, this is the second-largest stock market in the world with over 5 000 listed companies. Even after screening for robust ESG requirements, that still leaves hundreds of companies, with many global leaders in their niche or fast-growing brands amongst the largest population in the world.

There are multiple drivers of growth in China – unlike other parts of the world that face the risk of stagflation — yet these other regions still show high equity valuations. However, growth drivers are likely change over the coming decade. As the Chinese economy matures, consumer demand shifts from quantity to quality and there are new opportunities arising from the green economy and localising of supply chains.

“Chinese consumers are choosing to buy premium products from local companies. This is very different to say Russia or Brazil where growing affluence results in higher demand for global luxury brands.”

Some of the items made by Chinese brands cost thousands of dollars. For example, the most premium bottle of Moutai (a Chinese liquor) can cost up to £25 000 and the most popular mid/large-size SUV sold in China last year was a model from Li Auto, a Chinese company, well ahead of VW or the BMW X5.

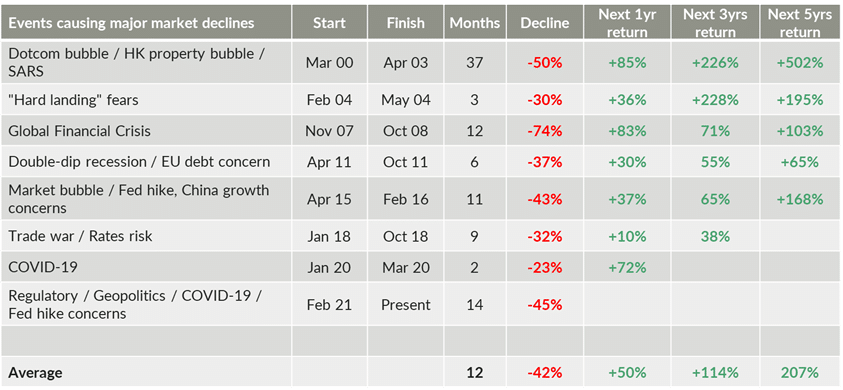

Perhaps the most compelling reason to invest in China right now is the depressed valuations whilst fundamentals for many companies remain robust. The following table illustrates how the Chinese market performed after previous market declines.

Source: Goldman Sachs, Bloomberg, Cederberg, RisCura. Index referenced is the MSCI China Index. April 2022. Past performance is not a guide to future returns.

Whilst it is difficult to call a market bottom, the Chinese government has moved to provide both monetary and fiscal stimulus (through increased infrastructure investment). Chinese equity performance is strongly tied to credit growth, which is rising again. The Chinese government has flexibility to provide the required stimulus as it is less leveraged than western governments, and does not have surging inflation to deal with.

However, recent share price falls did have valid reasons and that is what we discuss next.

“Last year we had a series of regulation salvos against all kinds of sectors of the Chinese market. What is going on?”

China has a one-party system which can drive substantial change quickly if it wants to. Policymakers decided that the country needed regulations and reforms to provide better social stability and for the economy to grow more sustainably. Major policy changes often come after strong economic growth —because the economy can better tolerate it and to avoid the economy overheating.

We don’t consider that the Chinese Communist Party has identified private enterprise as a threat (as suggested in the Financial Times interview). Ray Dalio of Bridgewater commented last year how he has witnessed many times before that foreign investors interpreted policymakers turning away from capital markets, whilst he instead observed steady and fast development of capital markets, entrepreneurship, and openness to foreign capital.

We have argued many times before that deep insight and specialisation are required when investing in Chinese equities. This is not only to find the big fish, but more importantly to avoid the traps. Specialist Chinese equity managers, many of whom are locally based, avoided the full impact of the regulatory onslaught compared to more generalist global fund managers. For example, most of the top shareholders of TAL Education (which regulations transformed it into a not-for-profit business) were managers that are not based in China.

The latest regulatory storm appears to have subsided. In March 2022, Vice Premier Liu He addressed key market concerns and called for order and transparency in dealings with big tech firms. Alibaba’s share price subsequently rebounded by 65% showing the significance of this speech.

“What are the government’s priorities and how can investors coalesce around these?”

We see three clear themes:

- The green economy

China’s aim to reduce carbon emissions is creating an unprecedented opportunity to invest in the production of electric vehicles and renewable energy. There are entire industries building components for electric vehicles that are growing rapidly and some of these exist almost entirely in China. For example, China produces 90% of the world’s lithium iron phosphate (LFP) batteries. - Replacement of supply chains

A well-established theme that will continue for many years is China’s drive to become self-sufficient. Geopolitical concerns – for example, watching the sanctions applied to Russia over Ukraine – have accelerated the policy of inward capacity replacement with significant growth in industries like semi-conductors where a Chinese company will now give preference to a local supplier over one in the USA. - Common Prosperity

The government’s pursuit of increasing equality will create opportunities and further losers. For example, there should be opportunities for smaller companies if larger ones are forced to end their monopolistic behaviour. Any company that could be seen to promote inequality or operate a monopoly must consider itself at risk.

“How big of a risk is real estate to the Chinese economy and also to investors?”

Real estate development is the largest single sector of the Chinese economy. Speculative builds were carried out but there is a genuine shortage of housing in many major cities and their suburbs.

This sector is also used by the government to control monetary conditions. It raises mortgage rates and limits bank lending to the sector when it feels the economy is overheating and vice versa. This is not new and neither is the market volatility resulting from overtightening monetary conditions.

The demise of Evergrande is a specific case and not representative of the wider industry. Evergrande took on debt at a much faster rate than its peers and larger in aggregate than any other developer. Its business model became unsustainable.

“Despite significant pressure for most of last year due to tight credit conditions, real estate will remain a dominant sector. Borrowing rates have reduced in addition to other stimuli and real estate has performed well this year. It will bring renewed risks at the peak of the next economic cycle but for now it has stabilised.”

“Beijing is clearly keen to see a stop put to this outflow of companies onto public markets elsewhere. Why?”

We contend that this is false. The Chinese government needs foreign investment and needs its companies to attract capital from foreign stock exchanges. It has been working with the US SEC to resolve the data requirements for Chinese companies to remain listed. However, this issue is political and may take time to fully resolve.

Meanwhile ADRs of Chinese companies are trading very cheaply. Most managers in China have avoided them despite the valuations but global value managers have a different perspective. Many of these believe the cheap valuations of ADRs represent investment opportunities with limited downside given that the largest Chinese companies are dual-listed in the USA and Hong Kong and the remainder will follow once the risk of delisting increases. Buying the ADRs therefore gives cheaper access to the same economic exposure.

“Are global fund managers taking on a huge political risk or is this an opportunity?”

The ability to access the world’s second largest stock market and also sell their investment products to the world’s largest population is essential for any global fund manager. Investing in China requires specialised on-the-ground expertise. We are encouraged to see skilled managers from the UK and US have realised this and many are now opening research offices in Shanghai and Beijing. This will benefit investors in global equities and global emerging markets in the medium to longer term.

What about geopolitics?

The Ukraine war and the severe lockdowns across China are new risks that have emerged more recently. Whilst we are not experts in geopolitics there are two important points to note. Firstly, China can’t isolate itself from the world if it wants to bring prosperity to its population. The current Russian experience will have demonstrated the consequences of isolation and sanctions to the Chinese leadership.

The other point is that isolation would be as drastic to Chinese companies as to the rest of the world. Volkswagen sells approximately 13 cars in China every hour. Whereas exiting Russia mostly had a small business impact on foreign companies, exiting China would be significant.

Bringing it all together

In summary, we believe China is investible. It has its risks although many are abating, valuations are depressed, and the Chinese government is beginning to provide stimulus at a time when the rest of the world is suffering from the risk of stagflation. Meanwhile, high-quality companies in China are growing rapidly with new growth drivers such as the green economy and inward-focused technology replacement programmes, for example in semi-conductors.